We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

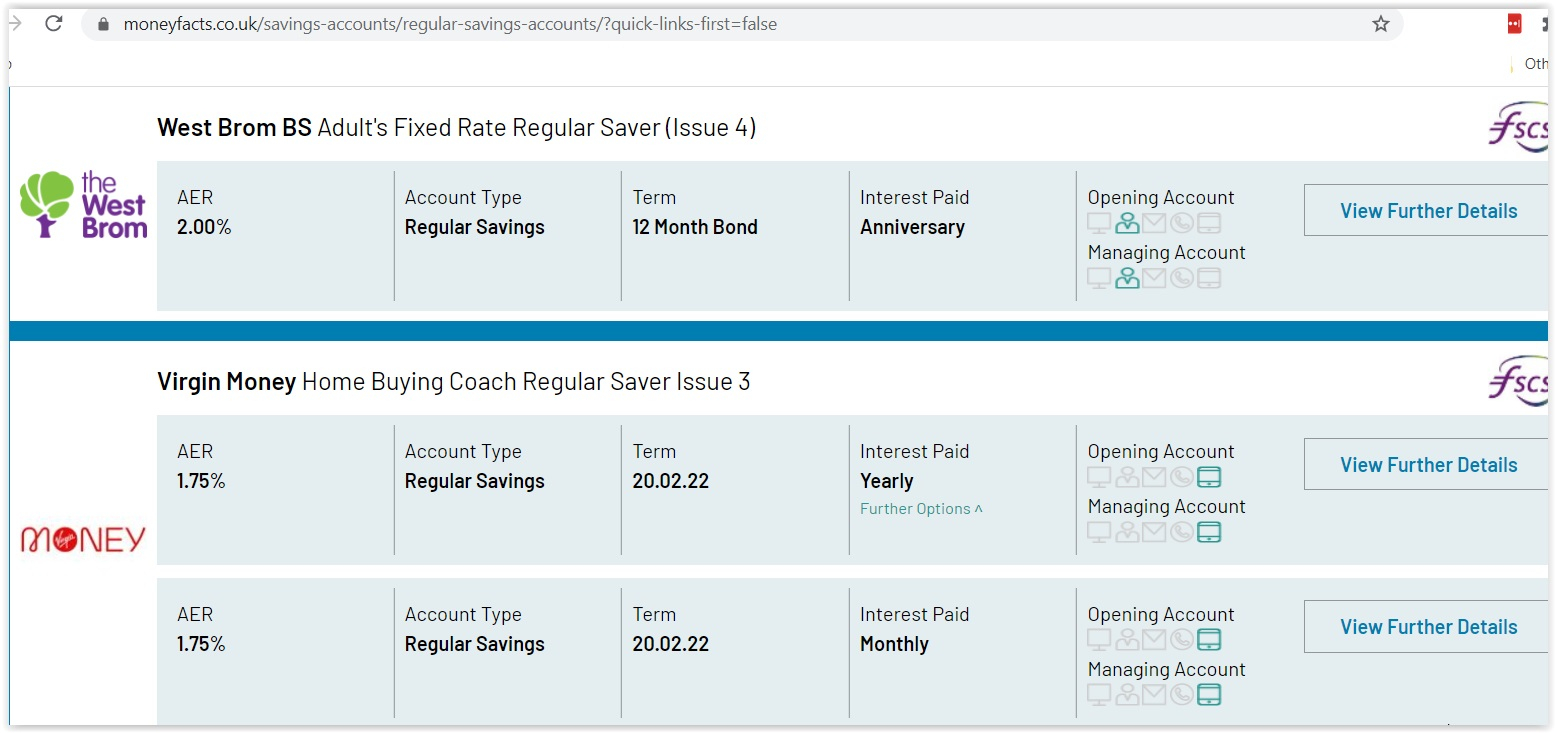

The account is not very hidden, given that it is on the Virgin website, and on the most popular savings account directory, and probably on other sites, too

someone said:- Before withdrawing the 1% ones they launched an app about buying a house and linked the app (best they could in a not 100% foolproof way) to a new reg saver at a rate that is appealing to most people but it's effectively hidden, you don't see it on their website, most will be accessing via the app and would have found out about it via targeted marketing or word of mouth.

someone said:

As always, there are the words on websites, and then there is the IT that supports/enforces [or not] the words on websites.There is also a new term added re only holding one (instead of one of each issue) 1

1 -

Its not on the VM website and the link you used is "technically" only available from the Home buyer Coaching App but been shared numerous times which leads to people thinking it's on the website for all to view. If you actually go direct to VM website homepage and search their saving products there is no mention of it.colsten said:The account is not very hidden, given that it is on the Virgin website,1 -

Thank you for this, I could only find the offline one via Google. Sadly I cannot apply for it atm as it comes up with an error that something went wrong when I try to login. I will try again in a bit!someone said:London7766551 said:

I had a look on their site but it says you need a branch appointment to open an account.cosh25 said:The Principality First Home Steps account was one I always looked at... notice that from today if can be opened online. Its meant for ‘first time buyers’ (not sure how this is enforced as haven’t had a proper dig around).

key points

£1500 max per month up to £25000 and tiered rates from 0.80% to 1.50% depending on balance.

Obviously there is more to the account, but heads up for those who may want to look further.It's a separate product. Raises the question on if someone with the branch based one can also open the online one. Given up to 1.5% on 2x £25,000 with "up to 6 withdrawals a year" (as you will have two withdrawal allowances) which ain't bad.Branch "First Home Steps Issue 2":-----Online "First Home Steps Online" :0 -

My second one is also open and funded, however there is also a message that they are still opening the account. Will Virgin care that I have two? time will tell......Gers said:JamesRobinson48 said:prixon said:I see Virgin Money have a new issue of their Home Buying Coach Regular Saver, which now runs until 20th Feb 2022 and is still at 1.75% (£250/mth max). It’s associated with the Virgin Home Buying Coach app but anyone can download this and they don’t necessarily have to be buying a house....

Thanks! If I'm not mistaken, one isn't allowed to hold more than one VM Home Buying Coach RS at the same time. But would be interested to hear if that turns out not to be the case, or if anyone manages to get both.I've just opened my second one via the link given above. Interestingly VM call it HBC regular saver 3 - must have missed number two!EDIT - and funded, and showing.0 -

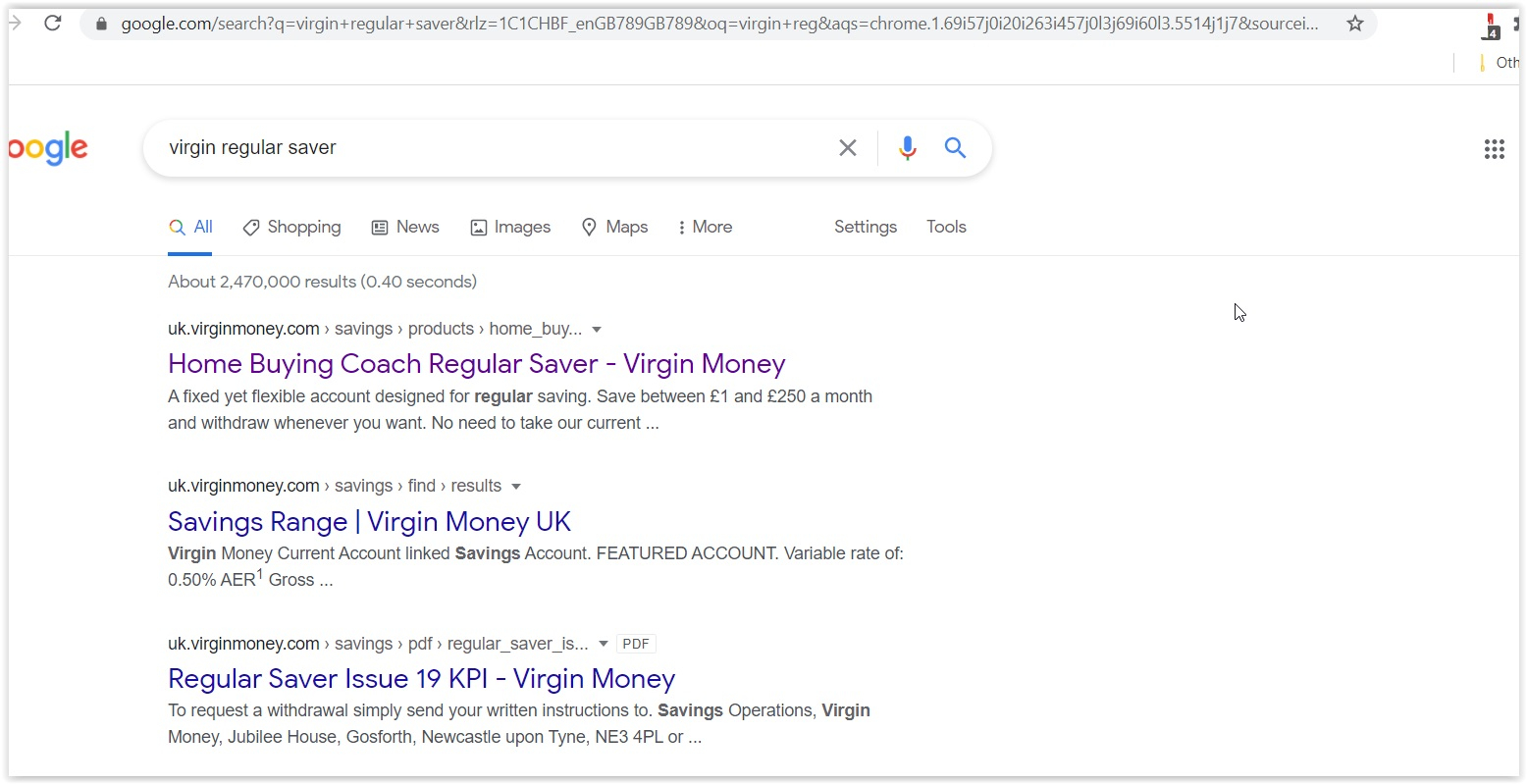

Of course it is on the website. It's the top hit on a Google search for "virgin regular saver"SFindlay said:

Its not on the VM website and the link you used is "technically" only available from the Home buyer Coaching App but been shared numerous times which leads to people thinking it's on the website for all to view. If you actually go direct to VM website homepage and search their saving products there is no mention of it.colsten said:The account is not very hidden, given that it is on the Virgin website,

0 -

I too have opened my second also got the message, it states account will be opened within 24hrs and also states I can fund it right now, so I would not worry.London7766551 said:

My second one is also open and funded, however there is also a message that they are still opening the account. Will Virgin care that I have two? time will tell......Gers said:JamesRobinson48 said:prixon said:I see Virgin Money have a new issue of their Home Buying Coach Regular Saver, which now runs until 20th Feb 2022 and is still at 1.75% (£250/mth max). It’s associated with the Virgin Home Buying Coach app but anyone can download this and they don’t necessarily have to be buying a house....

Thanks! If I'm not mistaken, one isn't allowed to hold more than one VM Home Buying Coach RS at the same time. But would be interested to hear if that turns out not to be the case, or if anyone manages to get both.I've just opened my second one via the link given above. Interestingly VM call it HBC regular saver 3 - must have missed number two!EDIT - and funded, and showing.

Mind you, I did open it via the app and not the link above.I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.0 -

Read my post, IT IS NOT on web site direct by going to their homepage and searching for available savings products!! So anybody not on these kind of forums who go to the VM website and search for avaialble products WILL NOT see the product and WILL NOT be able to apply for it therefore IT IS NOT on their website!!!colsten said:

Of course it is on the website. It's the top hit on a Google search for "virgin regular saver"SFindlay said:

Its not on the VM website and the link you used is "technically" only available from the Home buyer Coaching App but been shared numerous times which leads to people thinking it's on the website for all to view. If you actually go direct to VM website homepage and search their saving products there is no mention of it.colsten said:The account is not very hidden, given that it is on the Virgin website,

At no time did I say it wasn't available by searching for the link to a hidden page posted by previous APPLICANTS.1 -

SFindlay said:

Read my post, IT IS NOT on web site direct by going to their homepage and searching for available savings products!! So anybody not on these kind of forums who go to the VM website and search for avaialble products WILL NOT see the product and WILL NOT be able to apply for it therefore IT IS NOT on their website!!!colsten said:

Of course it is on the website. It's the top hit on a Google search for "virgin regular saver"SFindlay said:

Its not on the VM website and the link you used is "technically" only available from the Home buyer Coaching App but been shared numerous times which leads to people thinking it's on the website for all to view. If you actually go direct to VM website homepage and search their saving products there is no mention of it.colsten said:The account is not very hidden, given that it is on the Virgin website,

At no time did I say it wasn't available by searching for the link to a hidden page posted by previous APPLICANTS.I understand what you are saying as it's not showing here https://uk.virginmoney.com/savings/ but if you search in a browser for 'virgin money regular saver' it pops up.

0 -

Definitely not one for a lot, no matter what the checks are with a condition like this:London7766551 said:

Thank you for this, I could only find the offline one via Google. Sadly I cannot apply for it atm as it comes up with an error that something went wrong when I try to login. I will try again in a bit!someone said:London7766551 said:

I had a look on their site but it says you need a branch appointment to open an account.cosh25 said:The Principality First Home Steps account was one I always looked at... notice that from today if can be opened online. Its meant for ‘first time buyers’ (not sure how this is enforced as haven’t had a proper dig around).

key points

£1500 max per month up to £25000 and tiered rates from 0.80% to 1.50% depending on balance.

Obviously there is more to the account, but heads up for those who may want to look further.It's a separate product. Raises the question on if someone with the branch based one can also open the online one. Given up to 1.5% on 2x £25,000 with "up to 6 withdrawals a year" (as you will have two withdrawal allowances) which ain't bad.Branch "First Home Steps Issue 2":-----Online "First Home Steps Online" :- This account can only be opened by individuals who do not, or have not previously, owned a property.

0 -

I got involved with the app for the first one but this one I did totally without it and it's listed on the website with my others.trickydicky14 said:

I too have opened my second also got the message, it states account will be opened within 24hrs and also states I can fund it right now, so I would not worry.London7766551 said:

My second one is also open and funded, however there is also a message that they are still opening the account. Will Virgin care that I have two? time will tell......Gers said:JamesRobinson48 said:prixon said:I see Virgin Money have a new issue of their Home Buying Coach Regular Saver, which now runs until 20th Feb 2022 and is still at 1.75% (£250/mth max). It’s associated with the Virgin Home Buying Coach app but anyone can download this and they don’t necessarily have to be buying a house....

Thanks! If I'm not mistaken, one isn't allowed to hold more than one VM Home Buying Coach RS at the same time. But would be interested to hear if that turns out not to be the case, or if anyone manages to get both.I've just opened my second one via the link given above. Interestingly VM call it HBC regular saver 3 - must have missed number two!EDIT - and funded, and showing.

Mind you, I did open it via the app and not the link above.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards