We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Mortgage Approvals up in April

Spiv_2

Posts: 280 Forumite

Mortgage approvals rose in April

"The number of new mortgages approved for home buyers rose in April for the third month in a row, according to the Bank of England."

http://news.bbc.co.uk/1/hi/business/8078426.stm

"The number of new mortgages approved for home buyers rose in April for the third month in a row, according to the Bank of England."

http://news.bbc.co.uk/1/hi/business/8078426.stm

0

Comments

-

If anyone is interested:This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0

-

so thats roughly a 34% increase in mortgage lending since January?

what's the average % increase in mortgage lending from January to April?

be interesting to see (to take out the time of year spring thing)0 -

You're getting desperate now. 43,201? Is that all? And that's with the spring bounce; what's it going to be like when we hit the winter?

"Bank of England figures showed mortgage approvals rose for the fifth month in a row in April to a one-year high of 43,201. That was higher than the 41,000 expected and an increase of 3,163 compared with March.

Although it represents a sharp increase on the record low of 27,501 approvals in November, the number is also far short of the 2007 levels of approvals which were above 100,000. "

.0 -

-

You're getting desperate now. 43,201? Is that all? And that's with the spring bounce; what's it going to be like when we hit the winter?

It's bears like you that are getting desperate when you try to portray a 34% increase in approvals and 28% increase in lending as bad news. And the spring bounce is irrelevant, these figures are seasonally adjusted.0 -

You can seasonly adjust all you want. There's a massive gulf between 43,000 and 100,000+ mortgage approvals.0

-

Lets just put things in perspective with these approvals of 42,000, I have posted a link below which shows BoE mortgage approvals back to April 1993, house prices were still falling between then and '96 yet mortgage approvals averaged over 80,000 per month at that time, the lowest point being 69,000 in June 1995.

Take a look at the graph on this page, and the figures that go with it to see that 42,000 approvals a month is absolutely shocking especially as we are seeing Spring's figures coming through.

http://www.housepricecrash.co.uk/graphs-mortgage-approvals.php

It can only be looked on as a positive compared to the apocalyptic figures from late last year, it also proves the massive funding gap that is still apparent even though the government is giving away billions in future tax receipts to try and prop up the market. It will end in tears, mark my words.0 -

-

Lets just put things in perspective with these approvals of 42,000, I have posted a link below which shows BoE mortgage approvals back to April 1993, house prices were still falling between then and '96 yet mortgage approvals averaged over 80,000 per month at that time, the lowest point being 69,000 in June 1995.

Take a look at the graph on this page, and the figures that go with it to see that 42,000 approvals a month is absolutely shocking especially as we are seeing Spring's figures coming through.

http://www.housepricecrash.co.uk/graphs-mortgage-approvals.php

It can only be looked on as a positive compared to the apocalyptic figures from late last year, it also proves the massive funding gap that is still apparent even though the government is giving away billions in future tax receipts to try and prop up the market. It will end in tears, mark my words.

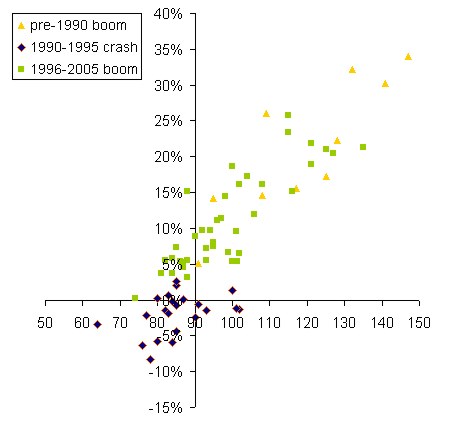

your graph is too one-dimensional Ad - it just shows the ups and downs. you should know by now that sourcing data from HPC.co.uk has it's own agenda...

have a look at this chart, also posted it elsewhere and it will explain why your comments "mortgage approvals back to April 1993, house prices were still falling between then and '96 yet mortgage approvals averaged over 80,000 per month at that time, the lowest point being 69,000 in June 1995" don't have much relevence due to the house sales also being driven by cash purchases or very low LTV's during that period. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.4K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.8K Spending & Discounts

- 244.4K Work, Benefits & Business

- 599.7K Mortgages, Homes & Bills

- 177.2K Life & Family

- 258K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards