We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Halifax and Lloyds don't so, assuming they follow the same patterns, I would say no but that's not definite.The problem may be your suggestion of 'another' monthly saver. You can only hold one no matter how many current accounts you have.2

-

I opened a BOS current account in Oct and have not yet had a hard search added to my score, but have had an RBS and HSBC search added for accounts I opened the same day. Anecdotal, but seems there's no hard search.1

-

Thanks for the info does anyone else could confirm about this ??kaMelo said:Halifax and Lloyds don't so, assuming they follow the same patterns, I would say no but that's not definite.kaMelo said:The problem may be your suggestion of 'another' monthly saver. You can only hold one no matter how many current accounts you have.I am not quite sure about this, but I read somewhere you could have another one BOS MS by applying with new profile.I did that with Halifax for Switching incentive, and just recently taking another advantage opening a new one and I now have two Halifax RSAs.0 -

Monmouthshire BS

They say they are running a 5 working day processing time for new account applications because they are overwhelmed with new applications. Even if Royal Mail ever get the applications to them, there's only a slim chance that the accounts get opened before December 1.7 -

Mansfield BS regular savings 30 account and regular esaver 30 to rise from 2.25% to 3.5% from 1st December.5

-

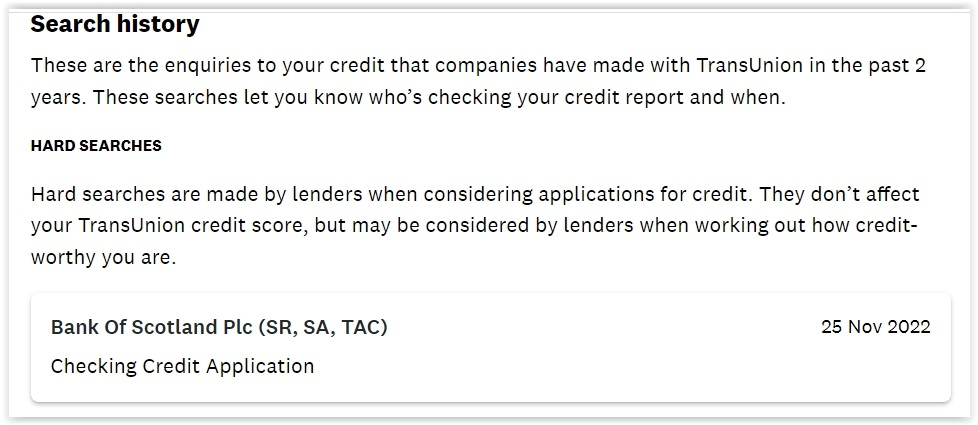

Hard search does appear on my CreditKarmaadindas said:I already have a few BOS current AC. Does anyone know if there is a hard credit search to open a new BOS current account ? I want to take opportunity to open a second BOS Monthly saver but I do not want to risk a credit search for such small gain.

1 -

I wonder how they'd be overwhelmed so quickly though, seeing as that new 5.5% account just launched yesterday and is only available by branch/post (and there are currently postal strikes anyway).Band7 said:Monmouthshire BS

They say they are running a 5 working day processing time for new account applications because they are overwhelmed with new applications. Even if Royal Mail ever get the applications to them, there's only a slim chance that the accounts get opened before December 1.1 -

I'm opening both, as I've maxed out the Barclays Blue Rewards 5% saver and all the others paying more than 3%silvercar said:Section62 said:

Yes, 3.75% is better than many of the alternatives on offer, so is worth considering. The question is if the 5.5% account didn't exist, would you open the 3.75% one?silvercar said:I’m new to this regular savings game, attracted by the interest rates. This maybe a stupid question, but if there are 2 savings accounts with MBS one paying 5.5% and one paying 3.75%, is the latter one only aimed at people who are maxing out after opening the higher paying one? Why would anyone want the 3.75% interest if they can open the 5.5%?

Thanks, just wanted to check if I was missing something.Band7 said:

The 3.75% account may be of interest to people who have enough money to have maxed the 5.5% one, and all the other regular savers which pay more than 3.75%.silvercar said:I’m new to this regular savings game, attracted by the interest rates. This maybe a stupid question, but if there are 2 savings accounts with MBS one paying 5.5% and one paying 3.75%, is the latter one only aimed at people who are maxing out after opening the higher paying one? Why would anyone want the 3.75% interest if they can open the 5.5%?

My bench mark for going down this route is currently 5%, so I wouldn't open the lower paying one. This is only my third one, I've recently opened NatWest and RBS regular savers.

I recall that Monmouthshire is the one we have to wait until they've actually received the deposit before we can actually apply to see the account in online banking if I'm not mistaken?I consider myself to be a male feminist. Is that allowed?0 -

They let you open the account in branch, so quite a few people will have gone to their local branch yesterday to open the accounts. There will also be a fair few people ringing them to ask questions about it so they possibly anticipate a surge in postal applications.t1redmonkey said:

I wonder how they'd be overwhelmed so quickly though, seeing as that new 5.5% account just launched yesterday and is only available by branch/post (and there are currently postal strikes anyway).Band7 said:Monmouthshire BS

They say they are running a 5 working day processing time for new account applications because they are overwhelmed with new applications. Even if Royal Mail ever get the applications to them, there's only a slim chance that the accounts get opened before December 1.

On top of that they also launched a premium saver at 3% yesterday, which lets you apply online, so they will be getting a lot of applications for that as well.

2 -

Correct. Once you have received the letter with the account number (and the passbook, IIRC), you can add the account to your online banking. It then takes a day for the account to show.surreysaver said:

I recall that Monmouthshire is the one we have to wait until they've actually received the deposit before we can actually apply to see the account in online banking if I'm not mistaken?

I can't remember what you need to do to get online access in the first instance but those new to MMBS might want to try and register now. It's bound to take some time to process, too.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards