We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

quirkydeptless said:Band7 said:Existing Santander customers: if for any reason you still have an old, unmatured, Santander RS hanging about, you can request it to be closed via Chat. Don't chose the "RS upgrade option" as this doesn't seem to work. Just ask for the RS to be closed, tell them where to pay any outstanding interest to, and what your address is. The old RS will disappear overnight, and you can then open and fund the 5% one within minutes.I'm a bit sloppy about closing unused accounts unless there is an easy 'close account' option online. I still had an old 3.2% one lying around with £0 in it, and so when I applied for a new one it said something like 'lucky you, you already have one'

So I used the mobile bot chat option with 'Regular eSaver Upgrade' as my reason for closure. A human appeared straight away on the chat and said 'Fab, I'll get that closed for you'. Or was it a human? Who can tell with AI nowadays?

So I used the mobile bot chat option with 'Regular eSaver Upgrade' as my reason for closure. A human appeared straight away on the chat and said 'Fab, I'll get that closed for you'. Or was it a human? Who can tell with AI nowadays? Also said to allow 2 working days for the full closure, but I will check tomorrow to see if I can open a new one.

Also said to allow 2 working days for the full closure, but I will check tomorrow to see if I can open a new one.

Noticing that my old RS was closed, I tried opening the new one on the same say and it worked, so now funded with £200 in 2 working hours rather than days Retired 1st July 2021.

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."2 -

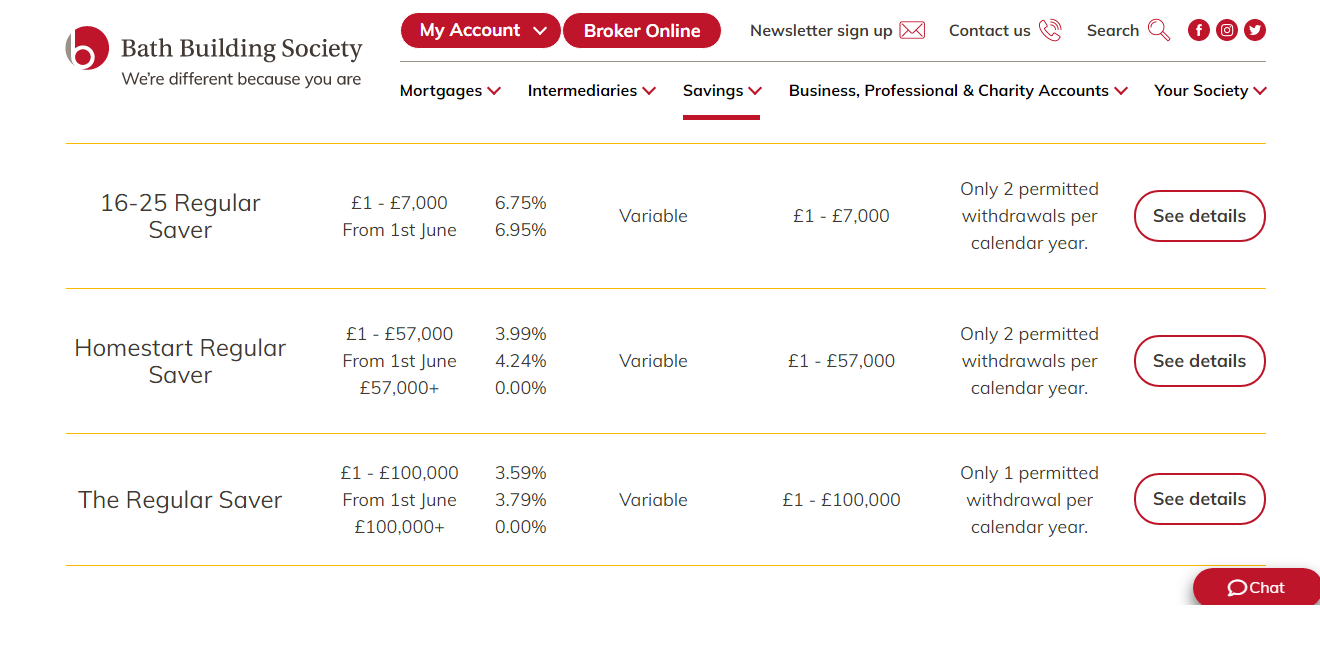

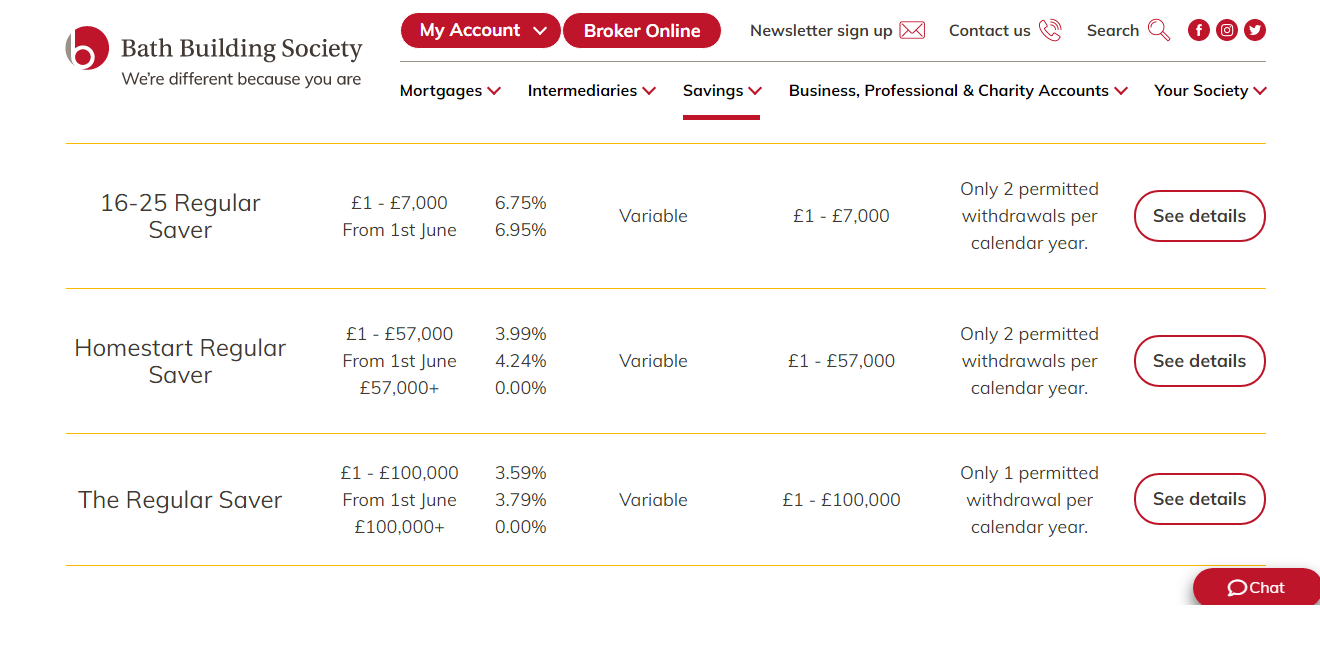

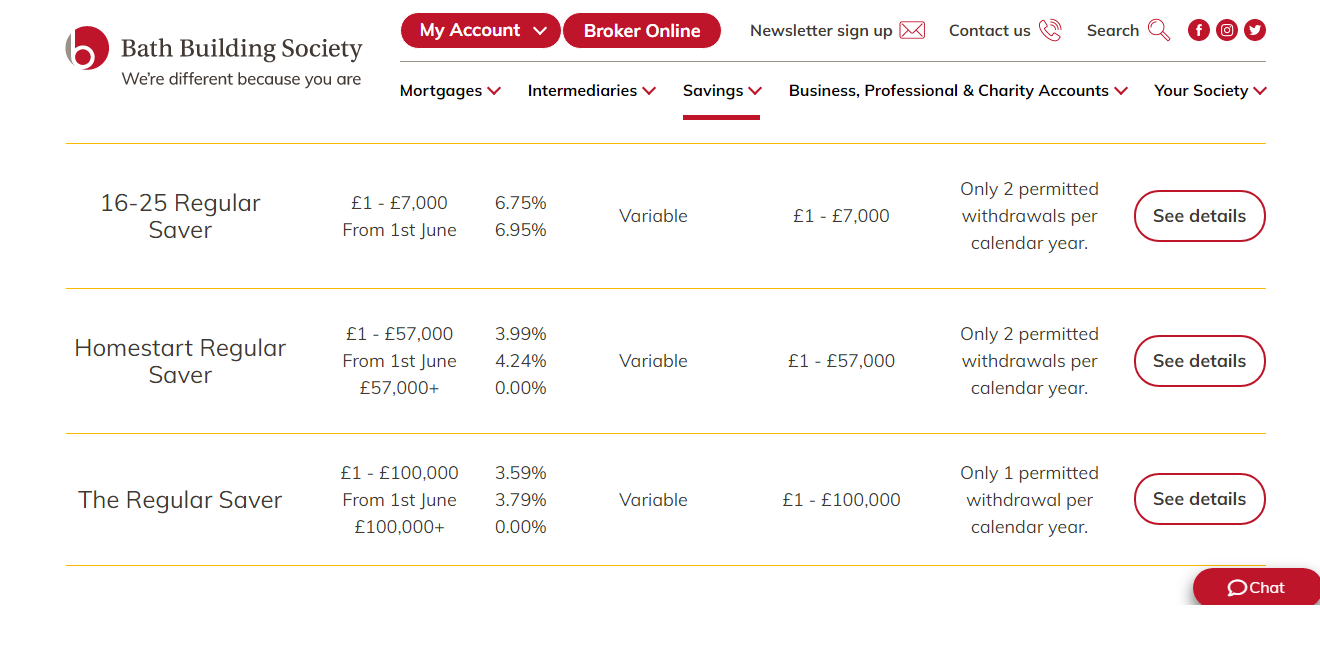

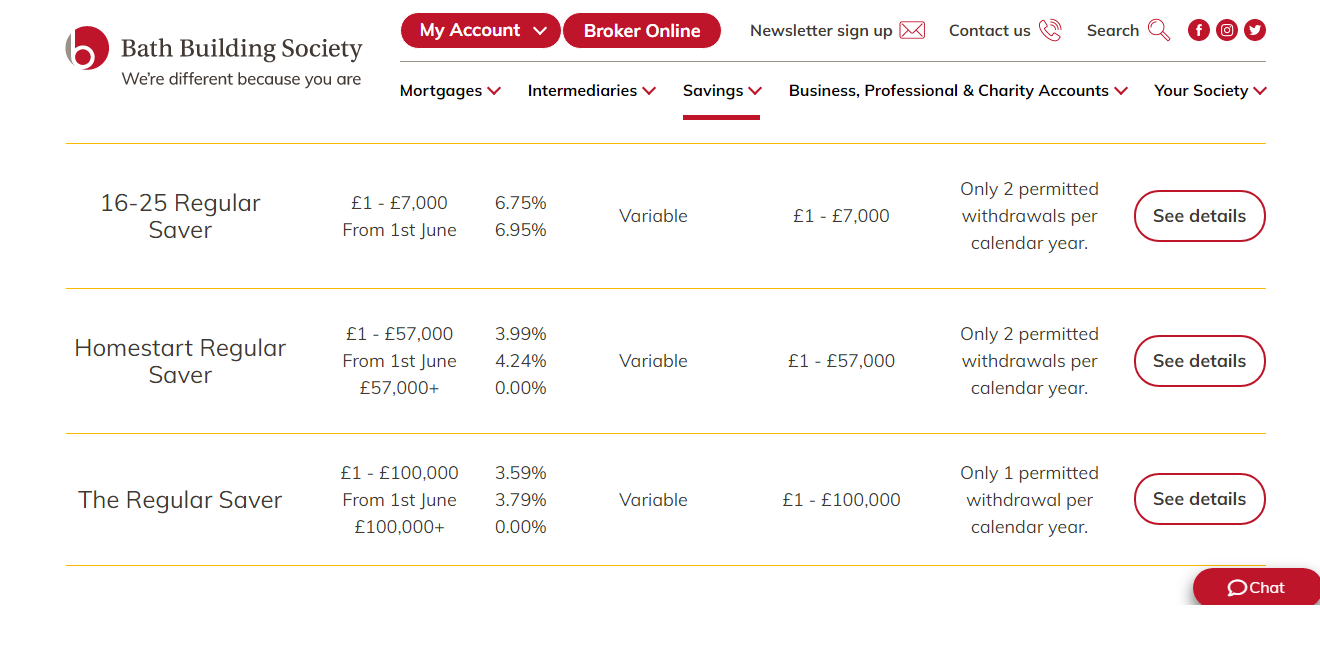

Bath BS are increasing their savings rates on 1st June

4 -

Wish I was aged 16-25 again so I could get that RSBridlington1 said:Bath BS are increasing their savings rates on 1st June

5

5 -

Would it count if parts of me was 16-25 ?t1redmonkey said:

Wish I was aged 16-25 again so I could get that RSBridlington1 said:Bath BS are increasing their savings rates on 1st June

I have some dental implants & a stainless steel pin in me leg which qualify ? Is it worth a try ?6 -

I suspect you'd have to fight tooth and nail to get away with that one.subjecttocontract said:

Would it count if parts of me was 16-25 ?t1redmonkey said:

Wish I was aged 16-25 again so I could get that RSBridlington1 said:Bath BS are increasing their savings rates on 1st June

I have some dental implants & a stainless steel pin in me leg which qualify ? Is it worth a try ?14 -

Old existing Santander Monthly Saver customers don`t forget to reduce your balance to 0 before using "chat" to close it and upgrade. I had £1 in it. "chat" will then ask which account to transfer closing interest too.

0 -

Moneyfacts is showing:

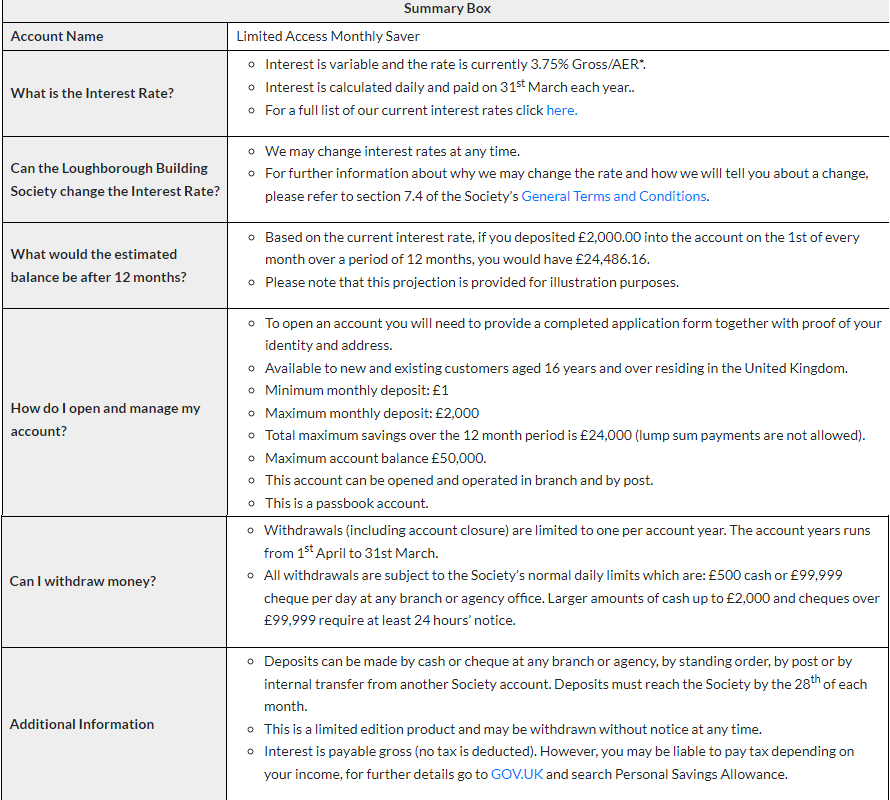

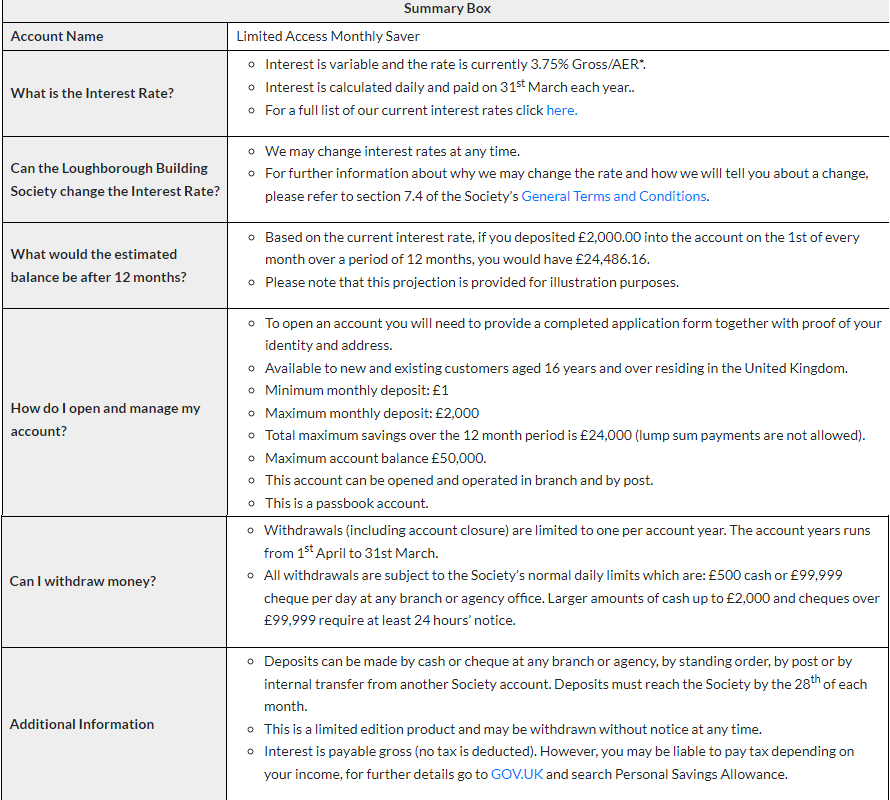

Loughborough BS new Limited Access Monthly Saver at 3.75% (no increase to the current RS showing yet)

Principality BS Various RS variable rates increasing. No fixed rate increase showing yet.

My First Home Steps Issue 2 for example: 3.55% paid at £1, 3.75% paid at £2501, 4.25% paid at £7501

Confirmed online, additionally Learner Earner Issue 3 NLA from 3.85% to 4%If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.3 -

Now showing on their website:ForumUser7 said:Moneyfacts is showing:

Loughborough BS new Limited Access Monthly Saver at 3.75% (no increase to the current RS showing yet)

I'm in two minds whether to go for this one. At present it's too low a rate to warrant funding it fully and Loughborough do deem to have a habit of not increasing the interest rate on their monthly savers much if ever so I doubt it will become competitive any time soon. On the other hand it requires a minimum monthly deposit of £1 so I would suffer a very low interest hit if I did open it with the minimum funding and the rate is variable so there is a small chance it could become competitive in the future.

1 -

Principality FHS 1 & 2 Online - Rate increases confirmed in online banking

Tier

Balance

Gross interest rateTier 1 £1.00 - £2,500.00 3.55% (Variable) Tier 2 £2,500.01 - £7,500.00 3.75% (Variable) Tier 3 £7,500.01 - £25,000.00 4.25% (Variable) 4 -

The main reason I won’t be opening it is balances cannot even be viewed online. That said, Loughborough BS has recently partnered with a company to help with what seems like digital banking development: https://www.fintechfutures.com/2023/05/loughborough-building-society-taps-finastra-for-digital-banking-and-analytics-solutions/Bridlington1 said:

Now showing on their website:ForumUser7 said:Moneyfacts is showing:

Loughborough BS new Limited Access Monthly Saver at 3.75% (no increase to the current RS showing yet)

I'm in two minds whether to go for this one. At present it's too low a rate to warrant funding it fully and Loughborough do deem to have a habit of not increasing the interest rate on their monthly savers much if ever so I doubt it will become competitive any time soon. On the other hand it requires a minimum monthly deposit of £1 so I would suffer a very low interest hit if I did open it with the minimum funding and the rate is variable so there is a small chance it could become competitive in the future.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards