We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Easy Access Savings Discussion Area

Comments

-

Wheres_My_Cashback said:There's a big clue in the product name

Okay folks. I give in - I should have paid more attention reading the title.Anyway, I am not interested in post / branch only.Thank you for reading this message.2

Okay folks. I give in - I should have paid more attention reading the title.Anyway, I am not interested in post / branch only.Thank you for reading this message.2 -

It is unfortunately branch or post application, but I think it can be managed online once opened (based on the information on the product page).soulsaver said:

Branch or Post only.ForumUser7 said:Harpenden Building Society triple access to 3% if conditions met re withdrawals from 21/02/2023

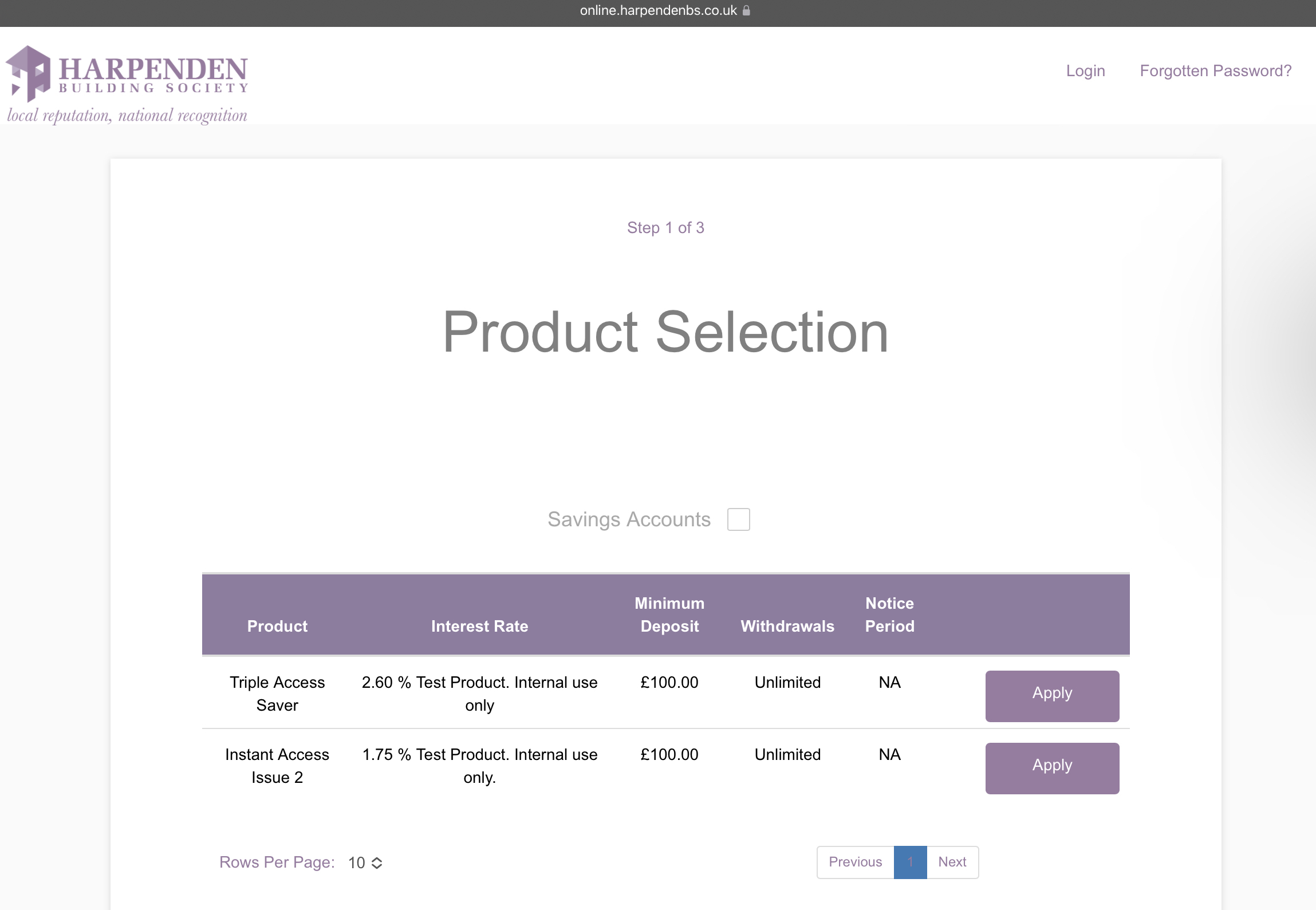

On a side note - don’t know when it’ll be enabled fully, but Harpenden seem to be working on enabling online applications. If you go to register as a new customer on their online service, the triple access and instant access are listed, with the disclaimer ‘Test Product. Internal use only’. If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

Cynergy's Easy Access is now at Issue 57 and down to 3.04% AER.

Issue 56 (3.11% AER) is now NLA.1 -

That's unexpected. I don't think they have done that before. Not even after Santander dropped their 2.75%. If they saw themselves leading the tables and not wanting loads of new applications, they used to make it exclusive for existing customers.AmityNeon said:Cynergy's Easy Access is now at Issue 57 and down to 3.04% AER.

Issue 56 (3.11% AER) is now NLA.0 -

Things look a little like EA accounts might be approaching their peak rather than large increases. Coventry Limited didn't increase for the first time in a year and remains 0.75% below BoE which it had kept up with before. There's only 0.5% between the worst of previously good accounts at 2.75% and that Coventry limited. It might be worth looking again at fixes still available at 4.35% or EA accounts with a large 12 month bonus element (2.2% for Tesco and Post Office) that would act as a floor should rates begin to drop later in the year.0

-

It's really tightened at the top end now. There are oodles of accounts now offering 3.00-3.05, a handful were at 3.10 ish but pulled back and it seems no one wants to put their heads much above the parapet.

Given that you could get 2.70-2.75% from big names (Santander, Chase) and 2.8-2.9% from 3-4 other banks (Zopa, Al Rayan, Gatehouse and others) before the last 0.5% rise from the BoE, it seems only 0.25% has ended up being passed on to savings accounts. Surprised that Zopa and Al Rayan haven't increased but clearly they don't need to.

For those with amounts in excess of £50k to deploy it seems like instant access savings isn't really following base rates but other products do and will start to look more attractive. Not appropriate for this thread but for those interested it might be worth looking into Money market funds that aim to match the SONIA rate (around 3.92% at the moment, and if BoE raises again as expected this will closely track it) or even short dated Gilts (3month to 1yr all yielding above 3.85%). There are other threads on this board which discuss these options.0 -

The fact fixed bond rates have been falling, maybe explains why easy access rates have stalled. If easy access rates had continued to improve much above 3%, bringing them closer to ~4% fixed rates, what would be the point in securing a fixed rate?jak22 said:Things look a little like EA accounts might be approaching their peak rather than large increases. Coventry Limited didn't increase for the first time in a year and remains 0.75% below BoE which it had kept up with before. There's only 0.5% between the worst of previously good accounts at 2.75% and that Coventry limited. It might be worth looking again at fixes still available at 4.35% or EA accounts with a large 12 month bonus element (2.2% for Tesco and Post Office) that would act as a floor should rates begin to drop later in the year.

0 -

For us newbies, can you give us some links please.cwep2 said:

For those with amounts in excess of £50k.... There are other threads on this board which discuss these options.0 -

Thanks @cwep2, I agree with you on the fact the last two or three months have not been as positive as the last year in increases, probably peaking as they don't need so much liquidity anymore, but what would be your opinion?cwep2 said:

Surprised that Zopa and Al Rayan haven't increased but clearly they don't need to.

or even short dated Gilts (3month to 1yr all yielding above 3.85%). There are other threads on this board which discuss these options.

Also are you considering 3-month Gilts and if so could you recommend where you would buy them?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards