We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Current market carnage - anyone selling or buying?

Hallion

Posts: 32 Forumite

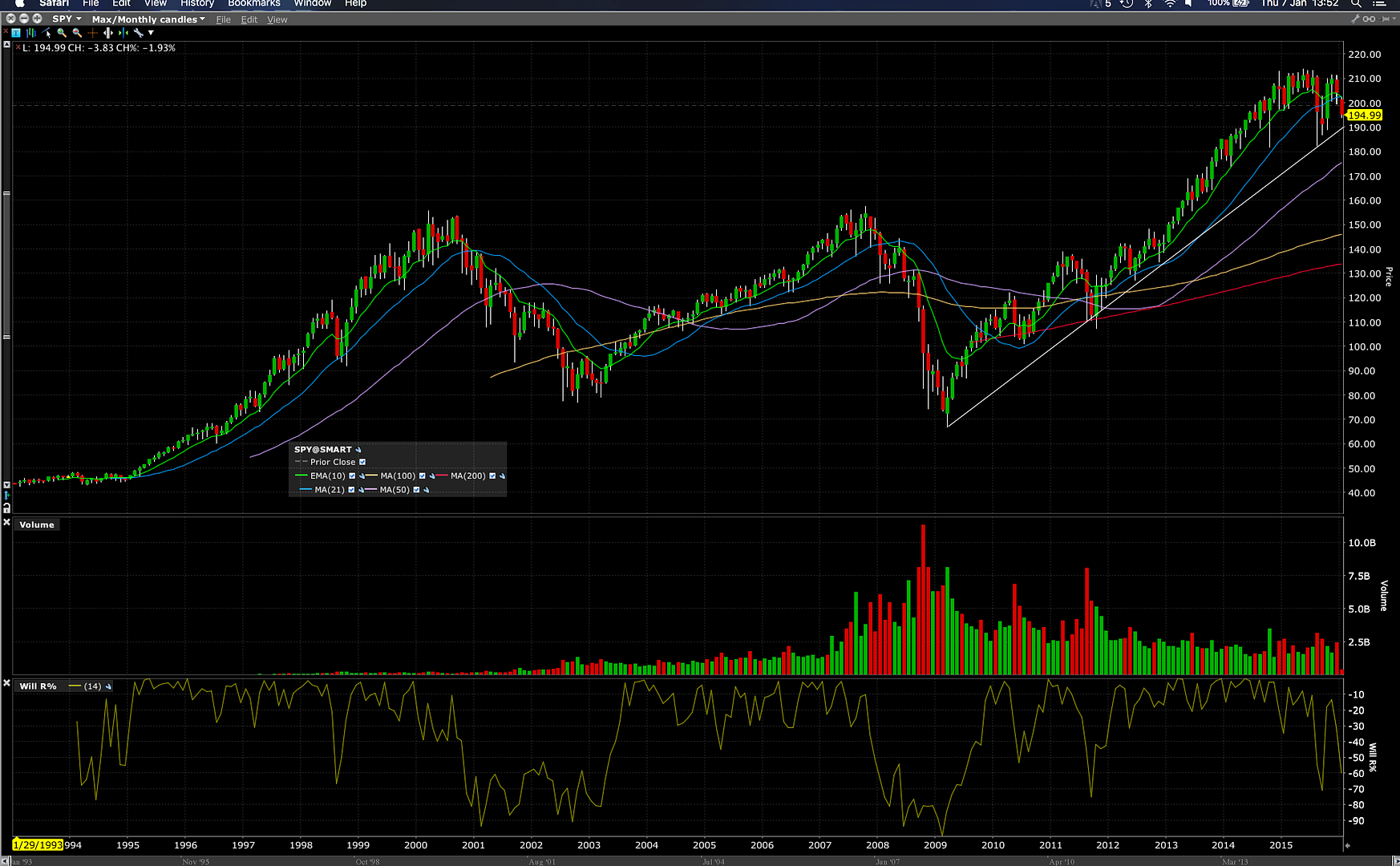

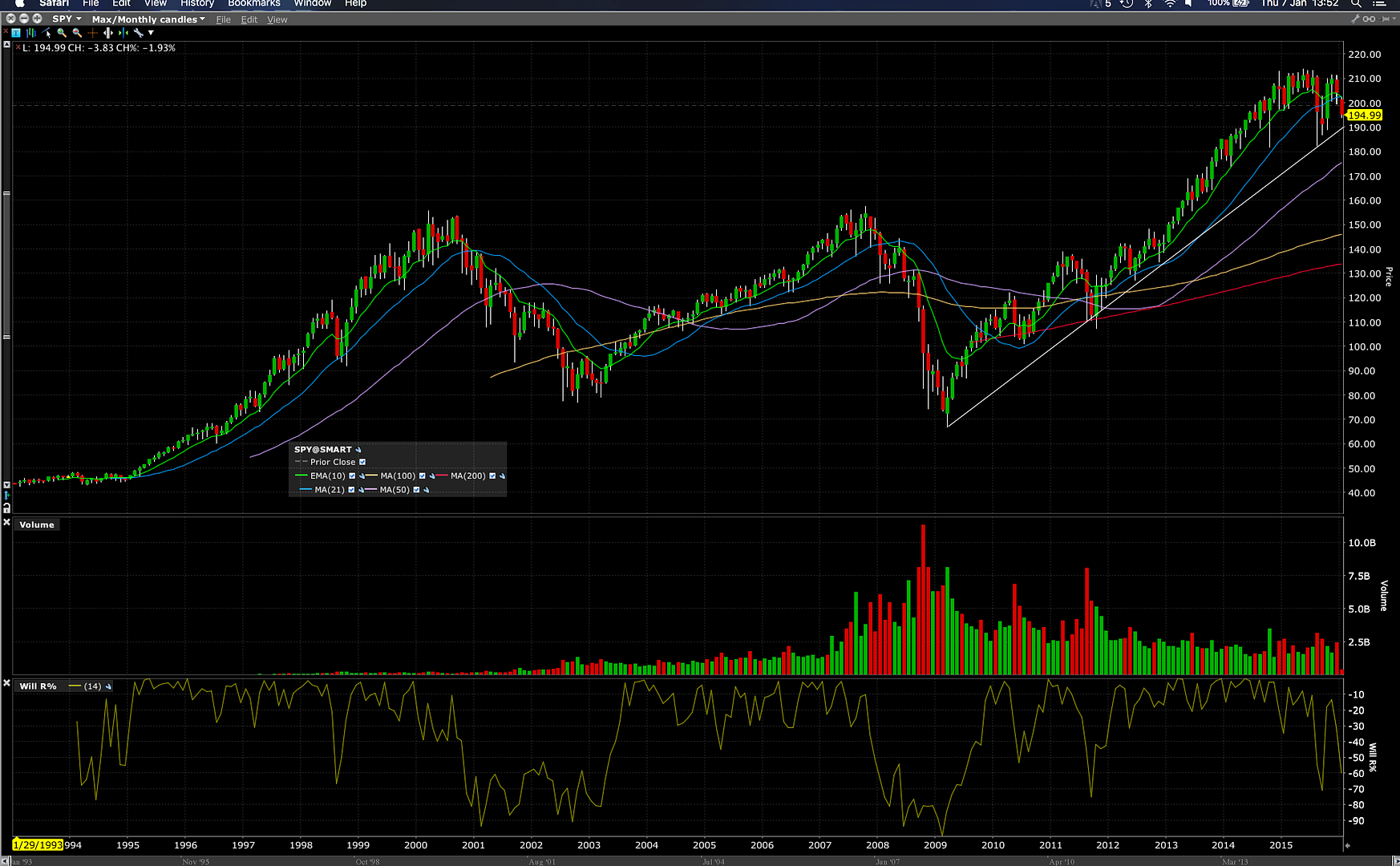

It's been a brutal start to 2016. I've been waiting to re-invest since cashing out of everything last August and have just started drip feeding into my favorite funds the last couple of days given the recent big drops. However I'm still rather bearish for 2016, especially when viewing the max SPY chart below :eek: so, what are your expectations for 2016?

0

Comments

-

I expect returns to be lower in the next few years than they have been in the last. But the advice remains the same. Diversify and chill

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

I'm not sure what to expect, but here are my guesses:

UK and European smaller companies will continue to do well for at least the early part of the year. Chinese stocks will continue to drop for a while longer, and this will continue to have a knock on affect on large cap developed market stocks. Markets will rise quite nicely in the second half of the year once the China situation is stabilized. Japan will outperform the other developed markets over the course of the year.

I have a bit of additional money to invest this month, which I am putting in a European smaller companies fund.0 -

Glen_Clark wrote: »I expect returns to be lower in the next few years than they have been in the last. But the advice remains the same. Diversify and chill

Likewise, especially in the US where it's difficult to envisage too much more of a P/E expansion driven gain thus leaving it to earnings to do the heavy lifting....which could be tricky given how high margins are already. I did drip feed a bit into Europe ex UK and Japan this morning though as see better prospects here and cheaper after current sell off.0 -

I bought some VMID yesterday to diversify. Should have waited till this morning, but there it is.“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0

-

Glen_Clark wrote: »I bought some VMID yesterday to diversify. Should have waited till this morning, but there it is.

VMID?

I did some shopping the other day (bought a very small portion of Artemis Global Energy), and am half tempted today, but I think I may hold off a bit longer before using the bulk of my cash. Could well be wrong, but I don't think the jitters are going to go away just yet.0 -

I'm tempted to put some in Murray International at this low but may wait for a small rise first.0

-

BrockStoker wrote: »VMID?

.

Its the ticker code;

http://funds.ft.com/uk/Tearsheet/Summary?s=VMID:LSE:GBP“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

BrockStoker wrote: »VMID?

I did some shopping the other day (bought a very small portion of Artemis Global Energy), and am half tempted today, but I think I may hold off a bit longer before using the bulk of my cash. Could well be wrong, but I don't think the jitters are going to go away just yet.

Probably need PBOC to stop /slow daily fix weakening of the RMB to calm the markets down, plus some stability in the oil price.0 -

bought some tesco shares on monday, don't know a great deal about investing but been following them for a while so basically had a punt, only £2k so not a complete disaster if they go down even more0

-

Has the credit bubble burst? Not the West this time. But the East.

Low oil prices are changing the dynamics of the Middle East.

So much uncertainty. perhaps an opportune time to sit back and simply watch events unfold. As difficult to predict who the casualties are going to be.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards