We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Easy Access Savings Discussion Area

Comments

-

Apologies Yep I was in a rush this morning & suffered a memory function failure - posted without normal dilligence.cymruchris said:soulsaver said:

PS You may want to visit the fixed interest threads - AFAIK Raisin doesn't do easy access so doesn't get discussedjackonet said:Hey all,

Was looking to sign up to Raisin but notice it sets up a Starling account to fund whatever savings accounts are set up. I'm already with Starling for my main current acount so was wondering if this will cause any issues before I sign on the dotted lineThey have got them / and current best rate is within the up to date top 10..

1 -

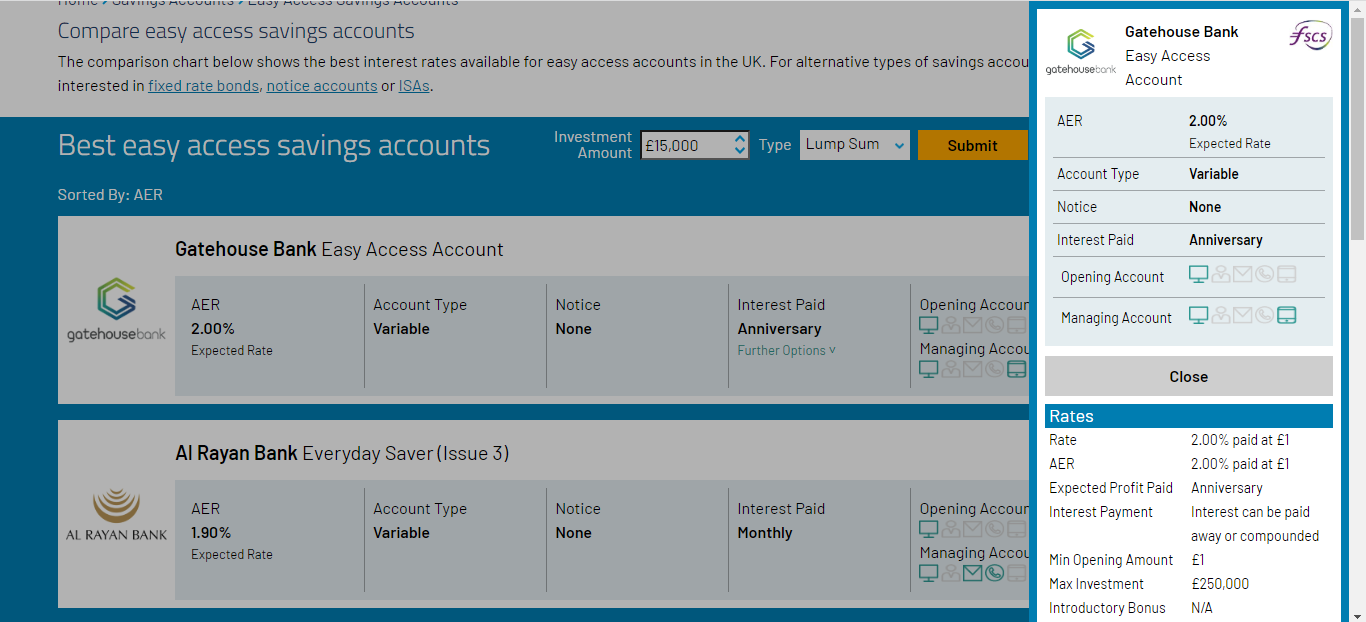

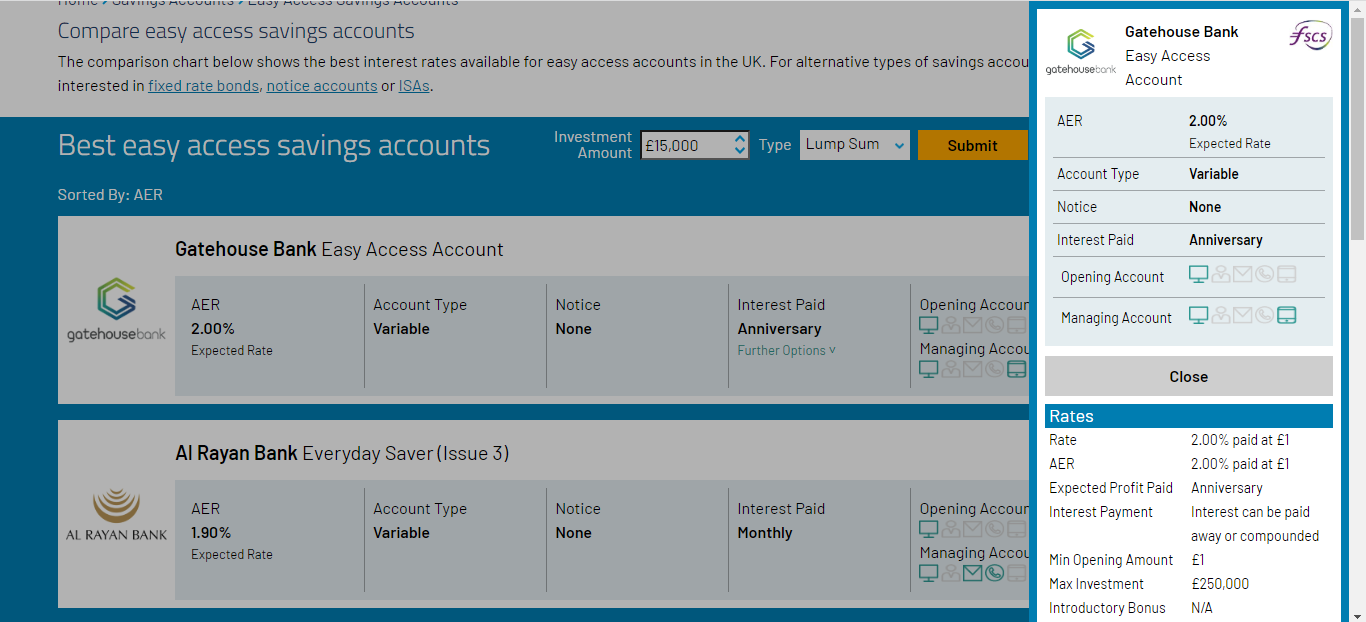

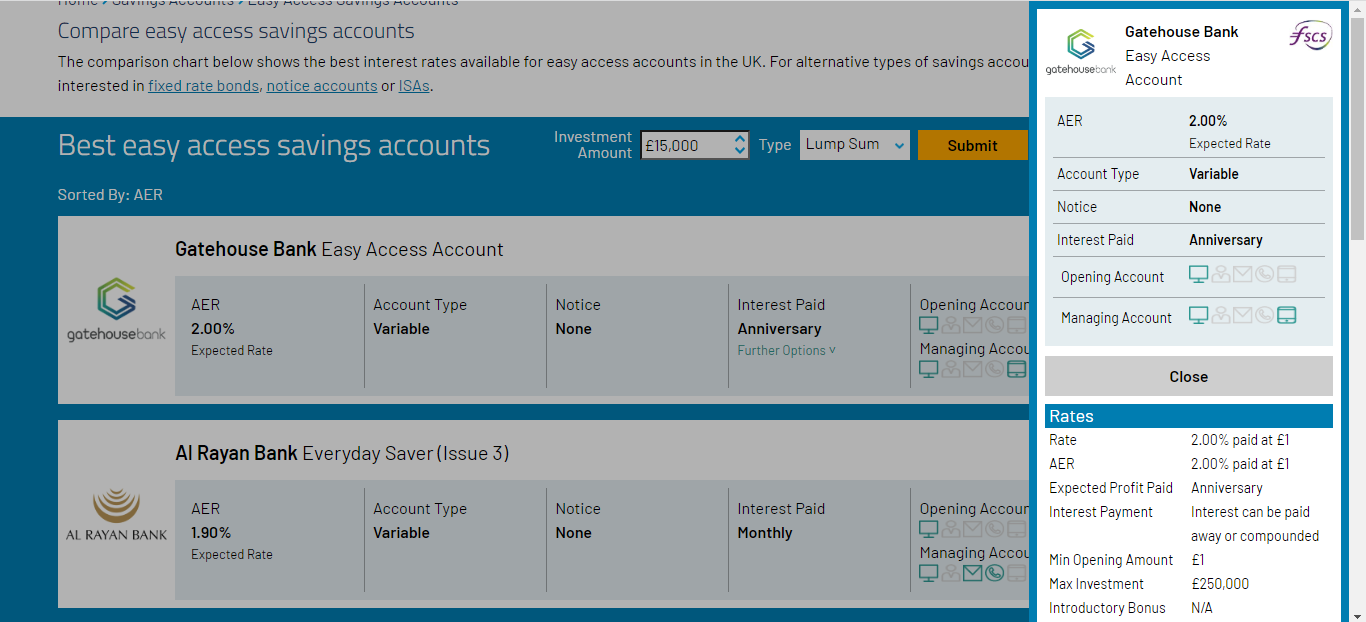

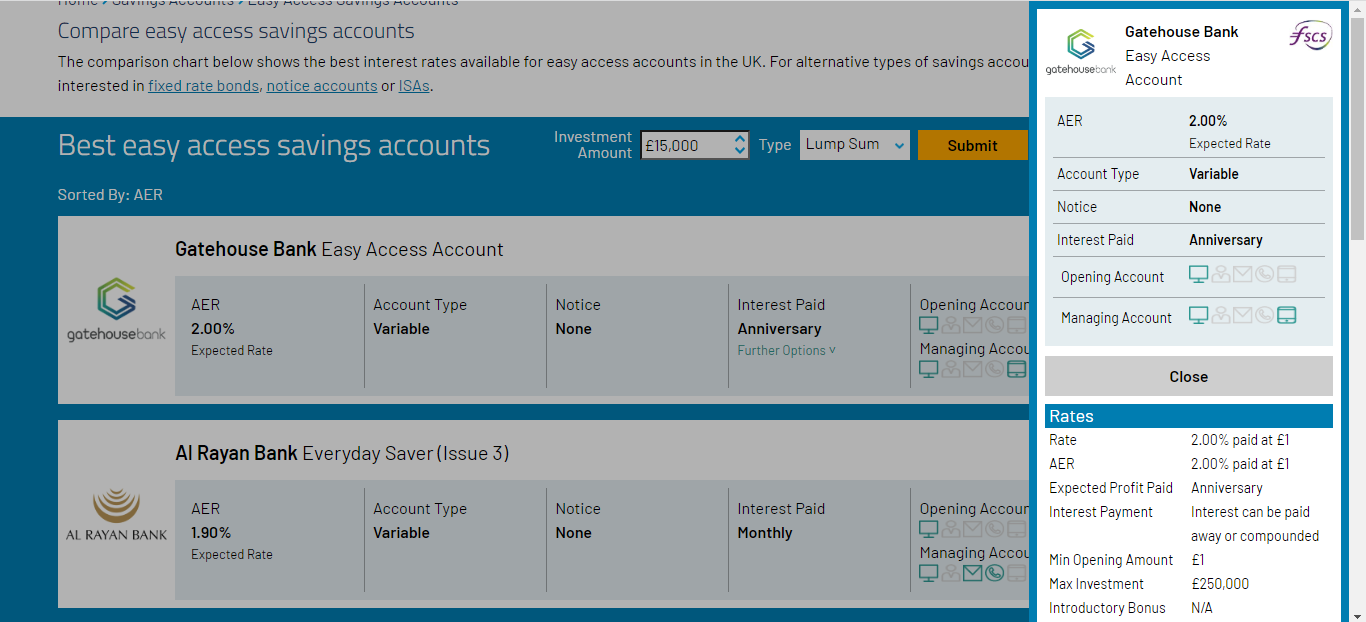

According to Moneyfacts, Gatehouse Bank's easy access account will soon be paying 2% EPR.

3 -

Marmaduke123 said:It's very annoying to have to open new accounts and go through the convoluted process of closing old ones! I suppose it must work for Tesco, even if not for their customers.You can close them without phoning them, though I've never tried it1

-

I have done it by form and it's easy tbhColdIron said:Marmaduke123 said:It's very annoying to have to open new accounts and go through the convoluted process of closing old ones! I suppose it must work for Tesco, even if not for their customers.You can close them without phoning them, though I've never tried it1 -

Yet when you go to the Gatehouse website, the rate for their Easy Access Account shows it as being at 1.80%!Bridlington1 said:According to Moneyfacts, Gatehouse Bank's easy access account will soon be paying 2% EPR. 1

1 -

Investec Online Flexi Saver up from 1.4% to 1.7%2

-

I'Steve_xx said:

I've just received the following email:

Yet when you go to the Gatehouse website, the rate for their Easy Access Account shows it as being at 1.80%!Bridlington1 said:According to Moneyfacts, Gatehouse Bank's easy access account will soon be paying 2% EPR.

0 -

It's actually changed to 2% on their website now.Bridlington1 said:I'Steve_xx said:

I've just received the following email:

Yet when you go to the Gatehouse website, the rate for their Easy Access Account shows it as being at 1.80%!Bridlington1 said:According to Moneyfacts, Gatehouse Bank's easy access account will soon be paying 2% EPR.

0

0 -

Question to those with a Gatehouse Easy Access accounts: how long do withdrawals take? Do they process them 7 days a wekk?0

-

Marmaduke123 said:It's very annoying to have to open new accounts and go through the convoluted process of closing old ones! I suppose it must work for Tesco, even if not for their customers.I agree. A problem I've had with Tesco savings accounts is that I elect to go paperless and I expect my statements to be available to download. When opening a new account to get a better rate, I have elected to close the old one. Unfortunately they only allow, I think, up to 5 accounts to be viewed online while others just vanish. They send me an email saying the closing statement is available to view, but instead they send me an unwanted paper statement by post.So, as you say their whole process is convoluted.Reginald Molehusband0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards