We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How on earth can two FTBs raise 20% deposits?

Comments

-

poppysarah wrote: »But they have longer tenancy security there don't they?

I think most landlords would be fairly happy with tenants that wanted to stay long term. I know I would be, no void periods and no hassle to keep getting new tenants.

Back to the original question, I'm afraid saving is the only option. It won't be quick or easy but worthwhile in the end. Have a look on the dealing with debt boards here for tips on saving money and also the Living Below Means board on fool.co.ukRemember the saying: if it looks too good to be true it almost certainly is.0 -

Just checking back in.

Thanks for the advice, we're definately looking to save money, we just need to streamline stuff like entertainment - we don't go out and drink much, we'd rather go out to eat at nice places, etc.

I think what many posters are missing is that :

a) If young people look at what their parents could afford compared to what they can afford at the same age, there is a big disparity.

b) Even if you saved 1000s of pounds per year over the last decade, that still left you way behind as house prices were going up by a greater amount.

It's been a big transfer of wealth from one generation to another, and you are right to question it.0 -

rhodesRocks wrote: »this thread has had me :rotfl::rotfl::rotfl::rotfl:

Yes, this is a very funny thread, but then according to PinkKiwi I must be thoroughly boring with no life whatsoever.

Going by her answers I was either thinking she was about 10, or plays the fairy Godmother in pantomime and uses method acting at all times.

Anyhow back on topic. I think the advice given on here, has been very good. I think it's possible when you've had a good look at your spending habits as well as your dependency on stuff that you will be able to cut down.

If the rent in a studio flat is a lot cheaper and you don't want to loose the furniture, you could put it into storage. We did that at £80 a month, but it was worth it. Even better if you could store it at a parents.

Good luck.MSE Forum's favourite nutter :T0 -

Thanks for the advice, we're definately looking to save money, we just need to streamline stuff like entertainment - we don't go out and drink much, we'd rather go out to eat at nice places, etc.

There's savings right there. Eat out only when you are away from home, and never just as an alternative to cooking at home. Oh, and when buying to cook at home start with the value/basics range and "upgrade" only if it is genuinely bad tasting.

You might benefit from getting 3 months of bank and credit card statements and totting up what you spend on different things, and then see what that could have been if you put it in a savings account (or fill in a proper "SOA"). I suspect it will shock you - it's quite possible you could have saved your 10% already.0 -

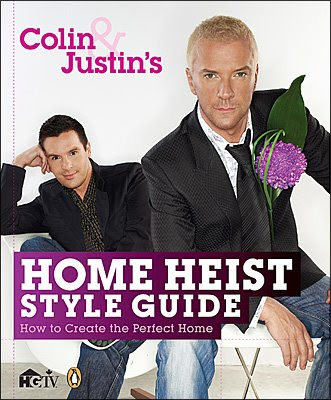

they would work wonders with a studio flat!0 -

It's tough and have to really want to save! We have given up so much to save what we have now and the only thing that keeps our spirits up is thinking about what we will have. I agree that it's very difficult. As a couple, we earn slightly less than you and pay £675 on rent. If we weren't together there is no way we could even think about buying a place.

I keep a very detailed spread sheet of our savings. It enables us to set savings targets and to see that we are heading in the right direction. We also transfer most of our money each month out of our current accounts and into savings and try to live on as little as possible. It's tough but we've managed to save enough for a 25% deposit and by saving that much we'll get a much better deal compared to 20% (honestly I couldn't believe the difference that 5% makes!)

EDIT

We also spent a month meticulously collecting receipts. When we sorted through them one evening it gave us a very clear idea of where we were wasting money. It was a slightly better indication than if we'd relied on bank statements because it took into account any cash we had spent.

We do still go out for nice food occasionally. I would rather buy a nice meal and have a glass of wine with it then spend all night out drinking so we almost never go out on a Friday or Saturday night. Our meals out have also become less frequent but then I am a great cook lol!

If you just start by cutting back a little bit on everything you might find you catch the savings bug. I remember when I started saving I wanted to buy a new pair of jeans, before I knew it I had the money and thought to myself "that's only a small amount away from the mp3 player I want, then it was only a small amount away from a new TV . . . then a car. Eventually it got to saving for the sake of saving and pride at how well I had done. At some point, I'm not exactly sure when, I realised that we could be close to a deposit on a house and my OH caught the savings bug too.0 -

When I bought my first house, I'd been saving up by living in a cheap, rented studio flat. I used every penny to then pay the mortgage deposit, and had nothing left for furniture. My first 2 months in my lovely new house, I was sleeping on a lilo borrowed from a friend (a proper cheap holiday lilo, not these new fangled comfy airbeds!!), had 2 deckchairs borrowed from my sister as my living room furniture, and my portable TV was sitting on an upside down cardboard box.

Seriously!!! That was it. Bought a second hand single bed the next month, some second hand wardrobes the month after, then finally a brand new double bed from Argos!

That was about 12 years ago. When did it become necessary to have your first home look like a showhome from Day 1..??!! :rotfl:0 -

We left behind the "it's not fair" argument on page one. As a society we are where we are, and you can whine about it or get on with saving up. Getting the money together to buy a house has always been hard (except for a brief window of opportunity in the mid 90s). Telling someone how hard done by they are is not going to get them a house.I think what many posters are missing is that :

a) If young people look at what their parents could afford compared to what they can afford at the same age, there is a big disparity.

b) Even if you saved 1000s of pounds per year over the last decade, that still left you way behind as house prices were going up by a greater amount.

It's been a big transfer of wealth from one generation to another, and you are right to question it.Been away for a while.0 -

Come and join us at the 'Saving for Deposit' thread - https://forums.moneysavingexpert.com/discussion/789675

Lots of people in lots of different situations with a common goal. Many inspiring posts and good ideas too 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards