We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Top Easy Access Savings Discussion Area

Comments

-

CHIP 2.9%. Where did that come from?2

-

Do you still have to give CHIP Open Banking access to your current account so that it can pinch your money at random times for no apparent reason other than the AI says so?

Had this for a while and it was just annoying. If the instant access account is available without the AI savings bot and its freedom to raid your bank account then it's a goer.0 -

Deleted_User said:CHIP 2.9%. Where did that come from?

I will give this a miss in that case. I stay with my Al Ryan 2.81% (hoping for an increase after next BoE interest increase) and Santander 2.75%

0 -

I had a CHIP account before, they were fine. I've got a few grand coming to me in a few days without a home. 2.9% will do just fine. (I also have Al Rayan & Santander but I feel it is important to encourage those that give the best rate.0

-

-

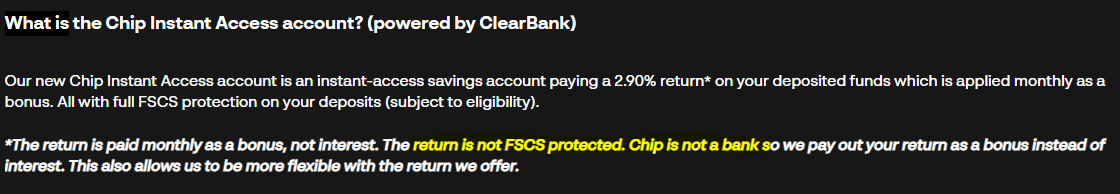

I guess they just test the market and have priced in next weeks BoE rise. The more interesting question for me is, based on,Deleted_User said:I had a CHIP account before, they were fine. I've got a few grand coming to me in a few days without a home. 2.9% will do just fine. (I also have Al Rayan & Santander but I feel it is important to encourage those that give the best rate.

a) They claim they are not a bank

b) They pay only a bonus,

c) Bonus doesn't compound

d) Bonus can only be withdrawn together with total funds (moving higher sums in and out monthly to access the bonus could lead to hours of calls to speak to fraud departments)

--> Will HMRC still treat it as interest because technically, the interest they pay is 0% and they are not a bank as they say??? Should the bonus not be treated as a CG?

For me the top rate isn't necessarilly the best rate if I have to jump through many hoops for just 0.09% more compared to Al Ryan.1 -

Yep, all good points. Each to their own.0

-

Just a reminder from today:

- Newbury Existing Member Account up to 3% on £4,000 / year

- https://www.newbury.co.uk/savings/accounts/existing-member-account/

- Welcome to Newbury Account up to 2.8% on £3,000

- https://www.newbury.co.uk/savings/accounts/welcome-newbury/

2 -

I am massively impressed with the speed of CHIP 2.9% account deposits and withdrawals. They are both literally instant between CHIP and the nominated current account, a Santander Everyday in my case. What's even better, Santander doesn't seem to have an issue with a large payment to a brand new account, as the money was pulled into CHIP with Open Banking. Way to go!

You don't need to authorise CHIP to do any autosaving, btw, and I won't use that function.1 -

Does anyone know the answer to this HMRC point please? It’s a very good point, I guess the way to figure it out is if tax is charged on interest bonuses at other banks which paid it already last tax year. I don’t have any accounts with bonuses so I’m unsure.pecunianonolet said:

I guess they just test the market and have priced in next weeks BoE rise. The more interesting question for me is, based on,Deleted_User said:I had a CHIP account before, they were fine. I've got a few grand coming to me in a few days without a home. 2.9% will do just fine. (I also have Al Rayan & Santander but I feel it is important to encourage those that give the best rate.

a) They claim they are not a bank

b) They pay only a bonus,

c) Bonus doesn't compound

d) Bonus can only be withdrawn together with total funds (moving higher sums in and out monthly to access the bonus could lead to hours of calls to speak to fraud departments)

--> Will HMRC still treat it as interest because technically, the interest they pay is 0% and they are not a bank as they say??? Should the bonus not be treated as a CG?

For me the top rate isn't necessarilly the best rate if I have to jump through many hoops for just 0.09% more compared to Al Ryan.If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards