We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Take a peek at my hand?

Comments

-

Thanks for another insightful update! I had the same itch for Palantir over a year ago and looks like it's doing well so far.1

-

Update #40, Q4 2024

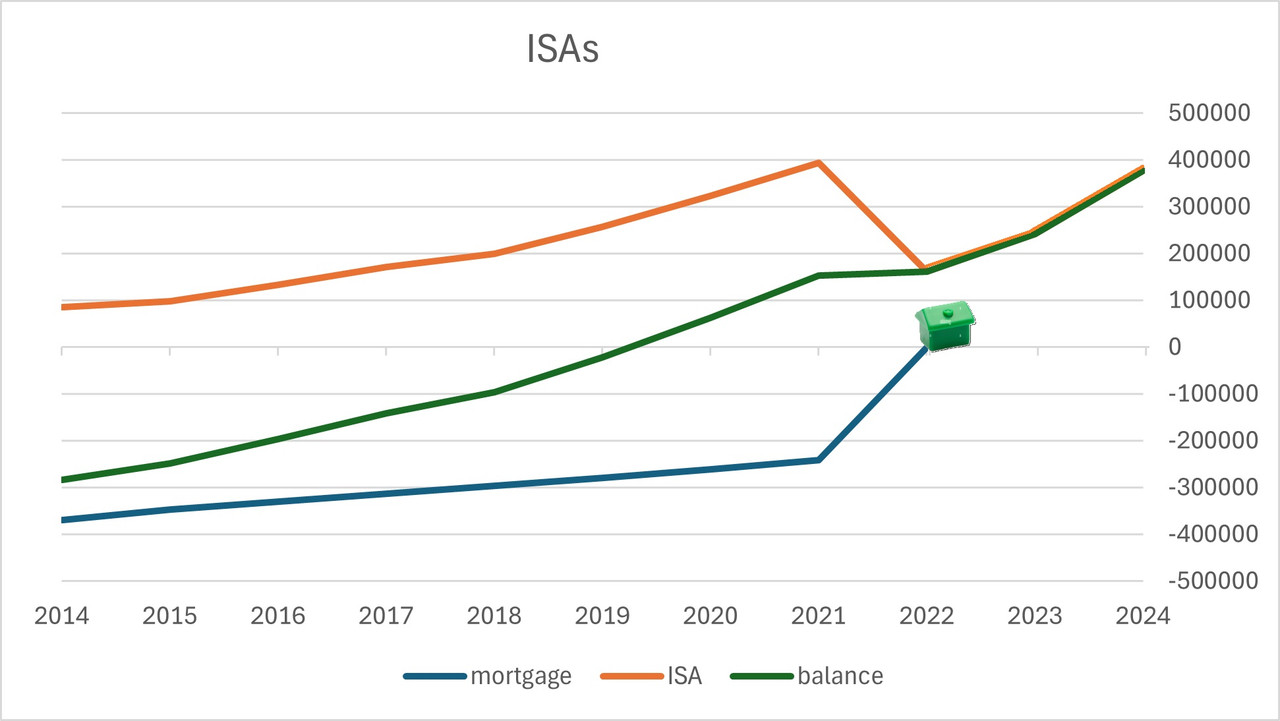

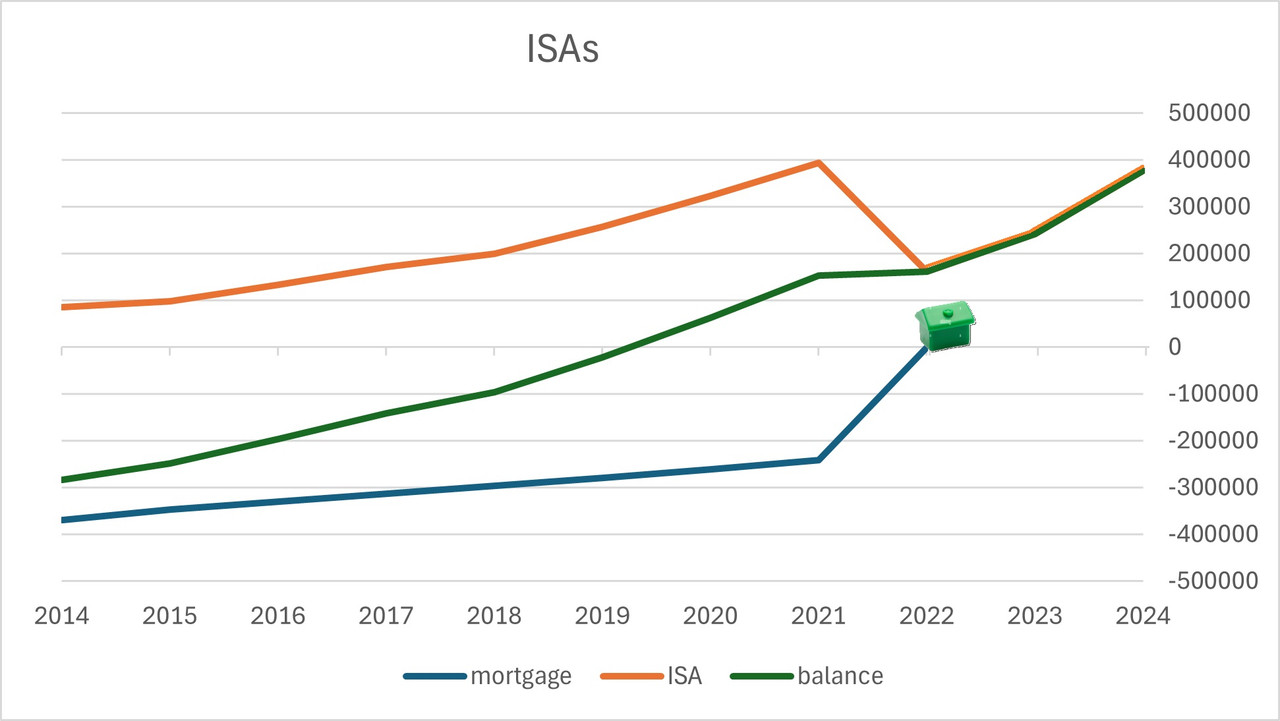

Ladies and Gentlemen, it has been exactly 10 years since the first post in this thread.

Please allow me to offer a short summary of those years, a snapshot of how things are now, and some brief musings about investing generally.

1. Summary of the last 39 posts:

My investing decade, in a nutshell, has looked like this:

- 31/12/2014: Started this diary. Scattergun selection of shares, niche ETFs, commodities. Big mortgage, full time job.

- 31/12/2015: Still scattergun, but read about passive investing on Bogleheads & liked the idea. Performance this year was around -7%... the only reason the balance want up was due to new investment.

- 31/12/2016: Decided on some investment rules for the first time. Looked at costs: total cost of running the portfolio this year was £535.

- 31/12/2017: Investments still a bit of a random basket of this and that. What I really want are tech shares, but they seem too expensive. Not enjoying my job much.

- 31/12/2018: Big reset. Sold everything. Started rebuilding the investments from the ground up, but this time kept it simple. By the end of the year, the portfolio was: 50% VWRL, 50% cash, 0% anything else.

- 31/12/2019: A good year for the stock markets. Work a complete war zone, and with a healthy buffer in the ISAs, felt empowered to start a new job: less pay, more time.

- 31/12/2020: Covid year! Grab a tissue.

- 31/12/2021: Someone here described this new-look portfolio as “mundane” which I actually found flattering. Sleeping very well at night by this time. Often not checking performance month to month.

- 31/12/2022: Used all the cash from the ISA to pay off the remaining mortgage. First and only withdrawal in the whole decade, but a big one. Remaining investments now 100% VWRP. But, suspect I may regret the decision not to continue to use that mortgage as leverage.

- 31/12/2023: Another good year. Now 80% VWRP, having bought some bonds for the first time, and dipped a toe back into the sharky waters of active investing by finally buying some tech shares.

- 31/12/2024: Best year so far. Global markets up 25-30%. In the ISAs, now back down towards 50% VWRP, which is the long term target.

Lots of changes but the constant was each year, trying to add as much as possible to the ISAs. Some years managed the full £20K (Ray's) +£20K (Rayette's), most years less.

2. Current position:

Current investments are:

- VWRP, £188K, 52%

- CSH2, £121K, 33%

- VGOV, £41K, 11%

- Alphabet, £15K, 4%

@moneysaver1978: Think I said I was going to hold them for 5 years, but those particular shares rose a lot since I bought them. Decided not to be greedy, sold them last week. Executing a Wolf of Wall Street move like this is the sort of thing I have been aspiring to for the last 10 years… and at last one came off! Maybe they will rise more, that’s OK, hopefully the new owner will get as much fun out of them as I had. Are you still holding?

@badger09: Yes, I have mainly done nothing again this year. However the 2 things I have done (buying one thing, selling another) seem have helped the bottom line. So, not absolutely nothing.

3. Brief Musings about Investment Generally

Entering the 2nd decade of this diary, what have I learned?

About investing:- Make it a priority to fund the ISAs every year.

- Don’t do things in a hurry..

- Don't do stupid stuff.

- Don’t rush to pay off that mortgage.

- 50% risky stuff and 50% safe stuff exposes you to plenty of upside, but protects you from the worst of the downside.

About loading the tanks:

- A single world equities fund is diesel for the growth engine.

- A government bond fund and a money market fund give good ballast in rough seas.

- A few carefully or luckily selected satellite investments can provide a bit of rocket fuel. Be careful, and if you can't be careful, be lucky.

Active or Passive?

So, which is best, passive or active investing? Well, I think passive is, for people like us. But I’m cautiously moving towards considering some selected shares again, once in a while, when an opportunity seems to be there - to supplement the core of the portfolio, a world cap-weighted ETF.

And with that, may I wish you a happy 2025. May things proceed onwards and upwards for you, as always.

Ray.

10 -

Happy New Year, @Ray_Singh-Blue - thanks for another insightful update!Ray_Singh-Blue said:Update #40, Q4 2024

Ladies and Gentlemen, it has been exactly 10 years since the first post in this thread.

Please allow me to offer a short summary of those years, a snapshot of how things are now, and some brief musings about investing generally.

1. Summary of the last 39 posts:

My investing decade, in a nutshell, has looked like this:

- 31/12/2014: Started this diary. Scattergun selection of shares, niche ETFs, commodities. Big mortgage, full time job.

- 31/12/2015: Still scattergun, but read about passive investing on Bogleheads & liked the idea. Performance this year was around -7%... the only reason the balance want up was due to new investment.

- 31/12/2016: Decided on some investment rules for the first time. Looked at costs: total cost of running the portfolio this year was £535.

- 31/12/2017: Investments still a bit of a random basket of this and that. What I really want are tech shares, but they seem too expensive. Not enjoying my job much.

- 31/12/2018: Big reset. Sold everything. Started rebuilding the investments from the ground up, but this time kept it simple. By the end of the year, the portfolio was: 50% VWRL, 50% cash, 0% anything else.

- 31/12/2019: A good year for the stock markets. Work a complete war zone, and with a healthy buffer in the ISAs, felt empowered to start a new job: less pay, more time.

- 31/12/2020: Covid year! Grab a tissue.

- 31/12/2021: Someone here described this new-look portfolio as “mundane” which I actually found flattering. Sleeping very well at night by this time. Often not checking performance month to month.

- 31/12/2022: Used all the cash from the ISA to pay off the remaining mortgage. First and only withdrawal in the whole decade, but a big one. Remaining investments now 100% VWRP. But, suspect I may regret the decision not to continue to use that mortgage as leverage.

- 31/12/2023: Another good year. Now 80% VWRP, having bought some bonds for the first time, and dipped a toe back into the sharky waters of active investing by finally buying some tech shares.

- 31/12/2024: Best year so far. Global markets up 25-30%. In the ISAs, now back down towards 50% VWRP, which is the long term target.

Lots of changes but the constant was each year, trying to add as much as possible to the ISAs. Some years managed the full £20K (Ray's) +£20K (Rayette's), most years less.

2. Current position:

Current investments are:

- VWRP, £188K, 52%

- CSH2, £121K, 33%

- VGOV, £41K, 11%

- Alphabet, £15K, 4%

@moneysaver1978: Think I said I was going to hold them for 5 years, but those particular shares rose a lot since I bought them. Decided not to be greedy, sold them last week. Executing a Wolf of Wall Street move like this is the sort of thing I have been aspiring to for the last 10 years… and at last one came off! Maybe they will rise more, that’s OK, hopefully the new owner will get as much fun out of them as I had. Are you still holding?

@badger09: Yes, I have mainly done nothing again this year. However the 2 things I have done (buying one thing, selling another) seem have helped the bottom line. So, not absolutely nothing.

3. Brief Musings about Investment Generally

Entering the 2nd decade of this diary, what have I learned?

About investing:- Make it a priority to fund the ISAs every year.

- Don’t do things in a hurry..

- Don't do stupid stuff.

- Don’t rush to pay off that mortgage.

- 50% risky stuff and 50% safe stuff exposes you to plenty of upside, but protects you from the worst of the downside.

About loading the tanks:

- A single world equities fund is diesel for the growth engine.

- A government bond fund and a money market fund give good ballast in rough seas.

- A few carefully or luckily selected satellite investments can provide a bit of rocket fuel. Be careful, and if you can't be careful, be lucky.

Active or Passive?

So, which is best, passive or active investing? Well, I think passive is, for people like us. But I’m cautiously moving towards considering some selected shares again, once in a while, when an opportunity seems to be there - to supplement the core of the portfolio, a world cap-weighted ETF.

And with that, may I wish you a happy 2025. May things proceed onwards and upwards for you, as always.

Ray.

I was close to selling the PLTR stock at something like $82 per share (around £550 "profit") probably thanks to the "Trump effect" but decided to hold them as I do view these as a long-term investment in the AI area. I am not in a great hurry to sell these.

Although I did wish I had sold all of AMC share during the hype so I have to be careful not to fall into the same trap!1 -

Update #41, Q1 2025

Got a confession to make. Been out buying stuff.

On the face of it, my portfolio might look like it is starting to descend into the chaos of 10 years ago. There's quantum computing stocks, wearable tech and even a metal ETF in there again (lithium this time).

But the difference this time is that the portfolio can also be described like this:

Cap-weighted whole-world equites tracker: 50%

Cash and bonds: 43%

Other stuff: 7%

The total value is now £446K.

Index funds are great, but I can't help thinking it's in the white water where you can make big returns (and big losses). That thought has never really gone away. The way I see it, as long as you don't get into dangerous stuff like spread betting or short selling, which I won't, then the most you can lose is 100% of your investment. But the most you can gain... well, it's unlimited.

Maybe I'll never experience another x9 bagger. But nothing ventured, nothing gained. Capping it at 10% of portfolio mind. We're not in a casino.

@moneysaver1978, it's good to hear that you are in profit on that investment, it has risen even further this quarter I see. Selling those shares really bumped up the value of my portfolio last year. This is exactly what I hoped might happen within this "other stuff" part of the portfolio, and to see it finally happen has given me some confidence in the strategy described above.

All the best,

Ray4 -

Hope you're doing well despite the popcorn-eating-and-watching market turmoil! Other than taking a punt in purchasing a few more shares of BoA when they were down, I have taken a "hands-off" approach generally even when Palentir went as high as $124.Ray_Singh-Blue said:Update #41, Q1 2025

Got a confession to make. Been out buying stuff.

On the face of it, my portfolio might look like it is starting to descend into the chaos of 10 years ago. There's quantum computing stocks, wearable tech and even a metal ETF in there again (lithium this time).

But the difference this time is that the portfolio can also be described like this:

Cap-weighted whole-world equites tracker: 50%

Cash and bonds: 43%

Other stuff: 7%

The total value is now £446K.

Index funds are great, but I can't help thinking it's in the white water where you can make big returns (and big losses). That thought has never really gone away. The way I see it, as long as you don't get into dangerous stuff like spread betting or short selling, which I won't, then the most you can lose is 100% of your investment. But the most you can gain... well, it's unlimited.

Maybe I'll never experience another x9 bagger. But nothing ventured, nothing gained. Capping it at 10% of portfolio mind. We're not in a casino.

@moneysaver1978, it's good to hear that you are in profit on that investment, it has risen even further this quarter I see. Selling those shares really bumped up the value of my portfolio last year. This is exactly what I hoped might happen within this "other stuff" part of the portfolio, and to see it finally happen has given me some confidence in the strategy described above.

All the best,

Ray

That said, I might be tempted towards the end of the year in offloading some shares that I have held for few years as in the words of Marie Kondo - they don't bring me joy - plus I might use these to overpay our mortgage or a small house extension.

Looking forward to your next update!1 -

Ray_Singh-Blue said:Update #41, Q1 2025

Got a confession to make. Been out buying stuff.

On the face of it, my portfolio might look like it is starting to descend into the chaos of 10 years ago. There's quantum computing stocks, wearable tech and even a metal ETF in there again (lithium this time).

But the difference this time is that the portfolio can also be described like this:

Cap-weighted whole-world equites tracker: 50%

Cash and bonds: 43%

Other stuff: 7%

The total value is now £446K.

Index funds are great, but I can't help thinking it's in the white water where you can make big returns (and big losses). That thought has never really gone away. The way I see it, as long as you don't get into dangerous stuff like spread betting or short selling, which I won't, then the most you can lose is 100% of your investment. But the most you can gain... well, it's unlimited.

Maybe I'll never experience another x9 bagger. But nothing ventured, nothing gained. Capping it at 10% of portfolio mind. We're not in a casino.

@moneysaver1978, it's good to hear that you are in profit on that investment, it has risen even further this quarter I see. Selling those shares really bumped up the value of my portfolio last year. This is exactly what I hoped might happen within this "other stuff" part of the portfolio, and to see it finally happen has given me some confidence in the strategy described above.

All the best,

RayGood work Ray.How did you increase your pot by so much since the last update, given markets are down a bit? Forgot to sell a few more Palantir shares?!1 -

Update #42 Q2 2025

Another quarter of laziness or masterful inactivity, depending on your perspective. Have done precisely nothing for 3 months.

Scores on the doors are now:

Equities: £269,711 (58%)

Bonds and cash: £192,233 (42%)

Total £461,945

itwasntme001 No- sadly, sold all those just over 6 months ago. They have doubled since then. Should have stuck with plan A, hold for 5 years. But the gain was making me a bit dizzy. The main reason for the increase in the bottom line was funding the ISAs for the 24/25 tax year, for both myself and Mrs Ray. But also, some of those Palantir gains got re-invested in quantum computing stocks. These have had a good few months, especially D-wave. But individual equities still make up less than 10% of the £461K, collectively they form a side salad not the main course, most of the rest got put back into the world index tracker.

Questions I have been pondering:

1) One british pound is worth 1.36 USD at the moment. Anyone hoping to take advantage of this by buying USD demoninated assets with their GBP?

2) The bond fund VGOV .. it's value is down a bit, even though interest rates have dropped not risen. I would have expected the opposite perhaps? Is this to do with currency hedging?

Ray

0 -

Ray_Singh-Blue said:Update #42 Q2 2025

Another quarter of laziness or masterful inactivity, depending on your perspective. Have done precisely nothing for 3 months.

Scores on the doors are now:

Equities: £269,711 (58%)

Bonds and cash: £192,233 (42%)

Total £461,945

itwasntme001 No- sadly, sold all those just over 6 months ago. They have doubled since then. Should have stuck with plan A, hold for 5 years. But the gain was making me a bit dizzy. The main reason for the increase in the bottom line was funding the ISAs for the 24/25 tax year, for both myself and Mrs Ray. But also, some of those Palantir gains got re-invested in quantum computing stocks. These have had a good few months, especially D-wave. But individual equities still make up less than 10% of the £461K, collectively they form a side salad not the main course, most of the rest got put back into the world index tracker.

Questions I have been pondering:

1) One british pound is worth 1.36 USD at the moment. Anyone hoping to take advantage of this by buying USD demoninated assets with their GBP?

2) The bond fund VGOV .. it's value is down a bit, even though interest rates have dropped not risen. I would have expected the opposite perhaps? Is this to do with currency hedging?

Ray1. Speculating in currency is speculating. By historical measures the pound still isn't all that strong against the dollar.2. Interest rates don't matter by themselves, only the effect they have on yields. 70% or so of VGOV has a duration over 5 years and yields have been increasing at the long end (or at least, not decreasing) so the price has fallen rather than risen. The steepness of the curve also matters for bond funds, and we've gone steeper, which isn't so good for existing investments (but does mean new investments might perform a bit more as expected..) but a lot could happen to yields yet. Long duration is volatile for a reason.1 -

@Ray_Singh-Blue if you were looking at VGOV, did you consider UK Treasury Bills? The returns so far are so-so (and I don't fully understand it) but apparently considered to be amongst the safest investments.

0 -

Thank you Ray - a little late to getting round to reading your latest update but as usual, interesting reading.Ray_Singh-Blue said:Update #42 Q2 2025

Another quarter of laziness or masterful inactivity, depending on your perspective. Have done precisely nothing for 3 months.

Scores on the doors are now:

Equities: £269,711 (58%)

Bonds and cash: £192,233 (42%)

Total £461,945

itwasntme001 No- sadly, sold all those just over 6 months ago. They have doubled since then. Should have stuck with plan A, hold for 5 years. But the gain was making me a bit dizzy. The main reason for the increase in the bottom line was funding the ISAs for the 24/25 tax year, for both myself and Mrs Ray. But also, some of those Palantir gains got re-invested in quantum computing stocks. These have had a good few months, especially D-wave. But individual equities still make up less than 10% of the £461K, collectively they form a side salad not the main course, most of the rest got put back into the world index tracker.

Questions I have been pondering:

1) One british pound is worth 1.36 USD at the moment. Anyone hoping to take advantage of this by buying USD demoninated assets with their GBP?

2) The bond fund VGOV .. it's value is down a bit, even though interest rates have dropped not risen. I would have expected the opposite perhaps? Is this to do with currency hedging?

Ray£6000 in 20231

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards