We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

When will we get growth again?

Comments

-

I think the poll is too optimistic and also to qualify as leaving a recession we'd need two quarters of growth?

On that basis it might not be till the next Olympics that we see some benefit, we are lucky to have that at this time

However its not impossible end of this year could happen to see 1 quarter of growth, I dont fully understand QE but if foreigners buy our debt at low rates then we're ok.

If we enter a death spiral of inflation, etc then less so

I'll vote Q2 of 2010 as I believe in people and general technology advances to make Britain efficient again despite the best efforts of (big) government

A sharp short recession might have been if all the banks had collapsed, that didn't happen so it'll be a while. (friday night analogy - get drunk, be sick vs hangover)

Yes this poll should be repeated on the front page, we're all gloomers Also a comparison to the 70's depression might be relevant, I wasnt investing then so if anyone was it'd be good to hear their opinions. This point of view is much undervalued just like that wall street trader who was there in the 30's and is still now, ben beneke has a live witness but he goes unheard 0

Also a comparison to the 70's depression might be relevant, I wasnt investing then so if anyone was it'd be good to hear their opinions. This point of view is much undervalued just like that wall street trader who was there in the 30's and is still now, ben beneke has a live witness but he goes unheard 0 -

The end of a recession is when +ve growth first appears according to most economist's definitions. I would prefer to define it as the point where quarterly growth returns to what is called 'trend' which is the level of growth that the economy can acheive without pushing inflation higher. For the UK that figure is about 2.3-2.5% pa so perhaps 0.8% per quarter.

GDP = consumption + investment + government spending + exports - imports. So for GDP to rise, one of the constituent parts needs to rise.

So how is the UK going to acheive that? Well at the risk of stating the bleedin' obvious, the UK needs to sell stuff. So what can it sell?

In the recent past, the UK's exports have comprised oil, financial services, design/advertising/music/TV (let's call them 'media') and high tech engineering (including car production).

Oil sales are falling as the world's economy gets tougher and the 'low hanging fruit' in the North Sea has been plucked. There are obvious problems in the financial services sector and I think it is fair to say that the financial sector will not be the size that it was in 2007 for many years to come. The other 2 areas will only be likely to grow once the economies of the UK's main export markets grow and that looks to be some way off.

So if foreigners aren't going to buy things from the UK, British people will have to do it. That could either be the UK Government or British consumers. Unfortunately both of them have borrowed huge amounts of money and in the case of the consumer at least will need to repay some of that before they can borrow again to consume. Borrowing to consume is really bringing consumption forward from tomorrow to today. Now tomorrow has arrived and consumption will have to fall to match the prior rise.

So that brings us to the last piece of what makes up GDP, investment. This is where the green shoots may be hiding. Interest rates are at half a percent which makes investment very appealing. If companies invest then they take on staff. Those staff then have money to spend on taxes and consumption. My feeling is that if interest rates can be kept low for a long time, investment by companies is likely to be what leads the UK out of recession.

The only real problem with that is the time it takes - it'll take perhaps a year for investment to take off (investment decisions take time and then it takes longer still to get the money together and get everything going) and perhaps 18 months to 2 years after that for it to have a big impact on unemployment.

Recovery is out there eventually but it'll take a while yet. My biggest fear is that the huge costs that will be placed on the UK economy by massive Government borrowing will make British industry unable to compete and so rule out recovery. Also, high levels of borrowing 'crowd out' investment by industry although that is less of a problem with interest rates at very low levels.0 -

Extracts from this week's "In the Red" Book ... I will leave these to stand alone, and offer comment in another post.

If many little people, in many little places, do many little things,

If many little people, in many little places, do many little things,

they can change the face of the world.

- African proverb -0 -

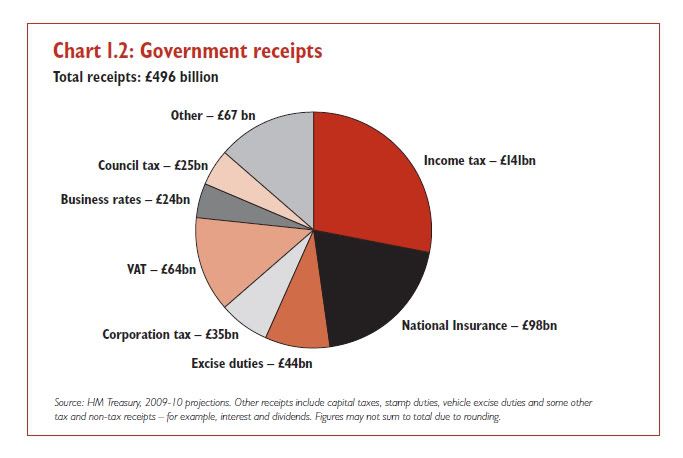

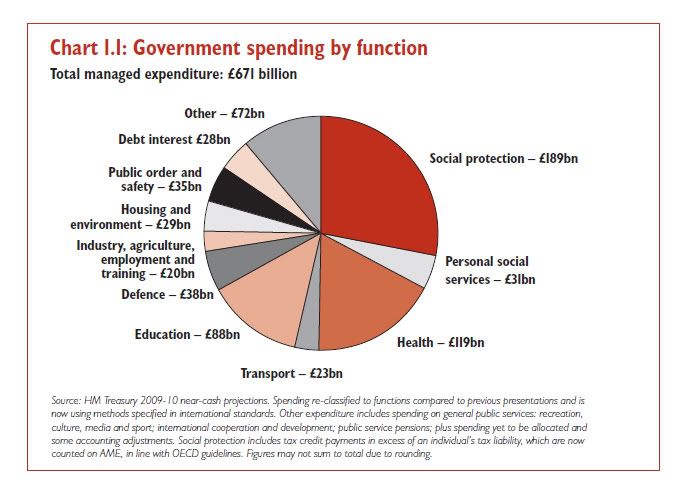

The above post shows the gap between Government Income and Expenditure.

For me a number of (main) thoughts occur:

1: Leading on from Generali's post, but adding to it, I think we all know that there will be cuts in expenditure, and at the next election my own guess is that we will be voting in part on what we hear about what those cuts will be (eg., ID cards), and whether we actually believe what we are being told.

2: More importantly, I kinda look at those figures and put them into a personal perspective, namely -- they show me my spending, and my income - but what they don't show is how I pay back the borrowing that I have, or am about to take on, to cover the gap - and repaying the enormous levels of debt involved will dictate our future for many years to come..

That is the really depressing bit for me, if covering the expected gap (and allowing for the figures being projections - not reality) how long will it actually take me to pay back the loans I am taking on - perhaps as much as £1trillion.

Generali mentions "trend growth", and is correct in so doing - and that is where it gets depressing - even at that rate of trend growth, if we get back there, it still means that it will be ages before we get back to a reasonable/affordable level of national debt - one that will allow for us to move forward.

As I said in an earlier post, we are in a deep deep hole, and when we hear of "signs of growth or recovery" - just remember how deep the hole is - we are going to be in it for a very long time.

*EDIT* - Martin, you do not have to be an economist to look at those levels of income, spending and borrowing without concluding that MSE techniques need to be adopted, namely how many ways can be found to increase the income, reduce the expenditure, and repay/balance the debts asap.If many little people, in many little places, do many little things,

they can change the face of the world.

- African proverb -0 -

While the debt is a huge concern in terms of its projected rising levels, it is important not to treat the very notion of debt as a villain in the piece. It is healthy to have some level of debt within the economy, after all, if the country's finances were to be equated to the statements of a company, debt represents the leverage that the firm takes on, which is essential to the firm trying to make the most in achieving its (predominantly profit-oriented) objectives.

Mapping this back to the country's finances, the objectives are more diverse, significant among them being ensuring the wellbeing of the people through spending on public services, having adequate to cover for benefits, however maligned they may be on account of their misuse. The country takes on debt in the form of leverage to try and optimize achievement of its objectives, but importantly, tries to have a clear strategy to service the debt in question, mainly keeping the interest costs under control by having adequate interest coverage ratios, and also ensuring that risk of default on the principal amounts is minimized. It is this last point that is the bigger concern facing the UK currently.It's always the grass that suffers, irrespective of whether the elephants are fighting or making love !!!0 -

meaning??????

Growth has been stimulated by credit for the past 60 years + are you saying none of this was real growth?'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

Official growth figures are less important than the balance sheet.

Golden rule borrowing has been blown out of the water. This should be dealt with now, not after the next election.

Real growth comes out of trading innovation/efficiency/skills/growing population, we would be in a better position now, if we hadn't wasted billions in the past. 60 years ago we had a war to pay for, not ministerial blackberry's and five a day coordinators on the never never.0 -

I have thought about this poll a lot since it was started, and have finally gone for Q4 THIS YEAR, by then the car production figures will have worked their way through, the numbers will still be poo but the YOY numbers will have stabilised. I also think that those who still have a few £££ in the bank will have a spend up around xmas and into the new year giving 2 quarters of growth, but then I think the numbers will go negative again in Q2 and Q3, and Q4 of 2010 will be the first of several years of positive numbers[strike]Debt @ LBM 04/07 £14,804[/strike]01/08 [strike]£10,472[/strike]now debt free:j

Target: Stay debt free0 -

http://www.independent.co.uk/opinion/leading-articles/leading-article-the-stark-questions-posed-by-a-desperate-budget-1674012.htmlJust as crucially, we need a vision of what industries will provide Britain's economic prosperity in the coming years. In recent years the financial services sector has accounted for some 30 per cent of corporate profits.

The fall in tax receipts from the banking industry is one of the central reasons for the catastrophic deterioration of Britain's public finances.

Mr Darling was right about one thing in his Budget speech: Britain cannot cut its way out of recession.

Economic growth is the only route to a healthy recovery. But where will that growth come from now that the unsustainable expansion of the banking sector has come to an end?

This week's Budget confirmed that Britain's old political and economic world has passed. But its replacement is still struggling to be born.

We also have to work out what is going to bring about the increase....or will we just rely on Tesco and the like to deliver the growth perhaps through ''bully business'' or oligopoly style business tactics...allegedly;)

Deborah Orr: What's wrong with us needing to grow a whole new economy?

http://www.independent.co.uk/opinion/commentators/deborah-orr/deborah-orr-whats-wrong-with-us-needing-to-grow-a-whole-new-economy-1673993.html

OK, She gets paid just to write about it...a whole different ball game doing the doing...but not bad article.

Some of you guys should join me in designing and making things...it may help a little?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards