We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Premium Bond Winner ?

Comments

-

Wealthier, yes, but statistically there are probably more wealthier older people than wealthier people below say late 50s plus (as they will generally still have mortgages to pay and child related expenses of some sort, therefore less disposable income to save in Premium Bonds or whatever their product of choice might be.) So I did not think older was inaccurate and the post may have been written quickly, as many regulars will post here as a hobby while on public transport / their breaks etc.eskbanker said:

So it's a dilemma for wealthier people then, rather than older ones per se?Kim_13 said:

Older people are more likely to have sufficient funds so as to be holders of a significant amount of Premium Bonds (as it is generally better to utilise PSA and fill ISA first, plus younger people are paying into a pension rather than drawing down.) Of course that is not always the case and there are younger people who have done well for themselves, inherited a lump sum or whatever it might be, just as there are older people with limited means and qualifying for Pension Credit.eskbanker said:

Not completely sure what 'this' dilemma is that you refer to but if it relates to comparing returns from investing against premium bonds or savings accounts, then this is surely applicable to all age groups and ought to be less of an issue now than in the many previous years when both savings and PBs returned significantly less than inflation?Primrose said:I think this is the dilemma many older people have with their savings now especially with the policies of the current government.

Unfortunately many people have an irrational view of tax and will do their utmost to avoid it, even to their overall detriment!Kim_13 said:It is more of an issue now as the PSA has not increased since 2016 and that coupled with higher returns for savers (which are a good thing) mean that more and more people face the conundrum of do I take the after tax return or make use of a tax free savings vehicle.

0 -

Received £25 today, a nice surprise! I presume this is from the reallocation process.0

-

Ooo, yes I got £91! What does this mean? I didn't get any communication from NS&I about it, but assume it is also tax free. I have used it to buy more bonds since that is what I do with any winnings. Shame they won't be eligible until March, as I assume if auto-reinvested, new bonds count immediately.skitskut said:Received £25 today, a nice surprise! I presume this is from the reallocation process.0 -

£91 must be from Income Bonds or something (taxable), since Premium Bond prizes have to be divisible by 25.WindfallWendy said:

Ooo, yes I got £91! What does this mean? I didn't get any communication from NS&I about it, but assume it is also tax free. I have used it to buy more bonds since that is what I do with any winnings. Shame they won't be eligible until March, as I assume if auto-reinvested, new bonds count immediately.skitskut said:Received £25 today, a nice surprise! I presume this is from the reallocation process.

1 -

I only have Premium bonds so it must be from Premium Bonds.

0 -

£91 is an odd amount, as already mentioned. My initial thought when reading it, was that it was a reissued larger prize, but you were close to maxing out your holding, so they reinvested some, up to the max (your chosen option) and paid out the balance to your nominated account. But that doesn't sound like the case, if you still had capacity to buy more bonds with those funds.

I hope this post makes sense - the new text editor isn't playing nice with my tablet keyboard.

2 -

Well, what is even odder is that it's £91.55

Hm. How weird. I just imagined it was unclaimed funds divided by all the bonds that would have won so hadn't thought about it not being a round figure of a usual prize.

0 -

Hahahahaaaa!!! Confession time!

I have just checked the details of the payment (which was received as a bank giro credit and why I assumed it was Premium Bonds as they arrive with this same description)..... And it's a refund from Sky having cancelled a month or two ago. Silly me!!!

I was genuinely confused for a while there. Sorry for causing some head scratching on here! 😄

3 -

Delighted that you've got to the bottom of it - but sorry that you're not up by the value of an unexpected prize.

1 -

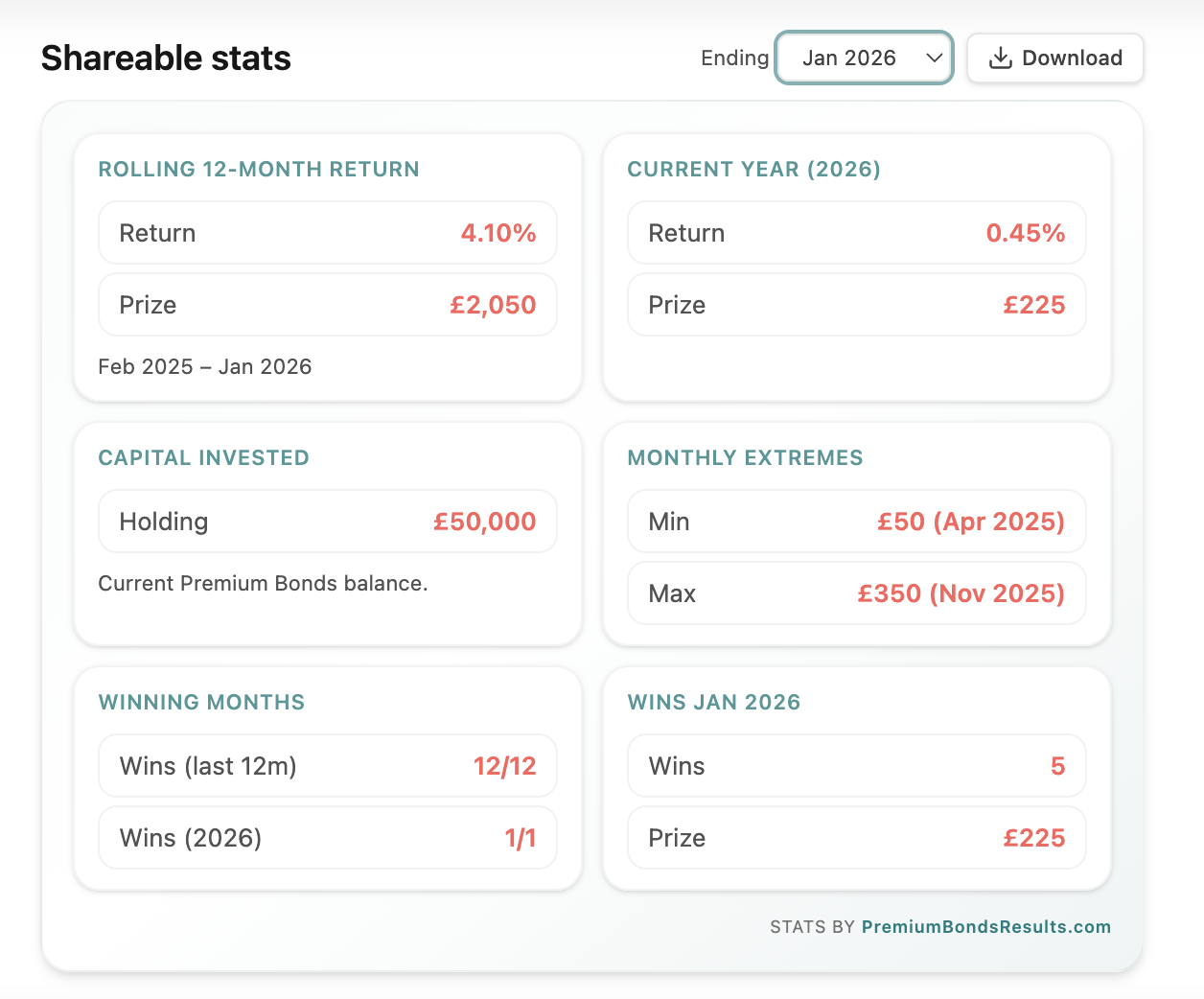

I’ve had Premium Bonds for about two years now (3 months on HH then FH). First year was decent - hit two £500 wins - but the last 12 months have been a bit more “polite applause” than fireworks. Still, I’ve never had a total blank month, so I’ll take it.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards