We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Easy Access Savings Discussion Area

Comments

-

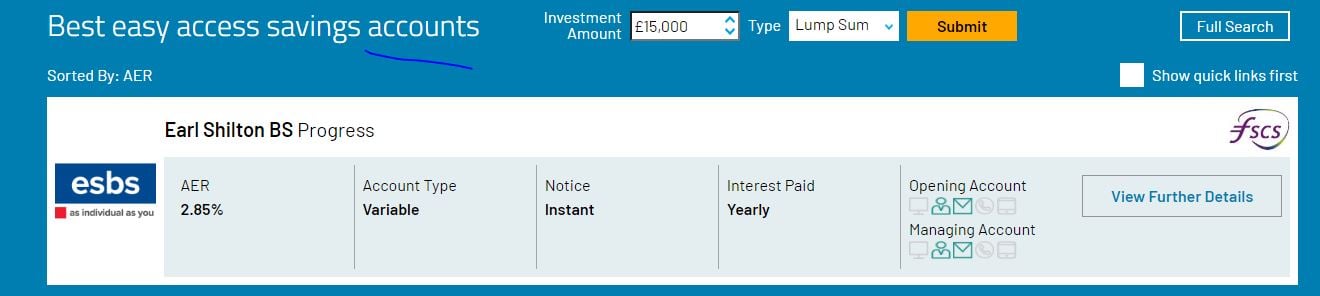

What they don't mention : :Major caveats for their accounts:- Postal, phone or branch applications only.

- Account cannot be managed online (only balance view).

- Withdrawals can only be requested by post or in branch.

- CHAPS and same-day Faster Payments incur a £30 fee.

- Next-day Faster Payments incur a £10 fee.

- To withdraw for free, it's either cash over the counter or cheque by post.

- they require you to make your application using a quill pen.

- a request for a withdrawal by cheque must be accompanied by a signed decleration by a judge or magistrate

- if you are requesting a cheque to be sent to you, please enclose a sae with your application

- sending a request does not guarantee that the Post Office will deliver it to us in a timely manor, nor to you for the receipt of our cheque

- a request arriving on a Friday may not be delt with until Monday if staff have declared it to be a POETS* day. However, on payment of an extra fee (£30) it will be processed that day, as a CHAPS withdrawal - see above.

*(!!!!!! early, tomorrow's Saturday)

Thank you for reading this message.5 - Postal, phone or branch applications only.

-

Gatehouse has this prominently displayed at the top of the page of their 5 Year Fixed Term Deposit Woodland Saver:intalex said:I must admit I had no idea this was the case with fixed rate Sharia accounts, and I almost opted for Gatehouse over Coventry for one of my fixes, and only picked Coventry as it was an easier and seamless transfer. But now I'm grateful to learn of the one-sided break clause as I had always assumed that aside from terminology the mechanics and risk between Sharia and standard fixed rate accounts were exactly the same, which is not the case.I'd be surprised if any Sharia provider actually tried to not honour their advertised expected profit for fixed term accounts, despite their right to do so, as the optics of such an unprecedented move would reflect terribly on the provider as well as Sharia accounts overall.What is the product?This is a 5 Year Fixed Term Woodland Saver account (previously named 'Green Saver'), operated under Shariah principles. This means that interest cannot be earned, but we generate profit instead.What does this mean for my money?The profit we share is the expected profit rate at the time you open your account. We monitor your account on a daily basis to ensure the expected profit rate will be achieved. If we believe the expected profit rate will not be achieved, we will contact you giving you notice of the new expected profit rate. You will then have the option to continue your account with us at the new rate, or close your account immediately with your original deposit returned, along with profit earned. To date, we have always generated and paid our customers the expected profit rate.

That being said, I still wouldn't choose them when there are competitive rates elsewhere.1 -

Millyonare said:Rheumatoid said:

I have as a Leics lad. Been around a long time. Maybe longer than meDeleted_User said:Earl Shilton? Never heard of them. Anybody?

This has probably already been posted, but Earl Shilton BS today has a 3.00% instant-access Heritage account for people aged over 50yo. Seems to be available UK-wide. Makes it just about the best easy saver in the UK right now. Max of 4 withdrawals a year is the downside.

I suppose there are some upsides to being old 0

0 -

Yes, they have options that you can manipulate to be a much better rate than that at their listing position, so I try to keep them visible without it being biased.Zaul22 said:Once again waiting for Zopa to go up now they are 14th on the 'top 10' as the list writer doesn't want to consider them as not making the cut.

Also note there are a couple of accounts listed that aren't currently 'universally' available.

And I agree they're falling to far behind: I've only got a few ££S there now, spread over 90 day notice accounts with progressive monthly end dates, to use as a ladder if they up the rates.

eta: typo fix0 -

Its been 4 weeks since my Wife sent off ID documents for the Santander 2.75% account and heard nothing since. I would assume we have lost a month already as its a 12 month rate.

She had issues with Santander in the past with a credit card, I recall it wouldn't let her pay the whole balance each month, she could only pay the statement balance which wasn't ideal so I think we will give up with them and look elsewhere.

I like the idea of an app and with wanting both easy access and a 1 year fixed rate, Atom is where I am looking at the moment. Although neither is the top rate you can get, the differences are minimal and having both easy access and fixed in the same place with an app is a benefit.0 -

Principality Web Saver Issue 8 -> 1.95 according to the online portal. Details not on main website yet.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

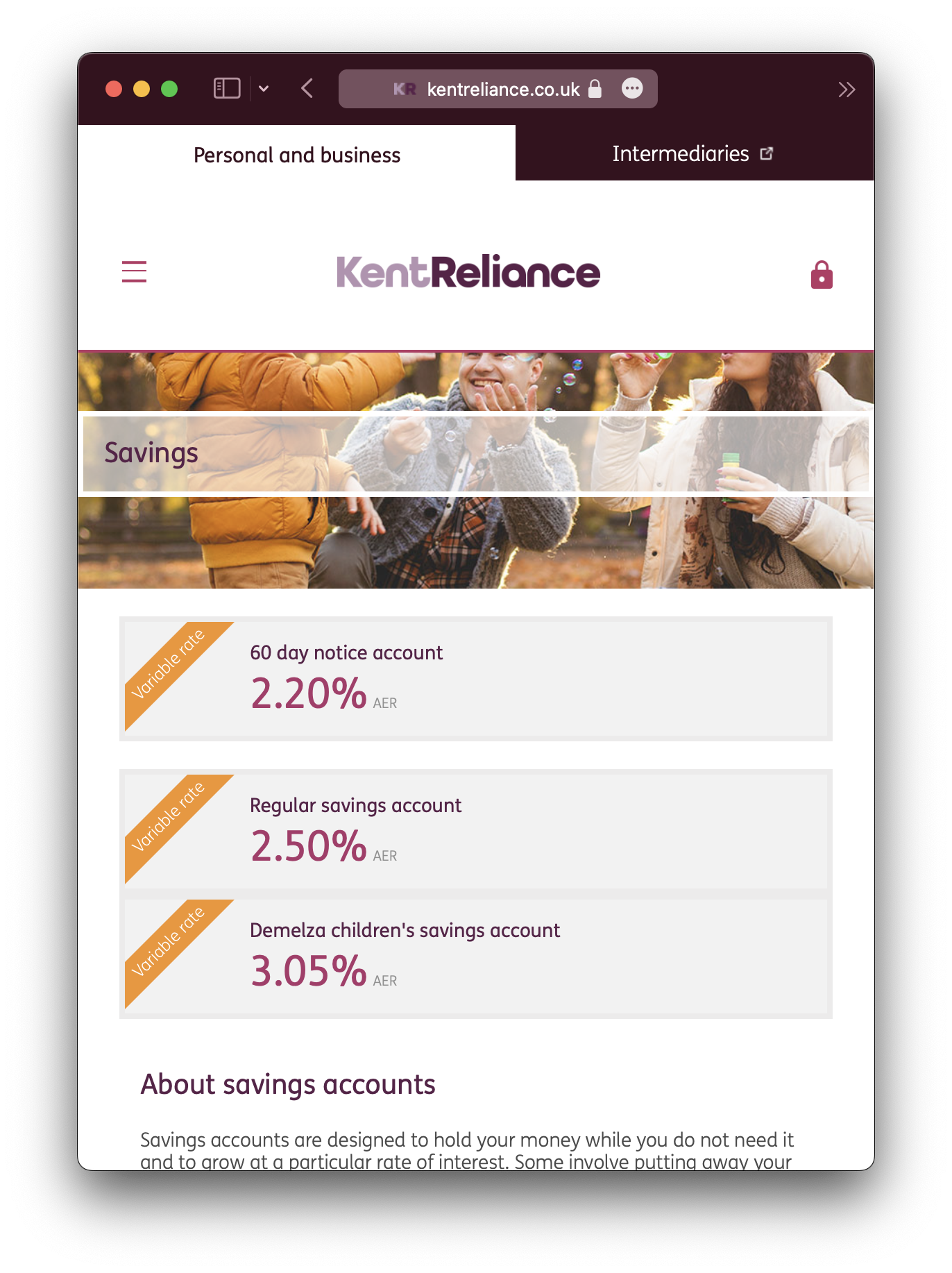

Kent Reliance Easy Access Issue 51 NLA. No replacement at this time.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.1 -

and still the main site is "advertising" Aldermore as the best place for your savings. Maybe the staff are having a lay in?0

-

It took 4 weeks for mine. The 12 months start from account opening date.Noneforit999 said:Its been 4 weeks since my Wife sent off ID documents for the Santander 2.75% account and heard nothing since. I would assume we have lost a month already as its a 12 month rate.

.0 -

it's worth noting that both Al Rayan and Gatehouse say, and I remember Martin saying it a few times, that they have never failed to meet their expected returns - so whilst there's no guarantee that they won't in the future, it's certainly not a concern that's keeping me awake at night.intalex said:Sensory said:

I thought you were asking whether the banks were breaking any deals, as opposed to asking hypothetically about whether the condition was acceptable from a general customer standpoint.intalex said:Right so it is a deal breaker for you, as it is for me

Fair enough, for easy access the uncertainty and lack of guarantees is precisely now standard easy access accounts work, so I'd say there is no difference.

But for fixed rates, the presence of a break clause is very much a tangible risk. Say, if rates today have maxed out and one takes up a 5-year fix at 5.10% and then rates drop to sub-1% just as rapidly as they have recently risen, say 6-12 months into the 5-year fix, which bank will resist the temptation to exercise such a break clause and leave customers scrambling for sub-1% deals. Furthermore, customers aren't even given equivalent break clause rights.

I must admit I had no idea this was the case with fixed rate Sharia accounts, and I almost opted for Gatehouse over Coventry for one of my fixes, and only picked Coventry as it was an easier and seamless transfer. But now I'm grateful to learn of the one-sided break clause as I had always assumed that aside from terminology the mechanics and risk between Sharia and standard fixed rate accounts were exactly the same, which is not the case.

1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

Earl Shilton? Never heard of them. Anybody?

Earl Shilton? Never heard of them. Anybody?