We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Do people budget for interest rate rises?

Comments

-

Not really. Have fixed fairly short deals and doubt it'll shoot up overnight. Pay rises usually cover any higher interest rates. Bought in 1991 so know about high rates lol! Very small mortgage now so it wouldn't make a lot of difference to me.2024 wins: *must start comping again!*0

-

We bought our first house in 1989 ... interest rates had just dropped from 15% to 14%. They then (briefly) went back up to 15% a couple of years later.

Thankfully we've now been mortgage-free for over a year.0 -

Of course people can predict IR just like they can predict next weeks lottery numbers. It’s just the degree of accuracy that matters.

I’m happy to let time be the judge of my predictions thanks ��0 -

SmashedAvacado wrote: »BoE base rate was no higher than 7% in the 90's. If you were paying a mortgage interest rate of 15% you were in the minority. 80's though - that might be true.

I applied for a mortgage in 1978, the rate was very high, 16%0 -

I don't budget for an interest rate rise, as everything I have is a fixed interest.

But I'm at the stage where my income is predicted to rise comfortably over rises in base rate (I'm in a job where a few promotions to a more senior level is a typical and well trodden path), and I'm not maxed out either so not really affected.

Your rates get cheaper as you change LTV brackets. I started on 2.24%, now on 1.64%, and with the recent base rises next remortgage will be around 1.9%.0 -

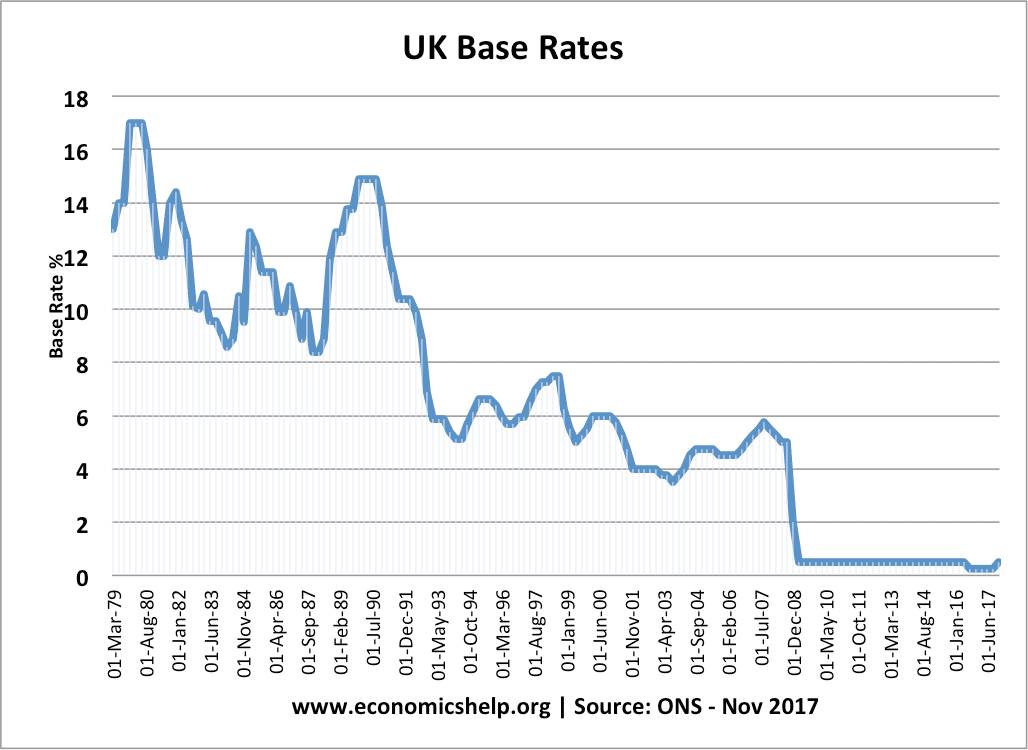

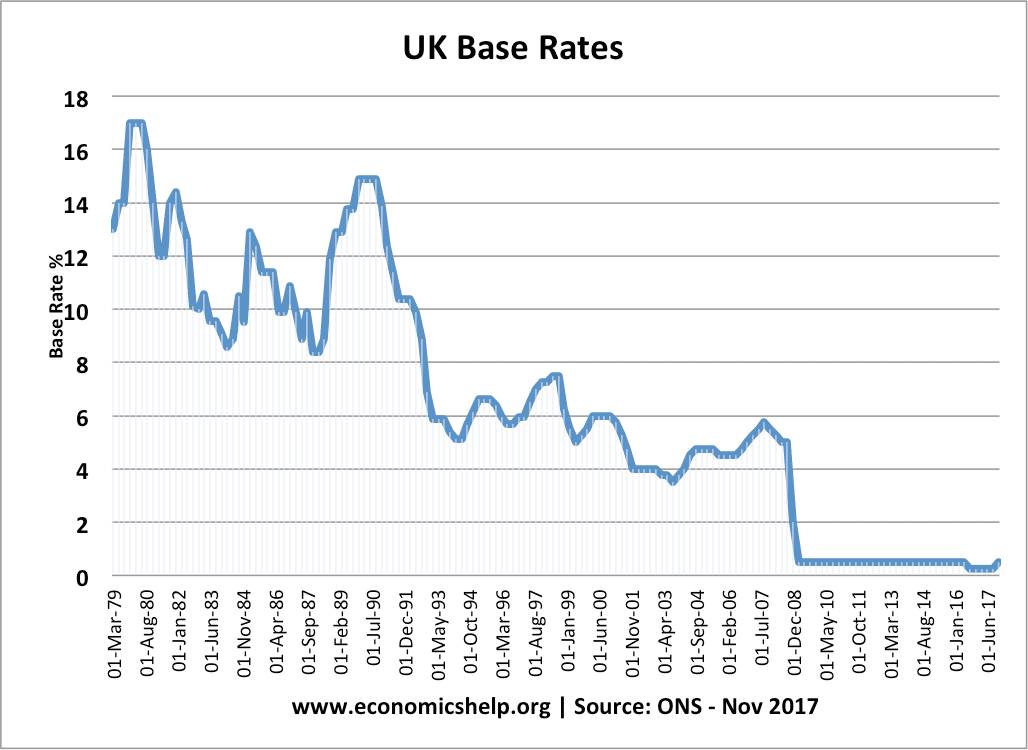

SmashedAvacado wrote: »BoE base rate was no higher than 7% in the 90's. If you were paying a mortgage interest rate of 15% you were in the minority. 80's though - that might be true.

0

0 -

We have, and have taken out a 5 year mortgage deal recently based on that risk. We can also afford an extra couple of hundred on top of what we are paying for if it does go up - it'll be very tight, but doable (so long as one of us doesn't lose out job!).

I know others who haven't though.0 -

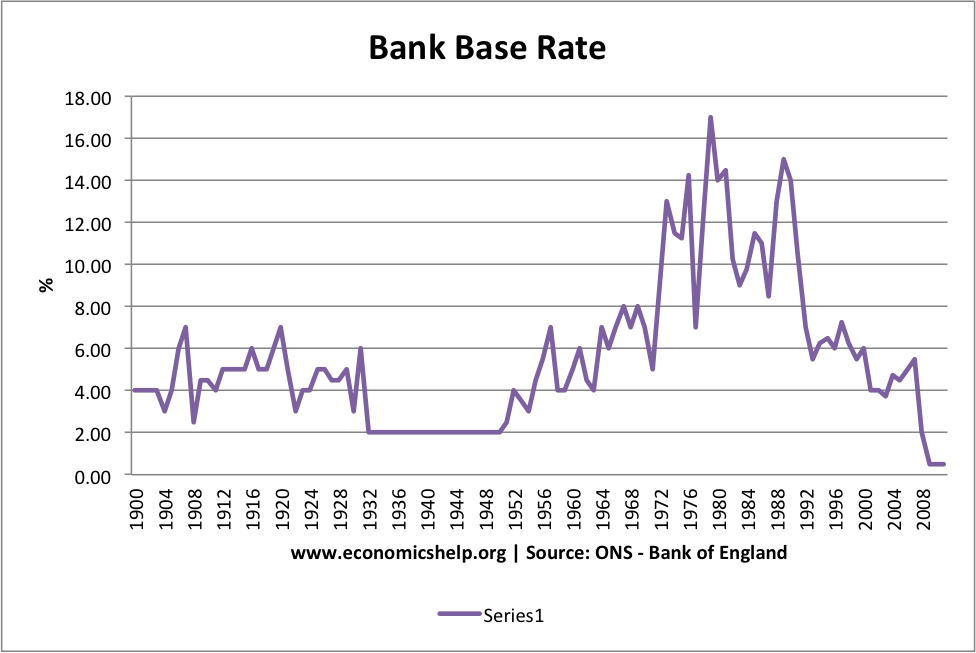

This demonstrates it beautifully - it's the low, low rates of the last decade which are the exception, not higher rates.

In fact, why not have an even longer view...?

~4-5% is the long-term median rate.

As Red Squirrel says, anybody who's taken a mortgage on in the last decade has "budgeted" for increases, whether they understand that or not, simply because they wouldn't have got the loan otherwise.

It's those who haven't remortgaged in the last decade who may well be trapped in that limbo land on SVR, unable to remortgage because of changed circumstances or because they're simply outside the affordability criteria, and are the ones who are at risk - especially those on repayment-vehicle-less interest-only mortgages at high LtVs on properties that have stayed static in value over the last few years.0 -

I do wonder sometimes when I look at our local new estate. Young families in 3/4 bed detached and big 4x4 cars (often two of them) parked on the drive. Not all of them can be earning enough to pay a hike in interest and I genuinely think they have no clue - as they're too young to remember it being any different.

Re the affordability checks often they are done before children come along and expenses go up, maybe only one and a bit incomes etc.0 -

Really interesting charts :beer:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.3K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.2K Work, Benefits & Business

- 599.4K Mortgages, Homes & Bills

- 177.1K Life & Family

- 257.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards