We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Budget 2016: House of Commons Rep Coverage

UKParliament

Posts: 749 Organisation Representative

Hi MSE’ers,

The Chancellor will deliver the Budget on Wednesday 16 March at 12.30pm in the House of Commons Chamber.

This will be followed by Budget debates in the Commons for three days on Thursday 17, Monday 21 and Tuesday 22 March.

The debates are an opportunity for the House of Commons to scrutinise the Budget Statement.

We’ll be posting regular updates for you, including links to live video coverage, transcripts of the Budget Statement and debates, background information from the House of Commons Library, and Budget facts.

The content we will be sharing will be politically neutral and impartial.

We want to hear your expectations of what might be in the Budget Speech as well as thoughts on it once it has been delivered. What parts of it will have the biggest impact for you?

Watch the Budget

Watch the Budget live on 16 March at 12.30pm. Watch again or catch-up on Parliament TV.

Read the Chancellor’s Budget Statement

The transcript of the Budget Statement will be made available three hours after it happens on Parliament's website: Today's Commons Debates

Official Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE

0

Comments

-

Thank you! Looking forward to the posts on here!Could you do with a Money Makeover?

Follow MSE on other Social Media:

MSE Facebook, MSE Twitter, MSE Deals Twitter, Instagram

Join the MSE Forum

Get the Free MoneySavingExpert Money Tips E-mail

Report inappropriate posts: click the report button

Point out a rate/product change

Flag a news story: news@moneysavingexpert.com0 -

What is the Budget Statement?

The Budget, or Financial Statement, is a statement made to the House of Commons by the Chancellor of the Exchequer.

The Budget statement includes:- a review of how the UK economy is performing

- forecasts of how the UK economy will perform in the future by the Office for Budget Responsibility (OBR)

- details of any changes to taxation.

The Chancellor's decisions usually remain secret until the speech. This is, mainly, to prevent anyone profiting from having advance knowledge of the government's plans.

What happens in Parliament?

The Chancellor of the Exchequer delivers the Budget statement to Members of Parliament in the House of Commons.

Provisional collection of taxes

Some measures, such as any changes to the rates of duty on alcohol and tobacco, come into effect on Budget day or soon after.

The power to make these changes on an interim basis, before the Finance Bill is passed, comes from the House of Commons approving a motion for the provisional collection of these taxes.

Debates

Traditionally the Leader of the Opposition, currently Leader of the Opposition Jeremy Corbyn MP, rather than the Shadow Chancellor replies to the Budget Speech.

The Budget is usually followed by three days of debate on the Budget Resolutions, these are the tax measures announced in the Budget. Each day of debate covers a different policy area such as health, education and defence. The Shadow Chancellor makes his response the day after the Budget statement during the Budget debates.

Budget Resolutions can come into effect immediately if the House of Commons agrees to them at the end of the three days of debate but they require the Finance Bill to give them permanent legal effect.

The Finance Bill

A new Finance Bill is presented to Parliament each year. It enacts the proposals for taxation made by the Chancellor of the Exchequer in their Budget statement and brings them into law.

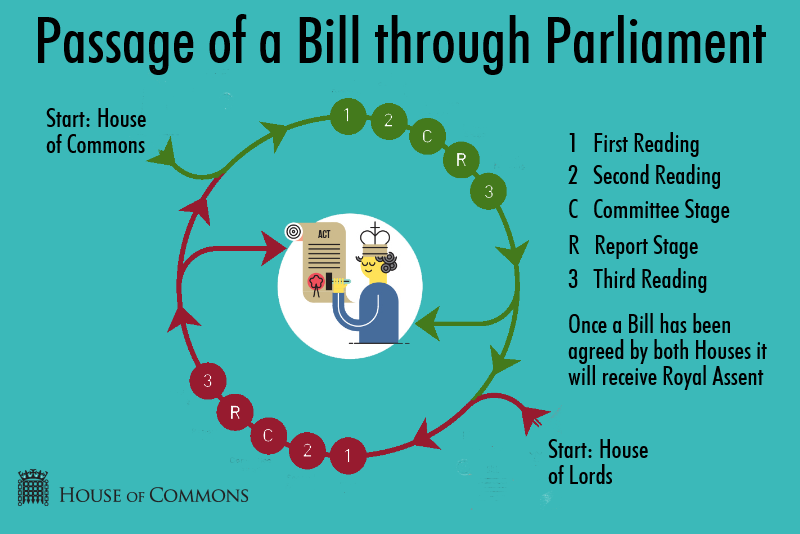

Once the House of Commons has agreed the Budget Resolutions, the Finance Bill starts its passage through Parliament in the same way as any other bill.

Scrutiny

Following each Budget statement the Commons Treasury Select Committee conducts an inquiry into the Government's proposals, gathering evidence from expert witnesses and publishing a report with its conclusions and recommendations.

The Government then produces a report in response to the Committee's findings.

The House of Lords Economic Affairs Sub-Committee examines selected aspects of the Finance Bill, including tax administration, clarification and simplification.

The Chairman of the Ways and Means

Traditionally, the Chairman of Ways and Means (Deputy Speaker) chairs the Budget debates rather than the Speaker. Watch current Chairman, Lindsay Hoyle MP, explain why.

Find out more about the Budget on Parliament's websiteOfficial Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE0 -

The House of Commons Library produces briefing papers to inform MPs and their staff of key issues. The papers contain factual information and a range of opinions on each subject, and aim to be politically impartial.

Here are some of the main points from the Commons Library Budget 2016 Paper:

Economic situation

Economic growth slowed in 2015 but remained solid at 2.2%, underpinned by strong increases in consumer spending. Inflation has hovered around 0% for most of the past year providing a boost to households’ spending power. Given the weak inflation rate, the Bank of England has kept its key interest rate at the historically low level of 0.5%, with most economists expecting them to leave it unchanged in 2016.

GDP growth in 2016 is forecast to be just above 2%, with consumer spending once again providing the impetus. Over the medium term, growth in the 2-2.5% range is forecast. Potential risks could come from the EU referendum in June, weaker-than-anticipated productivity growth, a recurrence of international financial market turbulence and fears over the global economy, particularly in emerging markets.

The number of people in employment rose in 2015, with the proportion of 16-64 year olds in work (74.1%) at its highest level since records began in 1971. Average earnings growth accelerated in the first half of 2015 to near 3%, but slowed towards the end of the year back down to 2%.

Public finances

The budget deficit – the difference between what the government spends and receives in revenues – is forecast to be £74 billion in 2015/16, this is equivalent to 3.9% of GDP. The Government plans to eliminate the deficit by 2019/20 and the Office for Budget Responsibility’s (OBR’s) November 2015 forecast suggests it is on course to do so.

At over 80% of GDP, Public Sector Net Debt – broadly speaking the stock of borrowing arising from past deficits – remains high by recent standards. The OBR forecast that the debt to GDP ratio will fall in 2015/16 and continue to do so over the following five years.

Business rates review

The Government has committed to publishing a review of the administration of the business rates system in England alongside the 2016 Budget. There are few indications of the likely conclusions of the review, but media commentary suggests that no major changes are anticipated.

Pensions tax relief

The Government had been expected to respond in Budget 2016 to itsconsultation on pensions tax relief. However, over the weekend of 5-6 March, it was reported that no major changes to tax relief on contributions would be announced in this Budget.

Other information

The Library has published a Budget edition of economic indicators.

Read the full paper: House of Commons Library Paper – Background to the 2016 BudgetOfficial Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE0 -

We know the worst, the ill, sick and disabled are yet to have their benefits cut...by overpaid staff who will be meeting targets per head to ensure they keep their own overpaid public service jobs.SO... now England its the Scots turn to say dont leave the UK, stay in Europe with us in the UK, dont let the tories fool you like they did us with empty lies... You will be leaving the UK aswell as Europe

0

0 -

It’s Budget Day!

The Chancellor of the Exchequer, Mr George Osborne, will deliver the Budget Statement to the House of Commons today. We expect this to commence at 12.30pm, after Prime Minister’s Question Time.

Will you be watching the Budget live on Parliament TV?Official Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE0 -

Its budget day everyday for us MSE's

Martin needs to preach and teach debt control to these elected overpaid unqualified amateur/s.SO... now England its the Scots turn to say dont leave the UK, stay in Europe with us in the UK, dont let the tories fool you like they did us with empty lies... You will be leaving the UK aswell as Europe 0

0 -

Here are 13 facts about Budgets and Chancellors:

- The word Budget comes from an old French word ‘bougette’ meaning little bag. It was customary to bring the statement on financial policy to the House of Commons in a leather bag. The modern equivalent of the bag is the red despatch box or Budget box.

- The word exchequer dates from the Norman Conquest and is thought to be derived from the Latin scaccarium, meaning a chequered board, as money was counted on a squared tablecloth.

- Budgets have traditionally been delivered in Spring as most taxes originally derived from land ownership and April marked the start of the new agricultural year.

- Pitt the Younger’s December 1798 Budget speech was the first to propose the introduction of income tax. This came into effect in April 1799, with the top rate set at 10% on incomes over £200 a year. This was abolished in 1802 by Henry Addington, but reinstated in 1803, following the beginning of the Napoleonic Wars. Income tax has been continually levied since the Income Tax Act of 1842.

- Sir Kingsley Wood, who served as Chancellor between 1940 and 1943 was due to announce the creation of the Pay as You Earn system to tax collection, but died suddenly on the morning he was due to announce this to the Commons in in September 1943.

- In his April 1953 budget, Chancellor R.A. Butler announced that the sugar ration would be increased from 10oz to 12oz a week, seen as a means of allowing for the baking of celebratory cakes to mark the Queen's coronation.

- Denis Healey’s April 1978 budget was the first to be broadcast on radio, following the beginning of regular radio broadcasts from Parliament earlier that month. John Major’s only budget as Chancellor in March 1990 was the first to be televised live.

- During Nigel Lawson’s 1988 Budget speech, Alex Salmond was dismissed from the Chamber and subsequently suspended from the House for a week after launching a verbal attack on Nigel Lawson, shouting “This Budget is an obscenity.” The House was later suspended for 10 minutes by deputy speaker Harold Walker following the outbreak of “grave disorder”, with many Labour members shouting 'shame' at the Chancellor's announcement that the top rate of income tax would be reduced to 40%.

- In the twentieth century, seven chancellors have delivered only one budget - Charles Ritchie in April 1903, Reginald McKenna in March 1916, Sir Robert Horne in May 1922, Stanley Baldwin in April 1923, Hugh Gaitskell in April 1951, Peter Thorneycroft in April 1957 and John Major in March 1990.

- Iain Macleod is the only twentieth century Chancellor not to have delivered a budget, dying suddenly in July 1970, a month after his appointment.

- In the twentieth century ten Chancellors have gone on to become Prime Minister - Herbert Asquith, David Lloyd George, Andrew Bonar Law, Stanley Baldwin, Neville Chamberlain, Winston Churchill, Harold MacMillan, James Callaghan and John Major. Gordon Brown became Prime Minister in 2007 after serving as Chancellor since 1997.

- Delivering twelve Budget speeches over various terms in office between 1852 and 1882, William Ewart Gladstone holds the record for delivering more Budget speeches than any other Chancellor of the Exchequer. Gordon Brown holds the record the number of consecutive budget speeches, delivering eleven between 1997 and 2007.

- George Osborne was appointed Chancellor in May 2010 at the age of 38, turning 39 before delivered his first Budget in June 2010. Osborne is the youngest Chancellor since Hugh Gaitskell, who was 44 when appointed in October 1950. Pitt the Younger was 23 when appointed in 1782.

Official Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE0 - The word Budget comes from an old French word ‘bougette’ meaning little bag. It was customary to bring the statement on financial policy to the House of Commons in a leather bag. The modern equivalent of the bag is the red despatch box or Budget box.

-

I'd like to know how many times George Osborne has used the words "hardworking families"?!Could you do with a Money Makeover?

Follow MSE on other Social Media:

MSE Facebook, MSE Twitter, MSE Deals Twitter, Instagram

Join the MSE Forum

Get the Free MoneySavingExpert Money Tips E-mail

Report inappropriate posts: click the report button

Point out a rate/product change

Flag a news story: news@moneysavingexpert.com0 -

"long term economic plan"

BINGO?!Could you do with a Money Makeover?

Follow MSE on other Social Media:

MSE Facebook, MSE Twitter, MSE Deals Twitter, Instagram

Join the MSE Forum

Get the Free MoneySavingExpert Money Tips E-mail

Report inappropriate posts: click the report button

Point out a rate/product change

Flag a news story: news@moneysavingexpert.com0 -

Catch up with Budget analysis on MoneySavingExpert.com/NewsCould you do with a Money Makeover?

Follow MSE on other Social Media:

MSE Facebook, MSE Twitter, MSE Deals Twitter, Instagram

Join the MSE Forum

Get the Free MoneySavingExpert Money Tips E-mail

Report inappropriate posts: click the report button

Point out a rate/product change

Flag a news story: news@moneysavingexpert.com0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.7K Banking & Borrowing

- 253.4K Reduce Debt & Boost Income

- 454K Spending & Discounts

- 244.7K Work, Benefits & Business

- 600.1K Mortgages, Homes & Bills

- 177.3K Life & Family

- 258.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards

https://www.youtube.com/watch?v=1eiTE1SEi-c

https://www.youtube.com/watch?v=1eiTE1SEi-c