We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Brexit, the economy and house prices (Part 3)

Comments

-

A_Medium_Size_Jock wrote: »"We didn't need to take anything back."

So why is there a need for a repeal bill?

In all the debate yesterday in the HoP I did not hear anyone suggest it was unnecessary.

Fortunately many of us realise that what you believe has little relevance to reality.

The repeal bill ensures that where the UK follows EU legislation its copied into UK domestic law. It's very necessary if we're leaving the EU which is probably why you didn't hear anyone in Parliament suggest it was unnecessary.

Nothing to do with sovereignty mind.

Let me help you further. From the parliament website*Parliamentary sovereignty is a principle of the UK constitution. It makes Parliament the supreme legal authority in the UK, which can create or end any law. Generally, the courts cannot overrule its legislation and no Parliament can pass laws that future Parliaments cannot change. Parliamentary sovereignty is the most important part of the UK constitution.

On any day during our EU membership parliament could have decided that EU law would no longer apply. Sovereignty hasn't been given away (and therefore doesn't need taking back). Peoples living in countries without their sovereignty where laws are imposed on them would probably find your definition of sovereignty to be ill-informed, self-indulgent and probably offensive.

* yes it does explain what is meant by the UK constitution.This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

I'm not sure why theres this fear that leaving the EU means we cant sell to it? it might be on different terms, but it wont be something we cant do

Not a single person on either side of the debate fears that UK/ EU trade will cease.This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

More than it needs the EU?

Ireland wont want harm to it's exports period, certainly not for some abstract notion of punishing the UK;

http://www.irishtimes.com/business/agribusiness-and-food/brexit-could-decimate-ireland-s-horse-racing-industry-1.3212662

A hard Brexit could decimate Ireland’s horse racing and breeding industry, resulting in hefty tariffs on the sale of horses into the UK and restrictions on horses being brought there to race, the chairman of Horse Racing Ireland has warned.

Joe Keeling said the industry here exported 65 per cent of its produce mainly to the UK and a reversion to World Trade Organisation (WTO) rules under a hard Brexit would result in an 11.5 per cent tariff on gelding sales, on top of the current sterling differential.0 -

Ireland wont want harm to it's exports period, certainly not for some abstract notion of punishing the UK;

http://www.irishtimes.com/business/agribusiness-and-food/brexit-could-decimate-ireland-s-horse-racing-industry-1.3212662

A hard Brexit could decimate Ireland’s horse racing and breeding industry, resulting in hefty tariffs on the sale of horses into the UK and restrictions on horses being brought there to race, the chairman of Horse Racing Ireland has warned.

Joe Keeling said the industry here exported 65 per cent of its produce mainly to the UK and a reversion to World Trade Organisation (WTO) rules under a hard Brexit would result in an 11.5 per cent tariff on gelding sales, on top of the current sterling differential.

After Brexit the UK decides what import tariffs apply to her imports and what restrictions will be placed on the movement of foreign horses.

Ireland won't want her export sales damaged but its really nothing to do with whether brexit is hard, soft or punishments are intended.This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

ilovehouses wrote: »After Brexit the UK decides what import tariffs apply to her imports and what restrictions will be placed on the movement of foreign horses.

Ireland won't want her export sales damaged but its really nothing to do with whether brexit is hard, soft or punishments are intended.

Are you saying the EU and it's members will merrily place tariffs on the UK and we wont reply in kind?0 -

Once again you imply your intelligence is better than that possessed by participants in the FTSE250 and 100.

Many within the FTSE350 are multinational companies with some, but not complete exposure to the UK.

Take Bank of Georgia (a FTSE 250 listed company) for example; it has some exposure to GBP markets but absolutely no exposure to the economy of the UK, no exposure to the loss of passporting rights that some banks will face (although likely to be minimal in reality even if it may take jobs from London) and Georgia in itself is relatively isolated from the rest of the world in international trade terms.

If you have both your income and expenses in a multitude of currencies then you're able to withstand variations to a greater extent than those highly exposed to one market.

In the case of a longer term variation we could (I believe we're likely to) see prices rise. It's better to start preparing for this now than waiting IMO, and if it doesn't happen there will at least be the advantage of either less debt or increased spending power at the end of it for those that do.💙💛 💔0 -

CKhalvashi wrote: »Many within the FTSE350 are multinational companies with some, but not complete exposure to the UK.

Take Bank of Georgia (a FTSE 250 listed company) for example; it has some exposure to GBP markets but absolutely no exposure to the economy of the UK, no exposure to the loss of passporting rights that some banks will face (although likely to be minimal in reality even if it may take jobs from London) and Georgia in itself is relatively isolated from the rest of the world in international trade terms.

If you have both your income and expenses in a multitude of currencies then you're able to withstand variations to a greater extent than those highly exposed to one market.

In the case of a longer term variation we could (I believe we're likely to) see prices rise. It's better to start preparing for this now than waiting IMO, and if it doesn't happen there will at least be the advantage of either less debt or increased spending power at the end of it for those that do.

When the SM tanked right after the referendum result you had Sky News with acres of red flashing breaking news and breathless presenters asking 'are you proud of this, peoples pension pots wiped out by the Brexit vote'

We've had booming stock markets since then and yet still Remainers find a negative spin.

JUNE 24TH 2016

http://money.cnn.com/2016/06/24/investing/brexit-london-stocks-crashing/

This is Brexit: London and European stocks get crushed

Many analysts see the FTSE 250 as a more accurate reflection of the British economy because it tracks firms that do more of their business inside Britain.

http://news.sky.com/story/stocks-plummet-as-brexit-punishes-global-markets-10323302

Stocks Plummet As Brexit Punishes Global Markets0 -

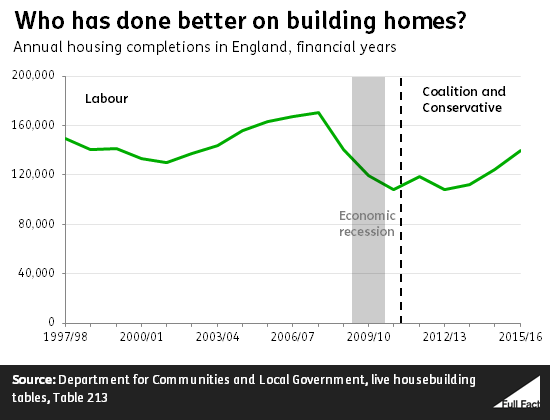

It was twenty years ago when Prescott made a promise to build a target number of new homes. 3 years later....target failed, and it's been pretty much the case ever since.

So why do you think this year it will be different?

Yes someone posted this the other day.

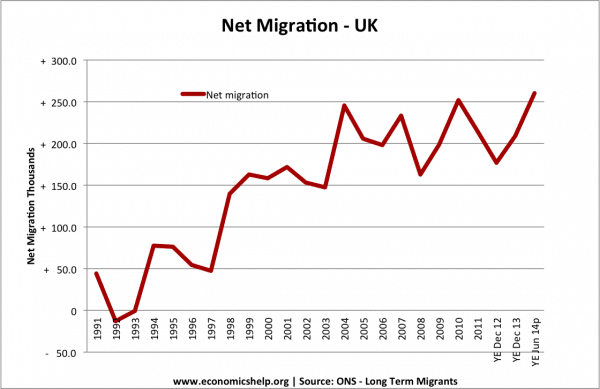

For 20 years we have had mass migration (since 1997) and politicians have not managed to build enough houses.

The population of the UK in 1997 was 58 million - it's now 66 million. Roughly 400,000 extra people.

The number of homes built.

Clearly politicians want mass migration but can't be bothered making sure people have some where to live.0 -

When the SM tanked right after the referendum result you had Sky News with acres of red flashing breaking news and breathless presenters asking 'are you proud of this, peoples pension pots wiped out by the Brexit vote'

We've had booming stock markets since then and yet still Remainers find a negative spin.

JUNE 24TH 2016

http://money.cnn.com/2016/06/24/investing/brexit-london-stocks-crashing/

This is Brexit: London and European stocks get crushed

Many analysts see the FTSE 250 as a more accurate reflection of the British economy because it tracks firms that do more of their business inside Britain.

I'm not trying to find a negative, I'm trying to point out that a lot of the spending was based on increased tourism (which is obviously not negative) and increased levels of spending on plastic (which is definitely a negative if not done right).

We risk losing access to the single market (which may or may not be a negative, I think it will be while I appreciate you don't) and therefore (in my opinion) losing some of the exports we have to potentially gain others.

My concern is that it will lead to stagnating incomes, slightly increased unemployment (although more jobs lost than the unemployment will rise) and increased inflation, which may cause issues for consumers and businesses who aren't planning ahead.

I'm not trying to be negative, I'm trying to be realistic. If you see that as being negative then so be it however if a block of people people aren't (or can't) spend more than the bare minimum then there is likely to be some adverse consequence of that.💙💛 💔0 -

Apart from the first paragraph which TBH is no more than unnecessary waffle (there was no mention in my post re: sovereignty which you repeatedly refer to), you yet again display remarkably poor understanding.ilovehouses wrote: »The repeal bill ensures that where the UK follows EU legislation its copied into UK domestic law. It's very necessary if we're leaving the EU which is probably why you didn't hear anyone in Parliament suggest it was unnecessary.

Nothing to do with sovereignty mind.

Let me help you further. From the parliament website*

On any day during our EU membership parliament could have decided that EU law would no longer apply. Sovereignty hasn't been given away (and therefore doesn't need taking back). Peoples living in countries without their sovereignty where laws are imposed on them would probably find your definition of sovereignty to be ill-informed, self-indulgent and probably offensive.

* yes it does explain what is meant by the UK constitution.

The UK could not in fact simply decide that EU law does not apply.

Maybe you need to read more upon supremacy of EU law in the UK (and indeed other EU member countries) - in fact this time I will help you.

https://fullfact.org/europe/eu-law-and-uk/

Unlike your suggestion, mine actually contains useful information which it looks like you missed or simply ignored.

Hence the repeal bill.it might be possible for Parliament to contradict EU laws. But this would seem incompatible with continued membership of the EU.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards