We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Budget 2017: House of Commons Rep Coverage

UKParliament

Posts: 749 Organisation Representative

Hi MSE’ers,

The Chancellor will deliver the Budget on Wednesday 22 November at 12.30pm in the House of Commons Chamber.

This will be followed by Budget debates in the Commons for three days on Thursday 23, Monday 27 and Tuesday 28 November.

The debates are an opportunity for the House of Commons to scrutinise the Budget Statement.

We’ll be posting regular updates for you, including links to live video coverage, transcripts of the Budget Statement and debates, background information from the House of Commons Library, and Budget facts.

The content we will be sharing will be politically neutral and impartial.

We want to hear your expectations of what might be in the Budget Speech as well as thoughts on it once it has been delivered. What parts of it will have the biggest impact for you?

Watch the Budget

Watch the Budget live on 22 November at 12.30pm. Watch again or catch-up on Parliament TV.

Read the Chancellor’s Budget Statement

The transcript of the Budget Statement will be made available three hours after it happens on Parliament's website.

Official Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE

0

Comments

-

The Budget, or Financial Statement, is a statement made to the House of Commons by the Chancellor of the Exchequer.

The Budget statement includes:- a review of how the UK economy is performing

- forecasts of how the UK economy will perform in the future by the Office for Budget Responsibility (OBR)

- details of any changes to taxation.

The Chancellor's decisions usually remain secret until the speech. This is, mainly, to prevent anyone profiting from having advance knowledge of the government's plans.

What happens in Parliament?

The Chancellor of the Exchequer delivers the Budget statement to Members of Parliament in the House of Commons.

Provisional collection of taxes

Some measures, such as any changes to the rates of duty on alcohol and tobacco, come into effect on Budget day or soon after.

The power to make these changes on an interim basis, before the Finance Bill is passed, comes from the House of Commons approving a motion for the provisional collection of these taxes.

Debates

Traditionally the Leader of the Opposition, currently Jeremy Corbyn MP, replies to the Budget Speech rather than the Shadow Chancellor.

The Budget is usually followed by three days of debate on the Budget Resolutions, these are the tax measures announced in the Budget. Each day of debate covers a different policy area such as health, education and defence. The Shadow Chancellor makes his response the day after the Budget statement during the Budget debates.

Budget Resolutions can come into effect immediately if the House of Commons agrees to them at the end of the three days of debate but they require the Finance Bill to give them permanent legal effect.

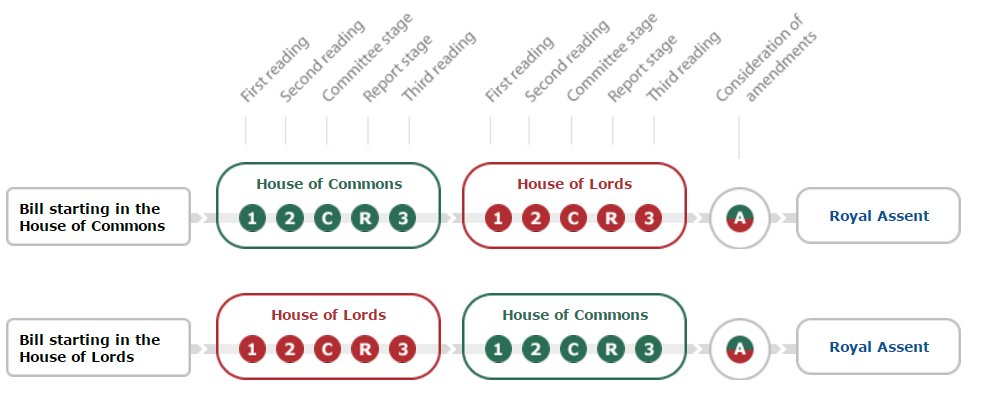

The Finance Bill

A new Finance Bill is presented to Parliament each year. It enacts the proposals for taxation made by the Chancellor of the Exchequer in their Budget statement and brings them into law.

Once the House of Commons has agreed the Budget Resolutions, the Finance Bill starts its passage through Parliament in the same way as any other Bill.

Scrutiny

Following each Budget statement the Commons Treasury Select Committee conducts an inquiry into the Government's proposals, gathering evidence from expert witnesses and publishing a report with its conclusions and recommendations.

The Government then produces a report in response to the Committee's findings.

The House of Lords Economic Affairs Sub-Committee examines selected aspects of the Finance Bill, including tax administration, clarification and simplification.

Find out more about the Budget on Parliament's website.Official Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE0 -

The House of Commons Library produces briefing papers to inform MPs and their staff of key issues. The papers contain factual information and a range of opinions on each subject, and aim to be politically impartial.

Here are some of the main points from the Commons Library Autumn Budget 2017 Paper.

Economic situation

Growth

Economic growth has been stable but modest so far in 2017 on the back of a slowdown in consumer spending. Latest quarterly GDP growth of 0.4% in the third quarter (Q3 2017) was similar to the 0.3% recorded in Q1 and Q2.

However, GDP growth has been slowing. GDP growth stood at 1.5% in Q3 2017 compared with a year before. This contrasts with many other advanced economies, particularly the Eurozone, which has seen growth accelerate in 2017.

The OBR has said that at Autumn Budget 2017 it intends to lower its productivity forecasts, presumably resulting in it lowering its GDP growth forecasts.

Prices and wages

Consumers have been squeezed by rising inflation following past falls in the value of the pound, notably following the June 2016 EU referendum. Inflation is currently at 3.0%, while average wage growth adjusted for inflation was 0.6% lower than a year before.

Wage growth remains weak despite unemployment being at its lowest rate since 1975 and near-record employment rates.

Interest rates

With inflation well above its 2% target, the Bank of England raised interest rates from 0.25% to 0.5% in early November. This was the first rate increase since 2007. The decision to raise rates was also partly a result of the Bank lowering its expectations of the economy’s potential growth rate, itself a consequence of lower productivity growth forecasts.

Public finances

Borrowing and debt

In 2016/17 the government borrowed £46 billion to make up the difference between its spending and income raised from taxes and other sources. Borrowing, often referred to as the deficit, is now at a similar level to before the 2007-2008 financial crisis.

In March 2017, the OBR forecast that the government will borrow more in 2017/18 than in 2016/17. This is still expected to be the case, despite an improvement in the borrowing data for the first half of 2017/18. The OBR forecast that borrowing will decrease in subsequent years up to the end of their forecast in 2021/22.

At 86% of GDP, public sector net debt – largely the stock of borrowing arising from past deficits – remains relatively high by recent and international standards. The OBR forecast it to fall to around 80% of GDP by the end of this Parliament.

Developments since March 2017

A series of developments since March 2017 may impact on the OBR’s borrowing forecasts:- The OBR anticipates “significantly reducing” their assumption for potential productivity growth, which will lower economic growth forecasts and increase borrowing.

- The Office for National Statistics (ONS) is moving English housing associations back to the private sector. Their borrowing – about £3 billion in 2016/17 – will no longer impact on the deficit.

- There appears to have been an underlying improvement in the public finances. The Institute for Fiscal Studies (IFS) – an economic think tank – estimate that the improvement could lower borrowing by around £11 billion per year.

- Since March 2017 the Government has introduced new policies and dropped some previously announced policies, which will effect spending and revenues.

- The Bank of England’s decision to raise interest rates in November will directly impact on the Government’s spending on debt interest.

- The Government’s targets for the public finances

The Government would like to eliminate the budget deficit by the middle of the next decade. This is its overall objective for the public finances. The Government has targets for government borrowing and debt aimed at achieving its overall objective. The OBR will assess performance against the borrowing and debt targets alongside Autumn Budget 2017.

The Government also has a cap to control welfare spending – the welfare cap. The Government is expected to announce level of the welfare cap, and in which year it should apply, during this Parliament.

Policies that may come up in the Budget

Public sector pay

Since 2013 the Government has funded public sector workforces for average pay awards of 1%. In Summer Budget 2015 the Government said that this would continue up to 2019/20, saving approximately £5 billion in that year.

In September 2017, the Government indicated that from 2018/19 public sector pay policy may be allowed to depart from the 1% average pay cap. Further details may be provided at Autumn Budget 2017.

Universal credit

While Universal Credit has been a subject of debate since its inception, this has intensified since roll-out accelerated in early 2017. In recent months, a particular focus of attention has been the length of time new claimants must wait before receiving their first payment. The Government may choose to address this and other concerns at the Autumn Budget.

Abandoning plans to apply LHA rates to the social rented sector

While the Government has abandoned its policy of applying Local Housing Allowance (LHA) rates to the social rented sector, we might expect further information on the cost of this change.

Brexit: the OBR’s forecasts and departments’ spending

Brexit and the OBR’s economic forecasts

After the EU referendum the OBR downgraded its economic forecasts in November 2016. In the short to medium term, the downgrade was based on the OBR’s judgement that Brexit related uncertainty will lead firms to delay investment and consumers will be squeezed by higher import prices, following the post-referendum fall in the pound. The OBR have made some broad-brush judgements – consistent with most external studies – about the period after Brexit. They assume that over the time horizon of their forecast any likely Brexit outcome will lead to: lower trade flows; lower business investment; and lower net inward migration than would otherwise have been seen. Taken together these result in lower economic growth.

In the longer term the OBR says that decisions made by UK governments in areas such as trade and regulation will determine whether future economic growth is enhanced or impeded.

Brexit and the OBR’s public finance forecasts

In November 2016, the OBR estimated that the referendum result and Brexit increased borrowing in all years of their forecast, rising to around £15 billion in each of the final three years of forecast. The OBR calculated this estimate by comparing its forecast to what its forecast would have looked like if there had been no referendum.

The OBR’s public spending forecast includes an estimate of the UK’s payments to the EU. While the UK remains a member of the EU these payments will continue as normal. The OBR assumes that after Brexit the spending – which it continues to forecast throughout the five-year forecast period – will be recycled into domestic spending. The recycled spending – roughly £13 billion per year – could be spent by the government as it wishes on domestic priorities or new spending commitments that could result from Brexit and the withdrawal negotiations.

Departments’ spending on Brexit

The Government has committed £250 million of additional funding in 2017/18 to help departments prepare for Brexit. The Government is expected to give an update on departments’ Brexit spending in the Autumn Budget.

Changing to an Autumn Budget and Parliament’s approval of spending

Moving to an Autumn Budget

From autumn 2017 the Government is presenting a single autumn Budget, to allow for greater Parliamentary scrutiny of Budget measures ahead of their implementation. This is intended to put an end to tax announcements being made twice a year in the Budget and Autumn Statement. Autumn Budget 2017 is the first announced under this new approach.

The OBR will continue to publish two sets of forecasts a year – one alongside the Autumn Budget and the other in spring. The Government will present a formal response to the OBR’s spring forecast.

After the Finance Act

The Budget and the subsequent Finance Act deal with the raising of government revenues. But before this money can be spent, further approval from Parliament is required each year: both to the amounts and the nature of the spending. This briefing discusses the annual cycle of approvals.

Read the full paper: Autumn Budget: Background briefingOfficial Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE0 -

For Budget updates as they happen check our MSE News story:

Autumn Budget 2017: Chancellor to unveil Government spending plansCould you do with a Money Makeover?

Follow MSE on other Social Media:

MSE Facebook, MSE Twitter, MSE Deals Twitter, Instagram

Join the MSE Forum

Get the Free MoneySavingExpert Money Tips E-mail

Report inappropriate posts: click the report button

Point out a rate/product change

Flag a news story: news@moneysavingexpert.com0 -

The Chancellor of the Exchequer, Mr Philip Hammond, will deliver the Budget Statement to the House of Commons today. We expect this to commence at approximately 12.30pm, after Prime Minister’s Question Time.

Will you be watching the Budget live on Parliament TV?Official Organisation Representative

I’m the official organisation rep for the House of Commons. I do not work for or represent the government. I am politically impartial and cannot comment on government policy. Find out more in DOT's Mission Statement.

MSE has given permission for me to post letting you know about relevant and useful info. You can see my name on the organisations with permission to post list. If you believe I've broken the Forum Rules please report it to forumteam@moneysavingexpert.com. This does NOT imply any form of approval of my organisation by MSE0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=2OxYrrOklx8

https://www.youtube.com/watch?v=2OxYrrOklx8 https://www.youtube.com/watch?v=lbo-Gm3LQ30

https://www.youtube.com/watch?v=lbo-Gm3LQ30