We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is the stock market over heating?

Comments

-

marathonic wrote: »Looks like we're on the road uphill again having made up about 50% of the total drop from peak.

I've been back fully invested since June 13th but, as I noted in the bond divergence from shares thread earlier, I've taken my first interest in bonds.

I'm 100% equities now and, to be honest, see equities surpassing their previous high of the year. However, given that equities have outperformed bonds by about 20% year-to-date, I'll be keeping a close eye on things.

As noted by princeofpounds in that thread, this divergence doesn't necessarily mean that bonds are good value as it all depends on the starting point.

bowlhead99 also makes a good point about having a portion invested in bonds so that you can reallocate to stocks if stocks drop 40% whilst bonds only drop half of that.

The problem is, stocks could rise by another 30% before that happens. Hence the difficulty in market timing.

I think I'll consider bonds if they drop to a level where I would consider them only 'slightly overvalued'. In the near term, I don't see any catalyst that will cause them to rise.

I am now building my portfolio up.

I have no bonds (yet). I may when I have the inclination. Whilst most mix bonds in I am content with the volatility of the Equities.

My ISA Now consists of:

EDIN

SOI

JLIF

HGT

EZJ

I have disposed of my NG. Holdings

I have managed to obtain share certificates for some historic shares outside of ISA and deciding what to with them.0 -

A_Flock_Of_Sheep wrote: »I have managed to obtain share certificates for some historic shares outside of ISA and deciding what to with them.

If you haven't used your Capital Gains Tax allowance for the year and don't anticipate using it, you could sell enough to use your allowance up and repurchase them inside the ISA (if you want to continue holding).0 -

marathonic wrote: »If you haven't used your Capital Gains Tax allowance for the year and don't anticipate using it, you could sell enough to use your allowance up and repurchase them inside the ISA (if you want to continue holding).

Yes! These are very historic and "windfall" shares like Halifax, Abbey National and when Utilites were privatised.0 -

marathonic wrote: »The problem is, stocks could rise by another 30% before that happens. Hence the difficulty in market timing.

I'm struggling to find value at current levels. So am taking profits on peaks. Then reinvesting on falls. Hold around 20% cash at one time.0 -

Thrugelmir wrote: »I'm struggling to find value at current levels. So am taking profits on peaks. Then reinvesting on falls. Hold around 20% cash at one time.

I think there's trouble finding value in any assets at the moment (well, being from Northern Ireland, I think property here represents a good buy after the falls of over 50% nominally that we've experienced - but that's a whole other topic of discussion).

However, in saying that, for pension investments which, aside from my house I bought in December, are my only investments, I struggle to allocate anything to cash.

That could be my downfall and there will come a point where being in cash is the prudent thing. However, if I switched in and out of cash in my pension, I can see myself missing three 5% rises for every 10% fall I manage to escape. I don't see it working out in the long run.

Hell, there isn't even value in cash with the expected inflation in the coming years.0 -

I wouldnt touch sterling bonds with a barge pole. At 30 its still too young to be wanting cash paid out in ten years or so. I would hope you will still be earning it and same applies to 20 or 30yr bond, I see no bargains ?

This whole thread is off, stocks can double in price and they can be cheaper then when they were half the price. Bonds however are stuck pretty much as when you bought them, they cant adapt

Divergence I will post any chart I see on that, it is big news but it should eventually lead to a nasty sell off in currency not global stocks0 -

sabretoothtigger wrote: »I wouldnt touch sterling bonds with a barge pole. At 30 its still too young to be wanting cash paid out in ten years or so. I would hope you will still be earning it and same applies to 20 or 30yr bond, I see no bargains ?

I see what you mean. Not much point considering them until the yield is beyond what you expect with regards to inflation over that period (and I expect inflation to exceed current yields significantly in the short-medium term).

However, on the other hand, if you expect equities to fall in the short term, perhaps a small allocation would be useful.

That being said, equities and bonds seem to be more correlated than they have been historically so, perhaps, if you are expecting stocks to end the year lower than current levels, a small allocation to cash would be more prudent than an allocation to bonds.0 -

I do hold cash though I consider it short term and I hold emerging bonds of countries that export goods, countries with growing population and it seems in 10 years more people will want to use that cash to buy from them. In 10 years we'll be paying (renewing) off our debts still and importing oil by giving away sterling, wheres the demand

Its very precarious but I bet some can profit from gilts if clever. The only thing on the list that tempts me is PIBS, at least it might pay above inflation

Problem is its a bank that is relying on BOE QE to stay afloat, UK savers are not able to help Nationwide really [if the worst should occur, ie. if we were Japan all these bonds would good as they have savers, UK has net debt]0 -

Glen_Clark wrote: »So still looks expensive to me

http://markets.ft.com/research/Markets/Tearsheets/Financials?s=NRR:LSE

It just keeps getting better!

http://www.londonstockexchange.com/exchange/prices-and-markets/stocks/summary/company-summary.html?fourWayKey=GG00B4Z05859GGGBXASX1

http://www.bbc.co.uk/news/business-251335020 -

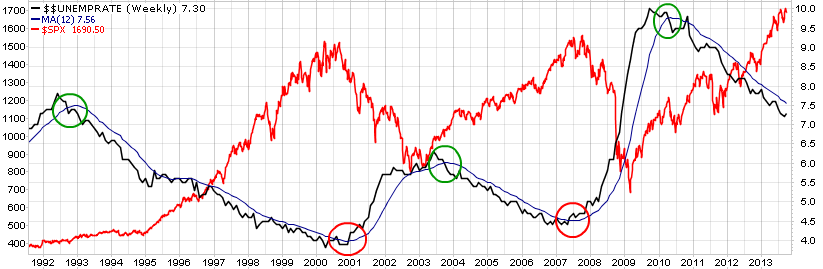

Everyone knows corrections happen from time to time and sometimes 10% or more.

The USA markets look to the job figures published every month for a clue to direction.

Heres a chart going back over 20 years where unemployment (black) is guaged against the SP500 (red).

The markets tend to rise if the economy is growing and creating jobs. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards