We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

If you are thinking of buying this summer ....

Comments

-

Im not waiting for the budget. As soon as my place sells i'll buy another!Squish0

-

I think it is already well known what is in the budget - cuts & tax rises. The only questions are how much and who and what will it do to house prices.

I see stagnation as the most likely outcome, falls next most likely outcome, I think any meaningful rise over the next 6-12 months is unlikely.

If prices are stagnant, in purely monetary terms, you are better off renting while the rental % is less than the interest %. Plus imo, most people rent in a smaller place than they end up buying.

E.g. Personally, when we buy, we are now looking at £400k. As a FTB, until we are past 20% deposit, that is about 6% interest. So £24k in interest costs a year.

We are renting at £1,100 in a smaller place at present, that is £13.2k. So if prices are stagnant, that is an extra £10.8k of equity we will have when we do move in the future.0 -

If you are thinking about buying a house this summer, are you waiting to see what comes in the emergency budget on 22 June before doing anything, or does that make no difference to you?

If you are waiting for the budget, do you expect it to make you more or less likely to go ahead with a purchase?

(Just curious! Estate agents are all saying that the market is quiet waiting for the budget so I wondered what the word on the street was!)

No. But it might impact on a second purchase of some land. We saw a very good deal that will suit us for ever. we priced in hardship and baked bean/chickpea living and felt that even if rices dropped another forty five/fifty percent this was a good buy at what we aid for it (not a loss free buy but a good buy) As we have never expected drops that big to us this was a sensible buy tht was not likely to hang around on the market much longer.

The second purchase really would be a bigger risk. It would ut us in a loan osition that would make us a little uncomfortable and might, weth tax rises probably inevitable for DH's income bracket etc we are dithering over. We cannot really afford it safely IMO.0 -

roseland69 wrote: »...

Edit to add: we WERE thinking of buying this Summer by the way at Xmas... but not any more. Prices are clearly dropping. Why buy now?

Really ??

Any evidence for this?

Even just a single verfiable source will do - but you need to better than pointing at one or two houses on Property Bee

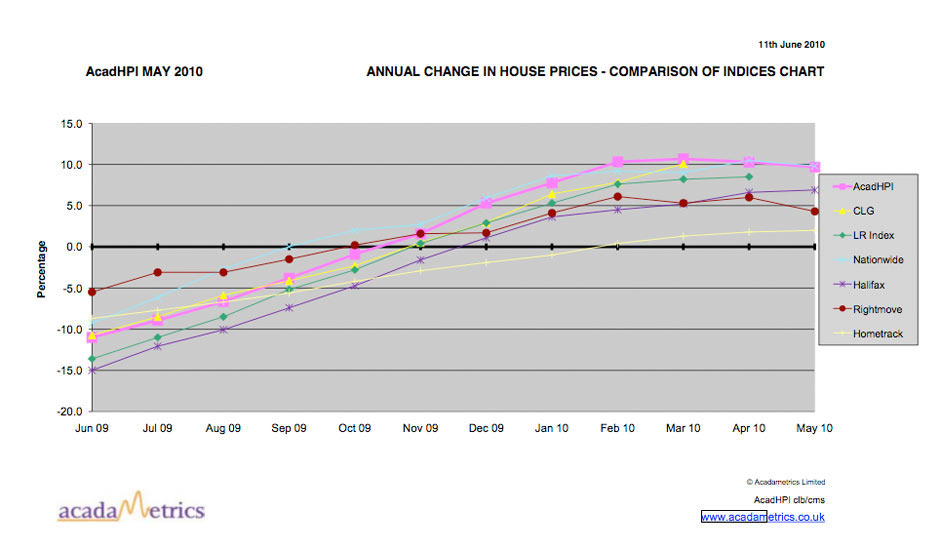

Every single external data collection body accepts that house prices are rising. Here is the proof:0 -

Henry_P_Chester wrote: »I'm with roseland here. Nearly bought in feb as a FTB offer declined, now the evidence is so overwhelming that price will fall I'll be waiting until next year at the earlist. Budget makes no difference we know it will be bad.

If any buyers are waiting untill after the budget I doubt they will hear anything that will make them rush out and buy! TBH I think it's just EA rhetoric.

Shame you didn't buy back in Feb. House prices have moved up substantially since then.

Why did you not take your chance to buy at the bottom of the market in Feb or March 2009? I know I did, and my BTL portfolio is up almost 15% since then.

:rotfl:0 -

Wow!! What a gluteus maximus you are!! 15% more than you were in Feb/Mar.0

-

Henry_P_Chester wrote: »Prices collapsed in the last recession 1988-1994. There's no reason to suggest this time will be any different.

Prices fell by just 13% in nominal terms in the last crash.

They fell by 23% in this crash.

Prices then stagnated for many years in nominal terms in the last crash, whilst falls continued in real terms as inflation, and eventually wages, rose.

Whereas in this crash prices rose strongly in nominal terms, whilst inflation also rose, but wages didn't keep up with either.

This crash is completely different to the last crash, and the last crash was completely different to the ones before. No two crashes have been alike, in cause, duration or recovery.

It takes a special kind of stupidity to assume this crash would follow the last one..... And an even more special kind of stupidity to assume it still would, when the facts have shown the opposite.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

nollag2006 wrote: »Really ??

Any evidence for this?

Even just a single verfiable source will do - but you need to better than pointing at one or two houses on Property Bee

Every single external data collection body accepts that house prices are rising. Here is the proof:

Er...you seem to have missed the fact that the most reliable source shows prices have been falling for the past 3 months. You really ought to keep more up to date - you appear to not even have seen all the recent Halifax drops! :rotfl:

Here's one of the threads you appear to have missed:

https://forums.moneysavingexpert.com/discussion/25264270 -

Wow ! A 0.2% fall in May caused by budget uncertainty and the removal of HIPS? I think that we both know what the underlying trend in the Halifax (well known "VI") shows:

You can do better than that Carol.

Quite disappointing0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards