We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

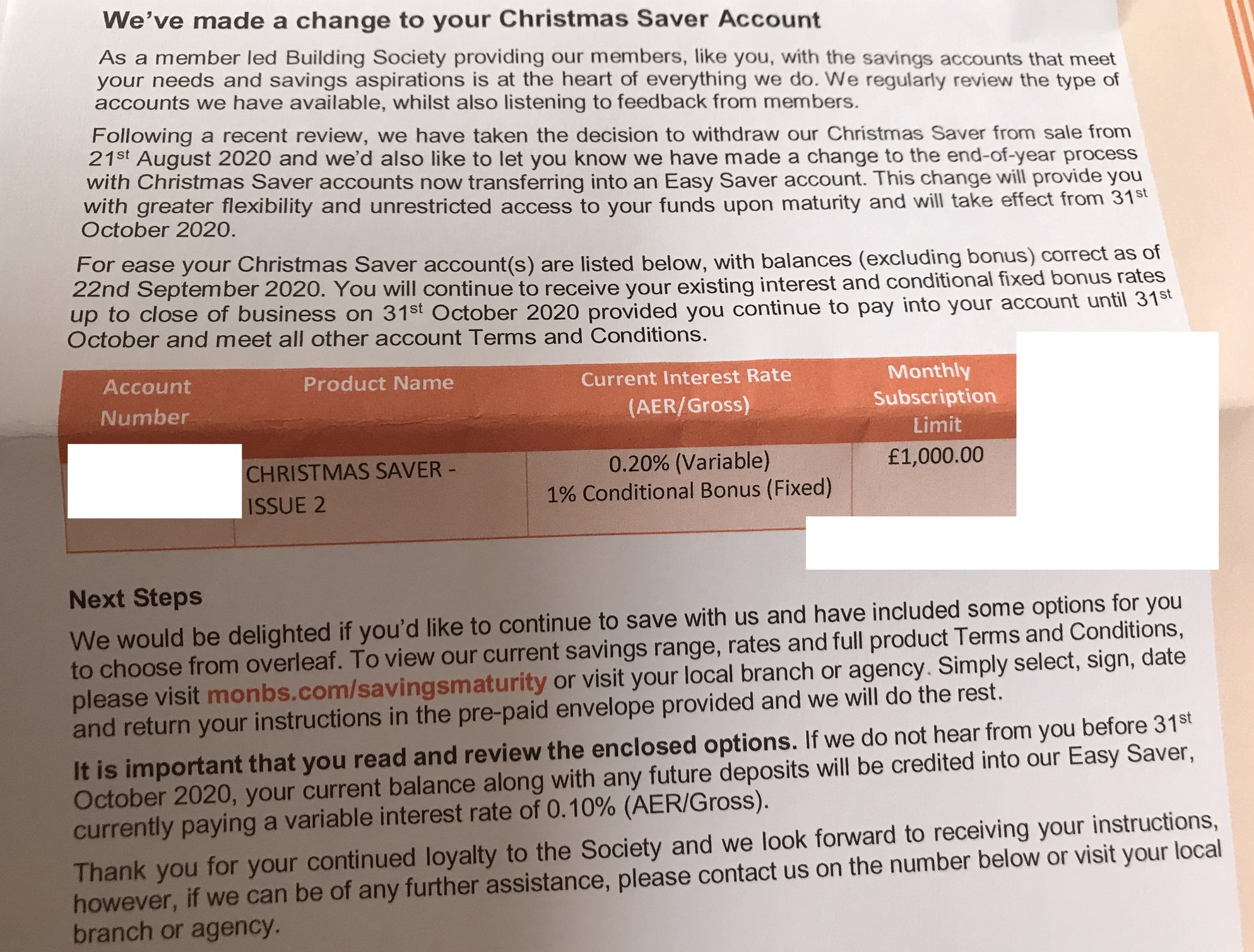

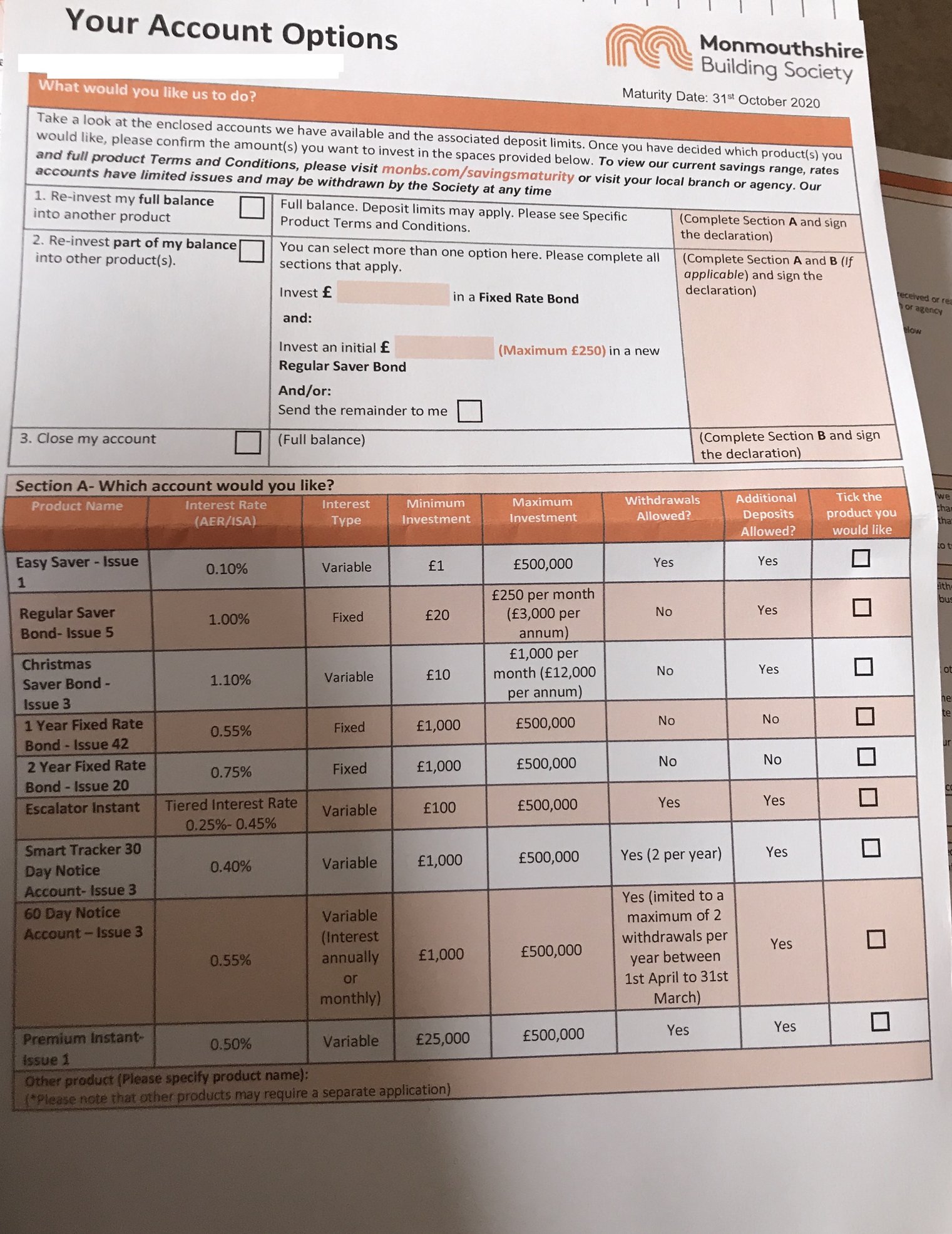

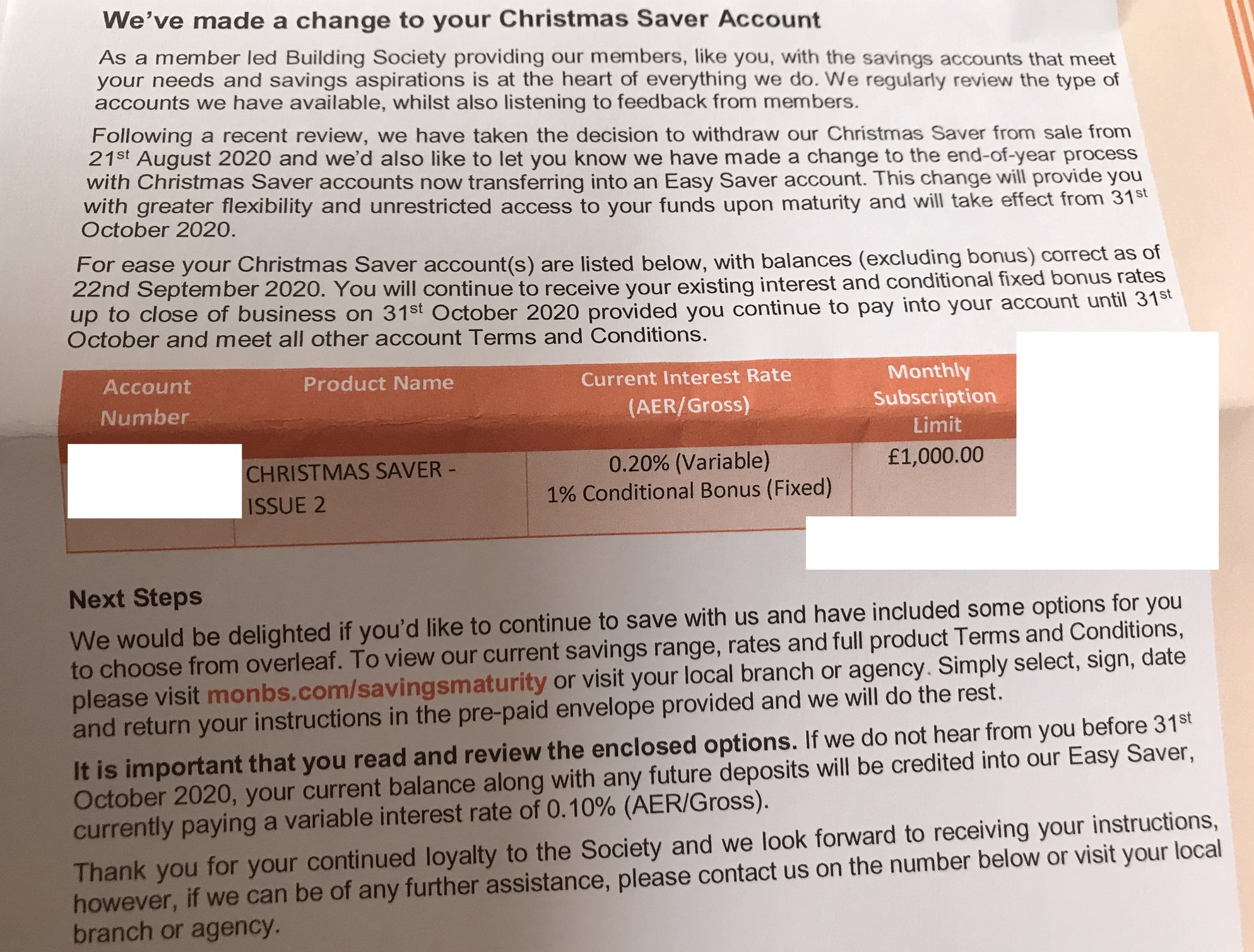

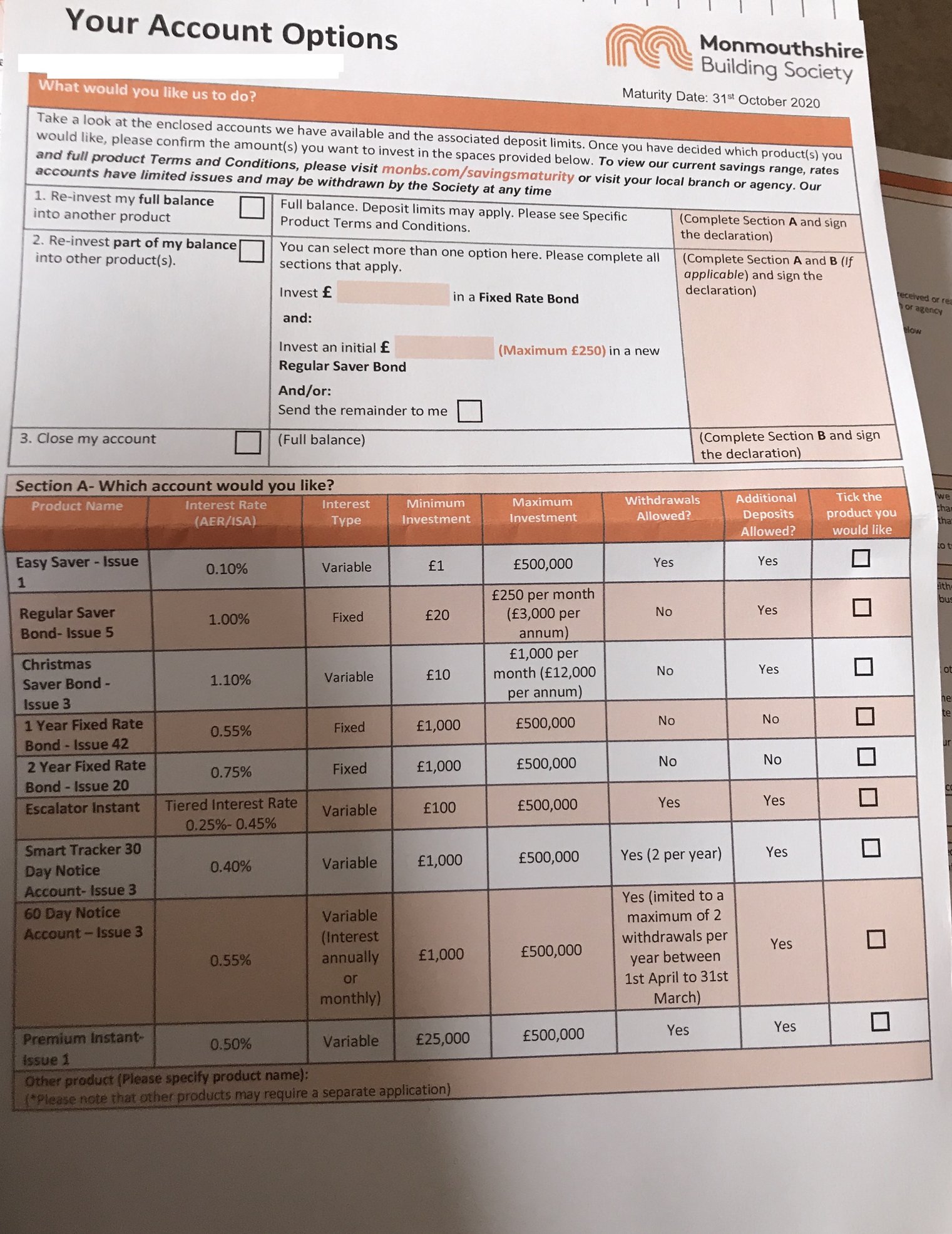

Has everyone (anyone) received a follow up letter to this asking for the returned maturity instructions?moi said:Monmouthshire BS have "made a change to your Christmas Saver Account," i.e. they're scrapping it, with the default being they turn it into an Easy Saver in a month.

Christmas Saver Bond Issue 3 @ 1.1% & £1000 per month looks like a decent replacement, but that only lasts 1 year, rather than rolling on

0 -

bubieyehyeh said:

While the letter is carefully worded I believe you can close the account early, based on the saving terms and conditions section 7.8schiff said:I've quite admired the Nottingham, and Furness, for not following the Gadarene rush to tiny rates for as long as they have. But it's disappointing that closing the account is apparently not an option (I've not had my letter yet). I would obviously prefer my £4000 earning better rates than 0.55% for the four months. Incidentally the T&Cs state that you can miss as many payments as you wish so I'll be cancelling my SO.

https://www.thenottingham.com/~/media/files/savings/forms and documents/savings-terms-march-19-lit3117.pdf?la=enIf we materially decrease an interest rate to your disadvantage, we will notify you in writing 14 days in advance of the change.You will be given 30 days from the date of this notification to close or switch your account without notice or penalty.We will define a decrease to an interest rate as ‘material’ if it reduces more than the Bank of England Base RateSo I've emailed to ask if my assumption is correct, and if so what the early closure process is.I assume NottBS are still stuck in the 20th century and withdrawl options are only cheque or CHAPS for a charge, or has covid change that.Pretty standard for all fixed-term accounts that carry any kind of early-withdrawal or early-closure penalty, in my experience. You can usually close an account without any penalty if they drop the interest rate before the end of the term.

0 -

Principality Building Society, 1 Year Regular Savings Bond Issue 22, 1.5% AER (Fixed), Min.£20 to open, Max.£250 per month, No Withdrawals.1

-

That's not a new account. Its been available for nearly a yearThomas_Crown said:Principality Building Society, 1 Year Regular Savings Bond Issue 22, 1.5% AER (Fixed), Min.£20 to open, Max.£250 per month, No Withdrawals.I consider myself to be a male feminist. Is that allowed?1 -

No. If you don't respond, it just gets turned into an easy saver. That's what I'm doing, as then I'll be able to transfer the money onto my linked accountveryintrigued said:

Has everyone (anyone) received a follow up letter to this asking for the returned maturity instructions?moi said:Monmouthshire BS have "made a change to your Christmas Saver Account," i.e. they're scrapping it, with the default being they turn it into an Easy Saver in a month.

Christmas Saver Bond Issue 3 @ 1.1% & £1000 per month looks like a decent replacement, but that only lasts 1 year, rather than rolling on

I consider myself to be a male feminist. Is that allowed?0

I consider myself to be a male feminist. Is that allowed?0 -

Who said it was new? It's still available and pays a higher interest rate than other accounts. Plus the interest rate is fixed, unlike Coventry BS. Take a look at the posts showing the Chorley BS renewal rates. 11 months ago Principality was paying 2.7% AER.surreysaver said:

That's not a new account. Its been available for nearly a yearThomas_Crown said:Principality Building Society, 1 Year Regular Savings Bond Issue 22, 1.5% AER (Fixed), Min.£20 to open, Max.£250 per month, No Withdrawals.0 -

This is the thing - I have responded - weeks ago.surreysaver said:

No. If you don't respond, it just gets turned into an easy saver. That's what I'm doing, as then I'll be able to transfer the money onto my linked accountveryintrigued said:

Has everyone (anyone) received a follow up letter to this asking for the returned maturity instructions?moi said:Monmouthshire BS have "made a change to your Christmas Saver Account," i.e. they're scrapping it, with the default being they turn it into an Easy Saver in a month.

Christmas Saver Bond Issue 3 @ 1.1% & £1000 per month looks like a decent replacement, but that only lasts 1 year, rather than rolling on

The letter is along the lines of 'if you've already responded ignore this letter'.

Hence I was keen to see if they're targeting everyone.

Previously I have been keen to praise Monmouthshire.

But they're turning into a bit of a shower.

0 -

Fixed that for you 😃Thomas_Crown said:

Who said it was new? It's still available and pays a higher interest rate than some other accounts but isn't the best rate you can get, as you can see from the first few posts in this thread.surreysaver said:

That's not a new account. Its been available for nearly a yearThomas_Crown said:Principality Building Society, 1 Year Regular Savings Bond Issue 22, 1.5% AER (Fixed), Min.£20 to open, Max.£250 per month, No Withdrawals.2 -

Yes, I got the follow up letter even though I had responded to the earlier one with my preferences.veryintrigued said:

This is the thing - I have responded - weeks ago.surreysaver said:

No. If you don't respond, it just gets turned into an easy saver. That's what I'm doing, as then I'll be able to transfer the money onto my linked accountveryintrigued said:

Has everyone (anyone) received a follow up letter to this asking for the returned maturity instructions?moi said:Monmouthshire BS have "made a change to your Christmas Saver Account," i.e. they're scrapping it, with the default being they turn it into an Easy Saver in a month.

Christmas Saver Bond Issue 3 @ 1.1% & £1000 per month looks like a decent replacement, but that only lasts 1 year, rather than rolling on

The letter is along the lines of 'if you've already responded ignore this letter'.

Hence I was keen to see if they're targeting everyone.

Previously I have been keen to praise Monmouthshire.

But they're turning into a bit of a shower.

MBS do work in mysterious ways.1 -

Listed on page 1 of this thread. Along with all the other RSAs worth considering.Thomas_Crown said:Principality Building Society, 1 Year Regular Savings Bond Issue 22, 1.5% AER (Fixed), Min.£20 to open, Max.£250 per month, No Withdrawals.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards