We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Travel Insurance Article Discussion

Comments

-

Nationwide website says the below, but is the first paragraph then voided by the sentence about 'being aware of circumstances'? For example, as of today we are all aware of COVID 19 as a virus, but if I book a 2021 trip thinking Covid 19 hopefully won't be an issue by then, but when I travel in 2021 I get sick with it, will they refuse to help me because I was 'aware of the circumstances' when I booked in Summer 2020?JPears said:Hi forum admins. There is a factual error on this page which would benefit from a correction:Specifically with the Nationwide FlexPlus account packaged travel insurance.Nationwide do NOT provide Coronavirus Medical cover or cancellation if the holiday was booked after 18th March. or to new account holders after 18th March 2020.Or indeed any Coronavirus related claim (which they don't publish what they consider as coronavirus related claim)See Nationwide webapage:If I book a trip will I be covered for coronavirus (COVID-19)?

Your travel insurance will provide cover for events relating to COVID-19, such as emergency medical expenses abroad, cancelling or cutting short a trip, as long as you are not travelling against doctor’s advice and the FCO were not advising against travel both when you booked your trip and when you depart on that trip.

Travel insurance will only cover you for circumstances that you were not aware of when you booked the trip or were due to travel.

We recommend you read your policy terms and conditions for full details on what is and isn’t covered.

0 -

Does anyone know what the payout limits are for the Nationwide Packaged Insurance? I had a quick scoot around the website but couldn't find it? We are planning a trip to Florida/Disney next year. We have a villa booked for 3 weeks which we can cancel until June next year free of charge. However we have 6 flights of about £900 each that i need to get and if the villa is needing to be cancelled after that we have paid £5,500 for the Villa. the quotes i got from Compare the market all had caps of about £3000- 5000. Hence my worry. Additionally, I don't know if anyone knows whether this would also cover the cost of the park tickets if we are unable to make it? I am paying for everything on Credit card anyway just in case so i can qualify for section 75, but i would like some insurance too! Any help./advice would be greatly appreciated.0

-

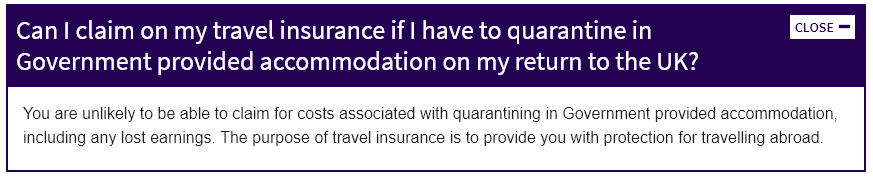

I'm having a hard time determining if travel insurance would cover the £1750 cost of a quarantine hotel if I travel to France (currently only self-quarantine needed on my return) in the event that, while I'm away, the rules change and I have to go into a quarantine hotel on my return. Can anyone shed some light on this please?0

-

Hmmmm...from some more research, and from a chat to someone at Aviva, it seems that travel insurance ceases to be any use as soon as you return to the UK, and will not cover the £1750 quarantine hotel cost if your destination's 'traffic light' status changes while you're away: https://www.abi.org.uk/products-and-issues/topics-and-issues/coronavirus-hub/travel-insurance/hellopaul said:I'm having a hard time determining if travel insurance would cover the £1750 cost of a quarantine hotel if I travel to France (currently only self-quarantine needed on my return) in the event that, while I'm away, the rules change and I have to go into a quarantine hotel on my return. Can anyone shed some light on this please?

0 -

Is there an Insurance policy that covers for Flight Cancellations, for example the type that easyjet etc are doing now?

I bought insurance only to later find out i'm not covered in these circumstances.

Looking for insurance to cover Europe and multi trip as I travel every 2 weeks.0 -

When the airline cancels the flight they refund you and pay any compensation due. However they do cover hotel, car hire etc. you would need a policy that covers abandonment which is probably an extra add on. Alternatively, book hotels with refundable bookings for cancelling.0

-

Is that meant to be “However they do NOT cover hotel, car hire etc.”?0

-

Nationwide Flexiplus - that comes packaged with their current account covers delayed departure and abandonment- you are expected to claim from the airline first under the flight delay regulations .DJFearRoss said:Is there an Insurance policy that covers for Flight Cancellations, for example the type that easyjet etc are doing now?

I bought insurance only to later find out i'm not covered in these circumstances.

Looking for insurance to cover Europe and multi trip as I travel every 2 weeks.

Check the T&Cs of the policy to see if it covers what you need .

https://www.nationwide.co.uk/current-accounts/flexplus/travel-insurance

0 -

Be warned LV Auto-renewal may not be the best price. When you purchase an LV travel insurance policy you will be enrolled into auto-renewal unless you opt out. Previously (last year) there was no opt out option. My policy renewal was more expensive than the online quote price and a phone call with them reveals that they were charging extra because we had covid (more than a year ago) and that an online purchase gets an additional discount. The issue with the auto-renewal is that you can't edit your details, therefore we were unable to remove having had covid, which isn't even a notifiable thing any more and, obviously you don't get the online purchase discount.My recommendation is to always get a new quote and check if it's cheaper. Also I would always opt out of the renewal because that way you are forced to manually get a new quote and probably a better price.0

-

My post is of a more general nature. I recently had a painful experience trying to claim for medical expenses incurred by my son in the US. The claim was only for £160 but It took many months and hours worth of phone calls to get it resolved. I wondered how easy it would have been to get the money back if he had been admitted to hospital and run up a bill of 4 or 5 figures. But the company in question had thousands of 5-star reviews. This made me realise that the star ratings of insurance companies are worthless because the vast majority of reviews (well over 99% from my limited research) are from people who haven't made a claim. It's the equivalent of reviewing a TV set before you have switched it on. And these reviews are favourable because the reviewers have only dealt with the company's salesmen, who are very friendly and helpful because they want our money. But if you look at the reviews of those who have made a claim (you'll find them almost exclusively under 1-Star) you will see how the company really treats its customers and in most cases it's poorly. It was noticeable that this company asked for a review as soon as I had bought the cover (which I declined to provide) but made no such request after I finally received the payout. I am currently trying to arrange insurance for another trip and, depressingly, all the companies I have looked at broadly fit the profile described above. And it doesn't seem to depend much on the price of the cover. I have yet to find a company that I feel I can rely on. So it would be hugely helpful if the MSE team could do some research and provide ratings on insurance companies based on how quickly and efficiently they handle claims.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards