We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What happens if the UK goes bankrupt (if it isn't already)?

Comments

-

John_Pierpoint wrote: »The miners' strike came near to civil war in my humble opinion.

Police road blocks everywhere. Concrete blocks dropped on black legs from motorway bridges.

I think you are underestimating the interconnection of everything these days.

It could be a lot worse than the electricity/toiletpaper/candles/sugar/etc. empty shelves experiences of the 1970's

You should of lived in a mining village at the time like I did,it was very scary.0 -

The next problem is likely to be in trade - it's becoming harder to pay for traded goods across the world as nobody wants to extend credit to their fellow man. People need credit to bridge the time between buying and selling their goods as I'm sure you know.

The problem after that will be Government borrowing. All Governments are trying to borrow huge sums of money and I'm not sure the cash is there.

Those are my predictions. Time will tell if I'm right or not. Watch out for protectionism and Governments printing money. Those will be the 2 things that turn a drama into a crisis.

Thanks. It's hard not to be positive when the sun is shining and the Generalissimos are happy!

Anyway, am off for a siesta. I did a big training ride this am and need some kip.

Regards to Mr fc123 too.

I have a feeling that my micro manufacturing venture could do OK out of all this for a while......though the high inflation that may come will be a learning curve. We've got used to selling/ making things for the same (or less) price for years.

Training and sleeping....sounds like a hard life;) ......but you're not missing much here....0 -

neverdespairgirl wrote: »That's a wonderful article, thanks for the post.

This bit's fantastic:

This was all financed by Landsbanki, one of the raiding banks that spent like mullered fishermen and borrowed like agoraphobic Vikings, who leveraged the economy into the stratosphere without a Keynesian parachute, along with every other bank in the monetarist world.

And I love his new collective noun:

Further down the shore is a speculation of modern flats, expensive, insubstantial urban penthouses that may well remain empty for ever.

and his flattering description of the Icelandic govt:

The Icelandic government is a dozen shepherds and a couple of grocers in Specsavers and M&S suits.

Bits of it sounded like UK too.

How fab would it be to be able to write like that? One day I am going to learn that skill....when I am an old ladee.;)0 -

As we get ready to celebrate the second anniversary of the death of Leman Brothers Bank; perhaps it is time to take stock again.

http://en.wikipedia.org/wiki/Bankruptcy_of_Lehman_Brothers

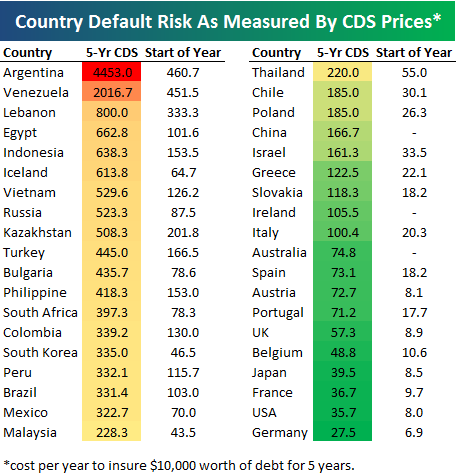

Interestingly in this table all the PIIGS including Greece were still in the green, unlike Greece's Balkan neighbours Bulgaria & Turkey, because it is a Euroland member.This is a table of default risk as measured by the CDS market for individual countries. It was taken in Just before Iceland blew up I believe so not too long ago. 0

0 -

IS there a table to show the figures now?0

-

I have some for the G7 Link:

USA 38

Japan 44

Germany 29

UK 64

France 54

Italy 158

For some reason Markit doesn't provide a CDS price for Canada, the 7th member of the G7. Not a liquid enough market at a guess. Markit is a well known and respected provider of pricing data for the financial services industry so the prices will have a good basis in the reality of the market.

CMA (who?) provide a list of the most expensive CDS rates link. They have a Greek CDS at 878.39 which apparently implies a 52% chance of default.

It's worth remembering that the sovereign CDS market is immature and illiquid so price discovery probably isn't great.

It's also probably worth considering that if you take out a CDS about the USA or Germany going bust and it actually happens then you probably don't have a great chance of getting your money!0 -

"The state is the great fiction by which everybody seeks to live at the expense of everybody else." -- Frederic Bastiat, 1848.0

-

Im sure you cant just print money off & then thats it sorted, everybody is paid off. That would create inflation in our country, but how would it affect our relationship with other countries?

I hope you don't mind my auxiliary question I think its on-topic

Why not thats what the US is doing!

It only hurts themselves as China are dumping the $ are urging its citizens to buy silver bullion.0 -

I have some for the G7 Link:

USA 38

Japan 44

Germany 29

UK 64

France 54

Italy 158

For some reason Markit doesn't provide a CDS price for Canada, the 7th member of the G7. Not a liquid enough market at a guess. Markit is a well known and respected provider of pricing data for the financial services industry so the prices will have a good basis in the reality of the market.

CMA (who?) provide a list of the most expensive CDS rates link. They have a Greek CDS at 878.39 which apparently implies a 52% chance of default.

It's worth remembering that the sovereign CDS market is immature and illiquid so price discovery probably isn't great.

It's also probably worth considering that if you take out a CDS about the USA or Germany going bust and it actually happens then you probably don't have a great chance of getting your money!

I'm still trying to get my head around what the point of a CDS for a sovereign nation that issues its own currency is. At worst such countries will stealth default - you'll get your pounds, dollars or yen back, they just won't be worth as much. Surely this certain repayment of the principal and interest means the CDS is worthless as it will never be triggered? Do they have some sort of provision for currency devaluation?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards