We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Banks cancelling overdrafts

Comments

-

Yes and I also doubt a family of 5 would have both parents on minimum wage.

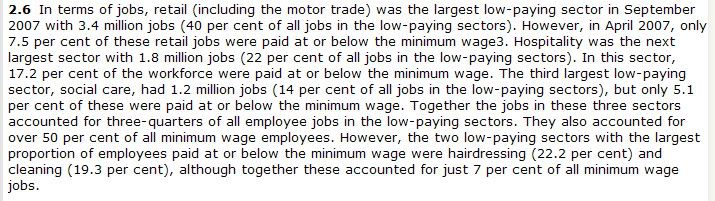

The following are extracts from a report by the Low Pay Commission - but from 2007 - as the economic problems mount, finding a job may be the bigger problem.

But my reason for posting these is - hopefully - to illustrate that depending on many factors, but particularly perhaps the region of the UK, linked with the skill sets of the individuals concerned - you may, just may, want to consider whether your questioning of the comments from another poster is justified, let alone constructive in the overall debate.

For me it seems entirely (and sadly) only too possible to have two parents on the minimum wage, and I have no reason to doubt that situation, however, I leave you to judge, here are the details (2007)******************

If many little people, in many little places, do many little things,

If many little people, in many little places, do many little things,

they can change the face of the world.

- African proverb -0 -

I had a quick look at this yesterday, but will have a better read later. However I did notice that someone had posted "£1 a day each for food"! Realistic (not!). Blah, blah, Aldi, blah, blah, Lidl, blah, blah, Netto, blah, blah, value range. I do the value range - unfortunately other than that we have only Tesco, a local supermarket whose prices are the same as Tesco, or the Co-op, and I'd have to be desperate to go in there as their prices as astronomical. I don't believe anybody can eat healthily on £1 a day - 'something on toast' is not what I'd class as a meal.

You can take a horse to a river.... 0

0 -

Stop being pedantic, you know what I am saying.

Yes - you're generalising. Every single situation is different. You (and others) appear to be saying (reading between the lines) "I can manage on my income, therefore you can manage on yours" "I can manage without an overdraft, therefore so can you".

The bottom line is that the banks are really doing the dirty on people by withdrawing an essential monetary buffer with little or no warning, then slapping enormous charges on them which in many cases are going to be impossible to pay back, and they will increase on a monthly basis when the charges take them further and further into the red.0 -

You can take a horse to a river....

Meaning . . .?

Actually you remind me of someone I used to work with. I was single, living away from home (abroad actually) and she still lived at home. She was telling me about something she'd been spending money on and telling me I should do the same. When I told her I couldn't afford it (we were on about the same money) she looked incredulous and asked "what do you spend all your money on?" I was pretty speechless at that question. Rent, bills, food perhaps? She apparently 'contributed' to the household finances by, in her words, buying the odd vase. She didn't have to pay board or buy any food so had no idea of 'how the other half lived'.0 -

The following are extracts from a report by the Low Pay Commission - but from 2007 - as the economic problems mount, finding a job may be the bigger problem.

But my reason for posting these is - hopefully - to illu ......

etc. save space

As I said before, I am not saying its not possible. I know plenty of people on minimum wage who have families to feed but they don't go and get overdrafts and loans, they learn how to budget. They don't have computers in their house, they don't have internet. They send money home every month to help their family. (they are Polish immigrants). They work 12/13 hours a day sometimes.

I'm not saying people don't have it tough by all means, but a lot of people exagerate problems they have. This is England remember lol 0

lol 0 -

Banks have a duty to lend responsibly, and those who have easily gained overdrafts and use them regularly (including myself and many others here) may well find themselves in trouble with them on the clause that the bank can remove it at any time. However, I believe (correct me by all means if I'm wrong) the banks cannot (by law?) then put their client in more trouble by completely removing a 3 or 4-figure overdraft and then adding charges because they can't repay it back. To add charges on a daily or weekly basis for those then over their new limit (often £0) claiming it is interest might be fair enough. Adding "administration" charges on top of those interest charges is highly immoral, and the banks are not only putting themselves at risk of a backlash from the client in question, they are also putting massive pressure on their client which is very immoral, and is basically bullying.0

-

I've posted a thread about it, but I was wondering if you could help.

Do you think HSBC would cancel my Graduate OD, rather than just reducing the interest free portion if I don't use. The plan was to pay in a little every month, but at the minute money's a bit tight. Do you think I should put my wages in there (bearing in mind I have another OD, whilst I wait for my Housing Benefit claim to be processed). It's due for renewal in September.0 -

Yes - you're generalising. Every single situation is different. You (and others) appear to be saying (reading between the lines) "I can manage on my income, therefore you can manage on yours" "I can manage without an overdraft, therefore so can you".

The bottom line is that the banks are really doing the dirty on people by withdrawing an essential monetary buffer with little or no warning, then slapping enormous charges on them which in many cases are going to be impossible to pay back, and they will increase on a monthly basis when the charges take them further and further into the red.

Yes and if you read through my replies I am not saying I am agreeing with the banks!

I am just saying consumers have a responsipility too, which they don't seem to care about and go on their wayes living in overdrafts, then throw a hissy fit when things are changed.

... well its a pretty well known expression. We've told you where you can cut back but its upto you to make it work. You obviously don't want to try and cut back. Your loss. Keep complaining. When it really comes to it you will regret not making the right decision. Just as many of those who are in debt choose not to.Meaning . . .?0 -

As I said before, I am not saying its not possible. I know plenty of people on minimum wage who have families to feed but they don't go and get overdrafts and loans, they learn how to budget. They don't have computers in their house, they don't have internet. They send money home every month to help their family. (they are Polish immigrants). They work 12/13 hours a day sometimes.

I'm not saying people don't have it tough by all means, but a lot of people exagerate problems they have. This is England remember lol

lol

It's good that we all have our own opinions, but sometimes knowing when, or when not to express them is even better.

Mind you, maybe you are right and I am wrong - maybe offering judgements on someone you do not know is acceptable, to me it is not - but hey, my problem might just be I live in Scotland :A

*EDIT*

PS: Just for the record (although I subsequently deleted the post) it was me who asked via an e-mail for the posts to be moved, and MSE Andrea (I think) who carried it all out. So maybe I am not all bad, huh? Again, I leave that to your judgement, ok.

It might also appear to be sycophantic to say I prefer to see you in your more helpful persona - it might be, but it would definitely be true.If many little people, in many little places, do many little things,

they can change the face of the world.

- African proverb -0 -

I've posted a thread about it, but I was wondering if you could help.

Do you think HSBC would cancel my Graduate OD, rather than just reducing the interest free portion if I don't use. The plan was to pay in a little every month, but at the minute money's a bit tight. Do you think I should put my wages in there (bearing in mind I have another OD, whilst I wait for my Housing Benefit claim to be processed). It's due for renewal in September.

Without an income they are more likely to remove it straight off, I would at least try and move half wages or something over each month. A lot of graduates who usually haven't found a job after 6 months find that they have their overdrafts removed quickly (more risk), as shown through this site.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards