We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

I used my phone it came up as step 2, had same boxes though, given it a go anyway, says they sending a welcome pack outBridlington1 said:

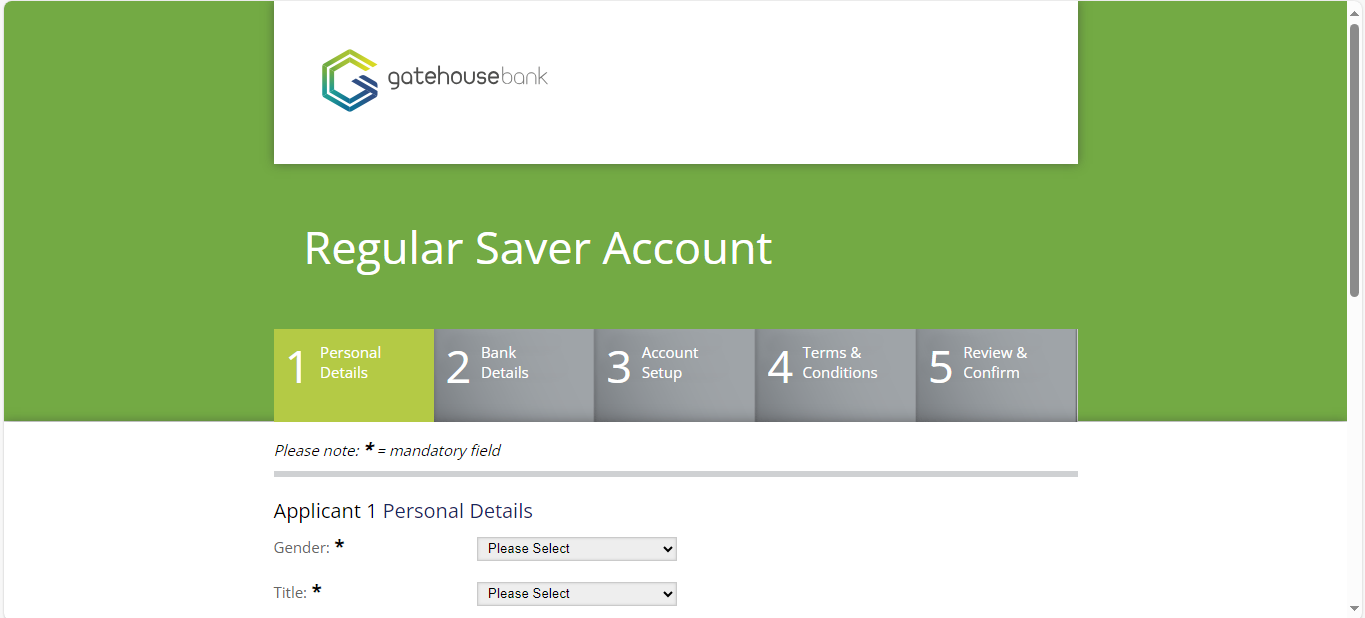

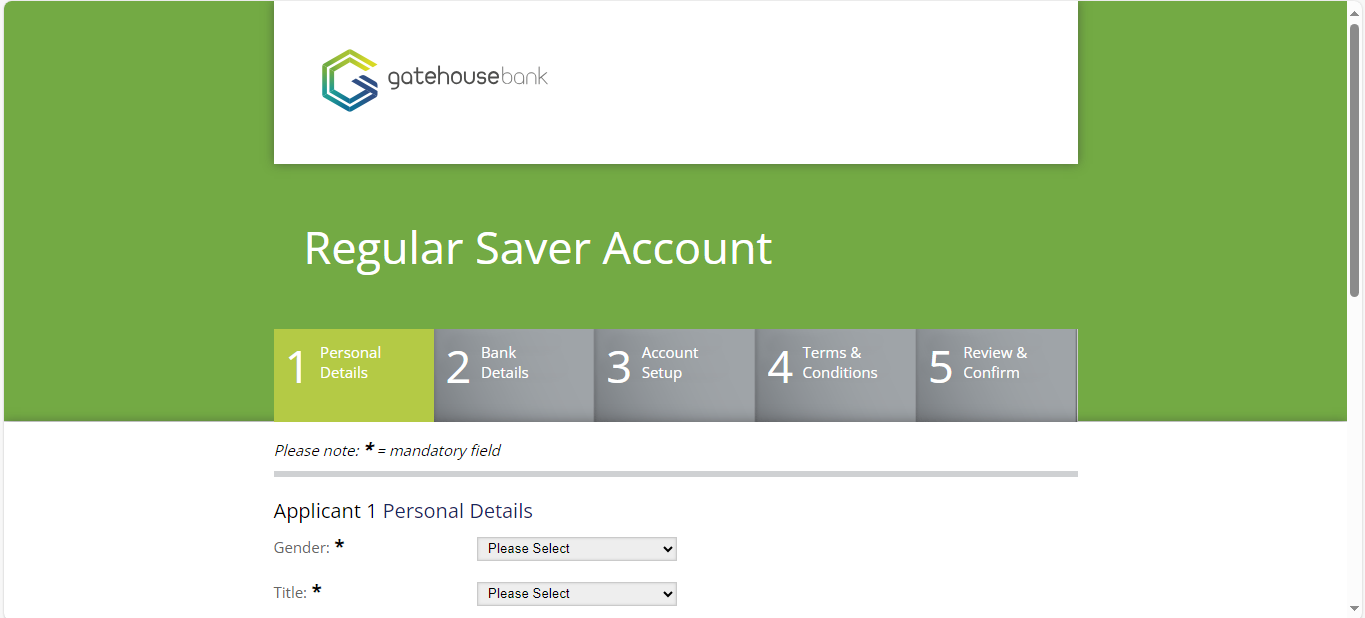

It seems to start at step 1 for me:jameseonline said:

I did think about workarounds, is that gatehouse link supposed to start at step 2?Bridlington1 said:

It may still be possible for you to open a 7% RS. There's a couple of possible options that I can see possibly working:jameseonline said:

Seems I've missed out as not already a Gatehouse customer, 5.3% better than some regular savers but obviously many above that rate.Bridlington1 said:According to Moneyfacts Gatehouse RS Issue 2 will be launched at 5.3% tomorrow, replacing Issue 1 at 7% Gatehouse's website already lists Issue 2 as being available but when logging into online banking it seems you can still apply for Issue 1 at 7% so for those interested in this account I'd suggest moving quick.

The terms for Issue 2 seem to be the same as issue 1 but with a lower interest rate, (£300/mth max, no withdrawals/closure permitted unless they reduce the expected profit rate).

Firstly if my memory serves me well when I applied for my first Gatehouse account I gained online access the same day. You could apply for a different savings account, get access to online banking and then apply for the 7% RS from there. You could then just fund RS, and let the other account close due to it not receiving funding.

Secondly there's the other option of using the old application link for the 7% RS as a new customer, which can be either correctly guessed or looked up on the wayback machine. The old link still seems to be live at first glance, I already have the account so can't check myself:

https://gatehousebanksavings.com/ApplyOnline/ApplicationForm.aspx?ProductId=GATREG1 0

0 -

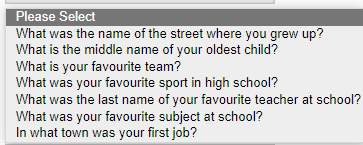

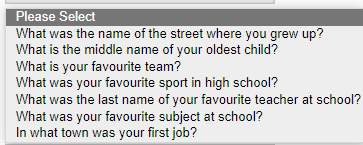

Can anyone remember the security question options please? I took screenshots of my responses, but they seem to be blank and I can’t remember the third question I selectedIf you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

They should be any combination of these:ForumUser7 said:Can anyone remember the security question options please? I took screenshots of my responses, but they seem to be blank and I can’t remember the third question I selected

3 -

I'm sure they will lower it at some point, but I will be surprised if the drop will be dramatic. I've opened this account in November 2010, I think it was the first time FD launched RS and it paid 8%. It was later reduced to 6%, which was still the top rate at the time. Since then, with an exception of a short period when base rate was at the very bottom and there were talks about negative rates, FD RS consistently offered very competitive rates.Profiterole said:Probably nothing but First Direct seem to be stalling me opening a new Regular Saver after my previous one matured earlier this month. They claim to be inundated with Applications, which I expect they are, but beginning to wonder if they are thinking about lowering the 7% rate....... Like I said probably nothing but thought it might be worth mentioning.3 -

Fantastic - thank you very very muchBridlington1 said:

They should be any combination of these:ForumUser7 said:Can anyone remember the security question options please? I took screenshots of my responses, but they seem to be blank and I can’t remember the third question I selected

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

OH has just checked the interest on his NatWest savings builder, that is meant to pay 5.25% on balances £1-10k and 2.25% on balances over £10k provided you top up at least £50 a month. He has a standing order transferring £100 a month to satisfy the latter point. It appears that they are paying 2.4% on the lot without tierring the interest rate. His balance is around £15k. His monthly interest payments are around £29 a month. Calculations suggest it should be double that.

https://www.natwestinternational.com/savings/savings-builder.html#interest-rates

It looks like the account is showing a lower interest rate here: https://www.natwest.com/savings/manage-your-savings/Interest-Rates-FCA.html

I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0 -

You don’t have to call and can do it via chat if you prefer.Vortigern said:

The only way to do it is to call them. They won't take an ad-hoc payment, but they will adjust your next standing order(s). Last time I did this, I had started at £25 per month for 5 months, added a large payment of £1675 to make up the deficit, then continued at £300/month for the rest of the term. All the payments were taken by standing order on the usual date each month.TheBanker said:I have a question about the First Direct regular saver.

It says that if you haven't paid in the maximum £300 per month, you can make up the missed payments. But how do you actually do this, there's no option to make an ad-hoc transfer. I reduced my SO to £25 in January as I was a bit short. The SO is now back to £300 but I would like to pay in the missed £550 (Jan and Feb underpayments of £275 each). But can't see how to do this?1 -

I got step 1, but the same message at the end. Did you get a confirmation email or anything please? I didn’t.jameseonline said:

I used my phone it came up as step 2, had same boxes though, given it a go anyway, says they sending a welcome pack outBridlington1 said:

It seems to start at step 1 for me:jameseonline said:

I did think about workarounds, is that gatehouse link supposed to start at step 2?Bridlington1 said:

It may still be possible for you to open a 7% RS. There's a couple of possible options that I can see possibly working:jameseonline said:

Seems I've missed out as not already a Gatehouse customer, 5.3% better than some regular savers but obviously many above that rate.Bridlington1 said:According to Moneyfacts Gatehouse RS Issue 2 will be launched at 5.3% tomorrow, replacing Issue 1 at 7% Gatehouse's website already lists Issue 2 as being available but when logging into online banking it seems you can still apply for Issue 1 at 7% so for those interested in this account I'd suggest moving quick.

The terms for Issue 2 seem to be the same as issue 1 but with a lower interest rate, (£300/mth max, no withdrawals/closure permitted unless they reduce the expected profit rate).

Firstly if my memory serves me well when I applied for my first Gatehouse account I gained online access the same day. You could apply for a different savings account, get access to online banking and then apply for the 7% RS from there. You could then just fund RS, and let the other account close due to it not receiving funding.

Secondly there's the other option of using the old application link for the 7% RS as a new customer, which can be either correctly guessed or looked up on the wayback machine. The old link still seems to be live at first glance, I already have the account so can't check myself:

https://gatehousebanksavings.com/ApplyOnline/ApplicationForm.aspx?ProductId=GATREG1 If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

I completed the application process, got a reference number, account number, sort code, email confirmationForumUser7 said:

I got step 1, but the same message at the end. Did you get a confirmation email or anything please? I didn’t.jameseonline said:

I used my phone it came up as step 2, had same boxes though, given it a go anyway, says they sending a welcome pack outBridlington1 said:

It seems to start at step 1 for me:jameseonline said:

I did think about workarounds, is that gatehouse link supposed to start at step 2?Bridlington1 said:

It may still be possible for you to open a 7% RS. There's a couple of possible options that I can see possibly working:jameseonline said:

Seems I've missed out as not already a Gatehouse customer, 5.3% better than some regular savers but obviously many above that rate.Bridlington1 said:According to Moneyfacts Gatehouse RS Issue 2 will be launched at 5.3% tomorrow, replacing Issue 1 at 7% Gatehouse's website already lists Issue 2 as being available but when logging into online banking it seems you can still apply for Issue 1 at 7% so for those interested in this account I'd suggest moving quick.

The terms for Issue 2 seem to be the same as issue 1 but with a lower interest rate, (£300/mth max, no withdrawals/closure permitted unless they reduce the expected profit rate).

Firstly if my memory serves me well when I applied for my first Gatehouse account I gained online access the same day. You could apply for a different savings account, get access to online banking and then apply for the 7% RS from there. You could then just fund RS, and let the other account close due to it not receiving funding.

Secondly there's the other option of using the old application link for the 7% RS as a new customer, which can be either correctly guessed or looked up on the wayback machine. The old link still seems to be live at first glance, I already have the account so can't check myself:

https://gatehousebanksavings.com/ApplyOnline/ApplicationForm.aspx?ProductId=GATREG1 2

2 -

The 5.25% savings builder is on NatWest International. Does your OH have a NatWest International bank account?silvercar said:OH has just checked the interest on his NatWest savings builder, that is meant to pay 5.25% on balances £1-10k and 2.25% on balances over £10k provided you top up at least £50 a month. He has a standing order transferring £100 a month to satisfy the latter point. It appears that they are paying 2.4% on the lot without tierring the interest rate. His balance is around £15k. His monthly interest payments are around £29 a month. Calculations suggest it should be double that.

https://www.natwestinternational.com/savings/savings-builder.html#interest-rates

It looks like the account is showing a lower interest rate here: https://www.natwest.com/savings/manage-your-savings/Interest-Rates-FCA.html

The domestic savings builder at 2.70% changed a while back and now no longer requires any monthly increase. As such it is no longer a regular saver and just an easy access saver.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards