We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Duplicate & triplicate payments to credit card. How?

Comments

-

rb10, you may have took a lucky guess, but i said you were right in your reply

So then why do others continue to guess the opposite instead of taking note of where i said you're correct?? Answer me that one - anyone?

As it's still a problem i'll spell it out again...

the problem isn't cashback

It isn't Santander paying cashback

It isn't Santander paying 'extra' cashback - they haven't.

It isn't Santander charging double or triple - they haven't.

It's that.....

Let's take 1 incident to keep it real simple & we'll use example figures....

We're right at the beginning so the balance is £0.00 on my card. LET'S FORGET ABOUT THE CASHBACK RIGHT NOW. My mum goes to the petrol station & puts £20 of fuel in her car (or i do, or the wife does - WHOEVER is not important)

So let's recap....

We begin with a £0.00 balance on the card & it has been used to buy £20 worth of fuel. Those are the key points you need to know.

The balance now reads £20.00 on the card ... can we all agree? (let's forget that it takes x days to update - we need to make this simple, not complicate it!)

The card says: transaction info: £20 at BP station.

So we come home. We log in to our Lloyds TSB account (this is important too because it's always TSB!) & send £20 to the credit card via faster payments.

The statement should read £0.00 now right? Except it doesn't.

This is where it's going to confuse everyone because i'm talking like this happens in real time. It takes days to update and the balance isn't REALLY £0.00, it just is in this example.......

.... The balance now reads -£20.00 because the payment has been sent TWICE from Lloyds TSB, even though the "send payment" button was clicked only ONCE.

OR the balance may read -£40.00 as the payment has been sent THREE times from Lloyds TSB - even though it was only sent once.

When the statement updates, some times it even shows as the payment being sent on a different date.

At this point - "maybe someone else logged in & sent payment" is not an option. I repeat NOT AN OPTION! Is not possible! So think of something else.

That is the problem. I want to know why - why does it happen when the button was clicked once, when nobody else logged in, WHY?

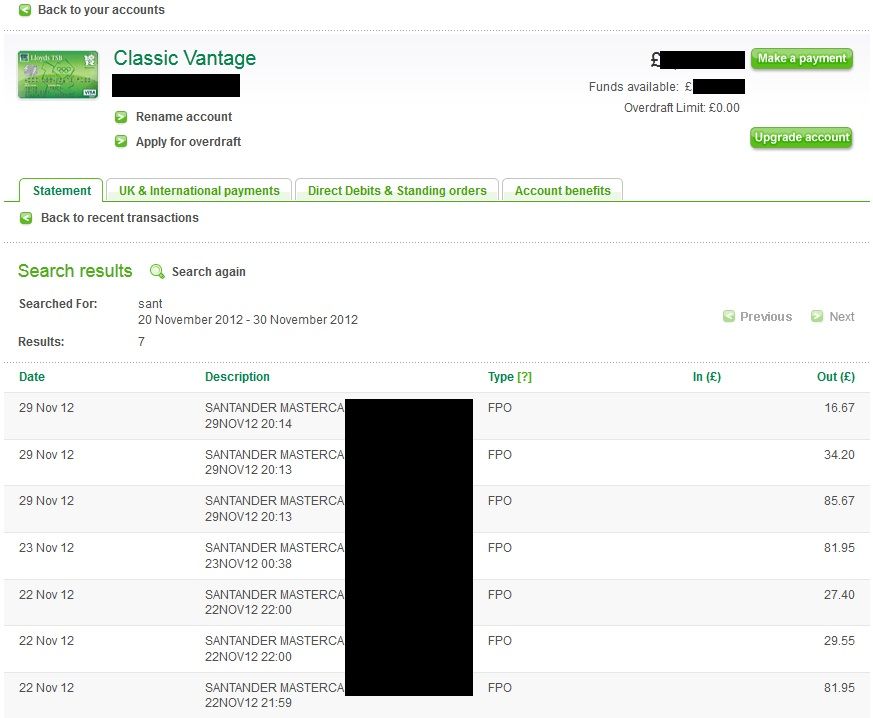

In fact, pictures speak a 1000 words. Here's a screenshot of one of my statements showing you the problem. The red squares highlight the problem....

And how would they refuse a fraud claim?The one bit that is clear is that you have complete disregard for the security of your mothers' money. Just don't complain if the bank refuse any future fraud claims from her accounts.

Tell me how they would know others have been using the account. They ask "did you make that transaction". They don't know that >I< physically pushed the button. My mother says yes i made that transaction. Unless CCTV is installed in our house somewhere, how do they prove she didn't do it - when she is always there if/when i make transactions.0 -

I've already said who.dalesrider wrote: »Hence my question as to who was actually doing this

Funny how you decide to question if it's not me doing it.So if it is not you doing it

To spell it out - yes it's me doing it. Deja Vu, i'm sure i said that earlier.

Oh yes ... i did.

THAT is how i can be certain.

I'm telling you, i'm not asking you.As a aside Op. On a credit card when you spend it goes into - (minus) when you pay it off in full you have a zero balance. If they add cash back that would give you a + (positive) balance.

That is, i am telling you how the Santander system is operated. I don't care whether they display a + a - or any other symbol next to the balance. I am telling you that when i was spending on the card it went into the plus under the "current balance" heading. Why we're discussing this i don't know as it's not important. Pay the transaction off & it reads £0. Get paid cashback and they owe ME money - it displayed a minus symbol.

If you don't agree with it, take it up with Santander.

I could've done. I've already mentioned why i don't though.As such could you not use this cashback as part payment off the next month ?

You'll just have to get over it then i'm afraid. I have.You should never of stated that other people use your card as people such as me who deal with fraud on a daily basis... Really go off on one at people that are that silly to believe that it wont effect them.

And what if i die next week? Yet i'm still going to work tomorrow instead of going out there enjoying my last days on Earth. What if, what if.What if you mother lost the card, or had her purse stolen just after using hte card in a shop. The fraudster then goes to a ATM and takes cash....

I haven't put a gun to her head. I'm well aware of the implications & i have discussed this with her too. I am fine with it, she is fine with it. Don't let it bother you.Do you really want to leave not only yourself, but also put a trusted person in a position such as that. All for the sake of a few quid...0 -

The screenshot was a bit more helpful, thank you, Nine_Lives.

However, we still only know part of the story - - e.g. we do not know how those "duplicates" show on the Lloyds account, and we do not know whether they get debited again from your account.

So I still don't understand what your problem is, and I certainly still don't understand what your question is. If you are not capable of expressing your problem and asking your question so people can comprehend them, that is, to put it politely, not our problem, but yours.

I can offer a guess though, and it is to do with fraud detection measures, most likely at the Santander end. It isn't a very common pattern that credit cards get paid off on a daily basis and with small amounts. Therefore Santander might credit the FPs initially but then automatically debit them again, until a human (in the bank's security department) eventually confirms the transaction as acceptable. Lloyds will probably re-send the (same) FP several times, until it either gets rejected for good, or accepted. At the end of the day (figuratively speaking), the amounts only get credited once to your Santander, and debited once from your Lloyds.

Just a guess. The easiest way to find out for certain is if you ask Santander.0 -

-

£81.95p was sent twice from the Lloyds account.

Seems straightforward enough. As transactions are dated and timed.0 -

Cross reference them then.Thrugelmir wrote: ȣ81.95p was sent twice from the Lloyds account.

Seems straightforward enough. As transactions are dated and timed.

2 showing on the TSB shot between 20-30 November

3 showing on the credit card shot - showing 22nd & 23rd November

None paid from any other account.

Also, the button was only clicked once for one payment - there'd be no need to submit twice.

And this is only one example - it's happened other times.0 -

Surely the simple answer is, wait until bill comes in and then everyone pays up and then pay the bill.

But then I am not you :cool:

F40 -

we still do not know whether the alleged duplicates get debited to the Santander account, and credited back to Lloyds account eventually.

If they do, then I suggest I am not far off with my guess that some automatic fraud prevention process causes the re-presenting of the transactions (a bit akin to re-presenting of cheques in the olden days).

If they don't, then dalesrider's guess is correct, i.e. someone is sending them twice. And I would still be flabbergasted because the owner of the Lloyds account would be out of pocket but we haven't heard that this is an issue.0 -

Right now we can see that payments have gone via IB twice...

Have you spoken to Lloyds about it?

Are you sure 100% that your mother is not going in and doing it again herself?

I do not think that its a security system issue (work with them) as if a payment is declined you would be contacted.

So that leaves either human error (clicking twice, more than one person doing it) or a browser error auto refreshing (halifax DO NOT REFRESH browser once submit clicked.

End of the day contact lloyds and see what they say....

But. To harp back to something you don want to hear....

Let your mother managae her own internet banking. As my money is on your mother doing it herself and not realising you have accessed and done it already.Never ASSUME anything its makes a>>> A55 of U & ME <<<0 -

Nope, only recently spotted it & was rectified by paying the money back to those who were out of pocket.dalesrider wrote: »Have you spoken to Lloyds about it?

Unless she is with me when i'm making the payments & then once i'm not there, she fires up the PC, despite not knowing how to work one, then logs on to the TSB account & sends the payment again, knowing that i've sent it previously, then no, she isn't doing it again.Are you sure 100% that your mother is not going in and doing it again herself?

Have always been contacted in the past - so this matches what you sayI do not think that its a security system issue (work with them) as if a payment is declined you would be contacted.

I do hope you don't ever bet REAL money.Let your mother managae her own internet banking. As my money is on your mother doing it herself and not realising you have accessed and done it already.

Yes, my mum doesn't realise as she's watching me send the money over & pay off the bill & her balance goes down. She doesn't realise the payment has been sent.

So like Popeye with his spinach - once i go out the room she all of a sudden knows how to work a PC (despite the fact she wouldn't be able to tell you what a web browser was, never mind actually open one), she opens a web browser, heads on over to the TSB site, logs on & navigates her way successfully around the site to send me another payment which has just been sent. So she's essentially GIVING me the money, but in a secretive fashion, as she doesn't tell me she does this.

This is essentially what you are suggesting.:rotfl:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards