We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Pension recovery from covid

Comments

-

The VLS40 recovered a bit quicker than the VLS60. Both are now just under 6% up for the year to date, which doesn't seem too bad to me. Not nearly as good performance as pure growth funds, but who knows what will happen going forward.TBC15 said:VLS 60 took 8 months to recover from its Feb high. It’s currently up just over 2% from Feb

0 -

I’ve often said here that the UK is only 5-6% of “the World” in market terms....makes sense to look wider (for those who agree broadly with Lars Kroijer’s approach). Hence I use an international fund that is up a third over the past 12 months.Joey_Soap said:Well done, I am still about 10% down because I had way too much in FTSE100 income stocks. Lesson well learned here.

One quarter of my main pot is with Aviva Baillie Gifford American.....an area that has literally doubled in the past 12 months.Crazy really (why wasn’t I smart enough to know that, and have ALL my funds there

Who knows what happens next?!Plan for tomorrow, enjoy today!0 -

It's a lesson well learned here and as the damage eases itself I am rebalaning out of the UK and towards a lower yield but with hopefully income and capital growth prospects.cfw1994 said:

I’ve often said here that the UK is only 5-6% of “the World” in market terms....makes sense to look wider (for those who agree broadly with Lars Kroijer’s approach). Hence I use an international fund that is up a third over the past 12 months.Joey_Soap said:Well done, I am still about 10% down because I had way too much in FTSE100 income stocks. Lesson well learned here.

One quarter of my main pot is with Aviva Baillie Gifford American.....an area that has literally doubled in the past 12 months.Crazy really (why wasn’t I smart enough to know that, and have ALL my funds there

Who knows what happens next?!

1 -

Joey_Soap said:Well done, I am still about 10% down because I had way too much in FTSE100 income stocks. Lesson well learned here.

The correct amount to have in FTSE100 income stocks is zero.

0 -

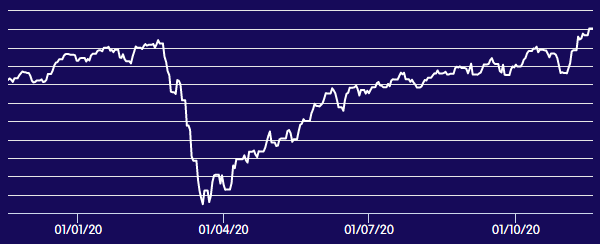

wymondham said:Just thought this might be interesting to some..... my pension has just recovered to pre-covid days - took a while!

... And then you have the lady in another post who sold in April, held everything in cash (and continues to) and wanted compo from the broker for putting her in those investments.FWIW I have a SIPP I haven't touched (much*) at all, its now up 7% from its previous high which was February. It dropped 24% at peak, what did yours do? I'm sure your graph doesn't start at zero because if it did that would have been an alarming fall !?

... And then you have the lady in another post who sold in April, held everything in cash (and continues to) and wanted compo from the broker for putting her in those investments.FWIW I have a SIPP I haven't touched (much*) at all, its now up 7% from its previous high which was February. It dropped 24% at peak, what did yours do? I'm sure your graph doesn't start at zero because if it did that would have been an alarming fall !? * It did have 15% in a REIT which i sold in May and put into the smaller cos fund, the two are now nearly the same %.

* It did have 15% in a REIT which i sold in May and put into the smaller cos fund, the two are now nearly the same %.

0 -

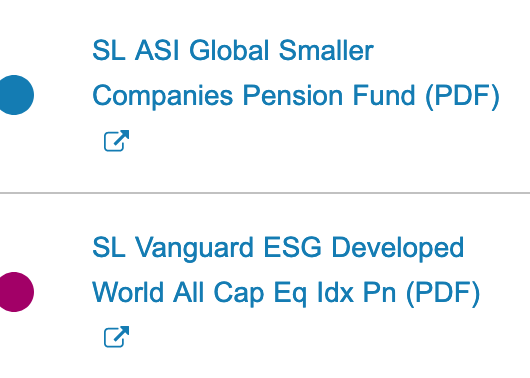

All 3 of the funds held in the DC part of my pension are up considerably from 1 year ago, and all higher than just before the Covid drop.

1 -

According to Morningstar charts, VLS 60 was 101 at the beginning of the year, peaked at 105 in Feb, dropped to 85 in March and was back to 101 in early June. I call it recovery.TBC15 said:VLS 60 took 8 months to recover from its Feb high. It’s currently up just over 2% from Feb

As noted, home bias worked against VLS but VLS 60 provided a smoother ride than VLS 100.0 -

I'm a bit gutted as I saw this pandemic coming and moved everything out of stocks and into cash, so althought I avoided the drop I didn't get back into the market as I couldn't see it recovering with all the uncertainty.So I am about where I was in February but could have made 20% or so!Back in now, hope it rises more on news of vaccines etc.(most of mine is in foreign stocks)

Make £2018 in 2018 Challenge - Total to date £2,1082 -

Investors are like gamblers, they only tell you when they win and things go well

. Great to hear of all the positive results, anyone brave enough to tell of bad experiences during Covid as we will all learn more from them.

. Great to hear of all the positive results, anyone brave enough to tell of bad experiences during Covid as we will all learn more from them.

2 -

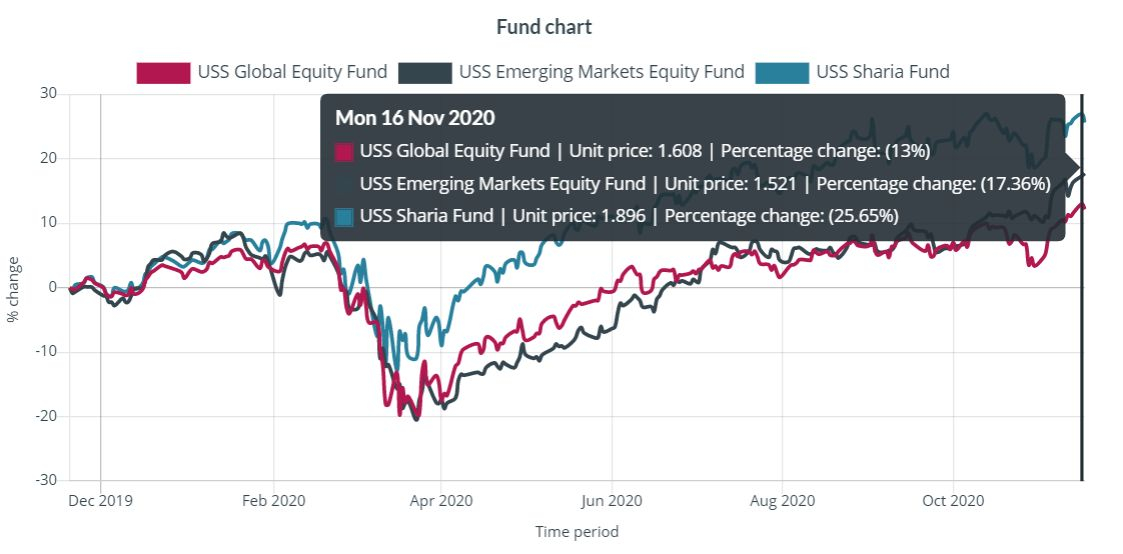

Here's mine for the approximately three years of no significant fund changes (but some weight changes) in my main long term growth equity pot. Covid drop was about 31%.

Danger: this is a high volatility/risk selection that is unsuitable for most new and more experienced investors! It's only about 50% of my total investable assets.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards