We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What happens if the UK goes bankrupt (if it isn't already)?

Comments

-

The miners' strike came near to civil war in my humble opinion.

Police road blocks everywhere. Concrete blocks dropped on black legs from motorway bridges.

I think you are underestimating the interconnection of everything these days.

It could be a lot worse than the electricity/toiletpaper/candles/sugar/etc. empty shelves experiences of the 1970's0 -

Did Iceland not go bankrupt? What happened there then?0

-

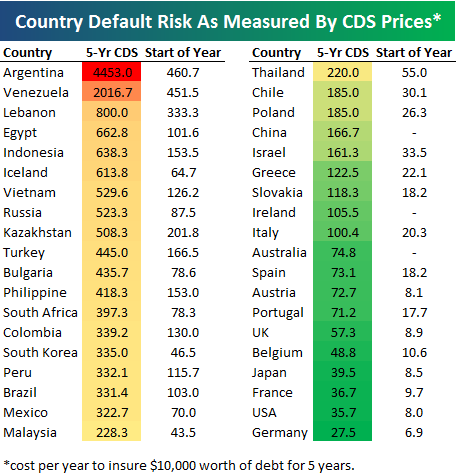

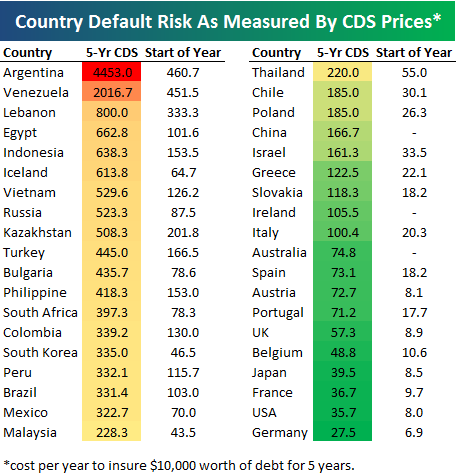

This is a table of default risk as measured by the CDS market for individual countries. It was taken in Just before Iceland blew up I believe so not too long ago.

Hope for the best.....Plan for the worst!

Hope for the best.....Plan for the worst!

"Never in the history of the world has there been a situation so bad that the government can't make it worse." Unknown0 -

Does ruminating on the ludicrous idea that the U.K could go bankrupt come under the heading of Scaremongering ?? :eek: , or is there a level beyond that ??

'In nature, there are neither rewards nor punishments - there are Consequences.'0

'In nature, there are neither rewards nor punishments - there are Consequences.'0 -

So what happens when the IMF runs out of funds?

Then it can't bail out any more countries or continue with agreed bails out until it has found a source of more funds. As it is not a sovereign body it can't print money, if it's run out of money then presumably we're assuming it has no saleable assets left so all it can do is ask for more cash from member countries.

However, countries seem to be a little short of cash right now as they seem to be borrowing an awful lot of it. If I was an investor that was unwilling to lend to the UK then I'd also be unwilling to lend to (for example) France for them to lend to the IMF to lend to the UK.

My summation of the world economy is that things are worse than you think but not as bad as you'd imagine just as long as protectionism doesn't come into play. If it does then things will be very, very bad indeed. If you suspect your MP is very anti protectionism then vote for him even if he's ZaNu Labour.0 -

Argentina was a recent case of this.Good question! Im really interested in stuff like this, I hope someone knowledgeable will answer.

My guess it that we will owe other countries favours big time & the pound will be dead. Im sure you cant just print money off & then thats it sorted, everybody is paid off. That would create inflation in our country, but how would it affect our relationship with other countries?

I hope you don't mind my auxiliary question I think its on-topic

http://business.timesonline.co.uk/tol/business/economics/article5031413.eceHope for the best.....Plan for the worst!

"Never in the history of the world has there been a situation so bad that the government can't make it worse." Unknown0 -

Does ruminating on the ludicrous idea that the U.K could go bankrupt come under the heading of Scaremongering ?? :eek: , or is there a level beyond that ??

I think the Daily Mail would even be proud of this thread....

Is it me or has this board got a little crazier since it was brought out from being a House Buying sub-board.... Weird.0 -

This is a table of default risk as measured by the CDS market for individual countries. It was taken in Just before Iceland blew up I believe so not too long ago.

CDS pricing only indirectly measures perceived default risk though. CDS prices directly measure the relationship between supply and demand of credit default swaps.

It is perfectly possible that in these times of risk aversion and debt deflation that banks aren't prepared to lend enough to ensure that pricing differences in the bond and CDS markets aren't arbitraged away.0 -

Yeah I heard a nasty rumor that the UK will run out of beer in the nest 10 days.:beer: Get it while you can!Does ruminating on the ludicrous idea that the U.K could go bankrupt come under the heading of Scaremongering ?? :eek: , or is there a level beyond that ?? Hope for the best.....Plan for the worst!

Hope for the best.....Plan for the worst!

"Never in the history of the world has there been a situation so bad that the government can't make it worse." Unknown0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards