We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Setting up a weekly standing order with Nationwide. Possible?

Options

Nine_Lives

Posts: 3,031 Forumite

I know it's possible with Halifax (& therefore i imagine TSB also), but the most frequent option through Nationwide appears to be monthly. This is no good for this payment - it needs to be weekly. It's going to the account holders eISA (so from Nationwide FlexAccount to same account holders Nationwide eISA).

It can be done with 52 single payments, but this is time consuming to set up.

Before it gets suggested, multiplying the amount by 4 & paying monthly isn't an option.

Can this be done at all? Any form that can be picked up in branch to pay weekly? Or is it a total non start with Nationwide?

It can be done with 52 single payments, but this is time consuming to set up.

Before it gets suggested, multiplying the amount by 4 & paying monthly isn't an option.

Can this be done at all? Any form that can be picked up in branch to pay weekly? Or is it a total non start with Nationwide?

0

Comments

-

Unfortunately I can't answer your question, however, in my experience Nationwide spends a lot more time and effort talking about customer service than they do actually providing any.0

-

The only thing I can suggest is to set up four monthly regular standing orders (or regular transfers as this is what Nationwide call internal transfers). You could set these up for dates such as 1st, 8th, 15th and 22nd and periodically do a single transfer to catch up the weeks. This may not be any good but its the only thing i can think of.I've worked in the Financial Services industry for the last 25 years. When posting on this forum I am not providing any financial advice or representing anyone but simply posting my own personal views. Always make sure you seek suitable Financial Advice from an authorised professional based on your own personal needs and objectives.0

-

Which will give 48 payments rather than 52. However just set the corresponding amount of each at 13/12ths of the standard weekly payment and you're done!The only thing I can suggest is to set up four monthly regular standing orders (or regular transfers as this is what Nationwide call internal transfers). You could set these up for dates such as 1st, 8th, 15th and 22nd and periodically do a single transfer to catch up the weeks. This may not be any good but its the only thing i can think of......under construction.... COVID is a [discontinued] scam0 -

So you just wanted somewhere to vent about Nationwide? :rotfl:Unfortunately I can't answer your question, however, in my experience Nationwide spends a lot more time and effort talking about customer service than they do actually providing any.

Sorry, i've thought about this & it's no good. The transfers aren't date specific, they're day specific - they'd need to be every Thursday.The only thing I can suggest is to set up four monthly regular standing orders (or regular transfers as this is what Nationwide call internal transfers). You could set these up for dates such as 1st, 8th, 15th and 22nd and periodically do a single transfer to catch up the weeks. This may not be any good but its the only thing i can think of.

Again, the payments can't be monthly, they have to be weekly - on the same daY.Which will give 48 payments rather than 52. However just set the corresponding amount of each at 13/12ths of the standard weekly payment and you're done!

Looks like single payments are the only way to go then. Thanks anyway.0 -

On the other side of the coin, Barclays even allow you to make regular payments for "Barclays Staff Pay Day", whenever that is - I've not tried it yet

0

0 -

I know it's possible with Halifax (& therefore i imagine TSB also), but the most frequent option through Nationwide appears to be monthly. This is no good for this payment - it needs to be weekly. It's going to the account holders eISA (so from Nationwide FlexAccount to same account holders Nationwide eISA).

It can be done with 52 single payments, but this is time consuming to set up.

Before it gets suggested, multiplying the amount by 4 & paying monthly isn't an option.

Can this be done at all? Any form that can be picked up in branch to pay weekly? Or is it a total non start with Nationwide?

Nationwide do not have the facility to do a weekly standing order, I used to bank with them and needed this facility and was told over the phone that weekly standing orders are not available. I thought that maybe a trainee was not fully up to speed so I went into the branch and was told the same story - what a shower.

I said that this basically means that the self proclaimed 'Worlds largest building society' cannot organize a weekly standing order. I only tolerated this because of the free overseas withdrawals which was useful back in the day when I was frequenting Asia.

Now that the boon of free overseas card usage has been revoked what does this shabby little organization have to offer? Another thing that used to rile me about these clowns was that their full on line banking statements were a day behind. To top it all off the in branch service is poor. Since jumping ship to HSBC I have never looked back.Money is a wise mans religion0 -

The ONLY reason that i stick with Nationwide now is their online banking system. I find it better than any other (although with their recent change, it's gone downhill a bit).

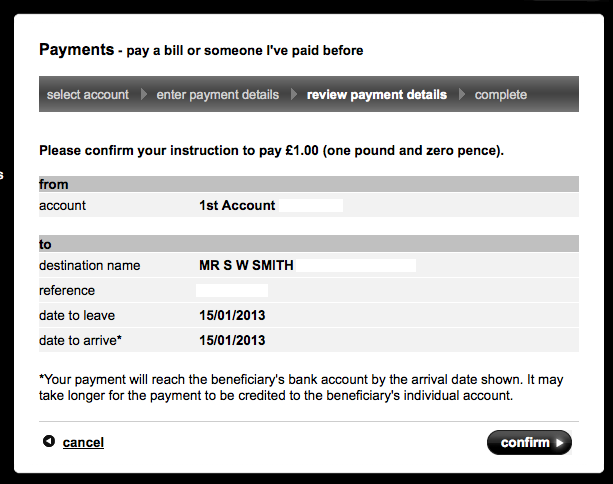

With Nationwide, i can set up singular payments on Jan 1st to happen Dec 31st of that year if i liked. With other banks i've tried - they only allow 31 days in advance, which to me is no good.

I also find their branch staff to be pretty stupid. Too many times i've gone in branch & they don't have a clue. I handed in an account closure notice yesterday & the woman didn't even know what it was.0 -

The ONLY reason that i stick with Nationwide now is their online banking system. I find it better than any other (although with their recent change, it's gone downhill a bit).

With Nationwide, i can set up singular payments on Jan 1st to happen Dec 31st of that year if i liked. With other banks i've tried - they only allow 31 days in advance, which to me is no good.

I also find their branch staff to be pretty stupid. Too many times i've gone in branch & they don't have a clue. I handed in an account closure notice yesterday & the woman didn't even know what it was.

With HSBC you can set up payments one year in advance, as far as I know this facility is not that uncommon. The Nationwide really has no redeeming features at all. Going back many years I used to recommend them, there was interest on the Flex account, free overseas card usage and the in branch service was good. Any financial institution which cannot organise a weekly money transfer in 2012 should be laughed at and avoided like the plague. They are firmly rooted in the dark ages.:rotfl:Money is a wise mans religion0 -

I've also been with TSB, Halifax, First Direct, Santander

I've found none of these offered me payments beyond 31 days. Disappointing really.

The gf & i play the lotto each week. One week i get, the next week she gets. We play online. It's easier for me to pay the lotto & she just "owes me". So each month i set up a payment from her account to mine on the final day of the month. Some times it's £12 a month, other times it's £18, depending. I do this for every month when January comes around. I'd never be able to do it with the other banks i listed.

That's just ONE example i should point out. I'd like to ditch Nationwide, but i only use it for that reason.0 -

If you can't do it with First Direct how come I've just managed to setup a payment for in nearly a years time?

0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.2K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.2K Work, Benefits & Business

- 599.3K Mortgages, Homes & Bills

- 177K Life & Family

- 257.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards