We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

I actually relented and have opened Virgin E17 and E18 and fully funded to-date"Look after your pennies and your pounds will look after themselves"0

-

same, opened 27/9/2019, matured 26/9/2019 £68.39pafpcg said:

Like Colsten, my partner & I made our first CoventryBS Regular Saver investment on 27-Sep-2019 and the accounts matured on 26-Sep-2020 with interest of £68.39. Monthly contributions were made on the 27th or the first working day thereafter - weekends caused an aggregate delay of three days during the year. Perhaps there were more delays if contributions were made on the 1st?schiff said:I would be interested to know when the folk who got around £68 opened their accounts. My first deposit was 1/10/19 and subsequent deposits were made on the FWDOTM as usual. I got £66.56, 3p more than expected. It takes a lot of days at 2.5% on £500 to make up that difference!

Edit: By my calculation, paying monthly calculations on the 1st would have been delayed by an aggregate of six days from 1-Oct-2019 to 1-Sep-2020.

Unlike Colsten, we had to wait until midday for the matured funds to be credited to our bank accounts!0 -

Coventry RS terms staterachlikeswinter said:I might have to withdraw my Coventry BS Reg Saver funds before maturity (to use as part of my flat deposit, which has happened quicker than expected!) I know that I will have the 30 day interest penalty by withdrawing before maturity, but does anyone know if that will mean I'll lose ALL interest due to me, plus the 30 day penalty amount? Or will I get whatever interest is due up to that point, minus the 30 day penalty?

For ref it would mature in Feb normally. Either way not a lot I can do, just curious as every penny counts!

This account is designed for saving your money. After the 14 day ‘cooling-off period’, you can take out money or close your account if you need to, but there will be a charge equal to 30 calendar days’ interest on the amount withdrawn. Notice for withdrawal/closure cannot be given. The charge will be deducted from the balance of the account at the time of the withdrawal.

"Look after your pennies and your pounds will look after themselves"0 -

grumiofoundation said:

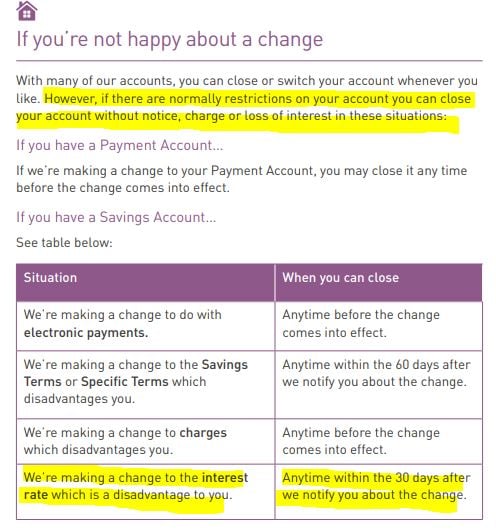

30 day interest penalty to withdraw for Coventry reg. saver.where_are_we said:£67.25 interest - account opened 28/9/19. Used the account closure option instead of withdrawal of funds - no need to keep an account paying .3% open. Whilst logged in opened new RS3 @ 1.55% variable - quick and easy - deposited £500 by FP and set up 11 monthly SO`s £500 from hub account - don`t forget it`s not calendar months but anniversary months and use last 8 digits of your new 9 digit account number. I presume if they drop the interest rate you will be able to withdraw balance with no loss of interest?Taken from their T&C`s:"If you’re not happy about a change - With many of our accounts, you can close or switch your account whenever you like. However, if there are normally restrictions on your account you can close your account without notice, charge or loss of interest in these situations: ............ We’re making a change to the interest rate which is a disadvantage to you. When you can close - Anytime within the 30 days after we notify you about the changeMy presumption is correct - if they drop their variable interest rate from 1.55% to a rate which you can better somewhere else then you can close your RS3 without penalty and withdraw the balance plus accrued interest.

2 -

schiff said:Coventry

I would be interested to know when the folk who got around £68 opened their accounts.My Coventry RS matured on the 26th September with £68.39 interestI added £500 per month from day one and monthly.

Retired 1st July 2021.

This is not investment advice.

Your money may go "down and up and down and up and down and up and down ... down and up and down and up and down and up and down ... I got all tricked up and came up to this thing, lookin' so fire hot, a twenty out of ten..."0 -

I stand happily corrected.where_are_we said:grumiofoundation said:

30 day interest penalty to withdraw for Coventry reg. saver.where_are_we said:£67.25 interest - account opened 28/9/19. Used the account closure option instead of withdrawal of funds - no need to keep an account paying .3% open. Whilst logged in opened new RS3 @ 1.55% variable - quick and easy - deposited £500 by FP and set up 11 monthly SO`s £500 from hub account - don`t forget it`s not calendar months but anniversary months and use last 8 digits of your new 9 digit account number. I presume if they drop the interest rate you will be able to withdraw balance with no loss of interest?Taken from their T&C`s:"If you’re not happy about a change - With many of our accounts, you can close or switch your account whenever you like. However, if there are normally restrictions on your account you can close your account without notice, charge or loss of interest in these situations: ............ We’re making a change to the interest rate which is a disadvantage to you. When you can close - Anytime within the 30 days after we notify you about the changeMy presumption is correct - if they drop their variable interest rate from 1.55% to a rate which you can better somewhere else then you can close your RS3 without penalty and withdraw the balance plus accrued interest.0 -

You don't need to get a better rate elsewhere to close the account.where_are_we said:grumiofoundation said:

30 day interest penalty to withdraw for Coventry reg. saver.where_are_we said:£67.25 interest - account opened 28/9/19. Used the account closure option instead of withdrawal of funds - no need to keep an account paying .3% open. Whilst logged in opened new RS3 @ 1.55% variable - quick and easy - deposited £500 by FP and set up 11 monthly SO`s £500 from hub account - don`t forget it`s not calendar months but anniversary months and use last 8 digits of your new 9 digit account number. I presume if they drop the interest rate you will be able to withdraw balance with no loss of interest?Taken from their T&C`s:"If you’re not happy about a change - With many of our accounts, you can close or switch your account whenever you like. However, if there are normally restrictions on your account you can close your account without notice, charge or loss of interest in these situations: ............ We’re making a change to the interest rate which is a disadvantage to you. When you can close - Anytime within the 30 days after we notify you about the changeMy presumption is correct - if they drop their variable interest rate from 1.55% to a rate which you can better somewhere else then you can close your RS3 without penalty and withdraw the balance plus accrued interest.

1 -

I agree with the clarification but think the "which you can better" comment was that one wouldn't be closing unless you could get a better rate elsewhere.3

-

Thanks - that's what I've read too, but I wasn't clear on if they'll still pay interest that I've earned thus far, minus the penalty (which is less than a fiver so not earth-shattering.) Guess I'll have to wait and see!typistretired said:

Coventry RS terms staterachlikeswinter said:I might have to withdraw my Coventry BS Reg Saver funds before maturity (to use as part of my flat deposit, which has happened quicker than expected!) I know that I will have the 30 day interest penalty by withdrawing before maturity, but does anyone know if that will mean I'll lose ALL interest due to me, plus the 30 day penalty amount? Or will I get whatever interest is due up to that point, minus the 30 day penalty?

For ref it would mature in Feb normally. Either way not a lot I can do, just curious as every penny counts!

This account is designed for saving your money. After the 14 day ‘cooling-off period’, you can take out money or close your account if you need to, but there will be a charge equal to 30 calendar days’ interest on the amount withdrawn. Notice for withdrawal/closure cannot be given. The charge will be deducted from the balance of the account at the time of the withdrawal.0 -

They will pay interest up to closure minus 30 days calendar days' interest. Could always contact them they may waive as a gesture of goodwill."Look after your pennies and your pounds will look after themselves"0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards