We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Bridlington1 said:

Application form and cheque now in the post.Bridlington1 said:

Unfortunately, the post box is where it'll stay until Saturday, postal strikes today and tomorrow.

3 -

Monnouthshire Building Society have also launched a Regular Saver Bond (issue 8) today, paying 3.75% (fixed rate).

The account runs for one year. It allows monthly deposits of up to £250 per calendar month.

The maximum balance is £3,000. It does not allow any withdrawals until after maturity.

If you close the account before maturity, the account will not qualify for the 3.75% rate. Any interest you have earned will be calculated at 0.20%.

The account can only be opened in branch or agency.

https://www.monbs.com/products/regular-saver-bond/

Please call me 'Kazza'.7 -

@chris_the_bee How long from your date of account opening was it until you got your passbook and ID back please? They put my postcode in wrong on the system (despite it being correct in my application form) and that combined with the fact I have not had my ID or passbook or anything back yet is making me very concerned - I do have a tendency to overthink things so all may be well in the end, but for now I'm trying to figure out as much as possible about what to expect. For anyone wondering, say my postcode was AB1 2CD they put AB122CD - it may find its way to me eventually, but who knows.chris_the_bee said:

I just opened a Furness account successfully using a Pension entitlement letter. Easy to request get a proof of benefit letter online from DWP. Takes about 5 days to arrive. Can also request another if one is not returned to you. Furness returned my original letter and council tax bill with the passbook.where_are_we said:EssexHebridean said:

If the documents required are to meet money laundering regs then a council tax bill is valid for 12 months use rather than just 3 months as most other bills would be. Might help someone as it doesn’t seem to be widely known.trickydicky14 said:

I'm waiting for my winter fuel letter to arrive, so you can confirm it will be Ok as I.D? Like you, no way am I paying for certified copies.where_are_we said:Furness RS5 application by post is time consuming. But for 4% and access without loss of interest just about worth it for myself and OH - double the benefit for a little duplication. They told me a certified copy for ID was required. Over cautious in my opinion because we have been with them for a number of years, registered for online, and have everyday saver accounts. We do not pay for certifying, ever, as a matter of principle. However a government benefit letter (winter fuel allowance for us) less than 3 months old backed up by a bank statement is also Ok.

Yes, Council tax bill is valid for 12 months. This is good to know. Generally speaking and in Furness Building Society`s case a council tax bill is in the address verification list. It`s the Identity Verification list that is problematical because it requires original valuable documents (risk losing passport or driving license) or a certified copy (costly, unless you know someone in the right profession). The way round this is a government benefit letter less than 3 months old backed up by an address verification letter which could be a council tax bill less than 12 months old or a bank statement, credit card statement or utility bill (all less than 3 months old). This would satisfy F B Society.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

I opened a Furness regular saver about a fortnight ago. I sent off an application form on the Friday and received my passbook back the following Tuesday. I still haven't received by other documents back yet though.ForumUser7 said:

@chris_the_bee How long from your date of account opening was it until you got your passbook and ID back please? They put my postcode in wrong on the system (despite it being correct in my application form) and that combined with the fact I have not had my ID or passbook or anything back yet is making me very concerned - I do have a tendency to overthink things so all may be well in the end, but for now I'm trying to figure out as much as possible about what to expect. For anyone wondering, say my postcode was AB1 2CD they put AB122CD - it may find its way to me eventually, but who knows.chris_the_bee said:

I just opened a Furness account successfully using a Pension entitlement letter. Easy to request get a proof of benefit letter online from DWP. Takes about 5 days to arrive. Can also request another if one is not returned to you. Furness returned my original letter and council tax bill with the passbook.where_are_we said:EssexHebridean said:

If the documents required are to meet money laundering regs then a council tax bill is valid for 12 months use rather than just 3 months as most other bills would be. Might help someone as it doesn’t seem to be widely known.trickydicky14 said:

I'm waiting for my winter fuel letter to arrive, so you can confirm it will be Ok as I.D? Like you, no way am I paying for certified copies.where_are_we said:Furness RS5 application by post is time consuming. But for 4% and access without loss of interest just about worth it for myself and OH - double the benefit for a little duplication. They told me a certified copy for ID was required. Over cautious in my opinion because we have been with them for a number of years, registered for online, and have everyday saver accounts. We do not pay for certifying, ever, as a matter of principle. However a government benefit letter (winter fuel allowance for us) less than 3 months old backed up by a bank statement is also Ok.

Yes, Council tax bill is valid for 12 months. This is good to know. Generally speaking and in Furness Building Society`s case a council tax bill is in the address verification list. It`s the Identity Verification list that is problematical because it requires original valuable documents (risk losing passport or driving license) or a certified copy (costly, unless you know someone in the right profession). The way round this is a government benefit letter less than 3 months old backed up by an address verification letter which could be a council tax bill less than 12 months old or a bank statement, credit card statement or utility bill (all less than 3 months old). This would satisfy F B Society.

One thing to bear in mind is that the postmen are on strike today and tomorrow and again next Wednesday and Thursday which will cause delays.2 -

Sent application with £10 opening cheque 12th NovForumUser7 said:

@chris_the_bee How long from your date of account opening was it until you got your passbook and ID back please? They put my postcode in wrong on the system (despite it being correct in my application form) and that combined with the fact I have not had my ID or passbook or anything back yet is making me very concerned - I do have a tendency to overthink things so all may be well in the end, but for now I'm trying to figure out as much as possible about what to expect. For anyone wondering, say my postcode was AB1 2CD they put AB122CD - it may find its way to me eventually, but who knows.chris_the_bee said:

I just opened a Furness account successfully using a Pension entitlement letter. Easy to request get a proof of benefit letter online from DWP. Takes about 5 days to arrive. Can also request another if one is not returned to you. Furness returned my original letter and council tax bill with the passbook.

Yes, Council tax bill is valid for 12 months. This is good to know. Generally speaking and in Furness Building Society`s case a council tax bill is in the address verification list. It`s the Identity Verification list that is problematical because it requires original valuable documents (risk losing passport or driving license) or a certified copy (costly, unless you know someone in the right profession). The way round this is a government benefit letter less than 3 months old backed up by an address verification letter which could be a council tax bill less than 12 months old or a bank statement, credit card statement or utility bill (all less than 3 months old). This would satisfy F B Society.

Account opened & passbook sent 16th Nov

I received passbook & paid max balance by bank transfer & set up online access 18th Nov

£10 cheque cashed 23rd Nov1 -

Suffolk (ex-Ipswich) BS wef 1 Dec

Holiday Save / Smart Save Monthly (Closed issues)

4.10%

Increase only 0.3%

source3 -

Nick_C said:

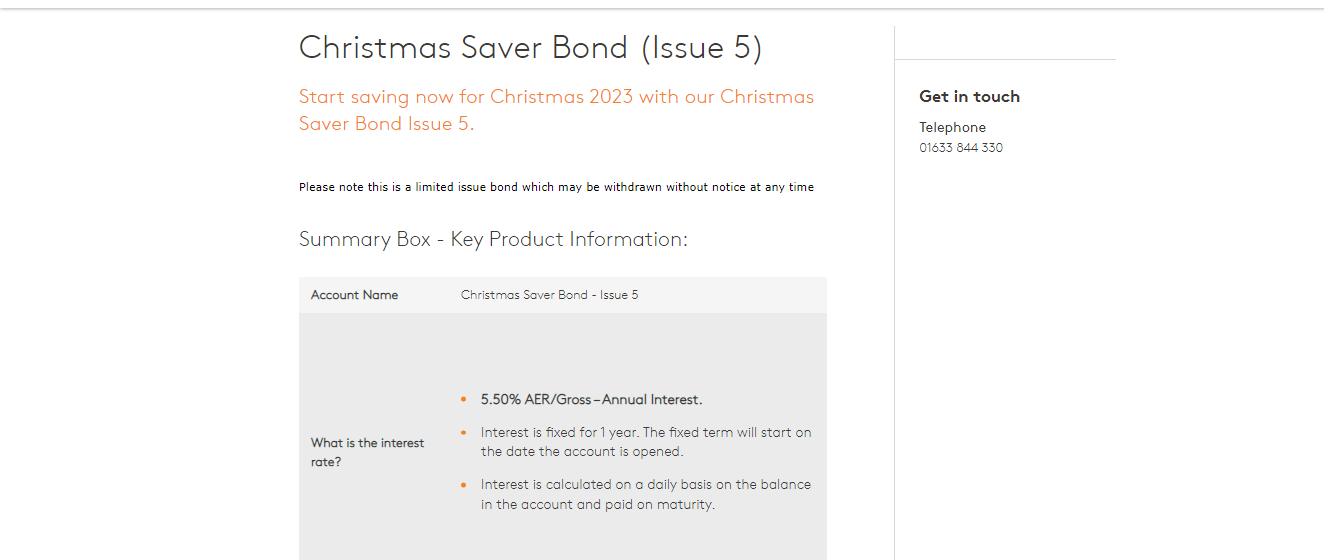

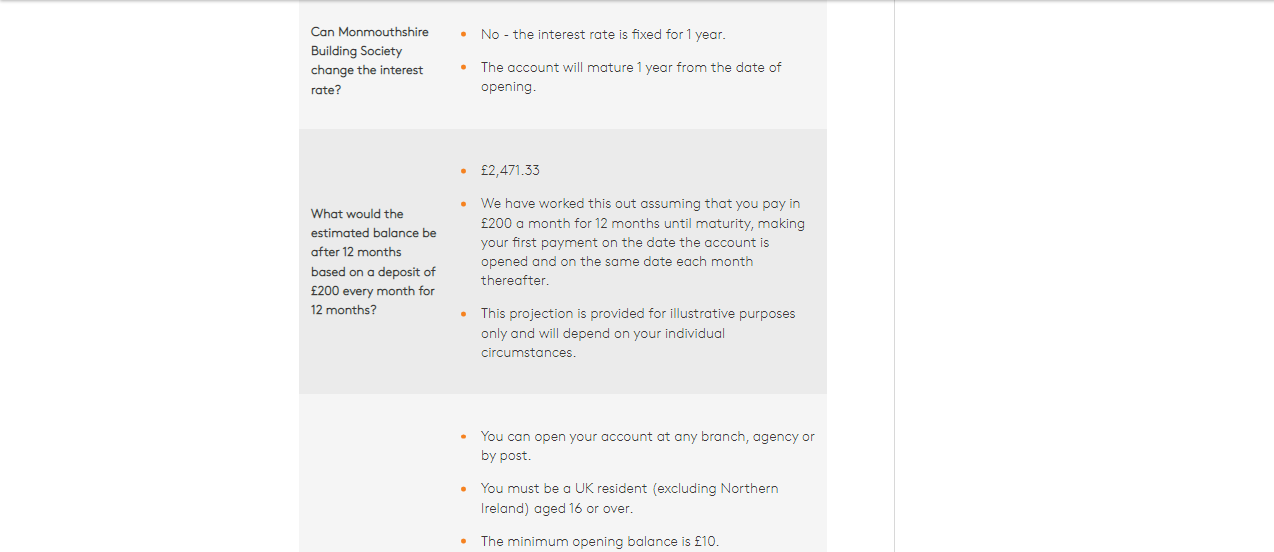

Key points;Bridlington1 said:Monmouthshire BS have launched a Christmas Saver bond at 5.5% (max £200/mth).

Open in branch or by post.

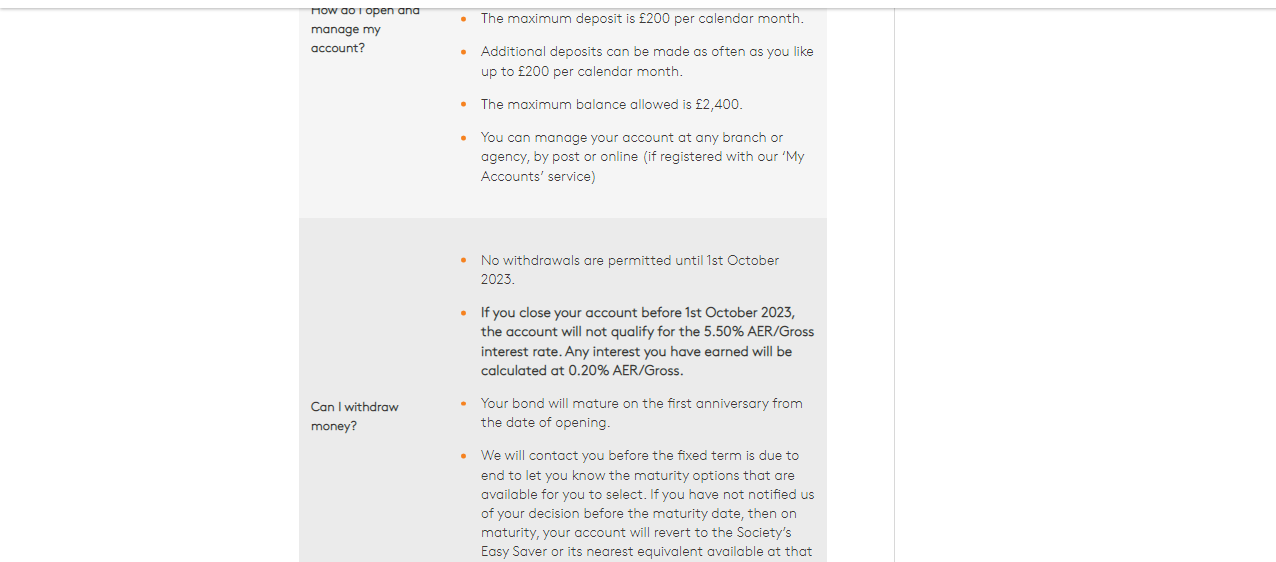

Fixed interest- No withdrawals are permitted until 1st October 2023.

- If you close your account before 1st October 2023, the account will not qualify for the 5.50% AER/Gross interest rate. Any interest you have earned will be calculated at 0.20% AER/Gross.

To me at least it’s pretty clear that Monmouthshire BS has launched both of the above regular savings accounts today at least partly in order to ‘better’ the currently available equivalent regular savings accounts from their ‘local’ rival, Principality Building Society, and potentially divert at least some of the money that would otherwise be heading Principality’s way over the next few months to Monmouthshire instead!Kazza242 said:Monnouthshire Building Society have also launched a Regular Saver Bond (issue 8) today, paying 3.75% (fixed rate).

The account runs for one year. It allows monthly deposits of up to £250 per calendar month.

The maximum balance is £3,000. It does not allow any withdrawals until after maturity.

If you close the account before maturity, the account will not qualify for the 3.75% rate. Any interest you have earned will be calculated at 0.20%.

The account can only be opened in branch or agency.

https://www.monbs.com/products/regular-saver-bond/

How are Principality going to respond to this rather cheeky challenge from their slightly smaller neighbours in South Wales, if at all? If they do decide to come back with a very good offer or two of their own, it could be very good news for savers!2 -

Probably not at all. Principality have a Wales-wide and borders presence and won't be too concerned about Mon BS.

Swansea BS ought to get their 'pen ol' into gear though.2 -

Re: Monmouth Xmas RS

Sorry if I’m being a bit thick, can you make an initial deposit into this account without sending a cheque?Save £12k in 2020 #42 £12,551.25 / £14,000 89.65%0 -

I suppose you could send/risk a £10 note but that's the only alternative, short of applying in person with cash.Reg_Smeeton said:Re: Monmouth Xmas RS

Sorry if I’m being a bit thick, can you make an initial deposit into this account without sending a cheque?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards