We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Depending on time of day request is made its usually same day, very worst case scenario first thing following day.ircE said:Can someone with experience with Principality please confirm how long it typically takes for funds to be transferred back to your main current account upon account closure? I'm considering drip feeding part of my emergency funds into the latest issue.2 -

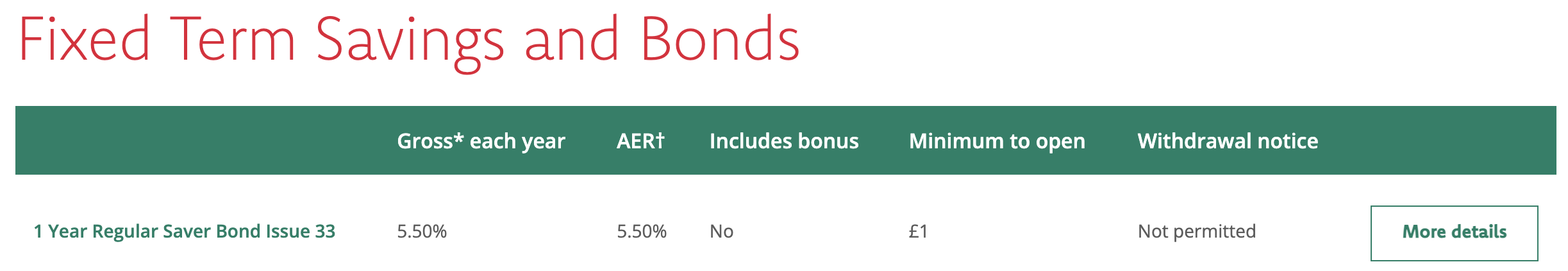

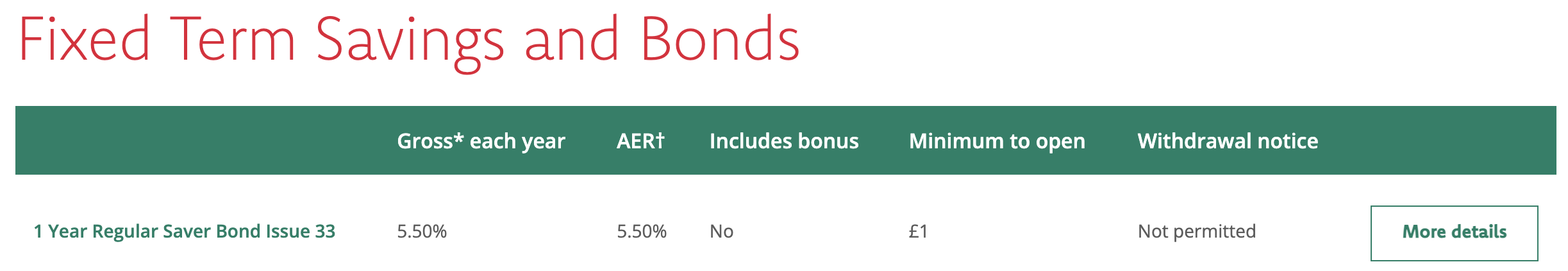

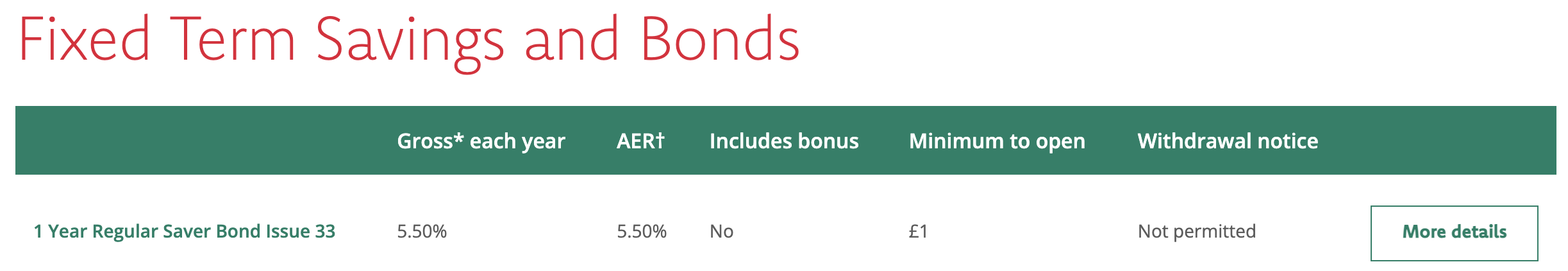

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/1-year-regular-saver-bondsubjecttocontract said:It's not showing on their website so far......perhaps it will be made available sometime later today.

Online now (Edit: Sort of)

Well, actually, issue 33 is listed, however, the link still goes to 32 ????

0 -

IIRC, if the closure is processed and transfer processed by 15:30, same working day. If after that, or on non working day, next working day.ircE said:Can someone with experience with Principality please confirm how long it typically takes for funds to be transferred back to your main current account upon account closure? I'm considering drip feeding part of my emergency funds into the latest issue.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

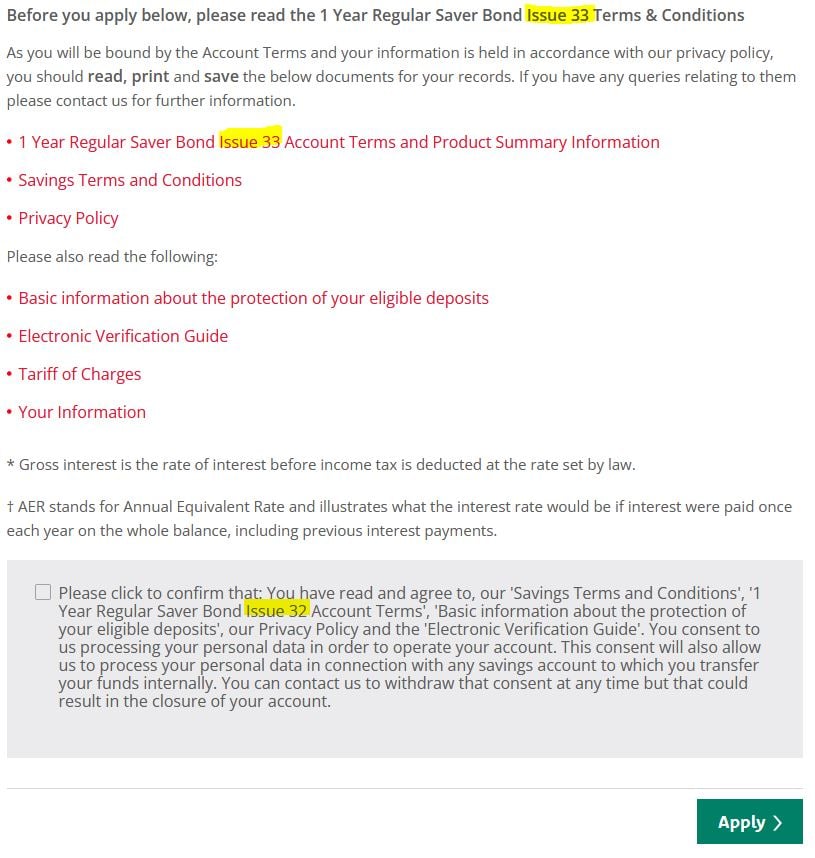

Yep, seems that the application process is still linked to issue 32 so won't allow me to open it (as I already have 32)wiseonesomeofthetime said:

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/1-year-regular-saver-bondsubjecttocontract said:It's not showing on their website so far......perhaps it will be made available sometime later today.

Online now (Edit: Sort of)

Well, actually, issue 33 is listed, however, the link still goes to 32 ???? 0

0 -

yep, the apply link at the bottom of the product page still uses the old product ID, so don't apply till it's something other than 6077 in the link (and the issue 33 T&C declaration shows)wiseonesomeofthetime said:

https://www.principality.co.uk/savings-accounts/fixed-term-savings-and-bonds/1-year-regular-saver-bondsubjecttocontract said:It's not showing on their website so far......perhaps it will be made available sometime later today.

Online now (Edit: Sort of)

Well, actually, issue 33 is listed, however, the link still goes to 32 ???? 0

0 -

Seems their IT folk still have some work to do

0

0 -

Opened the Principality Issue 33 on the 9th (but didn't fund it after the reported issues) so waited until this morning, funded it via a Faster Payment and it's now fully open.

0 -

Principality's product page has now been properly updated so you can now apply for issue 33.10

-

My goodness, Principality is getting quick! Usually it takes 2 hours for a deposit to reflect, but this time 15 minutes! Perhaps I timed it perfectly with a batch processing slot?If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

Mine was quick to show funding too - just have to wait for my Issue 31 to close and pay interest as 4% has become a bit of a duffer for an RS.ForumUser7 said:My goodness, Principality is getting quick! Usually it takes 2 hours for a deposit to reflect, but this time 15 minutes! Perhaps I timed it perfectly with a batch processing slot?3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards