We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Bucks BS Members and Locals RS (a legacy account) to increase to 3.45pc from 1 December (from 2.80pc).

Their available RS goes from 2.45pc to 3pc on the same date.4 -

Imagine their irritation at that penny not reconciled due to the cheque not being banked by Rudyson thensurreysaver said:

But balancing the books is important. Think how much it would have cost in auditors if the penny had just been ignoredRudyson said:

I have a cheque from Santander for 1p interest. i kept it as a souvenirphillw said:

No idea what they were doing then. They spent more money on the cheque than I got in interest. 3

3 -

I received a final demand (a red one) from British Telcom for £0. So, I sent them a cheque or £0.......never heard from them again. I framed the final demand and hung it in my office.4

-

25

-

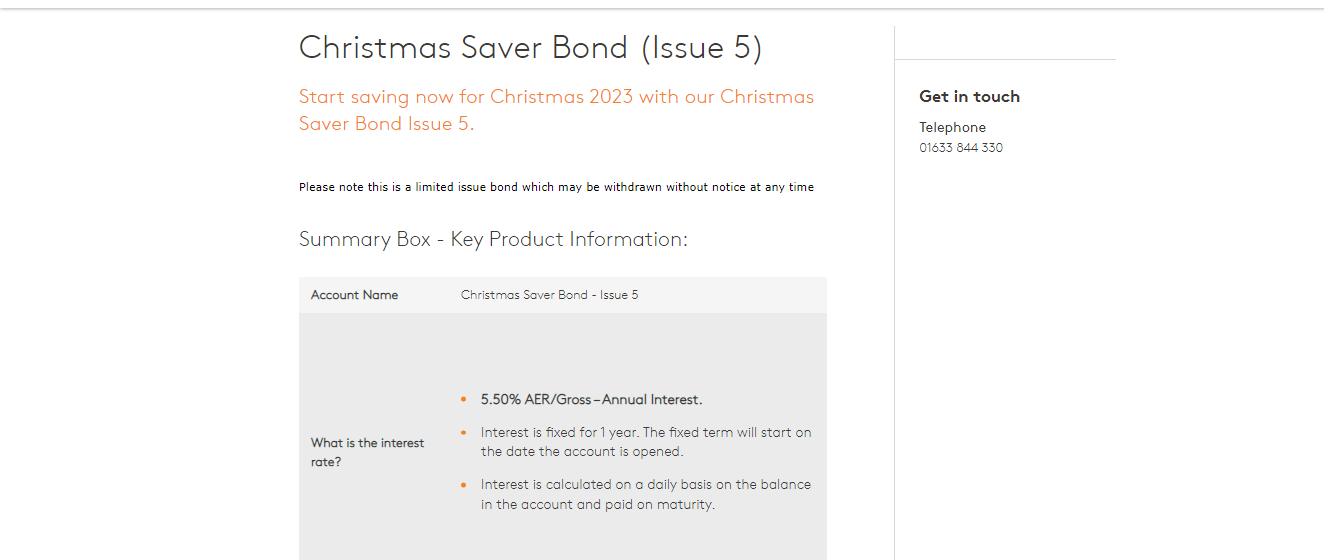

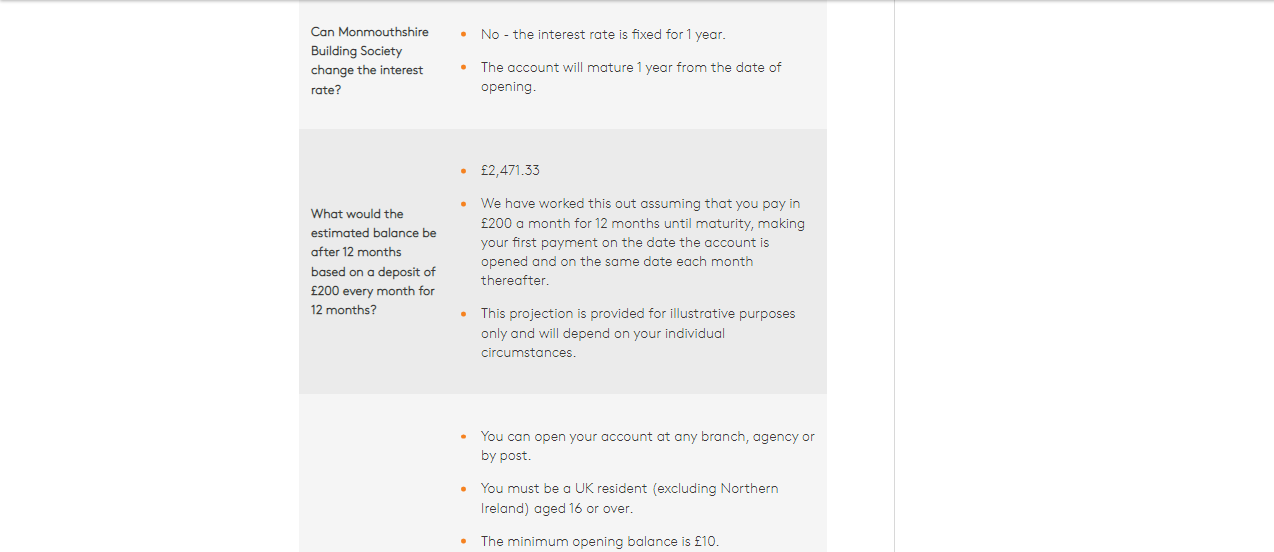

Apply by Post only? Are they joking?Bridlington1 said:Monmouthshire BS have launched a Christmas Saver bond at 5.5% (max £200/mth).3 -

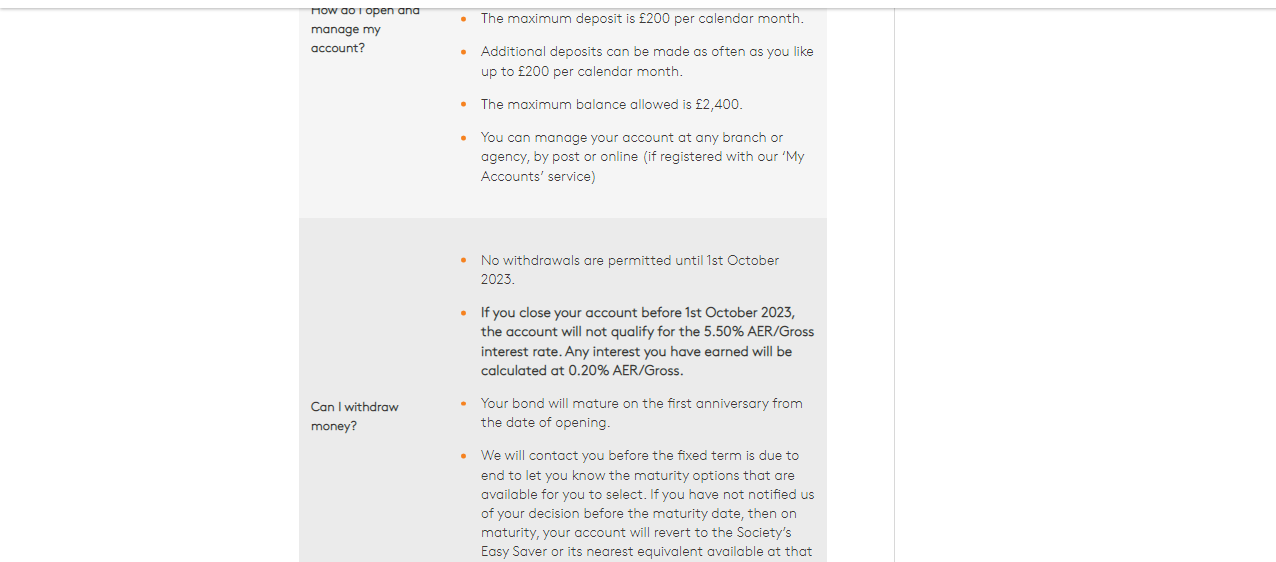

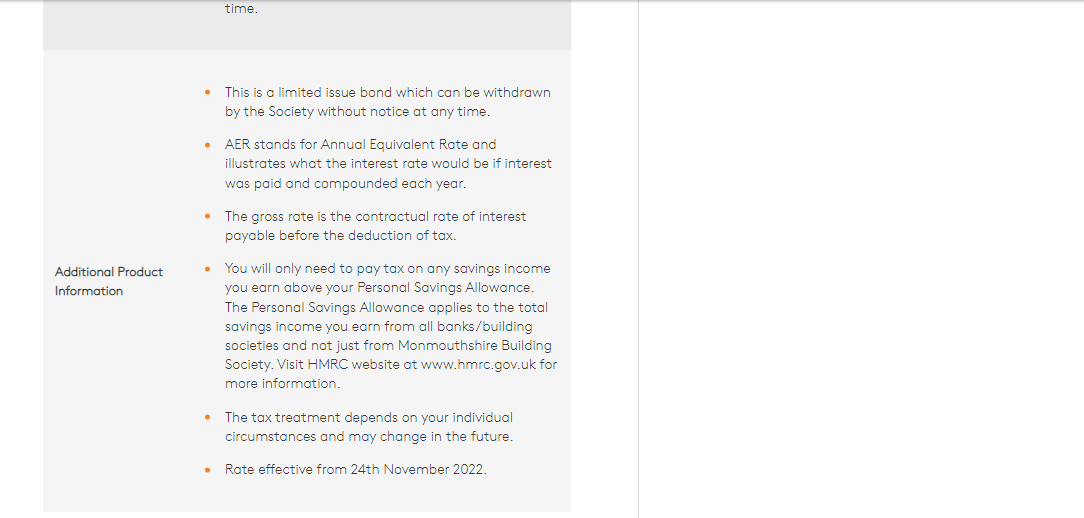

Key points;Bridlington1 said:Monmouthshire BS have launched a Christmas Saver bond at 5.5% (max £200/mth).

Open in branch or by post.

Fixed interest- No withdrawals are permitted until 1st October 2023.

- If you close your account before 1st October 2023, the account will not qualify for the 5.50% AER/Gross interest rate. Any interest you have earned will be calculated at 0.20% AER/Gross.

3 -

I wouldn't usually bother with any 'apply by post' accounts, but I think I will make the effort for a 5.5% one

Edit: Just realised I have 2 branches in my city so I can go to a branch instead (never even noticed their presence here before!).2 -

This is a very good rate, but I think no penalty-free closure option makes it one of the few I will not apply for...Nick_C said:

Key points;Bridlington1 said:Monmouthshire BS have launched a Christmas Saver bond at 5.5% (max £200/mth).

Open in branch or by post.

Fixed interest- No withdrawals are permitted until 1st October 2023.

- If you close your account before 1st October 2023, the account will not qualify for the 5.50% AER/Gross interest rate. Any interest you have earned will be calculated at 0.20% AER/Gross.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

I'd almost given up on Monmouthshire having another decent rate account.Bridlington1 said:Bridlington1 said:

I assume they've changed the opening method to cut out the need for them to send you the application form after you'd applied online as previously. This should meana quicker opening date in theory.

Fortunately I retain pre-paid envelopes just in case needed for times like now.3 -

Application form and cheque now in the post.Bridlington1 said:1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards