We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

I still have a First Direct RS with £1800 in i5 at 1%. Please could someone confirm the process to bin it so I can open a new one at 3.5%. I know I’ll lose interest but simply not worth keeping now. Do I have to call them? Thanks.0

-

jaypers said:I still have a First Direct RS with £1800 in i5 at 1%. Please could someone confirm the process to bin it so I can open a new one at 3.5%. I know I’ll lose interest but simply not worth keeping now. Do I have to call them? Thanks.I would also be interested re. FD, as mine's only been opened for a couple of months.Additionally, I have a Santander RS which recently auto-renewed at 0.50%, but noticed it's now paying 2.50% under a different issue. Is there any way to redesignate that account to the new issue without having to close the account (I don't particularly want to do that as have transactional history).0

-

You have to call to close the ac so (later) you can open a new one.jaypers said:I still have a First Direct RS with £1800 in i5 at 1%. Please could someone confirm the process to bin it so I can open a new one at 3.5%. I know I’ll lose interest but simply not worth keeping now. Do I have to call them? Thanks.0 -

My FD RS @ 3.5% account has no option to transfer money out online. You need to call or message to transfer money back to your normal account.jaypers said:I still have a First Direct RS with £1800 in i5 at 1%. Please could someone confirm the process to bin it so I can open a new one at 3.5%. I know I’ll lose interest but simply not worth keeping now. Do I have to call them? Thanks.0 -

FD: If you close your account before the end of the 12 month period, they'll only pay you interest at their standard Savings Account variable rate, which is something like 0.1%. You'd be better off reducing the monthly contributions to £25, and opening another RS elsewhere. Once your FD has matured, you can still start a new one.

Santander: I don't believe you can upgrade to the new issue but closing the old and opening a new one should be simple. You need to talk to Santander.3 -

My Chorley members regular saver is due to mature at the end of June and the paperwork came today. The replacement regular saver is paying a pitiful 1.4% so its a no from me.

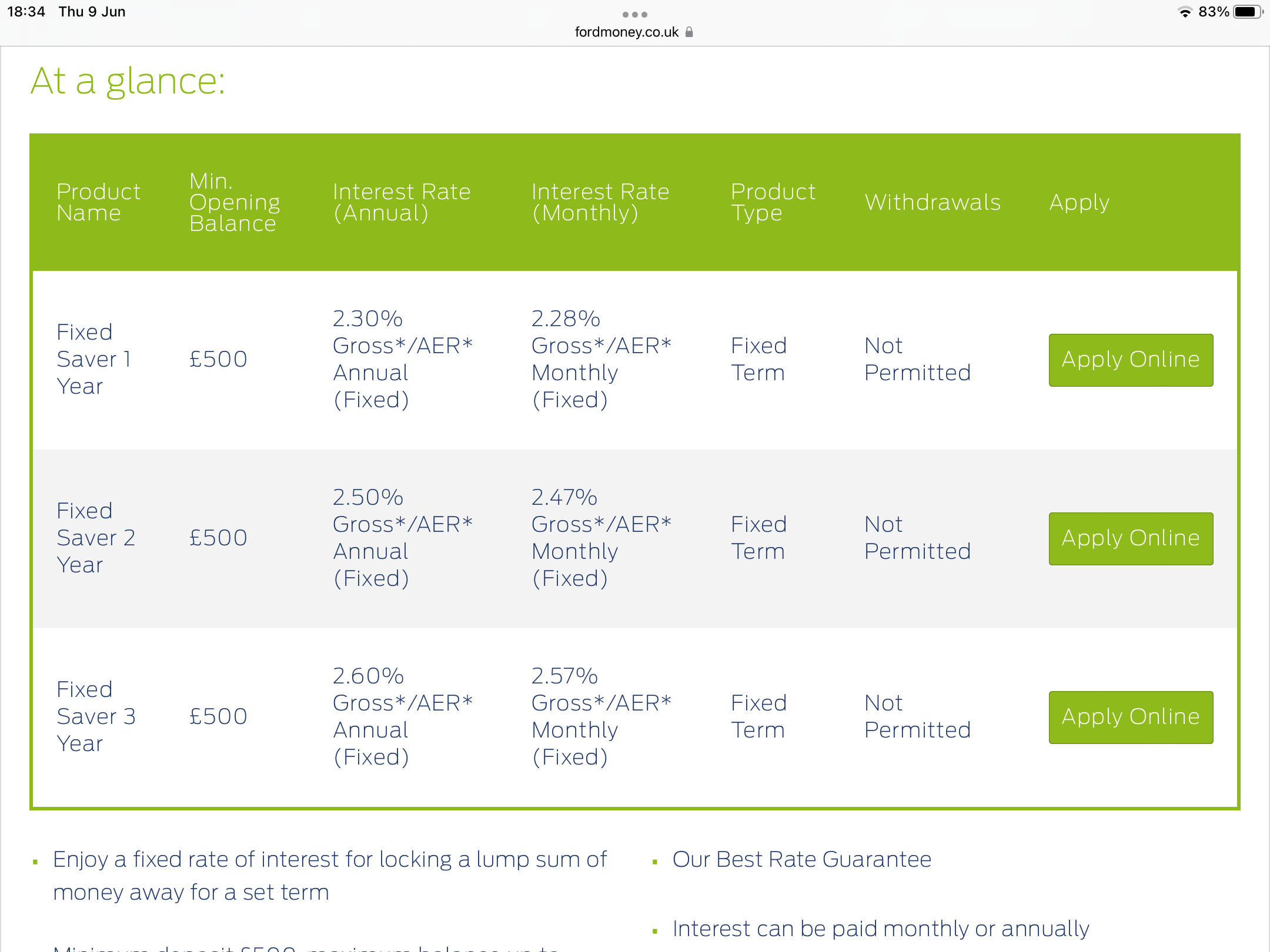

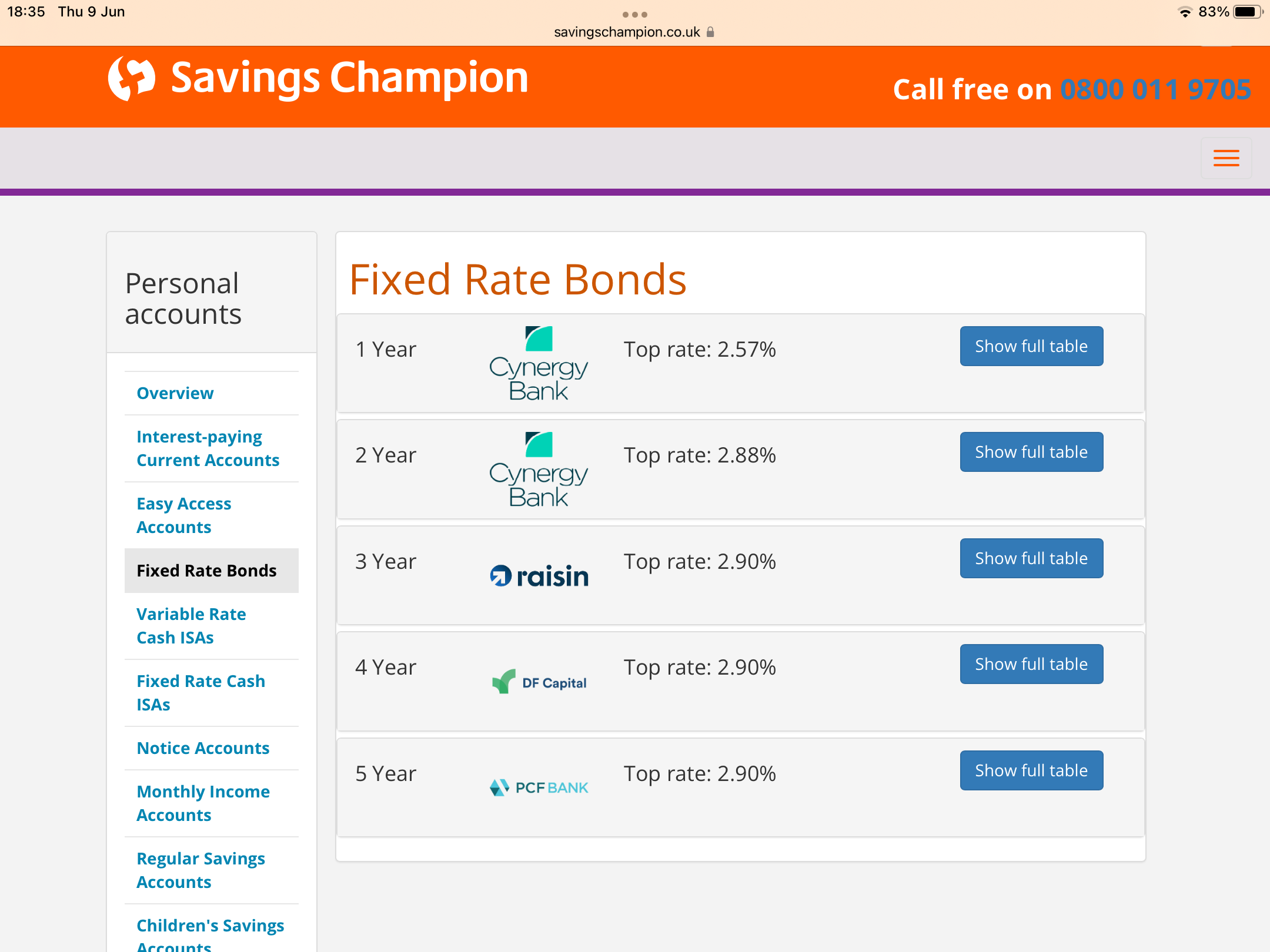

I've found a few 2 year fixed rate bonds paying 1.8, 1.9 and 2 % or thereabouts so the proceeds of various maturing regular savers that are imminent eg Chorley and Lloyds etc will be distributed between them.

I've got a Chorley seasonal saver 1 maturing in October so we will see what happens by then.

I am also thinking that if we close a maturing regular saver we might need to have some sort of instant easy account with a small balance so that we can still be counted as a customer, incase that Building Society does decide to have a good enough regular saver in the future.“Create all the happiness you are able to create; remove all the misery you are able to remove. Every day will allow you, --will invite you to add something to the pleasure of others, --or to diminish something of their pains.”0 -

I've also decided against opening the replacement Chorley Members RS at 1.4%. Although the rate is variable and not fixed for the duration, the account doesn't allow withdrawals or early closure (even at the penalty of a lower interest rate), so there is no escape for deposited funds until maturity. There is also a minimum monthly deposit of £25. With those quite onerous terms in a climate of rising rates, I do wonder if Chorley are seriously expecting many takers for this account. It is only available to savers with a maturing Regular Saver, so presumably most of those eligible will be experienced savers who know what to avoid.mhoc said:My Chorley members regular saver is due to mature at the end of June and the paperwork came today. The replacement regular saver is paying a pitiful 1.4% so its a no from me.

I've found a few 2 year fixed rate bonds paying 1.8, 1.9 and 2 % or thereabouts so the proceeds of various maturing regular savers that are imminent eg Chorley and Lloyds etc will be distributed between them.

I've got a Chorley seasonal saver 1 maturing in October so we will see what happens by then.

I am also thinking that if we close a maturing regular saver we might need to have some sort of instant easy account with a small balance so that we can still be counted as a customer, incase that Building Society does decide to have a good enough regular saver in the future.1 -

I was thinking the same but also want to retain the continuity of membership. Isn't is better to open a new RS and pay in the minimum £25 a month as from memory the minimum balance of an instant access account is £100 anyway?Deleted_User said:

I've also decided against opening the replacement Chorley Members RS at 1.4%. Although the rate is variable and not fixed for the duration, the account doesn't allow withdrawals or early closure (even at the penalty of a lower interest rate), so there is no escape for deposited funds until maturity. There is also a minimum monthly deposit of £25. With those quite onerous terms in a climate of rising rates, I do wonder if Chorley are seriously expecting many takers for this account. It is only available to savers with a maturing Regular Saver, so presumably most of those eligible will be experienced savers who know what to avoid.mhoc said:My Chorley members regular saver is due to mature at the end of June and the paperwork came today. The replacement regular saver is paying a pitiful 1.4% so its a no from me.

I've found a few 2 year fixed rate bonds paying 1.8, 1.9 and 2 % or thereabouts so the proceeds of various maturing regular savers that are imminent eg Chorley and Lloyds etc will be distributed between them.

I've got a Chorley seasonal saver 1 maturing in October so we will see what happens by then.

I am also thinking that if we close a maturing regular saver we might need to have some sort of instant easy account with a small balance so that we can still be counted as a customer, incase that Building Society does decide to have a good enough regular saver in the future.

0 -

Yes, that makes sense. I've got a Chorleian Saver from a previous RS maturity in which I've held £20 since the old RS matured. I've also got the Loyalty Seasonal Saver which matures on 31 October. But if I didn't have these I think I would let the RS mature on 30 June into a Chorleian Saver and leave the minimum amount in it.granta said:

I was thinking the same but also want to retain the continuity of membership. Isn't is better to open a new RS and pay in the minimum £25 a month as from memory the minimum balance of an instant access account is £100 anyway?Deleted_User said:

I've also decided against opening the replacement Chorley Members RS at 1.4%. Although the rate is variable and not fixed for the duration, the account doesn't allow withdrawals or early closure (even at the penalty of a lower interest rate), so there is no escape for deposited funds until maturity. There is also a minimum monthly deposit of £25. With those quite onerous terms in a climate of rising rates, I do wonder if Chorley are seriously expecting many takers for this account. It is only available to savers with a maturing Regular Saver, so presumably most of those eligible will be experienced savers who know what to avoid.mhoc said:My Chorley members regular saver is due to mature at the end of June and the paperwork came today. The replacement regular saver is paying a pitiful 1.4% so its a no from me.

I've found a few 2 year fixed rate bonds paying 1.8, 1.9 and 2 % or thereabouts so the proceeds of various maturing regular savers that are imminent eg Chorley and Lloyds etc will be distributed between them.

I've got a Chorley seasonal saver 1 maturing in October so we will see what happens by then.

I am also thinking that if we close a maturing regular saver we might need to have some sort of instant easy account with a small balance so that we can still be counted as a customer, incase that Building Society does decide to have a good enough regular saver in the future.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards