We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Bitcoin

Comments

-

If you will meet me half way down the M32 on Sunday at 14:30 I will take a few hundred Bristol City shirts off of your hands. I'll be in a white van (with McDonald's food wrappers all over the passenger seat.)Malthusian said:kuratowski said:Views on Bitcoin are rather like views on which Football team is best. Most of the people who care about it at all have already picked a side, and there is no sense in trying to reason with them. Any attempt at discussion is fruitless, and quickly degenerates into a slanging match.The difference between a Bitcoin slanging football match and a football slanging match is that if I'm bantering with a Bristol Rovers fan, it's not because I bought a load of Bristol City shirts in an attempt to get rich quick, and I want him to start buying Bristol City shirts so I can cash out for more than I paid.Think first of your goal, then make it happen!0 -

I am relatively new to investing compared with many in this forum but I am attracted to the passive investments / index trackers. The reason is because, I have read enough to know that I do not know enough at present. Nor am I willing, at the moment, to dedicate the time to learn and gain experience I think would be necessary to be successful at picking stocks, track and understand the active funds and the relatively labour intensive exercise of shuffling and adjusting a portfolio. And even then, the empirical evidence over the longer term suggests that even the professional active managers do not outperform the market across a longer term (20-30 years). Warren Buffet may be a value investor but most of us are not Warren Buffet, and assuming most of us even had the potential to be like Warren Buffet, there's plenty of things to get in the way of replicating his success. So, passives for me. But at least there's plenty of healthy, constructive, informed debate on that subject and that is the beauty of these forums.bowlhead99 said:

True, it can be quite tribal.kuratowski said:Views on Bitcoin are rather like views on which Football team is best. Most of the people who care about it at all have already picked a side, and there is no sense in trying to reason with them. Any attempt at discussion is fruitless, and quickly degenerates into a slanging match.

It reminds me a bit of some of the old 'passive investments vs active investments' discussions that used to rage. You get the passive zealots in one camp who strongly believe that passive is always best and should always be used, and you get the level headed people who say that passive should be used where it is good and active should be used where it is good. The lack of blinkered closed-mindedness from people who have active holdings within their portfolio, helped to give the passive zealots a feeling that they definitely had it right - because there were very few opposing zealots who wouldn't entertain that passive funds could be useful, while the passive zealots knew in their own mind that active funds could not be useful because they had read an article or research piece telling them that passive was best, and so everyone else was a dummy.

I'm simplifying the issue with generalisations of course, and these days the people who stuck around on the forum have generally learned to get along with each other just fine. With Bitcoin and other crypto there is periodically 'new blood' coming in (or users revisiting under new usernames) to kick off the discussion again, while people who heard all the points the first time can't really be bothered any more so will just dismiss them flippantly and give up on the thread.

That does run the risk of the bitcoin threads becoming an echochamber of bitcoin fans wanting to hear from each other that bitcoin is best and that they are going to get rich from it when the conventional economy collapses, which is a somewhat aggressive view and a bit at odds with the remaining conventional 'moneysaving expert savings and investments' set of threads. So there are usually some bitcoin sceptics who will join in the slanging match to try to inject a dose of reality so that general savers and investors are not misled into piling into crypto and losing 90% of their money overnight due to not appreciating the risk.

Back to Bitcoin. Having read through this read I think there's a lack of any real content or demonstrable understanding of what Bitcoin is, what is claims to be and what tests it would need to overcome to satisfy the, lets say, more traditional investors of this forum. The burden of proof should be on the Bitcoin advocates, there appears to be a few, so it would be interesting to lay down a few points as to:- What potential they see in Bitcoin fundamentally - as a currency OR a store of value.

- Why they think that potential is being realized e.g adoption in western markets;

- Self confessed barriers and problems in practicality e.g. government prohibition, cyber attacks, etc.

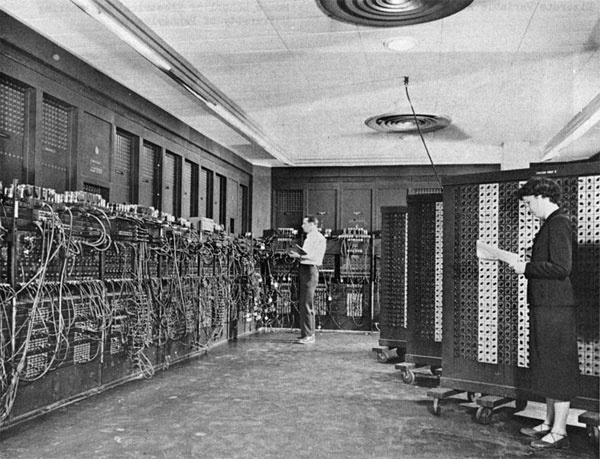

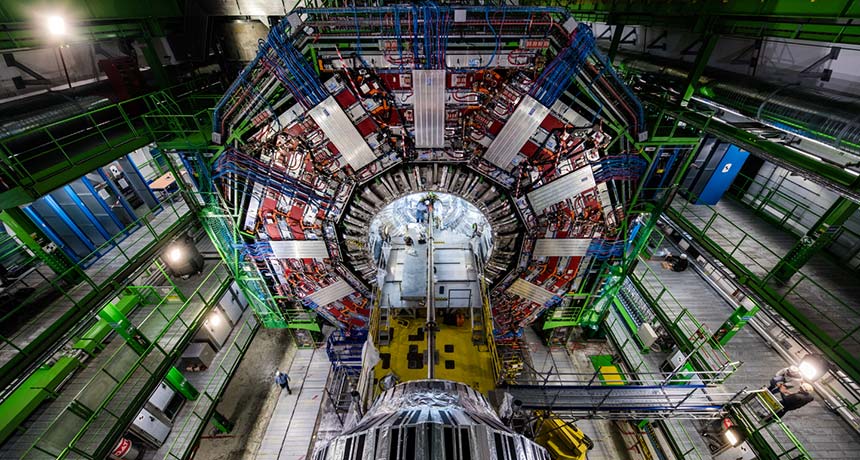

I think it's interesting - a friend of mine was showing me that, yesterday, in a 24 hour period, there had been something like 42 billion dollars worth of transactions in the bitcoin ledger. And he subsequently showed me these photos, "miners" - big business!. Hardly hipsters mining from their bedroom in their parent's house.

0 -

Sebo027 said:

I think it's interesting - a friend of mine was showing me that, yesterday, in a 24 hour period, there had been something like 42 billion dollars worth of transactions in the bitcoin ledger. And he subsequently showed me these photos, "miners" - big business!. Hardly hipsters mining from their bedroom in their parent's house.

What a complete waste of Earth's natural resources.5 -

Looks like the man in the pink shirt has just found a mined bitcoin as it popped out of the back of one of the servers.

2 -

Someone pointed out that this physical hardware wallet could be stolen thus rendering the Bitcoins inaccessible. You responded by talking about a seed phrase. This seed phrase can be used to recreate the Bitcoin holdings on a separate wallet, correct?

What then stops a malicious party with access to the seed phrase duplicating the holdings on a separate wallet and gaining the Bitcoins for themselves?

The seed phrase is supposed to be written down by the Bitcoin holder, yes? On indestructible material in case there's a fire, yes? How is the Bitcoin holder supposed to protect this seed phrase from being read by someone else given that it's in this form?

Unless I'm missing something, I can't see your 100% safe claim is valid. Please tell me what I'm missing.

1 -

Sebo027 said:Back to Bitcoin. Having read through this read I think there's a lack of any real content or demonstrable understanding of what Bitcoin is, what is claims to be and what tests it would need to overcome to satisfy the, lets say, more traditional investors of this forum.Without getting into Bitcoin's endless search for a problem to solve, even if Bitcoin made the transition from a volatile commodity traded predominantly by get-rich-quick gamblers to a stable currency (we'll leave aside that nobody has explained how it can do this, a job akin to Gilette trying to reinvent its razors as ice cream), it still wouldn't satisfy "traditional investors". Traditional investors want assets with a positive expectation of growth, and get-rich-quick zero-sum games and stable currencies both fail in that regard.The reason there is not much discussion of the first two questions is because they have very simple answers and can be looked up on Wikipedia. Bitcoin itself doesn't claim to be anything, any more than gold claims to be anything. It is what it is, which is a series of very long numbers which can only be owned by one person, the ownership kept track of by a peer-to-peer network.3

-

jaybeetoo said:Sebo027 said:

I think it's interesting - a friend of mine was showing me that, yesterday, in a 24 hour period, there had been something like 42 billion dollars worth of transactions in the bitcoin ledger. And he subsequently showed me these photos, "miners" - big business!. Hardly hipsters mining from their bedroom in their parent's house.

What a complete waste of Earth's natural resources.

What a complete waste of the Earth's natural resources.

What a complete waste of the Earth's natural resources.

What a complete waste of Earth's natural resources.

People should think like me and instead:

0 -

It's feasible to remember the seed phrase without writing it down, much as people remember their multiple passwords. After all, what is a 'phrase' if not a set of 'words' in an order (the individual words can of course be complex).puk999 said:

What then stops a malicious party with access to the seed phrase duplicating the holdings on a separate wallet and gaining the Bitcoins for themselves?

The seed phrase is supposed to be written down by the Bitcoin holder, yes? On indestructible material in case there's a fire, yes? How is the Bitcoin holder supposed to protect this seed phrase from being read by someone else given that it's in this form?

Unless I'm missing something, I can't see your 100% safe claim is valid. Please tell me what I'm missing.

If you don't want to write down the whole seed phrase for someone to find, you can just deliberately write it down incorrectly as you might do for any of the various passwords you need to record in life. For example, say you are going to make a 20 character password for some online account. You write down a 17 character password. Then at position 3, you insert the number 3. And at the new position 14 you insert the number 14. So you innocuously wrote down on a piece of paper "I could eat six pies!" but actually the password you're going to use for the website is ic3ouldeatsix14pIes!

As you know that the mathematical constant 'pi' is about 3.14, and the phrase is reminding your about your love of pi, you don't find it tricky to do. And also you knew that despite writing down the first instance of the 'I' as a capital letter because it looks more natural in the sentence, actually it's the last letter 'i' that is capitalised in your password, because ha, I never liked my English teacher. However, while someone finding the phrase written down on a piece of paper might think it is probably some sort of password string (because why the hell would anyone write down how many pies they could eat?), they may at best think that the 'six' part of it is supposed to be a number 6, or something like that. It takes a heck of a lot of social engineering to figure out how an individual's brain ticks. Much more than the common tricks to find out your first pets name or the city you went to school in.

So, storing complex passwords is not a problem for most people, even moreso if they are obscure passwords that don't look like normal words in the first place. It is generally trickier if you do want certain other people to be able to acess an account or a bitcoin wallet in the case of your untimely demise, Sharing it with your nearest and dearest so that they can access it after you are gone - without writing detailed instructions that can't get lost or destroyed by fire, and without risk of anyone ever finding what you had written down to them and what they would need to know to make it work - can be more complex.

1 -

To add to the information above, while a hardware wallet will generate keys to addresses that could be accessed if the seed phrase is discovered, most hardware wallets allow for the addition of a further password/passphrase once that point is reached so that a new set is generated.

If you're trying to fault security, it's worth noting that the "crypto" in cryptocurrency is short for "cryptography." Loss of funds in most frequently a result of human failures is security (naughty nephews allowed to get access to a wallet for which a user did not secure their seed phrase(s).0 -

Seems like you have to be a bit of a geek to use a cryptocurrency safely. I mean it's no good for the older generation who pops into the local building society each week with a passbook is it? There have been many tales of fortunes being lost in bitcoin through scams, fraud, carelessness; much more so (as in a higher percentage of total crypto value) than with conventional investments imho.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards