We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

FRUGAL LIVING CHALLENGE 2010, part 1. (Living on £4,000 a year)

Comments

-

sophiesmum wrote: »Good morning frunchkins

lol i like frunchkins!!

morning all, got very lost trying to keep up with the intro so i am setting aside time each day to catch up here

DH and i are going back to the gym (have been sick for 2 months!!) and it'll help with my plan of losing 2 stone this year (if i lose more that's good too!)

my main aim now is to keep our spends down and get a job. said job's salary would then be able to be used for overpayments of debt and possibly the odd treat.

take care

ioiweNonny mouse and Proud!!

Never argue with an idiot. They drag you down to their level then beat you with experience!!

Debtfightingdivaextraordinaire!!!!

Amor et metus. Lac? Sugar? Quisque massa vel duo? (stolen from a lovely forumite!)0 -

Should auld lang syne...

Happy New Year to everyone, as soon as my visitors have gone I'll seriously be looking at my budget. Not sure where I can cut back atm but it's always surprising when one sees things on paper, where the waste is etc..as soon as I've done that I'll be able to set my challenge..

Lots of MS and OS good luck everyone

Sparrer0 -

Hi all and a happy new year.

Hi Nykmedia please could you add me to the list. NEWLIFEAHEAD I hope I haven't missed out I was really looking forward to it.

From my other post on the other threadThere is just me, DS1 and DS2. I am trying to clear my debts as quickly as possible and to cut down on the unneccessary purchases. Trying not to get back into bad habbits.

My budget will be for £6000 which does not include mortgage, council tax, TV licence and water as I cannot change any of these. I thing anything less may be too hard for my first go.

I am hoping to save the rest from my wage after all bills to clear my debts and have some savings.

I am looking forward to starting this challenge and hopefully having a great year this year.Smile loan - £2821.98 / £0:)

Lloyds CC - £3102.54 / £3071.51

B'Card - £7615.65 / £7444.30

Bank of mom - £6000 / £6000

28/02/17 £ 19,540.17 / £16515.81 05/04/170 -

Good morning all (or it was when I started typing this post :rolleyes2 )

and a Happy New (and Frugal) Year to everyone

Closed down my 2009 accounting spreadsheet last night, and cast a last eye over my 2010 categories. Decided to increase the budget for some of the categories slightly, as I don't want to be rejigging them right through the year

2009 saw a LOT of rejigging, but in my defence a substantial amount of this was down to unexpected vets bills (just over £655 :eek: ) that had to be clawed back from somewhere - and to that end I've got a new 'Contingency Fund' category for 2010.

My starting budget for 2009 was £8k, and my closing balance was £7941.53 - meaning I came in £58.47 under budget overall :T

As the 2009 thread has been closed, I'd like to say a huuuuuuge "Thankyou" here to all who posted on there - without them spurring me on I think I'd have given up once the emergencies arose !!!!

Anyway, if I deduct the unexpected vets bills, this means I could have made the year on around £7285 - so I've allocated as close to £7,500 to my categories as I can (while keeping rounded monthly figures), and put the remaining part of my £8k budget (which comes to £499) into my Contingency Fund. If I end the year with this pot totally untouched I'll be delighted, but at least I now have a 'buffer' in case something goes pear-shaped towards the end of 2010

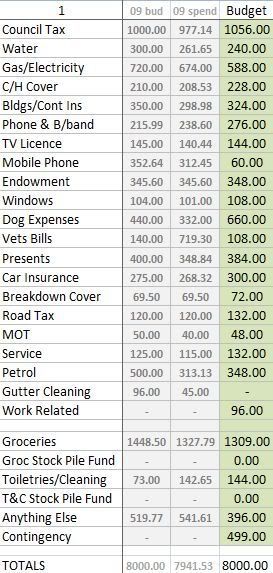

The totals page of my spreadsheet (my version is more complex than the one I send out on request - which, incidentally, I've now sent out over 60 copies of) now looks like this......

The '09 bud' figures are what my category budgets were set to for the start of 2009, and don't include any of the jiggling I did.

The '09 spend' should be self-explanatory

The 'Budget' figures are what I've set myself for 2010

Most categories are the same in terms of what they cover, but I have a few new ones (and one I've dropped).

Compared to my 2009 spends.......

Council Tax looks like I've given it a hefty increase, but part of this is due to the fact my Jan 09 payment was low (had effectively overpaid the first 8 months of the payment year)

Water (which is metered) I've dropped, but not to the level of 12x my current Direct Debit. At my annual review (August) I was in credit, so they dropped the payments to use up that as well as in-line with lower useage since Nov 08. So I expect it to go up in August, as I'm using more now (washing work uniform means at least one - and often 2 - extra wash loads a week) and I'll no longer have the credit to cover part of the annual bill

Gas/Electricity I've dropped, but again not to 12x my current Direct Debit. I got them to do a 'forced' annual review in Sep/Oct, and I was heavily in credit (again due to one less person using things - particularly as I've not needed the heating on as much for medical reasons).

C/H cover I've increased. The cost goes up every year, and this was lower than it should have been in 2009 due to the temporary reduction in VAT.

Bldgs/Cont Ins I've increased. Let's be honest, these things go up every year - and very unpredictably too

Phone & B/Band I've increased, as I know the base costs are about to go up. I signed up for an 18 month contract last January, which had a discount for the first 12 months - so that's due to go. Plus we now have the 50p/month increase that the government announced, which they claim will be used to roll out reliable internet access to remote places

TV Licence I've allowed for a never-ending annual increase that I can't do a thing about (apart from get rid of the TVs, and I'm not doing that until it's a choice of TV or food :rolleyes2 )

Mobile Phone shows a very hefty decrease. This is due to an expensive contract (which was the right thing for me when I took it out) coming to an end in August 2009

Endowment shows an increase, but this is purely so I can do my accounting with rounded figures

Windows has an increase to allow for the chaps putting up the prices again in 2010. I've made an assumption that it will be about the same rise in terms of date and amount as in 2009

Dog Expenses shows a hefty increase, which is 100% due to the specialist food I now have to get for the Dalmatian (started in October 09)

Vets bills is a funny one. It looks as if I've applied a decrease, but - if I actually deduct the emergency bills (£655) off what I spent - I've actually applied an increase against what I spent. This includes annual boosters, sedatives for the Dalmatian (for 5th Nov), worming tablets & flea treatment (the last 2 being bought on the Internet as they're much cheaper that way)

Presents I've increased, although I've dropped a couple of people from my 'must buy for' list - but I'm hoping this one will come in well under budget, as I want to get organised enough to make presents for several of the people on my list. In 2009 I'd forgotten to take into account younger DS turned 18 (so had extra spent, though I still managed to stay under budget) - but I've not reduced my 2010 budget against my 2009 spend as this year sees elder DS turn 21 :eek:

Car Insurance shows an increase. Looks higher than needed, but I want to try not including cashback this year (got £20 in 2009), and instead use cashback to make something I wouldn't have otherwise bought/done 'money neutral'.

Breakdown cover shows an increase, but like my Endowment this is only for rounding purposes. I've already had my renewal, which say the cost is actually staying the same

Road Tax again shows an increase I can do nothing about, but has also been over-budgetted for rounding purposes

MOT is a wild guess, but I've allowed for an increase on 2009

Service - ditto MOT

Petrol is a bit of guesstimate. I've worked out how much fuel I used in 2009 (323.16 litres), and at the price I paid yesterday that would be £339. But fuel costs increased by 22p/litre in the last 12 months (according to my records), so it's a total guess as to what I'm going to have to pay over the year - hence budget set slightly higher than that. But I'm also doing less mileage on a standard basis now (used to do a 7.5 mile round trip every school day until mid-Oct, but now only do it twice a week), so hopefully this will also help things balance out

Gutter Cleaning I've totally dropped for 2010. Moved in here (new build) in 2002, and it was 2007 before we considered getting them done (couldn't afford) and 2009 before they were done. On that basis I don't expect to look at including this again until 2012 or 2013.

Work Related is a new one, as I was out of work from late Nov 08 to early Nov 09. I did actually spend £72-ish on this during 2009 (two pairs of trousers, a pair of shoes, and a new iron!), but rather than split that all out I've ust included those purchases in my 'Anything Else'

Groceries shows a reduction, but compared to my final budget figure for 2009 it's actually an increase on a "per person per day" basis. This is one budget I kept trimming back on during 2009, but want to relax my eye on it a bit in 2010. I'm also feeding less people, as at the start of 2009 I was providing one main meal and 3 snacks a week for a younger GD and 5 snacks a week for my elder GD (school term-time). This changed in September to 5 snacks each, then dropped in October to 2 snacks each, then stopped altogether when I started work.

Toiletries/Cleaning I've allowed for an increase. 2009 was a totally wild guess, as I've never watched the pennies on this one before. But I've stocked up on a lot of items that haven't yet been opened, so hopefully 2010 won't be far off the mark

Anything Else has a decrease, as this includes my 'impulse spending' which is the one area I'm still working on curbing. But as this included £72 of work related expenses in 2009 it's not as big a drop as it look at first glance. This includes bits for the house (included some baking tins and silicon sheets in 2009), CDS and DVDs (bought more than I needed!), clothes (though won't include work related ones), shoes, eating out (once only in 2009, and that was on elder GDs birthday - and I only paid for me ) and bus fares (one only in 2009, when my car let me down on a morning I was due to take GDs to school). It also included £55 on a new car battery (which woudl come out of my contingency fund in 2010) -- so the reduction (after discounting that and works expenses) isn't all that noticable, as it only amounts to about £18

) and bus fares (one only in 2009, when my car let me down on a morning I was due to take GDs to school). It also included £55 on a new car battery (which woudl come out of my contingency fund in 2010) -- so the reduction (after discounting that and works expenses) isn't all that noticable, as it only amounts to about £18

Contingency is a new one, and will hopefully cover (or at least offer a buffer zone for) any unexpected expenses such as additional vets bills or car repairs (or excess on an insurance policy should I need to make a claim).

The two I skipped are Groc Stock Pile Fund and T&C Stock Pile Fund

As I have sooooo much lying around the house that fall into these categories, I'm currently working on doing an inventory - although it's going to take weeks if not months. (I'm marking stuff as I add it to the spreadsheet, which means I know exactly where I'm at if I need to use something in the meantime). As I use something from these stockpiles my spreadsheet will deduct the cost (what I paid for if I know, or a replacement value if I don't) from the relevant category budget, and add it to the relevant Stock Pile Fund. These I'll then use if I get the chance to bulk-buy something during the year (eg. I bought frozen chicken breasts, and tins of chopped tomatoes and baked beans in Jan 2009, and still have some of all of them left!), but actually intend to try and leave alone until right towards the end of the year. By then I hope to have depeleted my stock-piles such that I can se what I have, and easily get to what I want - and this will allow me to see what I'm short of going into 2011, so I can then use these funds to get set up for that year.

(Makes sense to me, but I know it's totally lost some people when I've tried explaining it in person :rotfl: )

Effectively this means I could end 2010 with a lot of money in these categories that hasn't been spent, but when setting my budgets for 2011 I need to take into account what I've used that hasn't been logged as a "new" spend (in order to set category budgets as accurately as possible) - so this should allow me to do that with ease Cheryl0

Cheryl0 -

-

Hello fellow frugalites

Just waiting for the shortbread to bake and them I'll pop next door for that promised coffee with the neighbour. (SM, I hope you realise there's a 'wee half' to be had before the coffee! :beer:).

(SM, I hope you realise there's a 'wee half' to be had before the coffee! :beer:).

Today is one of those mega-special festive feasting days, this is probably the biggest holiday of the year in Scotland, although we don't see much of the celebrations way down here in our corner of the country. So, the clootie dumpling is already boiling away in the pan, the shortbread is almost baked (I made some into donkey shapes with my novelty eBid bargain purchase cookie cutters :rotfl:), the beef broth is ready, the steak pie is ready to go into the oven and I just need to prep the veggies. I also have my little bowl of prawns defrosted. I love prawn cocktail, whereas, the others hate it. Dawn breakfast was a slice of whoopsied melon and then mid morning, when HS surfaced, we had our usual porridge.

I've just sent HS out to the garage to retrieve a bottle of the homemade champagne, hopefully it isn't frozen solid! :rotfl:

Have a great day and I will be back later to catch up (and fully read CW's mega post - sorry, not had time, so just skimmed through it). I reserve the right not to spend.

I reserve the right not to spend.

The less I spend, the more I can afford.

Frugal living challenge - living on little in 2026 while frugalling towards retirement.0 -

Ok, I've just given myself a huge fright.

In spite of thinking I was organised... (I am in a monthly routine of bunging about £250 into the bill paying account and then spending the rest on living expenses, and shoving any extra towards overpaying debts) I've put it all down on a spreadsheet and horrified myself! No wonder I end up running to the credit card at the end of the month to make ends meet.

So: our income is £308 a week after tax (£1335.65 pm or £16027 pa)

Expenditure (weekly, monthly, yearly)

mobile phone £9.23 £40.00 £480.00

home phone £10.85 £47.00 £564.00

car fuel £50.00 £200.00 £2,500.00

car tax £4.81 £19.24 £250.00

car insurance £4.07 £17.62 £211.44

regular debt payments £61.15 £265.00 £3,180.00

Totals weekly £140.10 monthly £588.86 yearly £7,185.44

we are in the position of having electricity/rent/council tax and tv licence taken off my husbands income before it reaches us as we live in a tied house. We don't really have any control over these at all.

So after the payments above, I have 167.00 ish a week "disposable income" for grocery shopping, clothing etc though how I've been disposing of it so far has been really ditzy.

The contract on the mobile phone runs out in September. I need to look into PAYG or some way to make things less, as I don't use it enough to justify the expenditure on that.

The car fuel is quite high, but this is because I'm undergoing treatment for a skin condition three times a week so I drive to the hospital. This should not be an issue in a month or so.

I would like to hesitatingly propose a grocery budget of £50 per week for 6 adults and a labrador.

I also think it would be sensible to put £10 a week aside for vague and various expenses such as clothing, (although, thank goodness, we seem to be pretty clothed up just now!) and random car/vet/dentist bills. I'm also going to buy any garden seeds etc out of the grocery budget. (I also need to persuade myself into the mentality that certain things, ie wine, chocolate, and books should be treated like treats rather than things I buy as necessities!)

So that would give me figures of :

expenses above + groceries of £50pw +£10 =

Total family spend on everything of £200 pw (£866.66 pm £10400pa)

All remaining money to be spent on overpaying the debts.

Have I done this correctly? NWCC £[STRIKE]2800[/STRIKE] £2600 Marbles £498.18 Egg £1,022.28 o/d1800 1400

NWCC £[STRIKE]2800[/STRIKE] £2600 Marbles £498.18 Egg £1,022.28 o/d1800 1400

Cap1 £250

student grant [STRIKE]£2000[/STRIKE]£1900 C.tax [STRIKE]£2312.91[/STRIKE] £301.64 live frugally,think sensibly, stop impulse buying,look at the bigger picture,relax,remember to budget,say no to the bairns. NSDs 6/10 GC £300/£200

FL £0/£2000 -

I expect most people to do just that, but it means I have it somewhere to refer back to at the end of the year - even if my laptop becomes one of the things to eat into my contingency fund :rolleyes2.......and I will be back later to catch up (and fully read CW's mega post - sorry, not had time, so just skimmed through it). Cheryl0

Cheryl0 -

hooray hooray happy new year everyone!

as people were saying in the intro thread (sorry no memory for names!) 2009 was a pretty rubbish year for me, but 2010 is now here to thrive! bring it!

Ive worked out my budget based on the DD's i have currently, but over the course of the year most of these will hopefully shrink as contracts end and I do lots of switching!;)

My figure is £4250 excluding rent and council tax but including everything else. This is for me, my beautiful rescue greyhound Penny and Maggie the 11 yr old Micra (who takes up a sizable chunk of budget! Im toying with the idea of going car less and may take the plunge later this year... of the £4250 Maggie is costing me £1084!! Thats a quarter of my budget on a car! Not including any other unexpected travel costs!:eek:

Good luck to everyone this year! Lets do it!:j:beer::j0 -

Looks good to me :Tsigns_of_recovery wrote: »Total family spend on everything of £200 pw (£866.66 pm £10400pa)

All remaining money to be spent on overpaying the debts.

Have I done this correctly?

And it always gives me a fright to see it written down too (even after a full year of doing this) - so you're not alone there Cheryl0

Cheryl0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards