We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Retirement Planning Tools

Comments

-

Just happened across https://www.standardlife.co.uk/retirement/tools - thought I would share it here.

Looks like a really quick and simple way to enter a range of things (multiple pensions, pots), for both you and your partner.

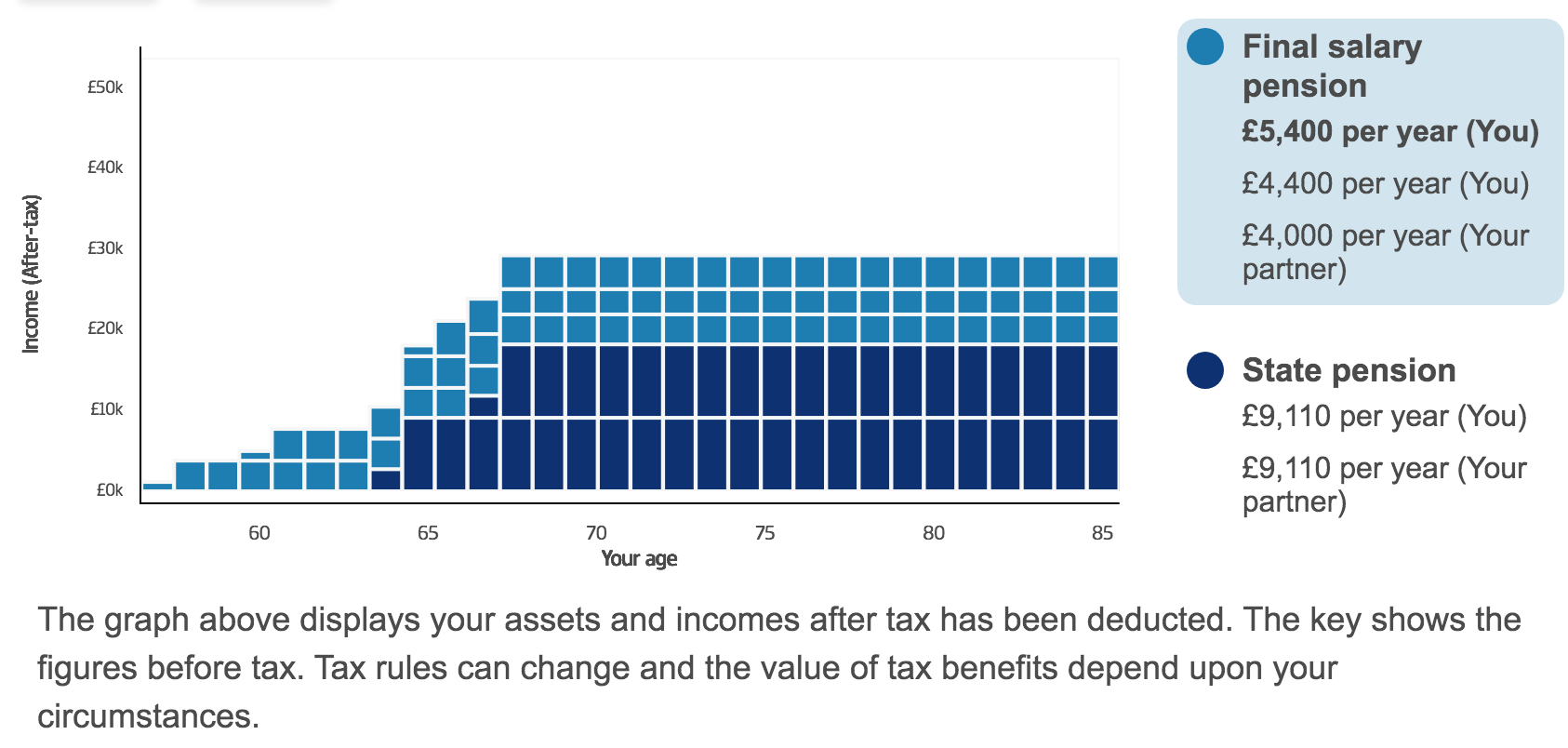

I like the short summary that builds up a simple bar chart to show they tell you what you have to live on: snip below before it adds a big purple splodge adding in your savings/DC pots to take you to what you can live on.

Slightly odd that they ignore shares you entered: maybe they imagine them all disappearing

...but otherwise REALLY fast and REALLY simple. With no obligation to speak with them at all!

Plan for tomorrow, enjoy today!2 -

It's a pity the SL calculator assumes all final salary pensions are inflation adjusted.0

-

As in "will go up broadly in line with inflation" ?westv said:It's a pity the SL calculator assumes all final salary pensions are inflation adjusted.

I hadn't especially spotted that...but I know our (small!) ones have some annual increase, so I think that isn't unreasonable.

As with anything looking 10/20/30 years ahead, they are only broad guidelines, so I would be happy with that assumption.

Do you have a DB pension that remains flat? That would be unusual, surely?Plan for tomorrow, enjoy today!0 -

PPF pension.cfw1994 said:

As in "will go up broadly in line with inflation" ?westv said:It's a pity the SL calculator assumes all final salary pensions are inflation adjusted.

I hadn't especially spotted that...but I know our (small!) ones have some annual increase, so I think that isn't unreasonable.

As with anything looking 10/20/30 years ahead, they are only broad guidelines, so I would be happy with that assumption.

Do you have a DB pension that remains flat? That would be unusual, surely?

Also, where do you enter a retirement date?

0 -

PPF? Pension Protection Fund? Now I'm confused!westv said:

PPF pension.cfw1994 said:

As in "will go up broadly in line with inflation" ?westv said:It's a pity the SL calculator assumes all final salary pensions are inflation adjusted.

I hadn't especially spotted that...but I know our (small!) ones have some annual increase, so I think that isn't unreasonable.

As with anything looking 10/20/30 years ahead, they are only broad guidelines, so I would be happy with that assumption.

Do you have a DB pension that remains flat? That would be unusual, surely?

Also, where do you enter a retirement date?

You get to pick a retirement age after putting in purchases etc.Plan for tomorrow, enjoy today!0 -

Yep. Or FAS as it used to be.cfw1994 said:

PPF? Pension Protection Fund? Now I'm confused!westv said:

PPF pension.cfw1994 said:

As in "will go up broadly in line with inflation" ?westv said:It's a pity the SL calculator assumes all final salary pensions are inflation adjusted.

I hadn't especially spotted that...but I know our (small!) ones have some annual increase, so I think that isn't unreasonable.

As with anything looking 10/20/30 years ahead, they are only broad guidelines, so I would be happy with that assumption.

Do you have a DB pension that remains flat? That would be unusual, surely?

Also, where do you enter a retirement date?

You get to pick a retirement age after putting in purchases etc.0 -

Yes seems ok. I still don't see anywhere to change the retirement date - it seems to assume I'll retire when my DB pension starts at 60.cfw1994 said:

Nope!westv said:Do you have to register to use the Standard Life tool?

You are asked for email so they can send you a link to return to: I have no problem with that! Give it a whirl, see what you think!0 -

Very odd. Even if I go back in, I get to choose again:westv said:

Yes seems ok. I still don't see anywhere to change the retirement date - it seems to assume I'll retire when my DB pension starts at 60.cfw1994 said:

Nope!westv said:Do you have to register to use the Standard Life tool?

You are asked for email so they can send you a link to return to: I have no problem with that! Give it a whirl, see what you think!

Did you continue to the point where it showed you an illustration?Plan for tomorrow, enjoy today!0 -

Mrs nbal and I are both 57, both working, a number or DB and DC pensions between us, full state pension and thinking about when to retire. We need a free tool to map out scenarios (lump sum payments, changed pension contributions, lower salary/part-time working, retirement ages, ...) so we can decide what's best for us. Standard Life planner is good, but its difficult to go back and change inputs without SL repeating we need to talk to their retirement people!Does anyone have any other recommendations/tools? Or has anyone built a spreadsheet they would like to share? I would think there must be quite a few people in our position, and extensive internet searching hasn't turned any decent tools up, especially for couples.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards