We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Totally shafted by HMRC and the SEISS

Comments

-

I wish you good luck. Let us know how you get on.1

-

0

-

We've done our research.0

-

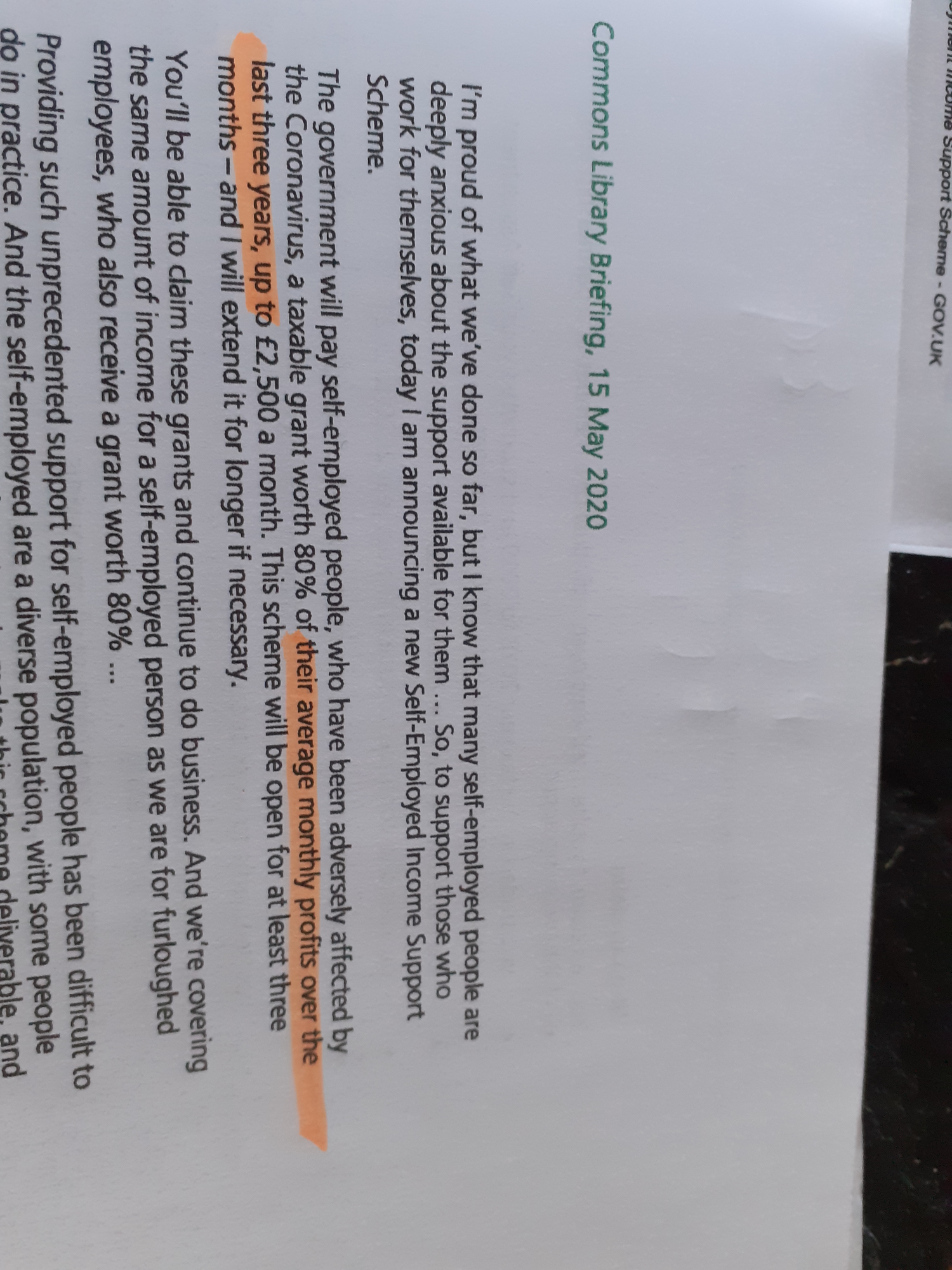

This is a very radical and generous scheme that has been brought in very quickly, with no long preparation time and a high number of claimants right from the "go". It is not really surprising that some of the people at HMRC make mistakes, definitely not astounding or shocking - in fact the opposite is probably true in that it would be quite surprising if no mistakes were made.deliclare said:

What is so astounding is that if they have given us the wrong information over the phone.....what shockingly bad training was given?

I know you are finding it hard, frustrating and annoying, but keeping your conversations friendly with the people you speak with at HMRC is the most likely to achieve positive and swift outcomes than aggressive / confrontational approach.

It is difficult for us all when our finances are hit like this, even more so as it is a reason that none of us could control or preditct - certainly no-one's fault, but not the HMRC fault either. With your husband's high level of income, some would thing that it is reasonable that you have some resilience. Also, I don't think you have mentioned what business your husband is in - can he still work to a reduced rate?10 -

Unfortunately you have no idea what our personal circumstances are- we are stuck between living in a rented house and a house which is being renovated- so we have rent, mortgage and 2x council taxes to pay (and no - we cannot get a council tax payment holiday as Sheffield are not doing this). So regardless of my husband's 'high income' we are struggling. I earn just over minimum wage. He works in construction and has had no work since early March due to sites closing down. He can't force businesses to have work done if they can no longer afford it.Grumpy_chap said:

This is a very radical and generous scheme that has been brought in very quickly, with no long preparation time and a high number of claimants right from the "go". It is not really surprising that some of the people at HMRC make mistakes, definitely not astounding or shocking - in fact the opposite is probably true in that it would be quite surprising if no mistakes were made.deliclare said:

What is so astounding is that if they have given us the wrong information over the phone.....what shockingly bad training was given?

I know you are finding it hard, frustrating and annoying, but keeping your conversations friendly with the people you speak with at HMRC is the most likely to achieve positive and swift outcomes than aggressive / confrontational approach.

It is difficult for us all when our finances are hit like this, even more so as it is a reason that none of us could control or preditct - certainly no-one's fault, but not the HMRC fault either. With your husband's high level of income, some would thing that it is reasonable that you have some resilience. Also, I don't think you have mentioned what business your husband is in - can he still work to a reduced rate?

Being under the full impression that you are entitled to help - and then being told (for no apparent or understandable reason) that you can't have the support you fully feel entitled to- has been hugely damaging to both our mental health. The stress has been unbearable. I would say unless you are in their shoes I wouldn't begin to start judging how people are coping. It is a simple fact - 3 years of tax returns with the average being taken. It is the most simple condition of the scheme. I would fully expect them to know this!!1 -

@deliclare

I understand you are having a difficult time and that the system looks like it’s incorrectly determining your eligibility for SEISS but taking our your frustration out on HMRC isn’t going to help.

You have asked for the decision to be reviewed and need to wait for this.

Everyone is suffering from the effects of Covid including government departments who will have many staff absent - HMRC will have moved others who don’t usually answer calls to answer them and probably borrowed staff from other government departments as well - for schemes which seem simple but I imagine the queries they get could be quite complex especially if they don’t deal with these issues on a daily basis. In addition, the call centre staff won’t be the ones who review cases.

Personally, I’m surprised that the SEISS system is up and running already - it wasn’t supposed to be launched until June.

i take it you’ve looked at mortgage holidays and the govt backed loan schemes as well.

5 -

It was a reasonable enough question given the large difference between the first two and most recent year, that there could have been some change in circumstance in play. Anyway, it seems like the OP has confirmed not so it does just look like an appeal is due.Jeremy535897 said:

This thread is about averaging the self employed profits for three years to get below the £50,000 cap. If OP had other income over the 3 years of over £100,000 on top of over £100,000 profits, I doubt he'd be that bothered about a £7,500 grant.jfinnie said:

As they seem so adamant, are you sure he's entitled to use the 3 year calculation?deliclare said:Well we won't be getting a penny.

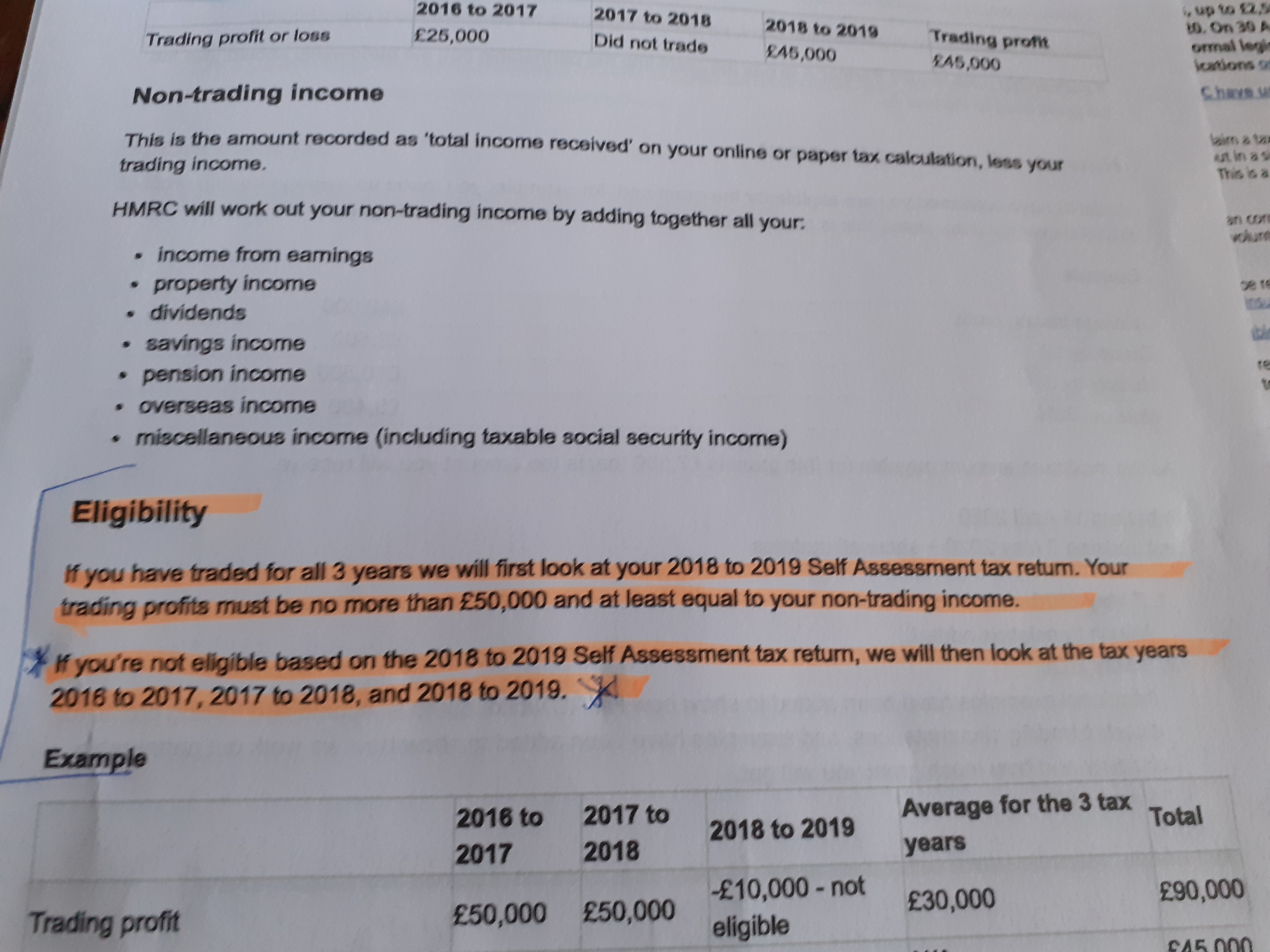

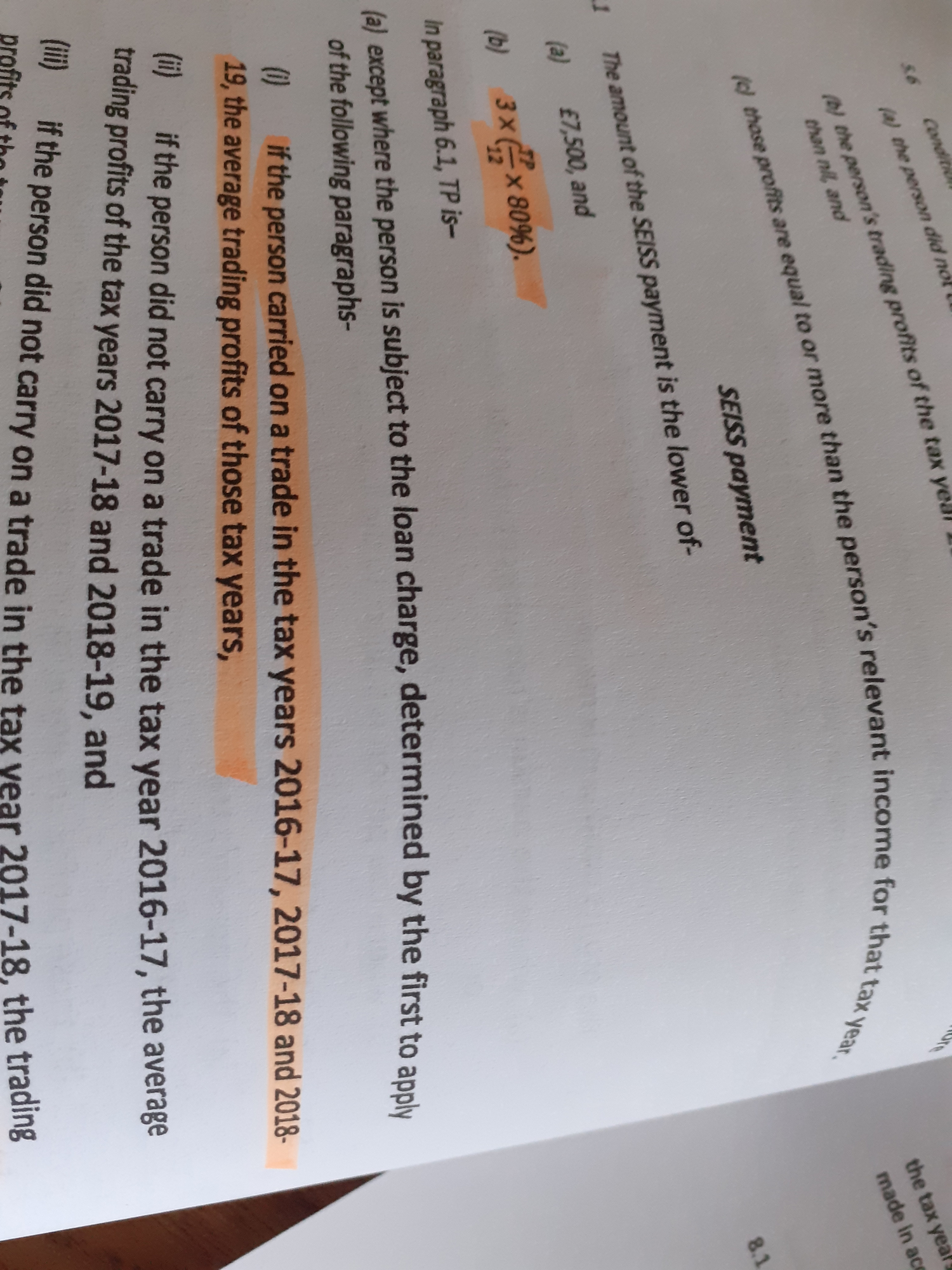

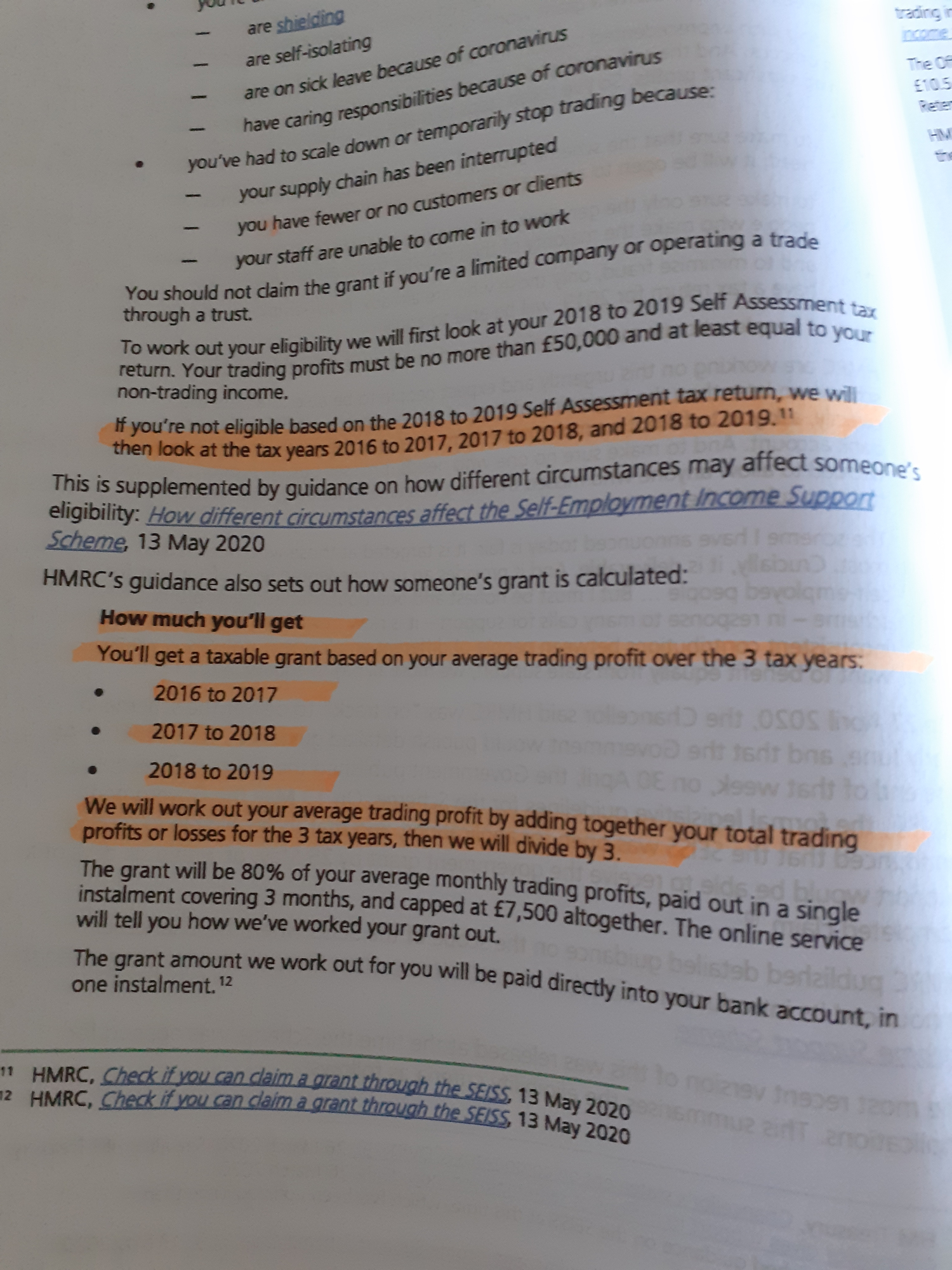

My husband's 18-19 tax return was £300 over the threshold. Utter rubbish that they say they will look at the other 2 tax years and take an average from the last 3 - they don't - even though the 2 previous tax years earned him £30k.

To do that I'm pretty sure the income from from self employment over the 3 year period has to be more than half of the total income over that period. If he also had some employment mixed in there it is quite possible he's not entitled by that calculation method either.

I'm not saying it is fair, but it seems like that is how it is structured.

What is frightening is that there shouldn't be any way for these calcs to be wrong if it is all dropping out of an automated system, which implies either they've had a truckload of monkeys working furiously to process these things manually (and badly), or they can't get even the most basic of calculations and logical propositions right in a computer program. Both are equally bad...

1 -

People's tax affairs are often complex so even the most basic calculation in a computer program may have gone through many branches of complex logic to get to the point and it is quite possible that someone coded this specific scenario wrongly and it didn't get picked up in testing. Its not as if they had months to design, code and thoroughly test the software that they would normally get and even then bugs creep in.jfinnie said:What is frightening is that there shouldn't be any way for these calcs to be wrong if it is all dropping out of an automated system, which implies either they've had a truckload of monkeys working furiously to process these things manually (and badly), or they can't get even the most basic of calculations and logical propositions right in a computer program. Both are equally bad...

Given what has had to be done in such a short time time I think HMRC have done a good job. Being polite and have the facts to hand will be the way to sort this out. As has been said people have had to be drafted in from other roles etc to deal with the enquiries and will have only had enough training to get them up and running.1 -

That council's policy on council tax sux's big time.deliclare said:

Unfortunately you have no idea what our personal circumstances are- we are stuck between living in a rented house and a house which is being renovated- so we have rent, mortgage and 2x council taxes to pay (and no - we cannot get a council tax payment holiday as Sheffield are not doing this).1 -

Hi all I can say keep trying

I was over the 50k for 18-19 (58)and 40ks for 17-18and 16-17 both years just under the average 50k (47k)

Applied Thursday 14th cleared to day 7500.00 good luck1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards