We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Top Easy Access Savings Discussion Area

Comments

-

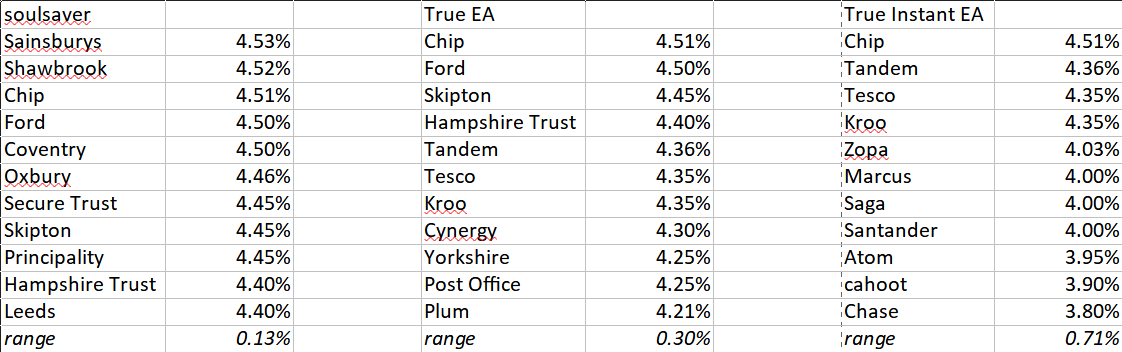

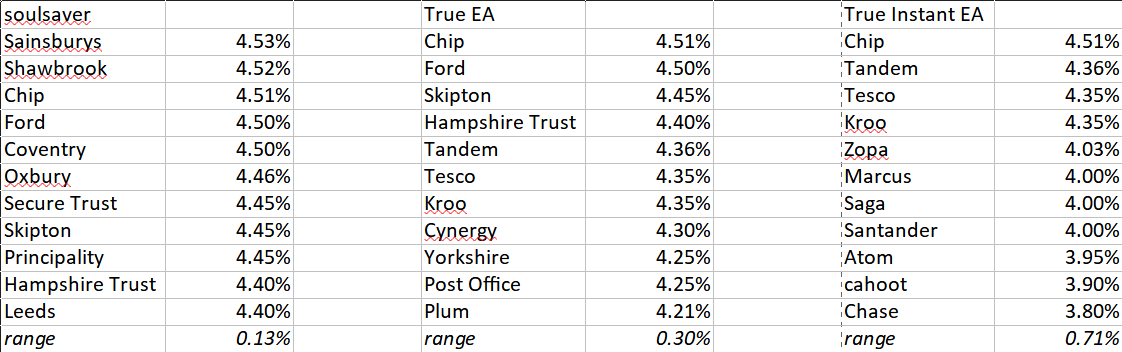

The at a glace chart is excellent. Thank youircE said:So I've been meaning to look at this for a while, and I figured it might be of interest to others based on @refluxer's tip off on Tesco Bank today but also earlier discussions around "what do we actually mean by easy access accounts" (@Hattie627 etc). The first section shows soulsaver's top pots as they currently stand.The second section shows the top rates for what I've referred to as "True EA": easy access savings accounts that have no minimum balances and allow unlimited withdrawals.The third section shows the top "True EA" accounts that also allow instant access, by which I mean the providers advertise deposit and withdrawal times as being up to 2 hours but usually less than this, 24/7.Some observations that jumped out to me:* competition is cut-throat to be the top rate, but more segmented for the rest, and at the cost of access/minimum balances* Chip is likely to remain popular even not being in the top spot* recent decisions from Tandem, Tesco and Kroo make much more sense considering their access and their part of the market* the new digital banks that attracted savers (and current account holders!) with their erstwhile high interest rates might have decided they are comfortable enough where they are now, relatively speakingAnyway, would be interested to see what others think and if I've missed anything obvious.4

The first section shows soulsaver's top pots as they currently stand.The second section shows the top rates for what I've referred to as "True EA": easy access savings accounts that have no minimum balances and allow unlimited withdrawals.The third section shows the top "True EA" accounts that also allow instant access, by which I mean the providers advertise deposit and withdrawal times as being up to 2 hours but usually less than this, 24/7.Some observations that jumped out to me:* competition is cut-throat to be the top rate, but more segmented for the rest, and at the cost of access/minimum balances* Chip is likely to remain popular even not being in the top spot* recent decisions from Tandem, Tesco and Kroo make much more sense considering their access and their part of the market* the new digital banks that attracted savers (and current account holders!) with their erstwhile high interest rates might have decided they are comfortable enough where they are now, relatively speakingAnyway, would be interested to see what others think and if I've missed anything obvious.4 -

All this switching for the top rate, I can see a lot of people getting P800 in Oct this year and next.

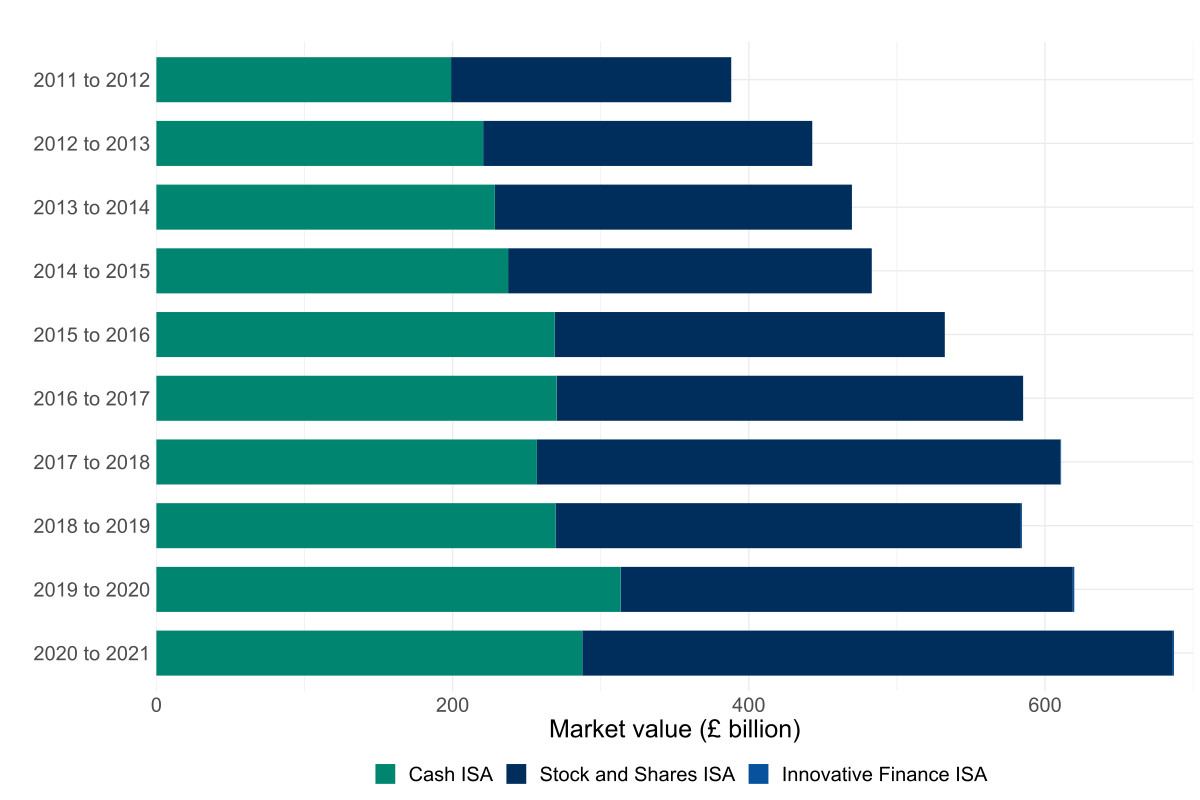

All through the years when ISA were out of fashion and people were ditching them because of the PSA, they might regret that now.0 -

Missing Investec !pearl123 said:

The at a glace chart is excellent. Thank youircE said:So I've been meaning to look at this for a while, and I figured it might be of interest to others based on @refluxer's tip off on Tesco Bank today but also earlier discussions around "what do we actually mean by easy access accounts" (@Hattie627 etc). The first section shows soulsaver's top pots as they currently stand.The second section shows the top rates for what I've referred to as "True EA": easy access savings accounts that have no minimum balances and allow unlimited withdrawals.The third section shows the top "True EA" accounts that also allow instant access, by which I mean the providers advertise deposit and withdrawal times as being up to 2 hours but usually less than this, 24/7.Some observations that jumped out to me:* competition is cut-throat to be the top rate, but more segmented for the rest, and at the cost of access/minimum balances* Chip is likely to remain popular even not being in the top spot* recent decisions from Tandem, Tesco and Kroo make much more sense considering their access and their part of the market* the new digital banks that attracted savers (and current account holders!) with their erstwhile high interest rates might have decided they are comfortable enough where they are now, relatively speakingAnyway, would be interested to see what others think and if I've missed anything obvious.0

The first section shows soulsaver's top pots as they currently stand.The second section shows the top rates for what I've referred to as "True EA": easy access savings accounts that have no minimum balances and allow unlimited withdrawals.The third section shows the top "True EA" accounts that also allow instant access, by which I mean the providers advertise deposit and withdrawal times as being up to 2 hours but usually less than this, 24/7.Some observations that jumped out to me:* competition is cut-throat to be the top rate, but more segmented for the rest, and at the cost of access/minimum balances* Chip is likely to remain popular even not being in the top spot* recent decisions from Tandem, Tesco and Kroo make much more sense considering their access and their part of the market* the new digital banks that attracted savers (and current account holders!) with their erstwhile high interest rates might have decided they are comfortable enough where they are now, relatively speakingAnyway, would be interested to see what others think and if I've missed anything obvious.0 -

2010 said:

All through the years when ISA were out of fashion and people were ditching them because of the PTA, they might regret that now.Which years were they? ISAs have increased in value. 0

0 -

When PSA was introduced and rates for ISA were and still are lower than non ISA, even ML was advising people to switch out or not open new ones because of the tax situation.0

-

Disappointing that Kent Reliance have a new issue but havent increased their previous issues which theyve done up until now. Also Tandem starting to noticeably lag behind others. Ford Money remains consistent with 20 increases over the last year without needing a new issue. It might only be a difference of £2 for each £10000 on a 0.25% gap over a month but sticking with accounts that consistently lag that will add up.1

-

Tandem awfully quiet I’m getting itchy feet1

-

2010 said:When PSA was introduced and rates for ISA were and still are lower than non ISA, even ML was advising people to switch out or not open new ones because of the tax situation.

2016? The data doesn't show people ditched ISAs then.

0 -

https://blog.moneysavingexpert.com/2022/04/martin-lewis-ditch-cash-isa/InvesterJones said:2010 said:When PSA was introduced and rates for ISA were and still are lower than non ISA, even ML was advising people to switch out or not open new ones because of the tax situation.

2016? The data doesn't show people ditched ISAs then.

0 -

Yes I am too. Will they go early with a rise or hold off..smithers1981 said:Tandem awfully quiet I’m getting itchy feet0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards