We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What happens if the UK goes bankrupt (if it isn't already)?

Comments

-

Understood, I just thought it might add another perspective before another thread goes down the end of the world, we're all doomed highway, as is popular hereabouts. It shows what the CDS market thinks, it's not infallible.CDS pricing only indirectly measures perceived default risk though. CDS prices directly measure the relationship between supply and demand of credit default swaps.

It is perfectly possible that in these times of risk aversion and debt deflation that banks aren't prepared to lend enough to ensure that pricing differences in the bond and CDS markets aren't arbitraged away.Hope for the best.....Plan for the worst!

"Never in the history of the world has there been a situation so bad that the government can't make it worse." Unknown0 -

John_Pierpoint wrote: »Russia & Argentina have both defaulted fairly recently, so you don't need to look to Zimbabwe to understand.

Expect the government to rob its people before things get really bad.

(EG reintroduce laws to make holding gold bars illegal, reintroduce "sterling" exchange controls, the law has only been suspended, make it illegal to leave the country with more than (say) 150 GBP in your wallet, put a limit on foreign currency available to "tourists". Increase the VAT/duty payable on foreign imports. Invent new "safety" standards to outlaw popular foreign imports etc. etc. - I m old enough to remember all these not long ago.)

I was in Argentina not long after the big financial crisis in 2003 and it was weird. All the big banks in the centre of Buenos Aires were all boarded up with metal grates and every day there would be protestors banging on them and beating drums and chanting anti-bank slogans. My dad is Argentine and the banks stole some of his money. He now hides it in his apartment but that has become more risky with the amount of robberies. Thank god he still gets a UK pension otherwise he would be in dire straights although his pension is worth much less now, its still about the amount his wife gets in wages from her job every week . 0

. 0 -

Yeah I heard a nasty rumor that the UK will run out of beer in the nest 10 days.:beer: Get it while you can!

Beer tends to be UK produced and the cheaper stuff in metal cans tends to go "off" after 18 months.

Now if you are buying something foreign that keeps ( red wine with a high alcohol content?) stock up now. I cannot see prices ever being as cheap again;)0 -

An 'Is the world about to end?' thread can't be too far behind this one :rolleyes:0

-

Now is that

"Snowball earth"

"Hell fire earth"

or

"Bird flu earth"?

All three have been featured on telly in the last few weeks!

"Asteroid strike earth" is on C4 tonight at 21:00.

John

(There seems a bit a respite for "peak oil earth", and "WW3 earth", but "going with a whimper" earth is still approaching at a rate of 1.3 million mouths a week).0 -

John_Pierpoint wrote: »Now is that

"Snowball earth"

"Hell fire earth"

or

"Bird flu earth"?

All three have been featured on telly in the last few weeks!

"Asteroid strike earth" is on C4 tonight at 21:00.

John

(There seems a bit a respite for "peak oil earth", and "WW3 earth", but "going with a whimper" earth is still approaching at a rate of 1.3 million mouths a week).

Apparently being hit by a meteor is a more likely form of death statistically speaking than dying in a plane crash. When a big meteor hits, tons of people will die. It's just that (thankfully) it doesn't happen that often so you're unlikely to have a mate ho died by meteor strike or indeed to have read about it in the local rag.0 -

Note that France has a had a huge deficit since the 1970s way beyond anything the UK has had, yet life went on. Its easy to be swept along with armaggedon scenarios, but as ever the truth is far more likely to lay somewhere on the middle ground.0

-

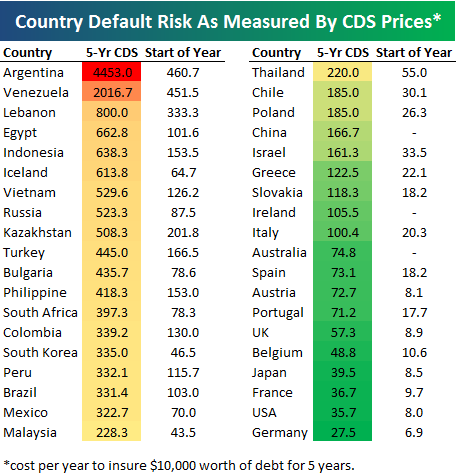

So that is Iceland and now Ecuador, which domimo next?This is a table of default risk as measured by the CDS market for individual countries. It was taken in Just before Iceland blew up I believe so not too long ago.

http://forums.moneysavingexpert.com/showthread.html?t=13521630 -

Does ruminating on the ludicrous idea that the U.K could go bankrupt come under the heading of Scaremongering ?? :eek: , or is there a level beyond that ??

Er - where exactly have you been in the last three months? :rolleyes:

If you read the Robert Peston blog he warned that national bankruptcy was a possibility when we stepped in and started funding the banks with taxpayer's money. At the time I believe the chance was about 5%. Since then things have got a lot worse what with the prospect of a global recession and a severe house price correction here.

We are facing the prospect of having to borrow vast sums on the international money markets to re capitalise our banks. If foreign investors are unwilling to lend us this money then the pound will crash.

It is very difficult to say what the consequences of such an event would be. Life will be a lot tougher but eventually the pound would go so low that foreign investment would return and a recovery would begin.

It has happened to many other countries over the years and people get through it. A few years of hard work and saving and we will recover.0 -

Then it can't bail out any more countries or continue with agreed bails out until it has found a source of more funds. As it is not a sovereign body it can't print money, if it's run out of money then presumably we're assuming it has no saleable assets left so all it can do is ask for more cash from member countries.

However, countries seem to be a little short of cash right now as they seem to be borrowing an awful lot of it. If I was an investor that was unwilling to lend to the UK then I'd also be unwilling to lend to (for example) France for them to lend to the IMF to lend to the UK.

My summation of the world economy is that things are worse than you think but not as bad as you'd imagine just as long as protectionism doesn't come into play. If it does then things will be very, very bad indeed. If you suspect your MP is very anti protectionism then vote for him even if he's ZaNu Labour.

Ok i'll risk looking stupid, what the bloody hell are you on about gen?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards