We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Pension recovery from covid

Comments

-

No, they are supposed to reduce volatility of your portfolio. Which is particularly important if you are approaching withdrawals. When stocks fall during a major event so do the interest rates so bonds tend to go up. There was a glitch in March due to cash flow problems. Institutional investors needed cash, were forced to sell treasuries which fell in price. Its called “market” for a reason. Demand and supply. However within a couple of days bonds recovered and jumped. It felt nice to see strong positive numbers at the time when everything else was in free fall.0

-

Um. Goes without saying that market prices have risen as interest rates have fallen. However a Gilt is issued at a nominal par value of £100. 30 years later it is redeemed at maturity for £100. There's no growth involved. Ultimately any notional capital gain thanks to market pricing will evaporate as the Gilt approaches maturity. In fact the value of the Gilt has been devalued thanks to inflation.Deleted_User said:

You are correctly illustrating that capital gains on bonds (“growth”) are possible and in fact that is exactly what we have seen over many decades (contrary to what Thrugelmir claimed) .Linton said:

Lets do some arithmetic which will make it clear...Deleted_User said:

If you look at a chart of historic returns for a gilt fund over the last 30 years you will find that the total return far exceeds the yields. What was the reason for that difference?Thrugelmir said:

Gilts offer fixed yields to redemption. They don't offer growth potential. Other than reinvestment of the income. Market prices will fluctuate daily won't impact the eventual outcome.cfw1994 said:

A friend told me his FA (I have no idea if an IFA or FA) had suggested 15yr gilts were going to take a drop some time back. Some of my “less risky” money is in a blackrock 25yr gilt tracker: it looked better than the similar bond option I had. I left it there....garmeg said:

Potentially this fund has to last 30 years plus as i am 56 so needs a high equity allocation.Deleted_User said:

If it was me, I would consider a more defensive portfolio. Now that things calmed down could be a good time. In March/April would have been bad time.garmeg said:Looking at my crystallised SIPP, I am down 6% from when i crystallised it in 2019 and down 15% from its February 2020 peak. It was 40% down from February at its worst (having ASEI Aberdeen Standard Equity Income and TMPL Temple Bar ITs didnt help alongside too much UK generally) so it is recovering.

Large movements like this do make it hard to make a decision about when to retire. Guess I will be a perpetual "One More Year" employee.

Maybe 80% in equity ETF and keep 20% in cash as bonds not good value now.

Something like VWRL or the HSBC and Fidelity ETFs?I can now see the past year has managed to muster 7.5% growth, which I am happy with.Partly makes me wonder where finance “specialists” get their ideas from!

10 years ago there was a 4% 50 year gilt issued. So with £100 invested over 50 years it will generate £200 interest (gilts dont compound) and return your £100.

This gilt is now worth £204. So a 104% capital gain in 10 years - whoopee!! And then there is £40 of interest on top!! Who needs equity!

The gilt will generate £160 interest in the next 40 years. take off the £104 loss in capital value which leaves £56 gain. And oddly enough £144+£56 profit=£200 which is what we calculated originally. So the increase in capital value now is just prepayment of the future returns you would have got anyway.

But now look to the future. In May this year there was a 41 year gilt issued with an interest rate of 0.5%. Clearly there is very little profit that can be brought foward to justify a rise in the capital value. Indeed, it is currently priced at £88, which represents a 12% loss in 6 months.

This is why I am veryt wary of gilts for the non-equity part of my portfolio.

See https://fixedincomeinvestor.co.uk/x/bondtable.html?groupid=3 for source of this data and a lot more.

Reinvesting a 17% yield for 30 years into further new Gilt issuance and repeating the process. Will result in a benefit from compounding. That's pure mathematics. However long dated Gilt yields are now on the floor. Impossible for history to repeat itself anytime soon.

0 -

1. Sell your gilts today. Nominal value becomes irrelevant. You have capital gain. Congrats.Thrugelmir said:

Um. Goes without saying that market prices have risen as interest rates have fallen. However a Gilt is issued at a nominal par value of £100. 30 years later it is redeemed at maturity for £100. There's no growth involved. Ultimately any notional capital gain thanks to market pricing will evaporate as the Gilt approaches maturity. In fact the value of the Gilt has been devalued thanks to inflation.Deleted_User said:

You are correctly illustrating that capital gains on bonds (“growth”) are possible and in fact that is exactly what we have seen over many decades (contrary to what Thrugelmir claimed) .Linton said:

Lets do some arithmetic which will make it clear...Deleted_User said:

If you look at a chart of historic returns for a gilt fund over the last 30 years you will find that the total return far exceeds the yields. What was the reason for that difference?Thrugelmir said:

Gilts offer fixed yields to redemption. They don't offer growth potential. Other than reinvestment of the income. Market prices will fluctuate daily won't impact the eventual outcome.cfw1994 said:

A friend told me his FA (I have no idea if an IFA or FA) had suggested 15yr gilts were going to take a drop some time back. Some of my “less risky” money is in a blackrock 25yr gilt tracker: it looked better than the similar bond option I had. I left it there....garmeg said:

Potentially this fund has to last 30 years plus as i am 56 so needs a high equity allocation.Deleted_User said:

If it was me, I would consider a more defensive portfolio. Now that things calmed down could be a good time. In March/April would have been bad time.garmeg said:Looking at my crystallised SIPP, I am down 6% from when i crystallised it in 2019 and down 15% from its February 2020 peak. It was 40% down from February at its worst (having ASEI Aberdeen Standard Equity Income and TMPL Temple Bar ITs didnt help alongside too much UK generally) so it is recovering.

Large movements like this do make it hard to make a decision about when to retire. Guess I will be a perpetual "One More Year" employee.

Maybe 80% in equity ETF and keep 20% in cash as bonds not good value now.

Something like VWRL or the HSBC and Fidelity ETFs?I can now see the past year has managed to muster 7.5% growth, which I am happy with.Partly makes me wonder where finance “specialists” get their ideas from!

10 years ago there was a 4% 50 year gilt issued. So with £100 invested over 50 years it will generate £200 interest (gilts dont compound) and return your £100.

This gilt is now worth £204. So a 104% capital gain in 10 years - whoopee!! And then there is £40 of interest on top!! Who needs equity!

The gilt will generate £160 interest in the next 40 years. take off the £104 loss in capital value which leaves £56 gain. And oddly enough £144+£56 profit=£200 which is what we calculated originally. So the increase in capital value now is just prepayment of the future returns you would have got anyway.

But now look to the future. In May this year there was a 41 year gilt issued with an interest rate of 0.5%. Clearly there is very little profit that can be brought foward to justify a rise in the capital value. Indeed, it is currently priced at £88, which represents a 12% loss in 6 months.

This is why I am veryt wary of gilts for the non-equity part of my portfolio.

See https://fixedincomeinvestor.co.uk/x/bondtable.html?groupid=3 for source of this data and a lot more.

Reinvesting a 17% yield for 30 years into further new Gilt issuance and repeating the process. Will result in a benefit from compounding. That's pure mathematics. However long dated Gilt yields are now on the floor. Impossible for history to repeat itself anytime soon.

2. Take any one year period. Take 5 year gilts. Show me when total return equalled the interest rates. Good luck.3. Pretty sure if I were to search this site you would have said the exact same thing 1, 2 and 3 years ago. The bonds have appreciated nicely since then. At some point bonds will fall. We just don’t know when. But at some point you will be right. Thats how the market works.2 -

I have owned at least one bond fund or bonds as part of a multi asset fund for all of my investing life. I sold the last fund on the 10th March this year and can't see me buying more bonds until interest have risen and QE cuts back. Until then cash and fixed savers will have to do. At least they pay more interest. They certainly have less risk.0

-

Do you think that the market, especially the bond market, doesnt understand arbitrage? If there was an easy and quick capital gain to be made beyond the market interest rate on the lump sum used people would be taking advantage and prices would adjust accordingly.Deleted_User said:

You are correctly illustrating that capital gains on bonds (“growth”) are possible and in fact that is exactly what we have seen over many decades (contrary to what Thrugelmir claimed) . You are incorrectly claiming that future returns on a bond are known in advance and are certain.Linton said:

Lets do some arithmetic which will make it clear...Deleted_User said:

If you look at a chart of historic returns for a gilt fund over the last 30 years you will find that the total return far exceeds the yields. What was the reason for that difference?Thrugelmir said:

Gilts offer fixed yields to redemption. They don't offer growth potential. Other than reinvestment of the income. Market prices will fluctuate daily won't impact the eventual outcome.cfw1994 said:

A friend told me his FA (I have no idea if an IFA or FA) had suggested 15yr gilts were going to take a drop some time back. Some of my “less risky” money is in a blackrock 25yr gilt tracker: it looked better than the similar bond option I had. I left it there....garmeg said:

Potentially this fund has to last 30 years plus as i am 56 so needs a high equity allocation.Deleted_User said:

If it was me, I would consider a more defensive portfolio. Now that things calmed down could be a good time. In March/April would have been bad time.garmeg said:Looking at my crystallised SIPP, I am down 6% from when i crystallised it in 2019 and down 15% from its February 2020 peak. It was 40% down from February at its worst (having ASEI Aberdeen Standard Equity Income and TMPL Temple Bar ITs didnt help alongside too much UK generally) so it is recovering.

Large movements like this do make it hard to make a decision about when to retire. Guess I will be a perpetual "One More Year" employee.

Maybe 80% in equity ETF and keep 20% in cash as bonds not good value now.

Something like VWRL or the HSBC and Fidelity ETFs?I can now see the past year has managed to muster 7.5% growth, which I am happy with.Partly makes me wonder where finance “specialists” get their ideas from!

10 years ago there was a 4% 50 year gilt issued. So with £100 invested over 50 years it will generate £200 interest (gilts dont compound) and return your £100.

This gilt is now worth £204. So a 104% capital gain in 10 years - whoopee!! And then there is £40 of interest on top!! Who needs equity!

The gilt will generate £160 interest in the next 40 years. take off the £104 loss in capital value which leaves £56 gain. And oddly enough £144+£56 profit=£200 which is what we calculated originally. So the increase in capital value now is just prepayment of the future returns you would have got anyway.

But now look to the future. In May this year there was a 41 year gilt issued with an interest rate of 0.5%. Clearly there is very little profit that can be brought foward to justify a rise in the capital value. Indeed, it is currently priced at £88, which represents a 12% loss in 6 months.

This is why I am veryt wary of gilts for the non-equity part of my portfolio.

See https://fixedincomeinvestor.co.uk/x/bondtable.html?groupid=3 for source of this data and a lot more.Lets look at a government bond in dollars because its easier for me to type. Suppose a bond with a coupon rate of 5% is available with exactly one year until maturity. If the interest rate is 5%, the bond is worth $100. If the interest rate is higher than the coupon value, the value of the bond will be depressed such that the total amount received will be comparable. If interest rates are 7%, there would be a 2% difference between the coupon and the interest rate, and the price would drop by about 2% (to about $98) to compensate. But if the interest rate is only 3%, the bond is worth a bit more (roughly $102), so if you sell it you get growth (capital gain).Future interest rates are unknown. And unpredictable. Therefore you have no idea what your long term bond will be worth in the future. Bond funds never wait until maturity before selling bonds and buying new ones at current rates. We’ve had lots of capital gains/growth on bond funds because interest rates have been dropping for a looong time. On top of all that, what actually matters is real return above inflation and future inflation is also unknown.

The point is that we’ve had a 30 plus year bull market in bonds/gilts and that there have been massive capital gains. Claiming otherwise is to ignore facts. The future is unknown. The potential for a very large drop in interest rates is limited so I agree that the case for buying long term gilts is more difficult than it used to be. I tend to focus on shorter duration. Still, Vanguard and others are making this case and there may be advantages in having gilts even without capital growth, eg so you have dry powder when stocks fall.

1 -

Trend in bonds is hardly new. Interest rates fell to the floor after the GFC. I probably was looking at the longer term myself a decade ago.Deleted_User said:

1. Sell your gilts today. Nominal value becomes irrelevant. You have capital gain. Congrats.Thrugelmir said:

Um. Goes without saying that market prices have risen as interest rates have fallen. However a Gilt is issued at a nominal par value of £100. 30 years later it is redeemed at maturity for £100. There's no growth involved. Ultimately any notional capital gain thanks to market pricing will evaporate as the Gilt approaches maturity. In fact the value of the Gilt has been devalued thanks to inflation.Deleted_User said:

You are correctly illustrating that capital gains on bonds (“growth”) are possible and in fact that is exactly what we have seen over many decades (contrary to what Thrugelmir claimed) .Linton said:

Lets do some arithmetic which will make it clear...Deleted_User said:

If you look at a chart of historic returns for a gilt fund over the last 30 years you will find that the total return far exceeds the yields. What was the reason for that difference?Thrugelmir said:

Gilts offer fixed yields to redemption. They don't offer growth potential. Other than reinvestment of the income. Market prices will fluctuate daily won't impact the eventual outcome.cfw1994 said:

A friend told me his FA (I have no idea if an IFA or FA) had suggested 15yr gilts were going to take a drop some time back. Some of my “less risky” money is in a blackrock 25yr gilt tracker: it looked better than the similar bond option I had. I left it there....garmeg said:

Potentially this fund has to last 30 years plus as i am 56 so needs a high equity allocation.Deleted_User said:

If it was me, I would consider a more defensive portfolio. Now that things calmed down could be a good time. In March/April would have been bad time.garmeg said:Looking at my crystallised SIPP, I am down 6% from when i crystallised it in 2019 and down 15% from its February 2020 peak. It was 40% down from February at its worst (having ASEI Aberdeen Standard Equity Income and TMPL Temple Bar ITs didnt help alongside too much UK generally) so it is recovering.

Large movements like this do make it hard to make a decision about when to retire. Guess I will be a perpetual "One More Year" employee.

Maybe 80% in equity ETF and keep 20% in cash as bonds not good value now.

Something like VWRL or the HSBC and Fidelity ETFs?I can now see the past year has managed to muster 7.5% growth, which I am happy with.Partly makes me wonder where finance “specialists” get their ideas from!

10 years ago there was a 4% 50 year gilt issued. So with £100 invested over 50 years it will generate £200 interest (gilts dont compound) and return your £100.

This gilt is now worth £204. So a 104% capital gain in 10 years - whoopee!! And then there is £40 of interest on top!! Who needs equity!

The gilt will generate £160 interest in the next 40 years. take off the £104 loss in capital value which leaves £56 gain. And oddly enough £144+£56 profit=£200 which is what we calculated originally. So the increase in capital value now is just prepayment of the future returns you would have got anyway.

But now look to the future. In May this year there was a 41 year gilt issued with an interest rate of 0.5%. Clearly there is very little profit that can be brought foward to justify a rise in the capital value. Indeed, it is currently priced at £88, which represents a 12% loss in 6 months.

This is why I am veryt wary of gilts for the non-equity part of my portfolio.

See https://fixedincomeinvestor.co.uk/x/bondtable.html?groupid=3 for source of this data and a lot more.

Reinvesting a 17% yield for 30 years into further new Gilt issuance and repeating the process. Will result in a benefit from compounding. That's pure mathematics. However long dated Gilt yields are now on the floor. Impossible for history to repeat itself anytime soon.

2. Take any one year period. Take 5 year gilts. Show me when total return equalled the interest rates. Good luck.3. Pretty sure if I were to search this site you would have said the exact same thing 1, 2 and 3 years ago. The bonds have appreciated nicely since then. At some point bonds will fall. We just don’t know when. But at some point you will be right. Thats how the market works.

0 -

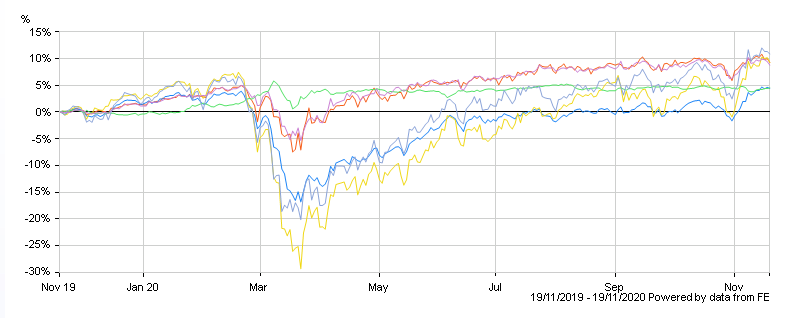

That is a pretty chart, & good explanation!quirkydeptless said:Well if we're sharing pretty charts, here's mine

So points I've noted to myself from the covid crash experience:

1. Everything in my portfolio went down, even the defensives.

2. The blue line in the middle is the £100 SIPP I opened recently with L&G Multi-Index 5 to get a TopCashBack offer. Historically, it fared the worst in terms of recovery so far.

3. The green line is my global government bonds. Took the smallest hit, but then flatlines.

4. The red line is my 'wealth preservation' investments. Took the next smallest hit, and recovering, albeit at a not exciting rate.

5. Yellow and Grey are my global equity ETFs. Biggest hit, but fastest recovery.

So no surprises here. My investments performed as I'd expected considering the circumstances.

The crisis was also a good test of my own behaviour. I just carried on with my regular investing as before, and will keep doing do through the next crash, and the next crash, and the next crash, and the next crash...

Curious what your 'wealth preservation' investments are.

Final paragraph is solid & perfect. In some ways, investing more (as things went down) could be seen as correct long-term behaviour, of course....but that also depends on when you need access to the money! Warren Buffet who once said that it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.”. Didn't do him much harm over the years Plan for tomorrow, enjoy today!1

Plan for tomorrow, enjoy today!1 -

1 - The capital gain reflected a rise fall in interest rates. If interest rates had fallen risen you would make a capital loss. In either case what do you do next? Do you think that interest rates can fall forever or will they rise and fall around some average point? This is very different to equity where in principal capital values can rise forever thanks to inflation.Deleted_User said:

1. Sell your gilts today. Nominal value becomes irrelevant. You have capital gain. Congrats.Thrugelmir said:

Um. Goes without saying that market prices have risen as interest rates have fallen. However a Gilt is issued at a nominal par value of £100. 30 years later it is redeemed at maturity for £100. There's no growth involved. Ultimately any notional capital gain thanks to market pricing will evaporate as the Gilt approaches maturity. In fact the value of the Gilt has been devalued thanks to inflation.Deleted_User said:

You are correctly illustrating that capital gains on bonds (“growth”) are possible and in fact that is exactly what we have seen over many decades (contrary to what Thrugelmir claimed) .Linton said:

Lets do some arithmetic which will make it clear...Deleted_User said:

If you look at a chart of historic returns for a gilt fund over the last 30 years you will find that the total return far exceeds the yields. What was the reason for that difference?Thrugelmir said:

Gilts offer fixed yields to redemption. They don't offer growth potential. Other than reinvestment of the income. Market prices will fluctuate daily won't impact the eventual outcome.cfw1994 said:

A friend told me his FA (I have no idea if an IFA or FA) had suggested 15yr gilts were going to take a drop some time back. Some of my “less risky” money is in a blackrock 25yr gilt tracker: it looked better than the similar bond option I had. I left it there....garmeg said:

Potentially this fund has to last 30 years plus as i am 56 so needs a high equity allocation.Deleted_User said:

If it was me, I would consider a more defensive portfolio. Now that things calmed down could be a good time. In March/April would have been bad time.garmeg said:Looking at my crystallised SIPP, I am down 6% from when i crystallised it in 2019 and down 15% from its February 2020 peak. It was 40% down from February at its worst (having ASEI Aberdeen Standard Equity Income and TMPL Temple Bar ITs didnt help alongside too much UK generally) so it is recovering.

Large movements like this do make it hard to make a decision about when to retire. Guess I will be a perpetual "One More Year" employee.

Maybe 80% in equity ETF and keep 20% in cash as bonds not good value now.

Something like VWRL or the HSBC and Fidelity ETFs?I can now see the past year has managed to muster 7.5% growth, which I am happy with.Partly makes me wonder where finance “specialists” get their ideas from!

10 years ago there was a 4% 50 year gilt issued. So with £100 invested over 50 years it will generate £200 interest (gilts dont compound) and return your £100.

This gilt is now worth £204. So a 104% capital gain in 10 years - whoopee!! And then there is £40 of interest on top!! Who needs equity!

The gilt will generate £160 interest in the next 40 years. take off the £104 loss in capital value which leaves £56 gain. And oddly enough £144+£56 profit=£200 which is what we calculated originally. So the increase in capital value now is just prepayment of the future returns you would have got anyway.

But now look to the future. In May this year there was a 41 year gilt issued with an interest rate of 0.5%. Clearly there is very little profit that can be brought foward to justify a rise in the capital value. Indeed, it is currently priced at £88, which represents a 12% loss in 6 months.

This is why I am veryt wary of gilts for the non-equity part of my portfolio.

See https://fixedincomeinvestor.co.uk/x/bondtable.html?groupid=3 for source of this data and a lot more.

Reinvesting a 17% yield for 30 years into further new Gilt issuance and repeating the process. Will result in a benefit from compounding. That's pure mathematics. However long dated Gilt yields are now on the floor. Impossible for history to repeat itself anytime soon.

2. Take any one year period. Take 5 year gilts. Show me when total return equalled the interest rates. Good luck.3. Pretty sure if I were to search this site you would have said the exact same thing 1, 2 and 3 years ago. The bonds have appreciated nicely since then. At some point bonds will fall. We just don’t know when. But at some point you will be right. Thats how the market works.

2. We have never before had such a long sustained fall in rates. I dont think any very long term data is available.

3. A few years ago the long term gilt rates were much higher compared with short term rates. Over time the fall in rates towards zero has moved towards longer durations. There is little more space left now.

0 -

That's in relation to individual shares not markets per se. He liked Coca Cola as a business when others didn't and to this day still owns 6% of the Company.cfw1994 said:

Warren Buffet who once said that it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.”. Didn't do him much harm over the yearsquirkydeptless said:Well if we're sharing pretty charts, here's mine

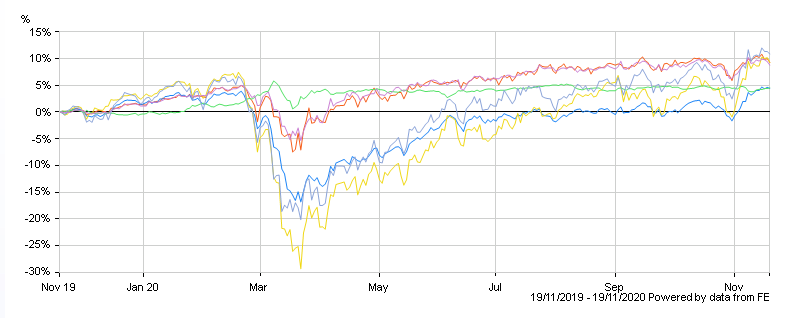

So points I've noted to myself from the covid crash experience:

1. Everything in my portfolio went down, even the defensives.

2. The blue line in the middle is the £100 SIPP I opened recently with L&G Multi-Index 5 to get a TopCashBack offer. Historically, it fared the worst in terms of recovery so far.

3. The green line is my global government bonds. Took the smallest hit, but then flatlines.

4. The red line is my 'wealth preservation' investments. Took the next smallest hit, and recovering, albeit at a not exciting rate.

5. Yellow and Grey are my global equity ETFs. Biggest hit, but fastest recovery.

So no surprises here. My investments performed as I'd expected considering the circumstances.

The crisis was also a good test of my own behaviour. I just carried on with my regular investing as before, and will keep doing do through the next crash, and the next crash, and the next crash, and the next crash... 0

0 -

Investing more during a crash usually means that you were not investing that money before the crash. Which means a bit of market timing maybecfw1994 said:

That is a pretty chart, & good explanation!quirkydeptless said:Well if we're sharing pretty charts, here's mine

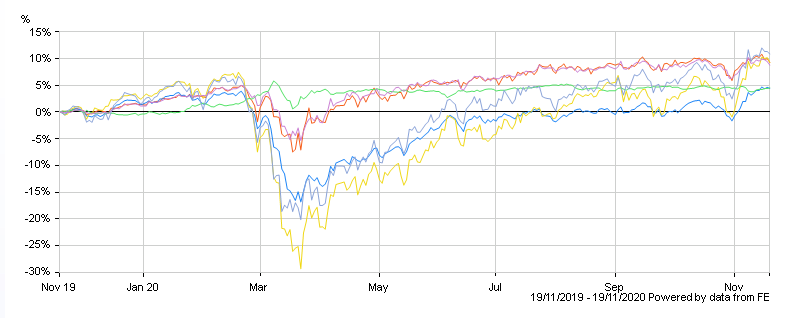

So points I've noted to myself from the covid crash experience:

1. Everything in my portfolio went down, even the defensives.

2. The blue line in the middle is the £100 SIPP I opened recently with L&G Multi-Index 5 to get a TopCashBack offer. Historically, it fared the worst in terms of recovery so far.

3. The green line is my global government bonds. Took the smallest hit, but then flatlines.

4. The red line is my 'wealth preservation' investments. Took the next smallest hit, and recovering, albeit at a not exciting rate.

5. Yellow and Grey are my global equity ETFs. Biggest hit, but fastest recovery.

So no surprises here. My investments performed as I'd expected considering the circumstances.

The crisis was also a good test of my own behaviour. I just carried on with my regular investing as before, and will keep doing do through the next crash, and the next crash, and the next crash, and the next crash...

Curious what your 'wealth preservation' investments are.

Final paragraph is solid & perfect. In some ways, investing more (as things went down) could be seen as correct long-term behaviour, of course....but that also depends on when you need access to the money! Warren Buffet who once said that it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.”. Didn't do him much harm over the years

, otherwise know as holding on to the money for an 'opportunity'. Some people end up doing it for years.

, otherwise know as holding on to the money for an 'opportunity'. Some people end up doing it for years.

Buffet was especially good at it but I am certainly not. Regular investments for me rain or shine.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards