We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Landlord asking for 3 Months rent in advance plus 1 month Deposit.

Comments

-

I'm going to join the chorus of 'told you so' I'm afraid.

You might have grounds to recover the holding deposit in the small claims court. It depends on any terms and conditions you were presented with prior to making the deposit, and any contract (verbal or written) you might have made with handing over the deposit.

They would argue that it was agreed non-refundable and you pulled out.

You would argue that it was agreed as refundable (an odd kind of deposit so may not be tenable) or that it was agreed non-refundable but that the landlord unilaterally changed the proposed terms of the tenancy. You would also probably argued that you were presented with no terms and conditions.

It would probably cost as much again to actually pursue through the court, and as much again in terms of time. You might get somewhere in terms of settlement by threatening court without having to actually go to it, depends if you want to go to the bother. As stated already consider it a lucky escape.0 -

As long as the Holding deposit is not in the Landlady's pocket I am happy to let the agents have it.

I wouldn't give up without a fight. Send them a letter telling them why you think that you should get your deposit back and give them a date by which to repay it to you. Tell them if you don't get it back, you will take them to the Small Claims Court. You don't have to do it, but there is no harm in threatening it as long as you are sure that you won't need to use them in future. If you think you will, then just set out why you think you should get your deposit back and don't threaten to take them to court.0 -

princeofpounds wrote: »I'm going to join the chorus of 'told you so' I'm afraid.

You might have grounds to recover the holding deposit in the small claims court. It depends on any terms and conditions you were presented with prior to making the deposit, and any contract (verbal or written) you might have made with handing over the deposit.

They would argue that it was agreed non-refundable and you pulled out.

You would argue that it was agreed as refundable (an odd kind of deposit so may not be tenable) or that it was agreed non-refundable but that the landlord unilaterally changed the proposed terms of the tenancy. You would also probably argued that you were presented with no terms and conditions.

It would probably cost as much again to actually pursue through the court, and as much again in terms of time. You might get somewhere in terms of settlement by threatening court without having to actually go to it, depends if you want to go to the bother. As stated already consider it a lucky escape.

I cant really help the situation much as I had already paid the deposit the moment i saw the property prior to posting this thread.

But yes you told me so and I am glad I have other options.I wouldn't give up without a fight. Send them a letter telling them why you think that you should get your deposit back and give them a date by which to repay it to you. Tell them if you don't get it back, you will take them to the Small Claims Court. You don't have to do it, but there is no harm in threatening it as long as you are sure that you won't need to use them in future. If you think you will, then just set out why you think you should get your deposit back and don't threaten to take them to court.

I ll will see what I can do about this.0 -

They have broken their terms. Send them a letter and in bold write "LETTER BEFORE ACTION" at the top. Basically they are using the fact that they are holding £100 of your money to give you unfair terms - they tried making you sign under duress by making you forefeit your money. The very threat of the small claims court, mention of under duress and the fact they have broken their terms should make them send your money back in no time at all. From now on, ensure everything is done by registered post - put it all in writing. If you want to then feel free to email them as well, but include a statement saying "You will be receive a copy of this letter shortly in the post". Do not ring them. Keep everything traceable.I paid the holding deposit immediately after viewing the property and the Initial terms were.

1. 1 month rent Plus 1 months deposit

2. Then after all references received, LL said she was not comfortable with my account being overdrawn and she is only prepared to go ahead if I was willing to pay 3 months rents upfront plus 1 month for deposit and then she chipped in the need to run a dehumidifier in the kitchen, I agreed to the 3+1 months rents upfront and expressed my concern about the dehumidifier business and then she change the terms again and said she ll take 1 month rent plus 2 months deposit 5 days after previously asking for the 3+1 terms.0 -

I wouldn't give up without a fight. Send them a letter telling them why you think that you should get your deposit back and give them a date by which to repay it to you. Tell them if you don't get it back, you will take them to the Small Claims Court. You don't have to do it, but there is no harm in threatening it as long as you are sure that you won't need to use them in future. If you think you will, then just set out why you think you should get your deposit back and don't threaten to take them to court.

Quoted for truth. If you placed a holding deposit on one set of terms, then they cannot insist on keeping it unless they are prepared to go ahead on the terms on which the deposit was placed.

It depends on how much time and effort you want to throw into pursuing that though. It's almost certainly not worth actually going to the court (even the Small Claims Court) - but it's certainly worth putting it in writing that you will do so if the deposit isn't returned by a specified date. It worked for me when Keatons tried to fleece me in a similar kind of situation.

There's not a chance in hell I would ever use Keatons again, so I wasn't bothered about that - but as stated above, don't burn your bridges if you will need to come back to them some day.For where your treasure is, there will your heart be also ...0 -

angrypirate wrote: »They have broken their terms. Send them a letter and in bold write "LETTER BEFORE ACTION" at the top. Basically they are using the fact that they are holding £100 of your money to give you unfair terms - they tried making you sign under duress by making you forefeit your money. The very threat of the small claims court, mention of under duress and the fact they have broken their terms should make them send your money back in no time at all. From now on, ensure everything is done by registered post - put it all in writing. If you want to then feel free to email them as well, but include a statement saying "You will be receive a copy of this letter shortly in the post". Do not ring them. Keep everything traceable.Quoted for truth. If you placed a holding deposit on one set of terms, then they cannot insist on keeping it unless they are prepared to go ahead on the terms on which the deposit was placed.

It depends on how much time and effort you want to throw into pursuing that though. It's almost certainly not worth actually going to the court (even the Small Claims Court) - but it's certainly worth putting it in writing that you will do so if the deposit isn't returned by a specified date. It worked for me when Keatons tried to fleece me in a similar kind of situation.

There's not a chance in hell I would ever use Keatons again, so I wasn't bothered about that - but as stated above, don't burn your bridges if you will need to come back to them some day.

Looks Like I will be taking this further and not letting go as the LL will be the person to benefit from not refunding my holding deposit.0 -

angrypirate wrote: »They have broken their terms. Send them a letter and in bold write "LETTER BEFORE ACTION" at the top. Basically they are using the fact that they are holding £100 of your money to give you unfair terms - they tried making you sign under duress by making you forefeit your money. The very threat of the small claims court, mention of under duress and the fact they have broken their terms should make them send your money back in no time at all. From now on, ensure everything is done by registered post - put it all in writing. If you want to then feel free to email them as well, but include a statement saying "You will be receive a copy of this letter shortly in the post". Do not ring them. Keep everything traceable.

Great advice. But again, ensure that you will not need to use them in the future.0 -

What does the actual document you signed when you gave the holding deposit say?

I agree with your stance on the damp by the way. A comment about keeping the deposit for 'damp/condensation' issues rings alarm bells for sure. Clearly this is a chronic problem in the flat.0 -

LL is asking for 3 month's rent in advance just because 2 out of 3 month's statement showed debit.

Coming from a previous rental of over 4 yrs never missed a payment.

IS she taking a !!!!?

Overdraft are meant to be used and are there for a reason.

(I have Interest free over draft up to £1k and never exceeded it.)

PS: EA as just informed me that the Landlord as informed her that I have to operate a dehumidifier every-time I cook as not to allow condensation to form in the Kitchen, sure this is not Good? when asked about the cost of running the equipment, EA said it has to go on my bill.

She said opening the windows alone when cooking does not cut it for her and will be checking in every couple of months to see.

Sounds to me her kitchen has inadequate ventillation and she should sort that BEFORE you take up residency and I would make it a condition of taking the place.

Out of order I say. An I am not a tenant, but own.0 -

What does the actual document you signed when you gave the holding deposit say?

I agree with your stance on the damp by the way. A comment about keeping the deposit for 'damp/condensation' issues rings alarm bells for sure. Clearly this is a chronic problem in the flat.

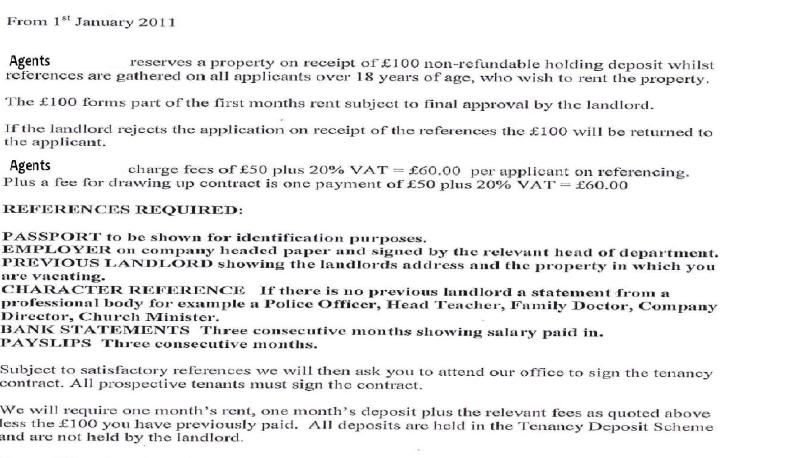

I have not signed any document up to date as it seems every single discussion I ve had with the EA has to be ran past the LL before any progress....But it is just the Reference sheet shown below: 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards