We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

While the letter is carefully worded I believe you can close the account early, based on the saving terms and conditions section 7.8schiff said:I've quite admired the Nottingham, and Furness, for not following the Gadarene rush to tiny rates for as long as they have. But it's disappointing that closing the account is apparently not an option (I've not had my letter yet). I would obviously prefer my £4000 earning better rates than 0.55% for the four months. Incidentally the T&Cs state that you can miss as many payments as you wish so I'll be cancelling my SO.

https://www.thenottingham.com/~/media/files/savings/forms and documents/savings-terms-march-19-lit3117.pdf?la=enIf we materially decrease an interest rate to your disadvantage, we will notify you in writing 14 days in advance of the change.You will be given 30 days from the date of this notification to close or switch your account without notice or penalty.We will define a decrease to an interest rate as ‘material’ if it reduces more than the Bank of England Base RateSo I've emailed to ask if my assumption is correct, and if so what the early closure process is.I assume NottBS are still stuck in the 20th century and withdrawl options are only cheque or CHAPS for a charge, or has covid change that.

1 -

KRBS

You normally have to visit a Branch to close a matured RS but they will now do an electronic transfer [to your linked account] over the phone. I am not sure what would happen if you didn't already have a linked account set up - mine has existed for years.

I didn't ask whether they would also open a new RS over the phone as I don't fancy their rate now. I presume they would.2 -

It's hardly worth it for them, it matures in six weeks.

I've had all three of these letter too - not from the Seasonal Saver though (currently 2.5%) has anyone received information about this account?veryintrigued said:2 -

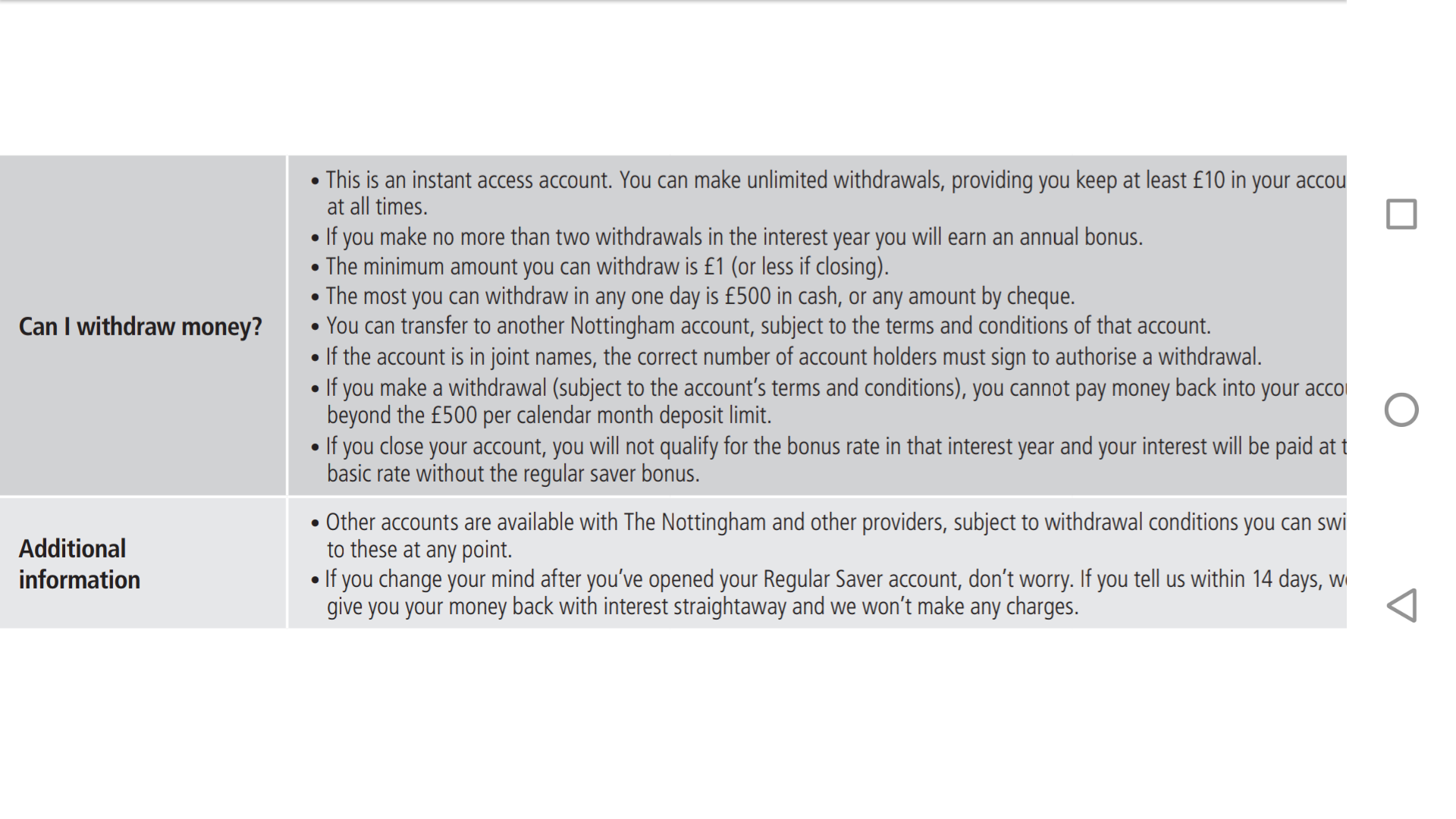

Be careful if closing the Nottingham Regular Saver 2. Although you are allowed two withdrawals per account year (which according to my notes runs on the year from 1 October to the following 30 September), no bonus is paid in the account year of closure. I got stung with this when I closed my Regular Saver 1.

However, I'm wondering if my information re the dates is incorrect. I've possibly copied and pasted it from Regular Saver 1, which paid interest and bonus on 30 September. But Regular Saver 2 pays interest on 30 June, so it would make more sense if the account year on this account runs to 30 June too. Can anybody please confirm?

Although the T&Cs say you can close without notice or penalty, I don't know whether losing a potential bonus would be interpreted as being a 'penalty' or not. They might still pay the bonus, but I suspect the computer will just automatically not pay it if the account is closed, so you might need to fight them for it.

It might be safer to withdraw most of the balance, leaving a nominal £10 (which I think is the minimum balance), and then close it after the end of the account year (whenever that might be!).0 -

Notts BS RS2spider42 said:Be careful if closing the Nottingham Regular Saver 2. Although you are allowed two withdrawals per account year (which according to my notes runs on the year from 1 October to the following 30 September), no bonus is paid in the account year of closure. I got stung with this when I closed my Regular Saver 1.

I'm not sure you're correct on this.

The RS 3 T&C are attached (ive mislaid the RS2 ones) and they do allow two withdrawals whilst still getting the bonus.

RS2 interest is paid at the end of June (see two pages ago on this thread where I've detailed some more interest dates for the Notts products.

This reflects the info in my personal spreadsheet.

0 -

Notts RS reductionsliamcov said:

I've had all three of these letter too - not from the Seasonal Saver though (currently 2.5%) has anyone received information about this account?veryintrigued said:

I also got letters for Panthers and RS8.ctdctd said:Notts BSLetter today - Regular Saver issue 2 down to 0.05% + 0.5% bonus from 1st November.

Bad post day.

All three 0.65% on Nov 1st

Even though these accounts do not allow withdrawals (except the RS issue 2) the letters state 'if you're considering moving your money to another account, please contact us or visit one of our branches and we can help you discover more about our other savings products. If you do decide to close your account and move your money to another provider you can do so by visiting your branch, although we will be very sorry to see you go.'

So does this mean they are going to allow us to close the accounts down even though they still have 1-5 months left to run on them?

Visited a branch this morning. A branch I normally avoid as they are hopeless (other Notts ones are superb).

True to form they didn't even know there were any reductions. Not even on the ones communicated three weeks ago.

Will revert to a more favoured branch next week.1 -

Thanks, but doesn't that confirm that you don't get the bonus (final bullet point under 'Can I withdraw money?').0

-

Second bullet states you can make two withdrawals without losing the bonus.spider42 said:Thanks, but doesn't that confirm that you don't get the bonus (final bullet point under 'Can I withdraw money?').

Simply reduce (withdraw) to the minimum amount, amend s.o. to minimum amount and keep the account and when bonus is due you'll get it paid.

As per my post a couple of pages ago.

That would be my advice.

0 -

I once enquired in branch when would be the best time to close my Nottingham RS2 and I was advised “ early July”, after the interest has been paid on 30th June.0

-

My wife and I have still not received our Chorley Loyalty Seasonal Saver Issue 1 maturity pack. The accounts will mature end of this month. Anyone else still waiting for theirs?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards