We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cca Requests Updates Please

Comments

-

I spent time and, recorded delivery, money reminding Moorcroft & RMA of their legal obligations. It made no difference and just prompted them into writing to me in return making all sorts of threats. As soon as I stopped writing to them they stopped writing to me - happiness all round!0

-

Ive had a reply today from a dca that holds two of my credit cards.

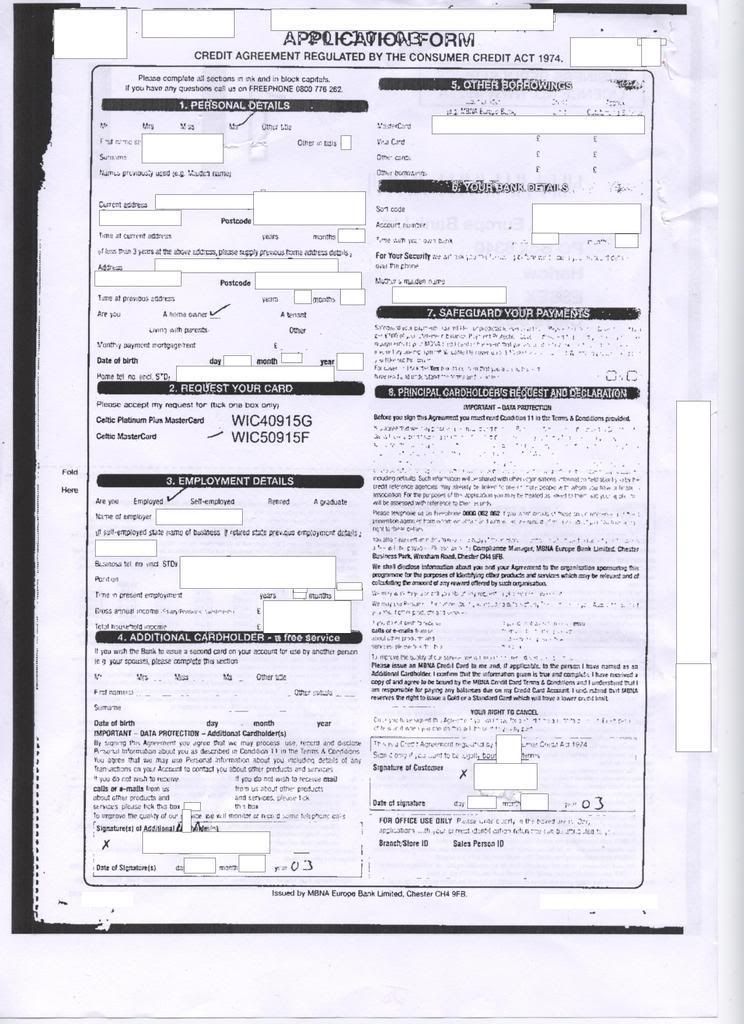

On the first one i dont see any sign of a credit limit or an interest rate. Its clearly an application form, not easy to read either. (better than the second one though) .

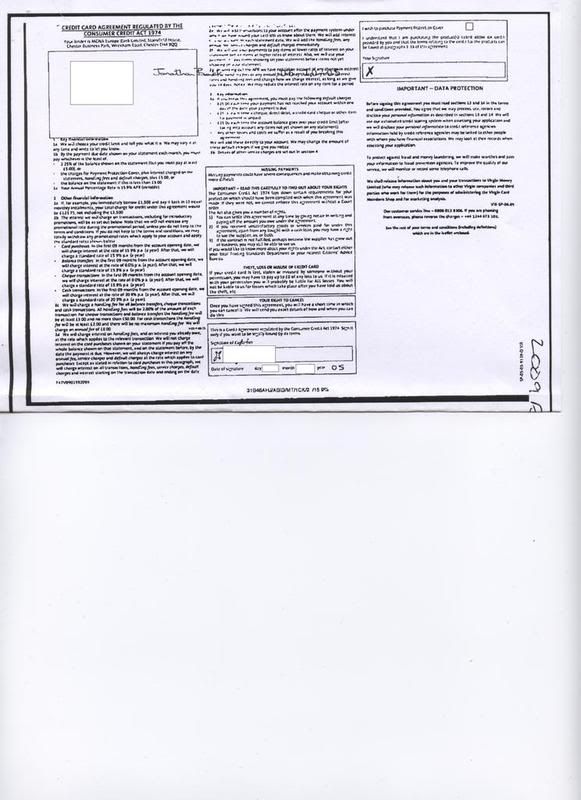

This is the first one

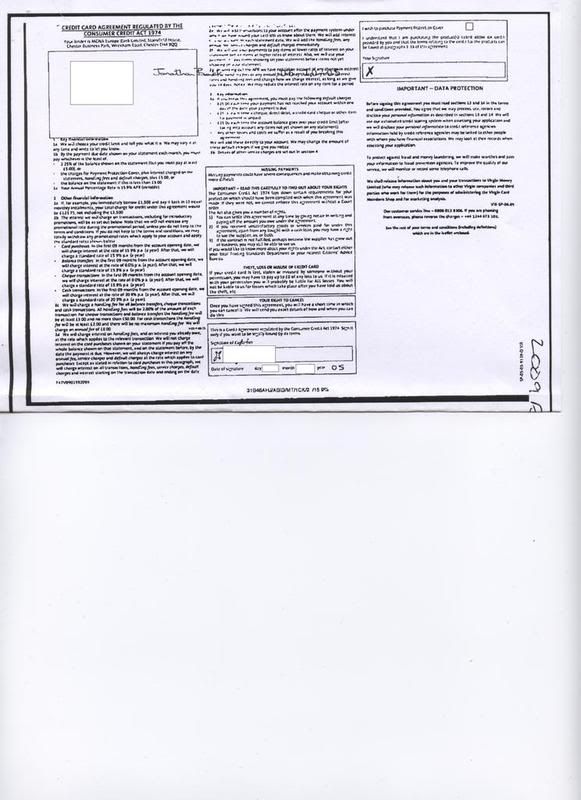

Heres the second one, just under the address box i can read (with a magnifying glass) "we will choose your credit limit & tell you what it is"

Can i ask for your opinions if these are enforceable or not please & what letter do i send if not.

Thank you.0 -

Coffeetime wrote: »Ive had a reply today from a dca that holds two of my credit cards.

On the first one i dont see any sign of a credit limit or an interest rate. Its clearly an application form, not easy to read either. (better than the second one though) .

My thoughts are that it is an application form and does not have all the prescribed terms that a valid CCA should therefore not enforceable.

I'm sure someone else will be along to confirm that and if thats the case then you can send this letter.

http://forums.moneysavingexpert.com/showpost.html?p=9323533&postcount=30 -

Thanks for that Bazza, i was thinking that aswel. But running it through the forum just in case,.0

-

Coffeetime wrote: »Thanks for that Bazza, i was thinking that aswel. But running it through the forum just in case,.

I'm sure others will be along to comment as well.

You could also try

http://www.consumeractiongroup.co.uk/forum/debt-collection-industry/105315-my-agreement-enforceable-useful-19.html

Create a new thread with your CCA(?) and post a link to that thread on the one above. They CAG guys are pretty clued up.0 -

:jCoffeetime wrote: »Ive had a reply today from a dca that holds two of my credit cards.

On the first one i dont see any sign of a credit limit or an interest rate. Its clearly an application form, not easy to read either. (better than the second one though) .

This is the first one

Heres the second one, just under the address box i can read (with a magnifying glass) "we will choose your credit limit & tell you what it is"

Can i ask for your opinions if these are enforceable or not please & what letter do i send if not.

Thank you.

hiya coffeetime -

i would like to truely understand this now i have seen your posts,

you state 2 card accounts

the first one is it the application form and then the bit with the address on, are those two peices together suggested by mbna as being part of the same account?

then you have the second one scanned where you would have your address but is that it?

im asking as ive been supplied what you have on the second scan ie with the address info, as being PART Of my agreement which is only what you have as your Second agreement ie i believe i have had what you have showing with the mbna address as being on the rear of what you have as your second agreement

hope this makes sense but i think would be very nice of you to confirm ive got it right

would appreciate your thoughts and clarification,,,i know a lot of people disputing this with mbna, have been supplied the prescribed terms as being on the rear but im still unsure were there in the first place - if we can prove something here i would be really :j

FRom my own experience, i would say if mbna have told you that your first 2 scans are of the same page ie front and back, with the prescribed terms if they were on the back can you tell if there is any bleed through???

if they have only sent the 2nd one as it is,,,,it really needs to be legible anyway,,,but ive tried this angle and they wont have it from me have now referred me to fos, it could be something you also could try (i note your date is much younger than mine, thus they could have got their acto together by 2005........hence my cca's are older )

also you know the typed up small letters and numbers - can they be matched up or are they just sequence numbers? at the bottom right areas,,,,

will come in later and see for any updates

thanks again maz

laters mazSealed Pot Challenge member 1525

"Knowledge is the Power to get Debt Free":j

Truecall device, stops all the unneccesary phone calls - my sanity has been restored and the peace in the house is truely priceless!:rotfl:0 -

Hiya

I have sent Barclaycard a CCA request, they failed to provide the relevant documents and have sent me a default letter. They also passed my account onto Mercers.

I have sent mercers the 12 + 2 dispute letter and stated the dates the CCA letter was sent to Barclaycard and that they had not responded with the relevant info. So they are aware that the account is in dispute. I also sent the doorstop collections letter (off the CAG website) and also the telephone harassment letter.

I received a letter from Mercers this morning that says…..

Thank you for your letter.

A payment of £204 is needed immediately to return your account to order. If you are unable to make this payment please call us immediately to discuss a more suitable repayment agreement.

In the meantime you must not use your card. – this is a joke as I have not used it in 2 years!!

What should I do if anything in response to their letter?

Thanks in advance for your advice.0 -

Hi has anyone got any emperience in dealing with defaults from phone bills?0

-

I was going to write to Lloyds tsb to ask for a copy of cca. we originally took the loan out in approx 2005 but re financed in Dec 2006. I have read that things changed in 2006 to allow for online applications etc. Do you think there is any point in asking for cca now?

I do have paperwork from when the loan was refinanced. A 'fixed sum loan agreement regulated by the consumer credit act 1974' 0

0 -

Ring the court tomorrow and request written confirmation. the case has been struck out.

l dont know if this should be on this thread but just wanted to tell you we had written confirmation today that this has been struck out! Yay!!

So thanks for all the support l've had from everyone, for this and other things.

Lots of love XXX0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards