We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

I have a question about the First Direct regular saver.

It says that if you haven't paid in the maximum £300 per month, you can make up the missed payments. But how do you actually do this, there's no option to make an ad-hoc transfer. I reduced my SO to £25 in January as I was a bit short. The SO is now back to £300 but I would like to pay in the missed £550 (Jan and Feb underpayments of £275 each). But can't see how to do this?0 -

First, from memory you can only top up the £275 you missed this month. ie the month you are in.TheBanker said:I have a question about the First Direct regular saver.

It says that if you haven't paid in the maximum £300 per month, you can make up the missed payments. But how do you actually do this, there's no option to make an ad-hoc transfer. I reduced my SO to £25 in January as I was a bit short. The SO is now back to £300 but I would like to pay in the missed £550 (Jan and Feb underpayments of £275 each). But can't see how to do this?

Second, call them, they will tell you how or do it for you.

Simple.

Plus tell you if you can make up last month.

0 -

Bigwheels1111 said:

First, from memory you can only top up the £275 you missed this month. ie the month you are in.TheBanker said:I have a question about the First Direct regular saver.

It says that if you haven't paid in the maximum £300 per month, you can make up the missed payments. But how do you actually do this, there's no option to make an ad-hoc transfer. I reduced my SO to £25 in January as I was a bit short. The SO is now back to £300 but I would like to pay in the missed £550 (Jan and Feb underpayments of £275 each). But can't see how to do this?

Second, call them, they will tell you how or do it for you.

Simple.

Plus tell you if you can make up last month.

Then let us know

0 -

You can top up more than only a month by simply calling them or chatting through the AppTheBanker said:I have a question about the First Direct regular saver.

It says that if you haven't paid in the maximum £300 per month, you can make up the missed payments. But how do you actually do this, there's no option to make an ad-hoc transfer. I reduced my SO to £25 in January as I was a bit short. The SO is now back to £300 but I would like to pay in the missed £550 (Jan and Feb underpayments of £275 each). But can't see how to do this?

Next payment will be 300 plus the amount missing (275 plus 275) as long as you request it. You can top up ALL the money missing, not only last month's sum1 -

To avoid doubts: my post was meant for 'TheBanker'E_zroda said:Bigwheels1111 said:

First, from memory you can only top up the £275 you missed this month. ie the month you are in.TheBanker said:I have a question about the First Direct regular saver.

It says that if you haven't paid in the maximum £300 per month, you can make up the missed payments. But how do you actually do this, there's no option to make an ad-hoc transfer. I reduced my SO to £25 in January as I was a bit short. The SO is now back to £300 but I would like to pay in the missed £550 (Jan and Feb underpayments of £275 each). But can't see how to do this?

Second, call them, they will tell you how or do it for you.

Simple.

Plus tell you if you can make up last month.

Then let us know [Quoted post removed by Forum Team]0

[Quoted post removed by Forum Team]0 -

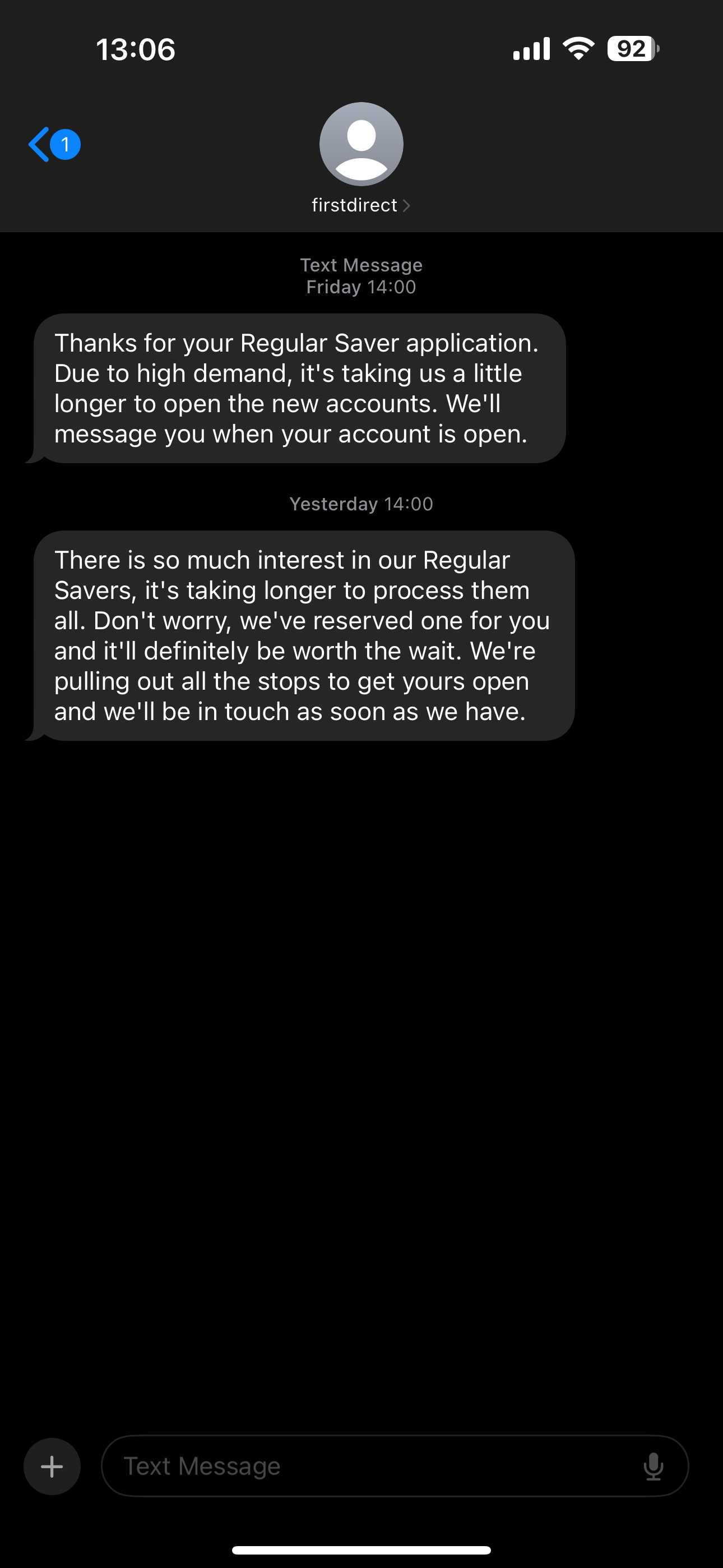

Probably nothing but First Direct seem to be stalling me opening a new Regular Saver after my previous one matured earlier this month. They claim to be inundated with Applications, which I expect they are, but beginning to wonder if they are thinking about lowering the 7% rate....... Like I said probably nothing but thought it might be worth mentioning.

2 -

Why the need for the putdown? it's not needed.E_zroda said:Bigwheels1111 said:

First, from memory you can only top up the £275 you missed this month. ie the month you are in.TheBanker said:I have a question about the First Direct regular saver.

It says that if you haven't paid in the maximum £300 per month, you can make up the missed payments. But how do you actually do this, there's no option to make an ad-hoc transfer. I reduced my SO to £25 in January as I was a bit short. The SO is now back to £300 but I would like to pay in the missed £550 (Jan and Feb underpayments of £275 each). But can't see how to do this?

Second, call them, they will tell you how or do it for you.

Simple.

Plus tell you if you can make up last month.

Then let us know [Quoted post removed by Forum Team]I choose the rooms that I live in with care,

[Quoted post removed by Forum Team]I choose the rooms that I live in with care,

The windows are small and the walls almost bare,

There's only one bed and there's only one prayer;

I listen all night for your step on the stair.8 -

Oh and before anyone jumps all over me I do understand the rate is fixed when the Account is open, so not trying to scare anyone ok lol0

-

FD system is old and clunky, like me.I still would not leave them though.Ive had a few issues with them in the past and no doubt will in the future.They sort the issues and give me money, a fare deal in my opinion.I have 9 bank accounts and have had issues with them all.0

-

The only way to do it is to call them. They won't take an ad-hoc payment, but they will adjust your next standing order(s). Last time I did this, I had started at £25 per month for 5 months, added a large payment of £1675 to make up the deficit, then continued at £300/month for the rest of the term. All the payments were taken by standing order on the usual date each month.TheBanker said:I have a question about the First Direct regular saver.

It says that if you haven't paid in the maximum £300 per month, you can make up the missed payments. But how do you actually do this, there's no option to make an ad-hoc transfer. I reduced my SO to £25 in January as I was a bit short. The SO is now back to £300 but I would like to pay in the missed £550 (Jan and Feb underpayments of £275 each). But can't see how to do this?

3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards