We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Currency Prepaid Card ripoff

Options

Comments

-

The problem is the ATM will detect the country of your card, it probably won't know what currency it's loaded with. So it detects a UK card and offers the option of charging it in GBP. Which basically means you get shafted with 3 exchange rate markup hits. One when you loaded the card in EUR. One when the ATM converted it to GBP. And another when the card converts it back to EUR.

I don't use prepaid cards but the general advice is to always load them in GBP, not foreign currency. Then you only ever get hit with one exchange rate markup, even if you do mistakenly accept DCC. Use the right card and you get the unadulterated VISA/MasterCard rate which are close to interbank, if you avoid DCC. Also if you don't spend as much as you loaded it with, you can withdraw once back at home without paying another conversion fee.0 -

Thanks for showing the email from Sainsbury.This is the response I received from Sainsburys.

If you opted to pay in the local currency and DCC has not been applied, please complete the attached dispute form and send it to [/FONT]prepaidmgmt_chargebacks_ppc@mastercard.com. They will be in contact with you directly following their investigation.

It's clear enough, up until the paragraph above, which would only make sense without the word "not". I think they should be saying that "If you opted to pay in the local currency [thus avoiding DCC] and DCC has been applied [regardless]" - then your choice to decline DCC was ignored, which is against the regulations and you need to report it to MasterCard.

But with the word "not" included it doesn't seem to make sense, to me anyhow, and I can see how you found it confusing.

Anyway, what happened was that you chose to let the ATM take pounds from your card, which holds euros, so Sainsbury charged you the 5.75% 'out of currency fee'. The ATM changed the pounds back to euros, at their awful rate with a 4+% margin, this being the legal financial scam of DCC that needs to be avoided.

So you got hit twice and lost about 10%. Does it start to make some sense now?

Maybe you could ask Sainsbury to clarify that paragraph of their email, in case I'm right and they added to your confusion by mistake.Evolution, not revolution0 -

Thanks for showing the email from Sainsbury.

It's clear enough, up until the paragraph above, which would only make sense without the word "not". I think they should be saying that "If you opted to pay in the local currency [thus avoiding DCC] and DCC has been applied [regardless]" - then your choice to decline DCC was ignored, which is against the regulations and you need to report it to MasterCard.

But with the word "not" included it doesn't seem to make sense, to me anyhow, and I can see how you found it confusing.

Anyway, what happened was that you chose to let the ATM take pounds from your card, which holds euros, so Sainsbury charged you the 5.75% 'out of currency fee'. The ATM changed the pounds back to euros, at their awful rate with a 4+% margin, this being the legal financial scam of DCC that needs to be avoided.

So you got hit twice and lost about 10%. Does it start to make some sense now?

Maybe you could ask Sainsbury to clarify that paragraph of their email, in case I'm right and they added to your confusion by mistake.

I disagree:If you opted to pay in the local currency and DCC has not been applied, please complete the attached dispute form

This is a reply to his query about the charges.

Their reply;Based on the information that you have provided, the issues you have experienced can be possible results of Dynamic Currency Conversion (DCC).

They go on to state that if he opted out of DCC and DCC wasn't applied(therefore ruling DCC as the reason for the discrepancy) they would accept the dispute form.

If they opted out of DCC and DCC was applied, then the onus would be on the cardholder to prove that they opted out of DCC.

But the cardholder in this case has admitted that they opted for DCC.

It's not that I am unsympathetic to the plight of the OP. They fell for every possible trick in the book here.But to suggest that the information is not published within the Sainsbury's blurb is simply not true.0 -

If that paragraph is written correctly, or they are just using a template, then your interpretation is the only one possible. I considered that of course, but as I say, for me it makes little sense. The OP took it to mean that he should in fact opt for DCC, and they have failed to clearly advise him to definitely avoid DCC and conversion from pounds with his card.I disagree:

This is a reply to his query about the charges.

Their reply;

They go on to state that if he opted out of DCC and DCC wasn't applied(therefore ruling DCC as the reason for the discrepancy) they would accept the dispute form.

If they opted out of DCC and DCC was applied, then the onus would be on the cardholder to prove that they opted out of DCC.

But the cardholder in this case has admitted that they opted for DCC.

It's not that I am unsympathetic to the plight of the OP. They fell for every possible trick in the book here.But to suggest that the information is not published within the Sainsbury's blurb is simply not true.

The OP has of course made every mistake possible, startng with choosing such a card, but Sainsbury have been less than helpful with advice, and worse if that paragraph is written incorrectly.Evolution, not revolution0 -

If that paragraph is written correctly, or they are just using a template, then your interpretation is the only one possible. I considered that of course, but as I say, for me it makes little sense. The OP took it to mean that he should in fact opt for DCC, and they have failed to clearly advise him to definitely avoid DCC and conversion from pounds with his card.

The OP has of course made every mistake possible, startng with choosing such a card, but Sainsbury have been less than helpful with advice, and worse if that paragraph is written incorrectly.

Once again I disagree. Both issues are very clearly tackled in the Welcome Pack under Things you can do with your Card

Click through my link in #11and take a look for yourself.

In addition, their reply to the OP lets them know that Sainsburys considered the problem to be DCC.Based on the information that you have provided, the issues you have experienced can be possible results of Dynamic Currency Conversion (DCC).

The OP bypassed every single possible safety net.0 -

You're not the first to encounter this with the Sainsbury's card.

If you accept DCC and allow the ATM to perform the currency conversion you'll be charged around 10% per transaction. You should make an official complaint with Sainsbury's for the incorrect advice you were given, perhaps they'll refund their conversion charges.

What incorrect advice??0 -

I was referring only to the lack of clarity in their email to OP, who had of course never before heard of DCC or read the literature provided. A simple clear instruction in the email would not have gone amiss.Once again I disagree. Both issues are very clearly tackled in the Welcome Pack under Things you can do with your Card

Click through my link in #11and take a look for yourself.

In addition, their reply to the OP lets them know that Sainsburys considered the problem to be DCC..Evolution, not revolution0 -

I was referring only to the lack of clarity in their email to OP, who had of course never before heard of DCC or read the literature provided. A simple clear instruction in the email would not have gone amiss.

Come on now.

Sainsburys has absolutely no idea of the exact wording on the Euronet ATM. The only advice that they can give is to choose to pay in the local currency.

In their reply they gave him a lot more info about DCC. What more could they do? Travel there and press the buttons for him??

Sainsburys is not his mother. If he chose to neither peruse the welcome booklet or the T&C, that is his lookout.Thank you for contacting Card Services.

Based on the information that you have provided, the issues you have experienced can be possible results of Dynamic Currency Conversion (DCC).

DCC is, in theory, an optional ‘service’ provided by individual retailers or at ATMs. It should be performed with the cardholder’s consent. It allows the cardholder the option to pay in either the currency of the country they are visiting or the home currency of the card.

For regulatory and anti-competitive reasons, MasterCard is unable to prevent the operation of DCC by retailers or ATM providers but has introduced rules to govern it. Prior to the transaction, any merchant or ATM offering the service should inform the cardholder of the payment choice available. This should be followed by a statement on the receipt, illustrating the choice the cardholder has made.

Clearly stating that DCC is not a good thing.

How many times do they need to be told?

So trying to claim a solitary line at the end of a reply as the cause of the confusion is patently ridiculous.

You can't save some people from themselves.0 -

The fact still remains that on no less than two occasions I wasn't able to withdraw money unless I opted for DCC and even with one ATM (Macho Banco) it implied that charges may be higher if I opted for local currency.

Wouldn't have been such a big problem if more restaurants had accepted cards and the complex we stayed at hadn't of had a technical fault with their card machine for all but the last day we were there.

And even taking DCC out of the equation, the charges the foreign banks levy just to withdraw money is still extortionate.

But I'm sure WAYT will still blame me for them applying these charges.0 -

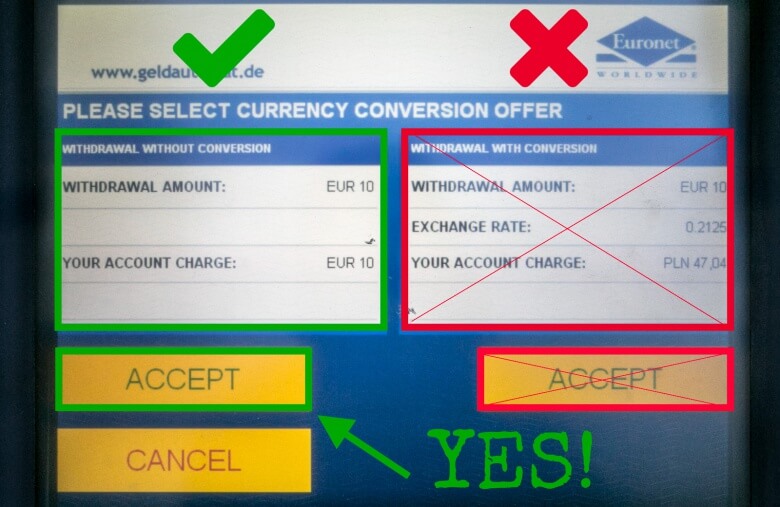

Example or someone using a card from Poland in Europe:

Here we can go into detail such as this. you can't expect Sainsburys to advise on the tricks of every dodgy ATM out there. They can only give general advice.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.2K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.2K Work, Benefits & Business

- 599.2K Mortgages, Homes & Bills

- 177K Life & Family

- 257.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards