We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

Same here.JamesRobinson48 said:SFindlay said:You might need to clear cookies or refresh your browser

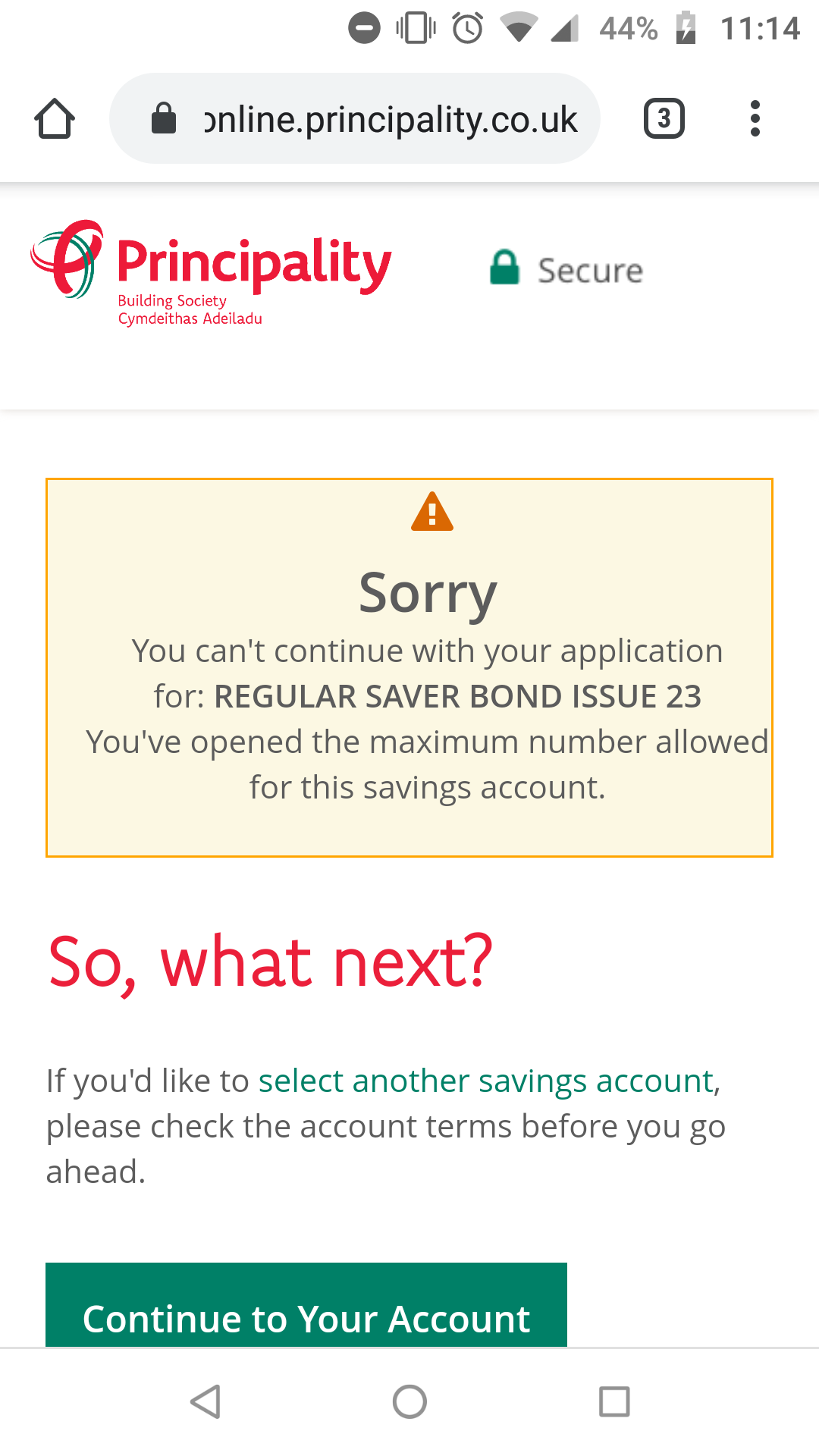

Has anyone managed to open Principality BS 24th Issue RS yet? I just tried and failed to do so online. Beyond a certain point their system seems to think they're still in the 23rd Issue, and curtailed my application on the grounds that I already have that one. Hopefully will be fixed within a few hours.0 -

Just tried and I got the same, spoken to them and she's away to inform the IT department of the problem and will email me result and I'll update here. Someone obviously forgot to press the right button this morning!!!JamesRobinson48 said:SFindlay said:You might need to clear cookies or refresh your browser

Has anyone managed to open Principality BS 24th Issue RS yet? I just tried and failed to do so online. Beyond a certain point their system seems to think they're still in the 23rd Issue, and curtailed my application on the grounds that I already have that one. Hopefully will be fixed within a few hours.1 -

SFindlay said:

Just tried and I got the same, spoken to them and she's away to inform the IT department of the problem and will email me result and I'll update here. Someone obviously forgot to press the right button this morning!!!JamesRobinson48 said:SFindlay said:You might need to clear cookies or refresh your browser

Has anyone managed to open Principality BS 24th Issue RS yet? I just tried and failed to do so online. Beyond a certain point their system seems to think they're still in the 23rd Issue, and curtailed my application on the grounds that I already have that one. Hopefully will be fixed within a few hours.

Above is the error message0 -

Its all working now, opened and funded.JamesRobinson48 said:SFindlay said:You might need to clear cookies or refresh your browser

Has anyone managed to open Principality BS 24th Issue RS yet? I just tried and failed to do so online. Beyond a certain point their system seems to think they're still in the 23rd Issue, and curtailed my application on the grounds that I already have that one. Hopefully will be fixed within a few hours.6 -

Thank for this open and funded for meIts all working now, opened and funded.

#40 Save £1 a day for Christmas 2020 £109/366

#9 Save 12k in2020 £3705/12000.000 -

I find this totally weird. It's as if Virgin have replaced their old fashioned RSs at 1% latest with the HBC at 1.75%. A reverse trend. I've opened and deposited. Let's see what tomorrow brings.0

-

schiff said:I find this totally weird. It's as if Virgin have replaced their old fashioned RSs at 1% latest with the HBC at 1.75%. A reverse trend. I've opened and deposited. Let's see what tomorrow brings.To me not weird, just they are activity trying to shifted their Reg Saver customer base to target the more "long term profitable customers".

- First they stopped their Store Based RS (they required the chat with the staff) which removes the "Granny with a passbook that wants to put a small amount away every week/month for x reason".

- They withdrew their online RS just before Xmas. TBH the rate at 1% was probably not pulling in the people they wanted, multi account openers like myself who wanted the fixed rate "just in case". Many times you could get instant access accounts with better rates.

- Before withdrawing the 1% ones they launched an app about buying a house and linked the app (best

they could in a not 100% foolproof way) to a new reg saver at a rate

that is appealing to most people but it's effectively hidden, you don't see it on their website, most will be accessing via the app and would have found out about it via targeted marketing or word of mouth.

There is also a new term added re only holding one (instead of one of each issue) which also hints at the above shift. No point then spending more than necessary to get your details and/or in the mindset of considering Virgin money for other products.2 -

The Principality First Home Steps account was one I always looked at... notice that from today if can be opened online. Its meant for ‘first time buyers’ (not sure how this is enforced as haven’t had a proper dig around).

key points

£1500 max per month up to £25000 and tiered rates from 0.80% to 1.50% depending on balance.

Obviously there is more to the account, but heads up for those who may want to look further.2 -

I had a look on their site but it says you need a branch appointment to open an account.cosh25 said:The Principality First Home Steps account was one I always looked at... notice that from today if can be opened online. Its meant for ‘first time buyers’ (not sure how this is enforced as haven’t had a proper dig around).

key points

£1500 max per month up to £25000 and tiered rates from 0.80% to 1.50% depending on balance.

Obviously there is more to the account, but heads up for those who may want to look further.0 -

London7766551 said:

I had a look on their site but it says you need a branch appointment to open an account.cosh25 said:The Principality First Home Steps account was one I always looked at... notice that from today if can be opened online. Its meant for ‘first time buyers’ (not sure how this is enforced as haven’t had a proper dig around).

key points

£1500 max per month up to £25000 and tiered rates from 0.80% to 1.50% depending on balance.

Obviously there is more to the account, but heads up for those who may want to look further.It's a separate product. Raises the question on if someone with the branch based one can also open the online one. Given up to 1.5% on 2x £25,000 with "up to 6 withdrawals a year" (as you will have two withdrawal allowances) which ain't bad.Branch "First Home Steps Issue 2":-----Online "First Home Steps Online" :

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards