We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Unenforceability & Template Letters II

Comments

-

Hi Never

I received my second letter from Barclaycard today basically disagreeing with what we put in the last one. I also got a lame excuse of a CCA from Cap One. Not signed or anything.

I see others have posted copies of there letter here, but as there is a lot of typing to repeat this, is there a way scanned letters can be posted or do you or others here know how to scan and copy the text?

By the way I only have £260 on the bcard account but £4k ish on the cap one. No response from 5 others so your original second letter will go off on Monday. 0

0 -

Greetings, NID et al. How do!? Long time no see (or seems like it).

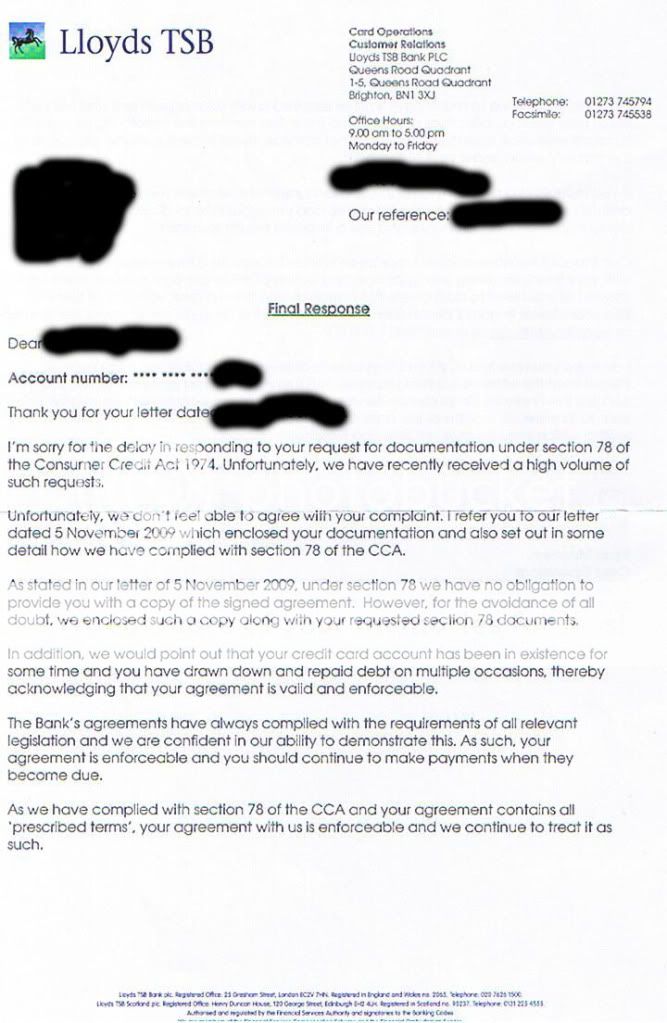

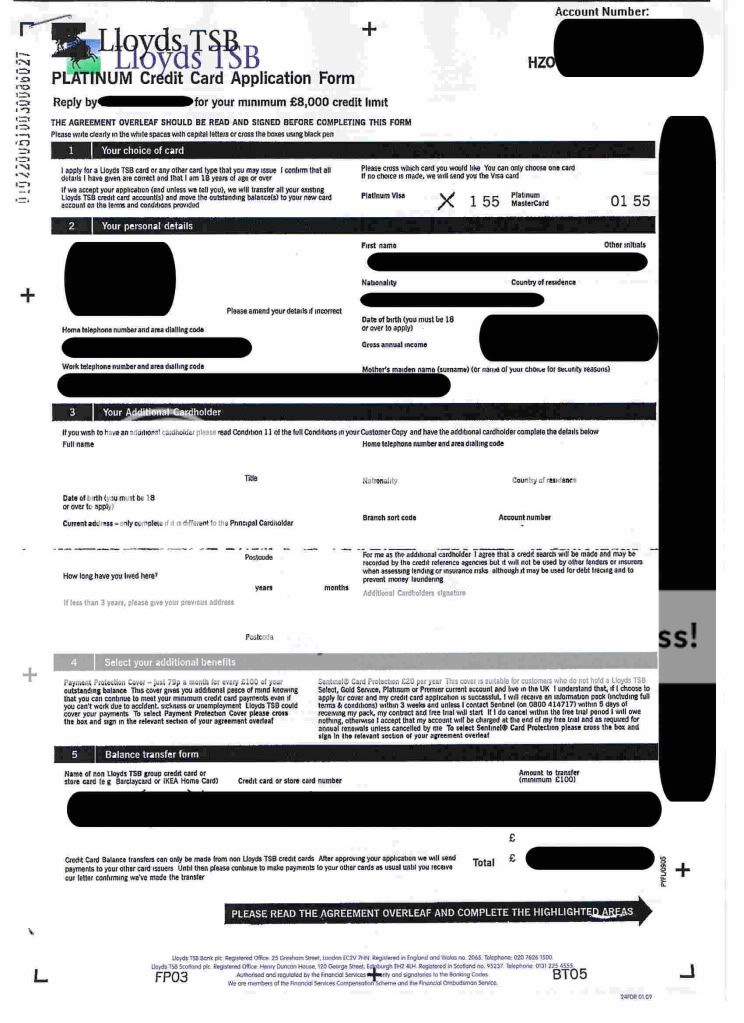

I've had a response from Lloyds to my dispute letter. Here's what they say :

What do you make of this mate? What do you think my next step should be?

CheersHi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

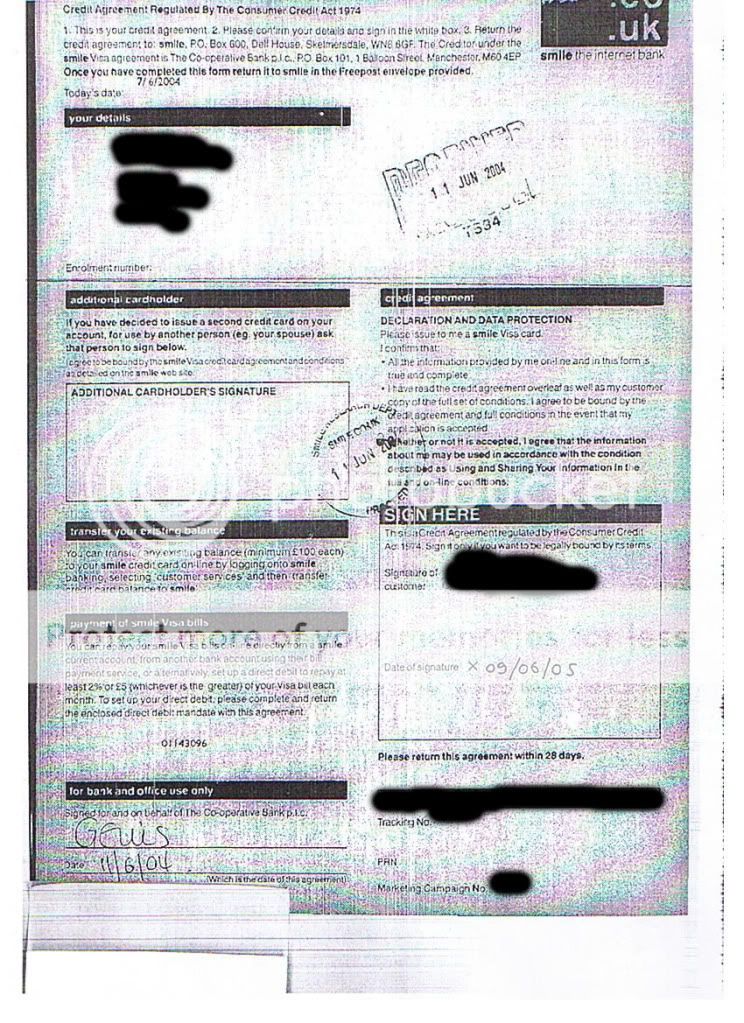

ALSO, I got the following back from Smile..... This is for a Classic credit card.....

Now this one is odd.

For starters, the date of signature on the bottom (i.e. my own signature) is 2005. Smile have stamped this all recieved in 2004... so a year before I signed it.

ALSO, the signature doesn't look like mine.

ALSO, the way the date I signed is written looks nothing like my writing.

ALSO, I am absolutely positive that I took this account out LONG before the date on the CCA or even long before the date stamped on the CCA.

I'm at a loss!Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

captainhaggis wrote: »Greetings, NID et al. How do!? Long time no see (or seems like it).

I've had a response from Lloyds to my dispute letter. Here's what they say :

Hi matey - ok, here's what i'd say back to them (with a copy of the CCA they originally sent you)! They aint got a clue! Dear Sirs,

Dear Sirs,

Account No: XXXXXXXX

I write with reference to your letter dated xx/xx/xxxx, the content of which has been noted, and subsequently disregarded in its entirety due to the fact you have still not responded with my simple request to supply me a photocopy of the original agreement. In response to this request I was supplied the document, a copy of which is attached, which did not comply with the requirements of the Consumer Credit Act 1974 (CCA1974).

Back to your letter;

You apologise for the delay due to 'receiving a lot of requests for these' but I do not feel that your staffing problems are anything to do with me so please try and remain on the subject matter in your subsequent responses as deviation costs me time; something valuable to me right now. You then go on to say you do not feel able to agree with my complaint and try to quote me the provisions of s.78 (CCA1974) which is utter nonsense. Have you any idea what s.78 of the act actually states?

I quote;

78(1) of the 1974 Act provides similar duties in respect of running-account credit agreements. The debtor can request a copy of the executed agreement (and any document referred to in it) together with a statement showing:As is clear from the above, you are duty bound to supply me with a copy of the executed agreement and to me, executed means a copy of the form you allegedly sent me at the time the account was opened. I am more than happy to pursue Civil Procedure Rule (CPR 31.16) disclosure action, if necessary which will then mean you have to comply with my request. The more you refuse me a copy suggests you do not have one meaning I will pursue this to the hilt.

• the state of the account

• the amount, if any, currently payable under the agreement

• the amounts and dates of any payments that will become payable if there are no further drawings on the account (or if not ascertainable, the basis on which this will be determined).

The next paragraph of your letter is rather amusing, to say the least. Without going into too much detail, I think we both know that just because somebody may have used and repaid a card account does not constitute - in a court of law - legal compliance. I am not for one moment suggesting I am trying to avoid repayment of any alleged debt, moreso that I wish to confirm the legality of the agreement at the time the alleged account was opened. May I suggest you seek professional legal guidance in this matter because it appears you are being misled from the replies i've received from you so far.

You then go on to mention that the bank always issues compliant agreements, you obviously forgot about the case of Gary Lloyd vs Lloyds TSB (2007) then? I think this point has been proved, with a simple Google search. Incidentally, have you seen this letter, it is very familiar: http://contractchecker.co.uk/examples/lloyds.gif

I do not see the need to continue to correct the mistakes, in your understanding of the legislation, from your letter but instead propose that you comply with my request or walk away before I take legal action against you, to recover a photocopy of the original agreement. Bear in mind I have studied the agreement you have sent and this does not meet the Prescribed Terms. Therefore I need to see the original to determine the legitimacy of the agreement and subsequent contract.

I sincerely hope you do not consider collection activity as the OFT Guidance clearly states that it is unfair to pursue third parties for payment when they are not liable and in not ceasing collection activity whilst investigating a reasonably queried or disputed debt; you are deemed to be using deceptive and/or unfair methods. Additionally, ignoring and/or disregarding claims that debt is being disputed, whilst continuing to make unjustified demands for payment amounts to physical & psychological harassment.

I would ask that no further contact be made concerning the above account unless you can provide evidence as to my liability for the debt in question, by way of sending an original copy of the agreement, and await your written confirmation that this matter is now closed.

I look forward to your reply.

Yours faithfully

Sign digitally 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

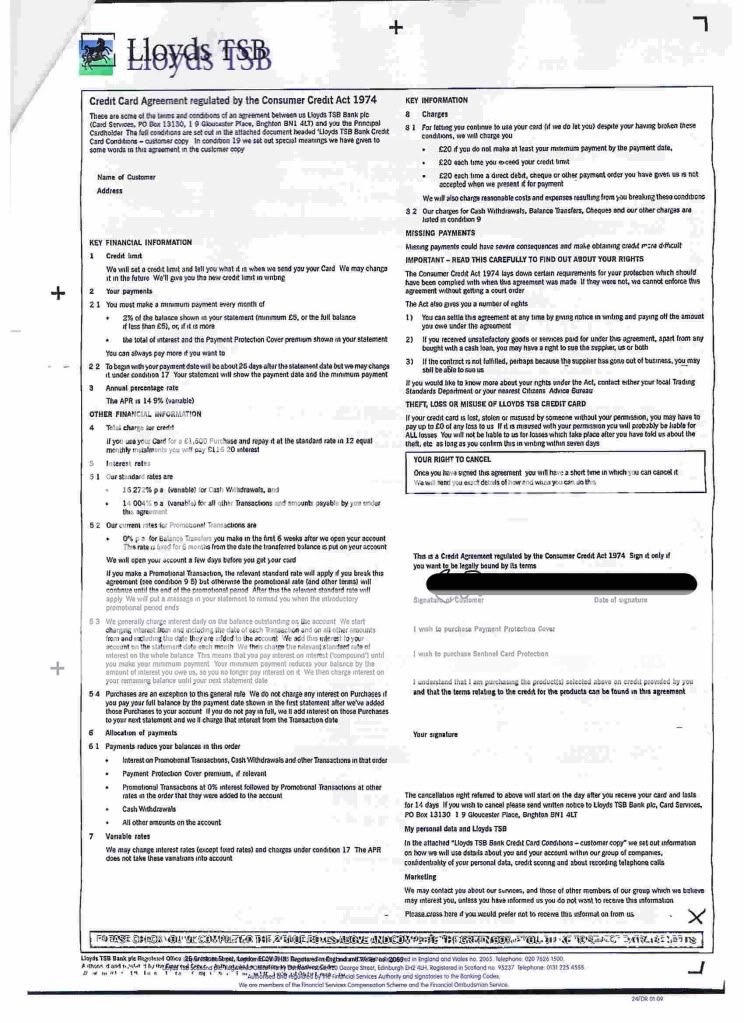

captainhaggis wrote: »ALSO, I got the following back from Smile..... This is for a Classic credit card.....

Send this to them matey with a copy of the CCA they sent you (i.e. what you posted up!) ......

Dear Sirs,

Dear Sirs,

Account No: XXXXXXXX

On xx/xx/xxxx I wrote requesting that you supply me a true copy of the executed credit agreement for the above numbered account. In response to this request I was supplied the document, a copy of which is attached, which did not comply with the requirements of the Consumer Credit Act 1974 (CCA1974) because it is a forgery - quite simply.

The form was signed by G Ellis on 11 June 2004Just a quick question if I may; how was it possible for you to stamp the form as received in June 2004 but it was not signed until June 2005? The handwriting is also not my own nor is the signature shown on the agreement. I assume you are aware that falsifying a legal document is a severe crime, so is fraud (which is what this amounts to)?

The form was stamped by Smile on 11 June 2004

The form was signed by the customer on 9 June 2005

The signature and date is not my handwriting

I therefore offer you 14 days in which to confirm that this matter is closed and no further action will be taken by Smile, otherwise you'll hear from my solicitor and no doubt the press will be hounding you when I advertise the evident fraudulent activity with the agreement. I suggest you give serious consideration to this as any attempt of litigation will be vigorously defended and I will counter claim for all quantifiable damages.

I respectfully request a response to this letter in 14 days.

Yours faithfully

Sign digitally 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Hi Never

I received my second letter from Barclaycard today basically disagreeing with what we put in the last one. I also got a lame excuse of a CCA from Cap One. Not signed or anything.

I see others have posted copies of there letter here, but as there is a lot of typing to repeat this, is there a way scanned letters can be posted or do you or others here know how to scan and copy the text?

By the way I only have £260 on the bcard account but £4k ish on the cap one. No response from 5 others so your original second letter will go off on Monday.

If you're not happy at the response crappy1 sent you then just send the CCA Query letter (this is generalised for ease) which tells them the prescribed terms are not intact. Then just let them write back telling you why they are (i.e. don't do thier job for them lol)....

Letter here: #5 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Hi matey

I'm loving the pants off the letter to Smile. Oucha!

As for the Lloyds one, I'm less sure (but no less impressed!)

They DID send me a CCA and it WAS signed etc. I seemed to think it looked OK but you said it didn't look good to you.... Before I do press on with this next letter to Lloyds, could you remind me why you think this isn't enforceable? Do you remember the documents?

Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0

Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

never-in-doubt wrote: »Yes mate you ignore them now. If they write back let us know what they say and we'll sort it.... ideally we want to sit tight until january and see what happens with the test case judgement

Cheers, will wait and see what happens next. Got a response to the Clydesdale letter we sent out, they are looking into my complaint and will be in touch. Will let you know the response to that one. Thanks again for all your help.:idea: Had lbm, switched it off too many times. Now am trying to sort my life out :T:T

:T Proud Supporter of Niddy :T0 -

I received a letter from Triton credit services

Creditor: National Westminster Bank Plc

Creditor Ref: ****************

Amount Due: £12,994.24

Dear Mr Terimon,

We have been formally instructed by National Westminster Bank Plc in respect of the above unpaid debt that despite numerous reminders, you have failed to settle or to make mutually acceptable repayment arrangements.

We must inform you therefore, that unless you telephone National Westminster Bank Plc on 0870 909 3809 immediately with you proposals of repayment, thr debt will be referred to us or an equivalent debt recovery agent for collection.

Yours Sincerely0 -

I sent off a CCA to NatWest for a CC i have had for 13 years but cant afford to pay now. They replied by wanting a signature which i refused and sent the follow up letter

Today i received a letter from (including the return of my postal order) saying:

I write with reference to your recent request under section 78(1) to supply copies of the original agreement set out under the Consumer Credit Act.

We regret to advise that the agreement has been misfiled and despite searching our records we have been unable to locate it. Regrettably we are unable to comply with your request made under section 78(1) of the CCA and return your £1 you paid. Notwithstanding this the agreement remains valid, and we expect you to continue to meet your obligations under the agreement. We should point out that if you do not resume making payments we will report the default to the Credit Reference Agencies.

Section 78(6) 'Unenforceable' omly prevents us from pursuing recovery of the debt through the courts.

I trust this clarifies the matter for you.

Yours sincerely

I write with reference to your recent request under section 78 (1) to supply copies of the original agreement set out under the Consumer Credit Act.

We appreciate that under s.78(6) of the Consumer Credit Act if you decide not to meet your obligations under the card agreement as they fall due we will be unable to take steps to enforce repayment of the card debt by court action. Nevertheless, we expect you to meet your obligations under the agreement, bearing in mind that the agreement isn't void, and remains valid albeit unenforceable.

We do not dispute that the agreement is currently not enforceable so we see no need for any threatened action to obtain a court declaration to that effect.

For the avoidance of doubt and as previously advised if you do not make the card repayments as they fall due we will report your default to the Credit Reference Agencies.

-The information Commissioner Office have considered the circumstances in which credit reference agencies should be permitted to record details of unenforceable credit agreements.

-The ICO has expressed the view that where a credit agreement clearly existed and credit has been provided to the debtor and notwithstanding that it may not fulfil all the requirements of the CCA and as a consequence, the agreement is unenforceable, it is appropriate for information about the agreement, including any failure by the debtor to repay his or her debt, to be recorded with the credit reference agencies. A factor in the view expressed is that responsible lending decisions are dependant upon lenders receiving accurate information about individuals' ability (and/or inclination) to repay their debts.

This is our final response in the matter.If you are dissatisfied with this final response, you may refer your concern to the Financial Ombudsman Service. I can assure you that we will co-operate fully with any investigation they may undertake. If you decide to take this course of action, you must do so no later than six months from the date of this letter.

The enclosed leaflet, produced by the Financial Ombudsman Service, gives you more details about what thet do and how you can contact them.

Yours sincerely0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards