We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Nationwide to start a new log in procedure.

Comments

-

There are other issues related to card theft. For example, if a customer is

issued with an ATM card, the same card and PIN will be used for CAP, and so

the PIN digits on the reader will wear down. Because customers are encouraged

to carry their CAP readers around with them, it may be stolen along with their

cards, perhaps telling the thief which digits to try.

You'd need to be very heavy handed for the numbers on the card reader to wear down, and if they did you would just ask the bank for a new one. And, while customers are free to carry the readers around with them, I don't know any bank that particularly encourages you to do so.0 -

I havent actually been home so far this month so mine is probably at my apartment.

Whilst I understand the need for good security. There are many other ways. Blocking access makes life inconvient for everyone. Except the fradsters who will be able t get around this with ease. Natwest, HSBC & lloyds allow you to see your money / transactions without difficulty.

I can check money has gone in okay. So no need to worry. I can also tell when I spend money, dont like that bit. But also my balances on the cards for shopping / petrol.

Natwest / RBS have a system where you can keep an eye on your money yet if you need to pay money out for a first time card reader is needed. They do allow me to transfer an sparer cash to a savings account, especially if I am abroad for a few days and not needing their cards.

i am not even going to mention abroad, as thats one of the reasons I had a nationwide account. I dont understnad what I have done wrong.0 -

-

http://www.nationwide.co.uk/search/DisplayArticle.aspx?article=1508samwsmith1 wrote: »Well I never got sent one, where do I request one from as I can't see an option in there online banking.0 -

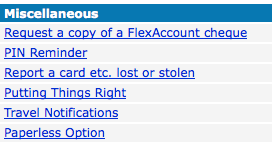

This is my misc section:

So it would seem that my account doesn't require one.0 -

I see no problem with it.

The difficulty is that the security issues with internet banking are a continual and increasing threat. We have the majority of people running windows PCs which are easily compromised. We also have so many phishing scams that look so good. The card reader login would make NW one of the most secure banking sites going. Isnt that what we want? Anyway the card reader is such a small item that to have it to hand/take it away with you is hardly a burden. How many people so internet banking when they are away on hols anyway? Its hardly a big deal and as a NW customer, i cam happy that they are taking further steps to secure my banking experience.Feudal Britain needs land reform. 70% of the land is "owned" by 1 % of the population and at least 50% is unregistered (inherited by landed gentry). Thats why your slave box costs so much..0 -

C_Mababejive wrote: »I see no problem with it.

1) Accessing from more than one place causes problems.

2) It's one more thing to break, and is a single point of failure.

3) It shifting the onus even further onto the customer for any fraudulent activity.

4) It's yet another security measure which annoys, since we already have a user-id which is difficult to remember (when you consider the number of accounts some have, all of which have their own permutations of credentials,) and two passwords on the account.

While I applaud the fact that NW is attempting true two-factor authentication, the implementation leaves something to be desired. However the hardware they're using (a card with a 4 character password, where the characters are limited to numbers, and a reader that is interchangeable between banks) is little better than what they have currently. If someone (with the currently required online credentials) can go to a cashpoint and withdraw money, then there is no extra security being added here.

i.e the fact that the token required is the same token used elsewhere adds nothing more to the security.Conjugating the verb 'to be":

-o I am humble -o You are attention seeking -o She is Nadine Dorries0 -

Paul_Herring wrote: »1) Accessing from more than one place causes problems.

2) It's one more thing to break, and is a single point of failure.

3) It shifting the onus even further onto the customer for any fraudulent activity.

4) It's yet another security measure which annoys, since we already have a user-id which is difficult to remember (when you consider the number of accounts some have, all of which have their own permutations of credentials,) and two passwords on the account.

I agree completely. And yes, I travel a lot and I access my internet banking from my laptop, from my netbook, from my smartphone, and from my home, my Mum's home, from accommodation abroad, from the car... the list goes on. I personally find the card reader incredibly annoying already, as I always forget to have it to hand until prompted - I know, I'm just thick, but I have more important things to think about and when I want to pay a bill, I want to do just that. I don't want to have to faff about with a card reader to log in and, presumably, then again to make the actual payment! NW ARE YOU LISTENING!!!! :mad: Now, Santander's OTP by SMS I can live with as I always have my phone with me (sad I know, but my job requires this). Can't the banks offer both alternatives, so as to try to offer the customer what they want? Oh... silly me... we are talking about banks - after all, when did they ever really want to please their customers? 0

0 -

samwsmith1 wrote: »This is my misc section:

So it would seem that my account doesn't require one.

http://www.nationwide.co.uk/search/DisplayArticle.aspx?article=1508

I can't see an option to order a Card Reader

The option to order a Card Reader will only show on your internet banking page if you are ordering a Card Reader from a FlexAccount Visa debit card account. If you don't have a FlexAccount Visa debit card account, you do not need a Card Reader and the option to order a Card Reader will not be available.0 -

You obviously didn't read the next paragraph:http://www.nationwide.co.uk/search/DisplayArticle.aspx?article=1508

I can't see an option to order a Card Reader

The option to order a Card Reader will only show on your internet banking page if you are ordering a Card Reader from a FlexAccount Visa debit card account. If you don't have a FlexAccount Visa debit card account, you do not need a Card Reader and the option to order a Card Reader will not be available.Other ways you can order a Card Reader- you can call our 24 hour Call Centre on 08457 30 20 10, or

- visit your nearest branch. To find your nearest branch please follow this link to our branch finder.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards