We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

£50 Cashback with NatWest or RBS Invest

Comments

-

PS thanks to the OP for the info

Pay Off Debts by Xmas 2025 debt £0/74000

Pay Off Debts by Xmas 2025 debt £0/74000 -

Apologies if this is an obvious question but I can't find any info. If you obtain the cashback and then want to close investment how easy is this to do and is there a fee?0

-

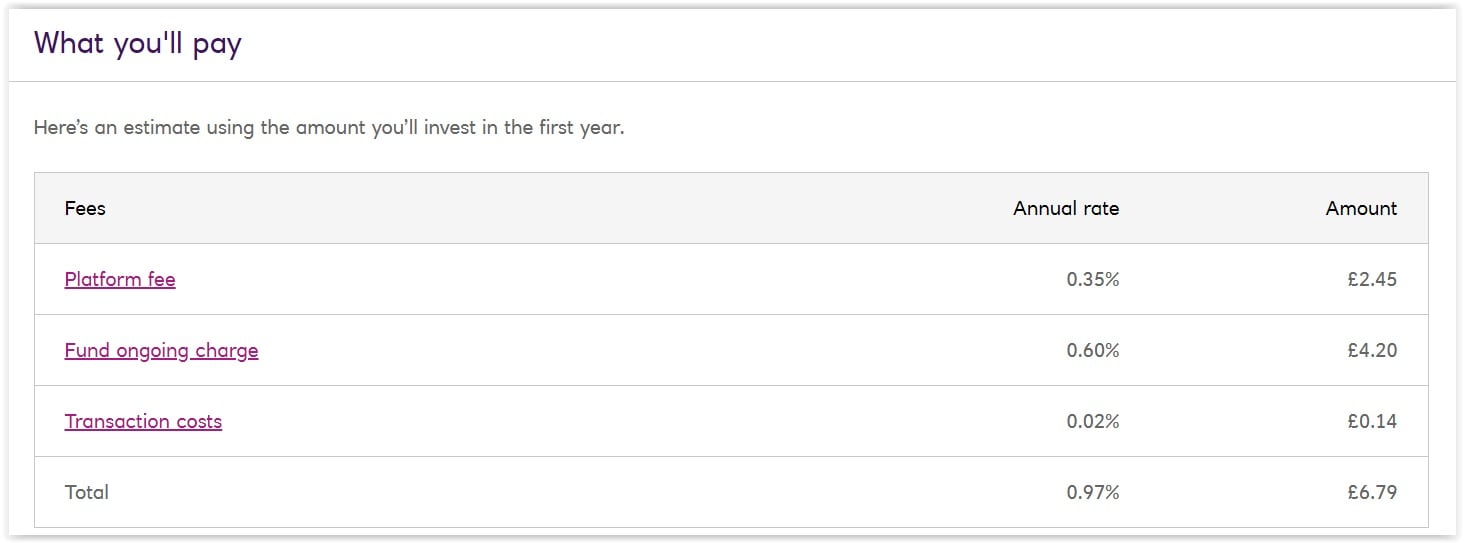

I don't think there is a charge for closing the account. Below is the estimate of the charges for an initial investment.of £100, and £50 monthly thereafter, for a full year. No idea whether they will pro-rata the charges if you close the account in November. The platform fee is taken quarterly; the OCF comes off the actual Fund.

3 -

I havent opened an ISA this year. My savings will be no where near the PSA. Would I better off choosing one over the other between the ISA or GIA?

0 -

Gains from investments are subject to Capital Gains Tax, and CGT allowance, £12,300 in the current tax year. The advantage of using an S&S ISA is that you don't need to bother with any record keeping, and you don't have to tell the HMRC about any gains you made in the S&S ISA.ischris85 said:I havent opened an ISA this year. My savings will be no where near the PSA. Would I better off choosing one over the other between the ISA or GIA?

It's quite painless doing this offer as an ISA - all you have to do is click the ISA button, and the rest will be done for you. If you are doing the offer at Natwest and at RBS, you can obviously only do it as an ISA with one of them as otherwise you'd breach ISA rules.

You also limit your ability to invest in an S&S ISA elsewhere - but I reckon you might be able to liquidate your holdings in the Natwest ISA and then ask another ISA provider to transfer the cash. This sounds rather complicated, so if you want to invest in an S&S ISA with a different provider this year, it might be easiest to do the Natwest/RBS offers in their GIAs.2 -

This webpage is quite interesting regarding the performances of past fund categories.

1 -

There's a serious limit to the usefulness of their historic performance charts as all you can do is compare the Natwest Funds amongst themselves, not with any of the Market indices, or with freely traded Funds. I would normally never use Natwest Invest but this offer is a little bit of fun so I am going to play.2

-

Worth a punt for £50

I want to invest in a GIA and get my payment in dividends as I've plenty of slack in the tax free allowance there, but I can run close to the £1000 tax free allowance for the interest along with my savings, although the plummeting rates are making that one easier too

I want to invest in a GIA and get my payment in dividends as I've plenty of slack in the tax free allowance there, but I can run close to the £1000 tax free allowance for the interest along with my savings, although the plummeting rates are making that one easier too Not sure where the break would be for interest/dividend payment though, i.e. lowest risk one will be interest, the 2nd highest risk one which looks like it might break the 60% bonds and be an interest payer payer so not sure, other 3 would be divis.Retired 1st July 2021.

Not sure where the break would be for interest/dividend payment though, i.e. lowest risk one will be interest, the 2nd highest risk one which looks like it might break the 60% bonds and be an interest payer payer so not sure, other 3 would be divis.Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."0 -

Has anyone tried signing up to both yet?I think....1

-

All the NatWest Funds are "Accumulating", there is no "Income" option, so you won't see any dividend or other payment. Whichever of their risk options / Funds you choose, your return won't be a split of interest and dividend but it will be the change in Fund value. Hopefully this will be a positive change but it could be a negative, or no, change.quirkydeptless said:Worth a punt for £50 I want to invest in a GIA and get my payment in dividends as I've plenty of slack in the tax free allowance there, but I can run close to the £1000 tax free allowance for the interest along with my savings, although the plummeting rates are making that one easier too

I want to invest in a GIA and get my payment in dividends as I've plenty of slack in the tax free allowance there, but I can run close to the £1000 tax free allowance for the interest along with my savings, although the plummeting rates are making that one easier too Not sure where the break would be for interest/dividend payment though, i.e. lowest risk one will be interest, the 2nd highest risk one which looks like it might break the 60% bonds and be an interest payer payer so not sure, other 3 would be divis.

Not sure where the break would be for interest/dividend payment though, i.e. lowest risk one will be interest, the 2nd highest risk one which looks like it might break the 60% bonds and be an interest payer payer so not sure, other 3 would be divis.

Your taxable gain will be any positive difference between the price you bought your units in the Fund, and the price you sell them at, whenever you sell them. This is why you need to keep detailed records if you invest outside an S&S ISA.

Your PSA won't be in any way affected by any gain for those Natwest/RBS investments. If you make a profit when you sell, it counts as Capital Gain and is subject to Capital Gains Tax if your total Capital Gains exceed your Capital Gains Tax allowance, which is £12,300 this financial year. Just for completeness, I should also mention that you cannot claim any tax relief if your investments make a loss.

Please ignore all of the above and read this instead: https://personal.natwest.com/personal/investments/natwest-invest/how-are-my-investments-taxed.html4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards