We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Top Easy Access Savings Discussion Area

Comments

-

It is there, I saw it earlier, but only found by doing a page-search for the word "Shariah", and then following a drop-down link to read the text you correctly quote.eskbanker said:

They refer to such accounts as 'non-standard', but seem to have dropped their explanation of how Sharia products differ from 'standard' savings accounts, which I'm sure used to be in that article - the fact that it's an expected profit rate rather than interest is a valid distinction, even though the vast majority (but crucially not all) of such accounts have paid out the expected rate....Rollinghome said:

Would also help if it were made quite clear the reason why the top payer by a good margin is not considered to be a Top-pick so that savers could make their own judgement taking that reasoning into account.

Edit: the article does still have the wording I was thinking of, but it's positioned within the fixed rate section for some reason:Sharia accounts – in accordance with Islamic banking principles – prohibit interest. Instead, they give 'expected profit' rates which, by definition, mean returns aren't guaranteed – though we're not aware of any UK-based sharia banks that have failed to pay their expected rates in the past.

The accounts are open to anyone, of any faith, and the ones above are fully UK-regulated, meaning you get £85,000 per person, per institution savings safety protection. Sharia banks also follow a rule not to invest in areas such as gambling and alcohol.

What's more, it isn't mentioned anywhere afaics, that the accounts that don't qualify for MSE's unexplained definition of "Top savings accounts" are Sharia. So why would anyone look for an explanation? Nor is it pointed out that, arguably, Sharia banks are required to operate to higher standards of social responsibility than many other banks

A lot of people of the Moslem faith are understandably very sensitive to wide-spread Islamophobia, and inept articles such as that could well be misinterpreted.

1 -

I just went back to the article and the Al Rayan easy access account does actually refer to paying 'expected profit', with that term hyperlinked to wording similar or identical to the above, but yes, point taken that the references to Sharia accounts aren't particularly consistent, as with much else in an article refined and rewritten over many years.Rollinghome said:

It is there, I saw it earlier, but only found by doing a page-search for the word "Shariah", and then following a drop-down link to read the text you correctly quote.eskbanker said:

They refer to such accounts as 'non-standard', but seem to have dropped their explanation of how Sharia products differ from 'standard' savings accounts, which I'm sure used to be in that article - the fact that it's an expected profit rate rather than interest is a valid distinction, even though the vast majority (but crucially not all) of such accounts have paid out the expected rate....Rollinghome said:

Would also help if it were made quite clear the reason why the top payer by a good margin is not considered to be a Top-pick so that savers could make their own judgement taking that reasoning into account.

Edit: the article does still have the wording I was thinking of, but it's positioned within the fixed rate section for some reason:Sharia accounts – in accordance with Islamic banking principles – prohibit interest. Instead, they give 'expected profit' rates which, by definition, mean returns aren't guaranteed – though we're not aware of any UK-based sharia banks that have failed to pay their expected rates in the past.

The accounts are open to anyone, of any faith, and the ones above are fully UK-regulated, meaning you get £85,000 per person, per institution savings safety protection. Sharia banks also follow a rule not to invest in areas such as gambling and alcohol.

What's more, it isn't mentioned anywhere afaics, that the accounts that don't qualify for MSE's unexplained definition of "Top savings accounts" are Sharia. So why would anyone look for an explanation? Nor is it pointed out that, arguably, Sharia banks are required to operate to higher standards of social responsibility than many other banks

A lot of people of the Moslem faith are understandably very sensitive to wide-spread Islamophobia, and inept articles such as that could well be misinterpreted.

Personally I'm unconvinced that this is symptomatic of Islamophobia but would suggest that, as this thread already veers off track down a variety of rabbit holes, this probably isn't the place to develop that particular line of debate!0 -

I am not of Moslem or any other faith, and you don't have to declare your faith to the Shariah banks any more than you have to declare it to the non-Shariah ones. Not sure why faith should come into the comparison, tbh. I do find it somewhat peculiar that MSE make a very noticeable distinction for Shariah banks. Why can't they just do what moneyfacts do and list them in order of interest / profit rate.Rollinghome said:

It is there, I saw it earlier, but only found by doing a page-search for the word "Shariah", and then following a drop-down link to read the text you correctly quote.eskbanker said:

They refer to such accounts as 'non-standard', but seem to have dropped their explanation of how Sharia products differ from 'standard' savings accounts, which I'm sure used to be in that article - the fact that it's an expected profit rate rather than interest is a valid distinction, even though the vast majority (but crucially not all) of such accounts have paid out the expected rate....Rollinghome said:

Would also help if it were made quite clear the reason why the top payer by a good margin is not considered to be a Top-pick so that savers could make their own judgement taking that reasoning into account.

Edit: the article does still have the wording I was thinking of, but it's positioned within the fixed rate section for some reason:Sharia accounts – in accordance with Islamic banking principles – prohibit interest. Instead, they give 'expected profit' rates which, by definition, mean returns aren't guaranteed – though we're not aware of any UK-based sharia banks that have failed to pay their expected rates in the past.

The accounts are open to anyone, of any faith, and the ones above are fully UK-regulated, meaning you get £85,000 per person, per institution savings safety protection. Sharia banks also follow a rule not to invest in areas such as gambling and alcohol.

What's more, it isn't mentioned anywhere afaics, that the accounts that don't qualify for MSE's unexplained definition of "Top savings accounts" are Sharia. So why would anyone look for an explanation? Nor is it pointed out that, arguably, Sharia banks are required to operate to higher standards of social responsibility than many other banks

A lot of people of the Moslem faith are understandably very sensitive to wide-spread Islamophobia, and inept articles such as that could well be misinterpreted.

I haven't actually checked the MSE article recently, so don't know whether they have Shariah savings accounts in the same 'category' as non-Shariah current account that pay interest. The Nationwide FlexPlus is a bit of a red herring as it isn't open to anyone who already enjoyed the 12 months interest - clearly very different to a savings account, non-Shariah or Shariah. And even different to the Virgin Money M Plus, which is still paying more than the best non-Shariah instant access savings account, albeit just for £1,000 (Flexplus is a mere £1,500).eskbanker said:..... perhaps worth noting that they also list Nationwide's FlexDirect current account at 5% as a non-standard option for easy access, even though it's clearly a better rate than all the others, so I can see their logic that it's a grey area with room for nuance, rather than simply 'best rate wins'....1 -

I don't think anyone has suggested that it is Islamophobic, but then, like you and Daliah, I'm not a Moslem.eskbanker said:

Personally I'm unconvinced that this is symptomatic of Islamophobia but would suggest that, as this thread already veers off track down a variety of rabbit holes, this probably isn't the place to develop that particular line of debate!

However I would fully understand why a Moslem might consider it otherwise and wonder why a bank that operates to what they consider to be higher ethical standards should be dismissed in that way when it's exactly the sort of account they, and perhaps non-Muslims, would prefer.

There is a large Moslem community in Britain and this site should give them full consideration.

I'd be happy to see this thread move on.

1 -

https://www.alrayanbank.co.uk/guide-expected-profitHowever I would fully understand why a Moslem might consider it otherwise and wonder why a bank that operates to what they consider to be higher ethical standards should be dismissed in that way when it's exactly the sort of account they, and perhaps non-Muslims, would prefer.

As the return is “expected profit”, rather than “guaranteed interest”, there is a small element of risk, which is shared between the customer and the Bank.

The higher ethical standards are what increases this risk. It is slightly different for fixed term accounts than easy access..If, for some reason, the Bank were unable to meet the expected profit rate it had quoted on its fixed term deposit products, the customer would be notified and given the option of ending the agreement, with their original deposit and profit earned to date intact, or they could accept a lower “expected profit rate” moving forward.

1 -

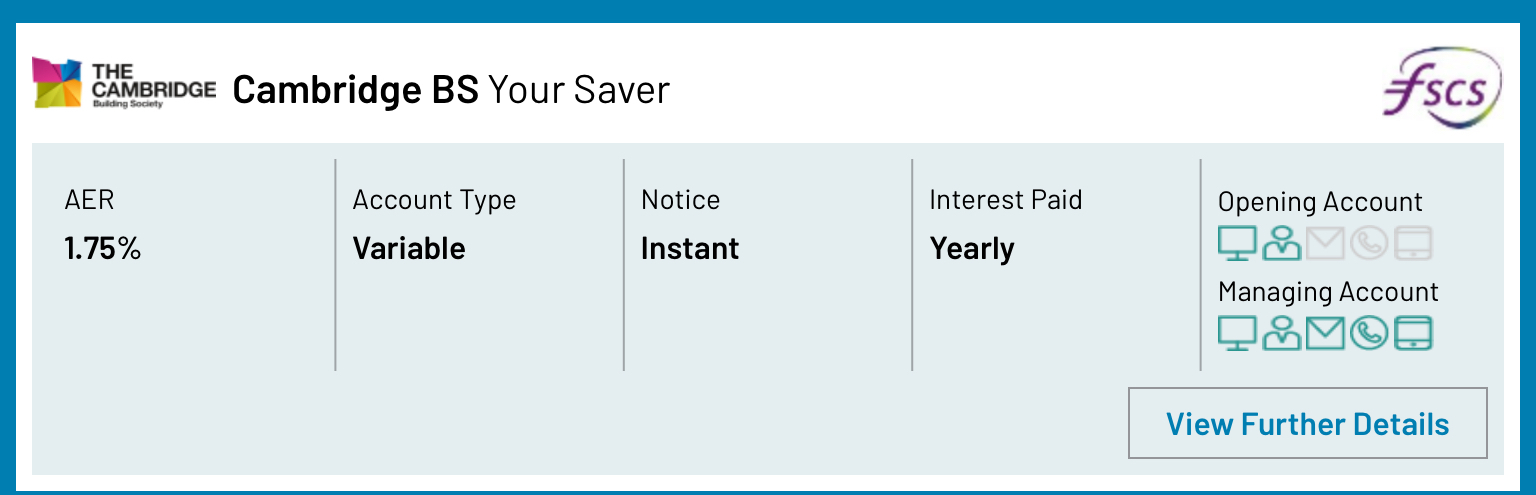

Can’t see this in top 10.According to Moneyfacts, Cambridge BS have launched Your Saver at 1.75% on 2nd September. One withdrawal per month, minimum £100. Equal with Nationwide Triple Access. May be useful for membership to qualify for the RS in 12 months.4

-

Added to the Top Easy Access ranked list ToTP hereMDMD said:Can’t see this in top 10.According to Moneyfacts, Cambridge BS have launched Your Saver at 1.75% on 2nd September. One withdrawal per month, minimum £100. Equal with Nationwide Triple Access. May be useful for membership to qualify for the RS in 12 months.0 -

A new one for your list I think:

Secure Trust Bank Access Account 1.8%. Min £1k1 -

Yep thanks - IIRC it was posted up before but the STB webby didn't confirm and you could apply for the lower rate but it wasn't clear you'd get the 1.8 if you did.Expotter said:A new one for your list I think:

Secure Trust Bank Access Account 1.8%. Min £1k

It is there now... so it'll be added to the ToTP here

Access Account - Secure Trust Bank

1 -

Anyone heard anything from Ford Money? They are usually pretty good at keeping close to the top of the list, but heard nothing since the 0.5% increase.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards